Position in Rating | Overall Rating | Trading Terminals |

242nd  | 2.0 Overall Rating |  |

Alpaca Trading Review

Alpaca Trading has become one of the most popular options for individuals looking to trade stocks and ETFs without paying fees. It is easy to use and cost-effective, so it is a great platform for both beginners and more experienced traders. It is also known for its features, such as simple APIs for developers to make custom trading tools and fractional shares, which enable everyone to invest in well-known companies even with a much smaller budget. Alpaca makes trading accessible to a large number of people by focusing on simplicity and affordability.

The company is focused on delivering a seamless trading experience for modern traders, such as those interested in the automation of strategies. Beyond this, Alpaca's infrastructure offers real-time market data, making it a developer-friendly choice for fintech startups or businesses looking to embed trading functionality into their services. Nevertheless, it is only allowed to operate within the United States and does not currently offer assets such as forex or cryptocurrencies.

The purpose of an article like this one is to analyze Alpaca Trading and its offerings in the barest yet effective manner possible. If you’re an investor just starting out or a more selective trader, it is useful to understand the tools and services at your disposal on Alpaca. Alpaca makes investing more convenient and easier for all by leveraging commission-free trading, allowing adaptive investments, and catering to developers’ requirements.

What is Alpaca Trading?

Alpaca Trading Regulation and Safety

This balance is provided by regulation since the company operates in the US and is overseen by top-tier regulators in the industry. Primarily it operates under the aegis of the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA). This sort of regulatory oversight provides some layer of investor protection insurance; however, there are no banking licenses as well as public listings for Alpaca, which may alter the level of insurance provided.

Alpaca Trading Pros and Cons

Pros

- No fees on trades: trade without paying commissions.

- Easy-to-use APIs: simple integration for developers.

- Fractional shares: invest in expensive stocks with small amounts.

- Extended hours trading: trade before and after regular market hours.

Cons

- Lacks banking license: no direct banking features available.

- Limited asset types: only stocks and ETFs are offered.

OPEN YOUR ACCOUNT NOW

Benefits of Trading with Alpaca Trading

Alpaca Trading Customer Reviews

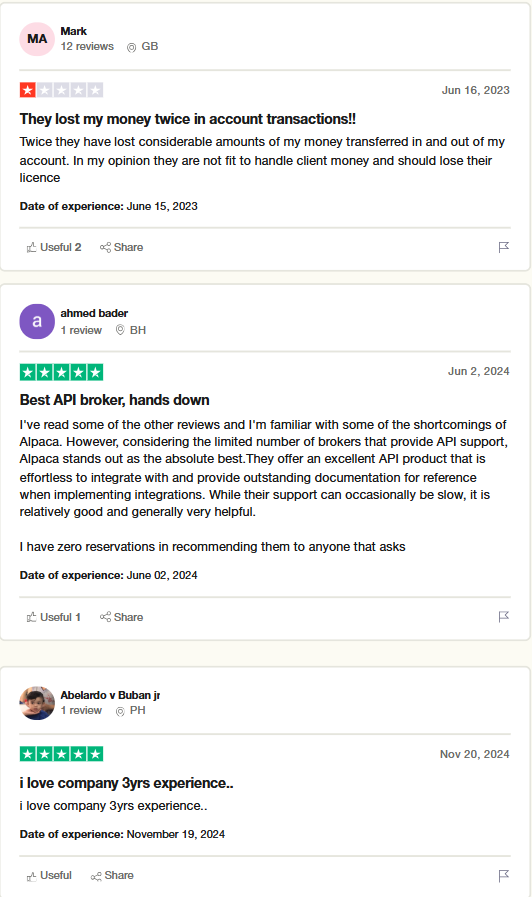

Alpaca Trading has had mixed experiences from customers, who appreciate the excellent API integration and detailed documentation that allows for seamless implementation. The platform's innovative features are easy to use, especially for algorithmic traders. Although the support team is generally helpful, it can be slow to respond sometimes, but users appreciate the overall quality of assistance.

However, some customers raise some concerns about issues with transactions from accounts, such as delays or errors in fund transfers. Such incidents have brought up questions about the reliability of the platform in handling client funds. Nonetheless, Alpaca is still a popular choice among traders who prioritize robust API support and user-friendly technology, making it stand out in the automated trading space.

Alpaca Trading Spreads, Fees and Commissions

For both stocks and ETFs, trading in Alpaca is completely commission-free, making it one of the cheap options for investors. Here, there aren't any traditional commission fees. Instead, the platform earns through a payment for order flow (PFOF), which is like market makers paying Alpaca to direct a trade order. There aren't any directly associated commissions with trade execution. However, the execution price can be affected by the PFOF arrangement.

Alpaca charges interest against the amount borrowed for margin trading, where the financing rate varies with the amount borrowed and the current market environment. This means that if the position is kept overnight or money is borrowed to maintain a position, it will incur extra charges using any kind of leverage. Marginal interest rates vary from margin to margin, and when using borrowed money, they may need to be kept on a very short leash. Although Alpaca doesn't charge any trading spreads or commissions, fees could apply to anything else not listed above. These include wire transfers and inactivity fees. The account inactivity fees, based on the use of third-party services for the account, will be determined.

Thus, all fees should be studied along with any fee schedule and cost thereof for such charges in order to ensure clarity on how much else there may be in terms of unexpected costs above what might be normal for general trade practices.

Account Types

Alpaca Trading offers both individual and institutional investors a single account type. Along with features for more experienced traders including extended trading hours and API connectors, it enables both cash and margin accounts.

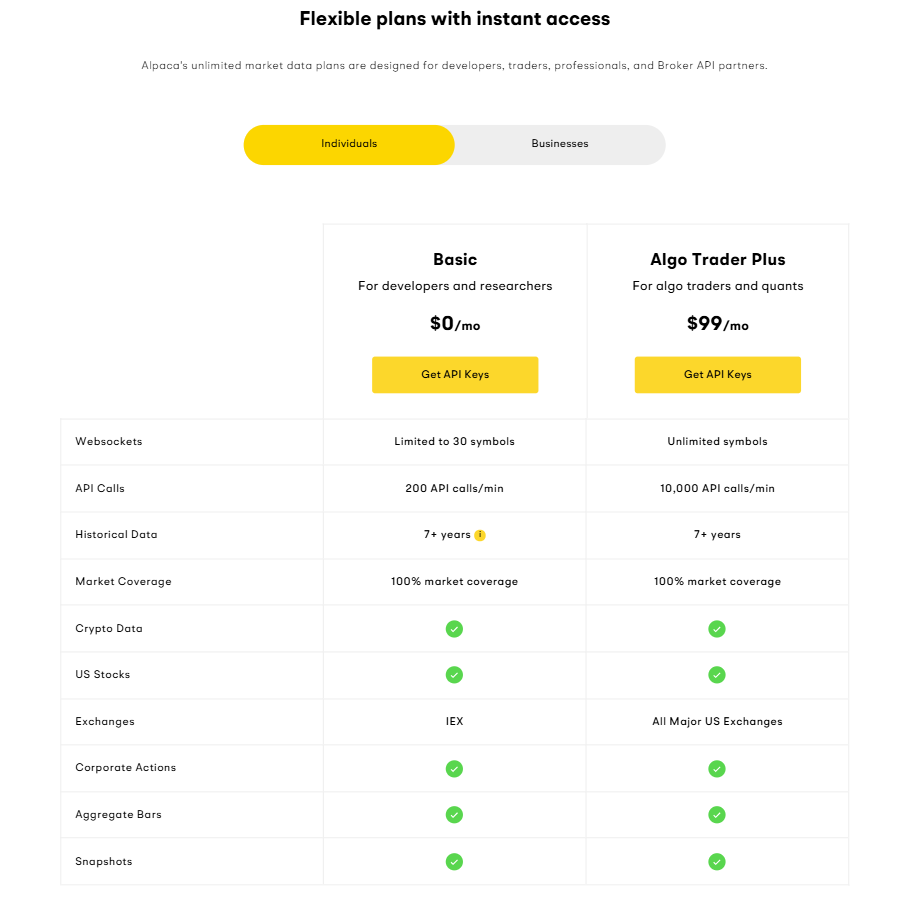

- Basic Plan: The Basic Plan is designed for developers and researchers who need essential market data. It offers Websockets limited to 30 symbols, 200 API calls per minute, and access to 7+ years of historical data. With 100% market coverage and no cost, this plan provides a reliable starting point for individuals exploring market data integration.

- Algo Trader Plus Plan: The Algo Trader Plus Plan is tailored for algo traders and quants who require advanced features and greater capacity. It includes unlimited Websockets symbols, 10,000 API calls per minute, and 7+ years of historical data, ensuring comprehensive access to market insights. For $99 per month, users benefit from 100% market coverage and the flexibility to handle high-frequency trading needs.

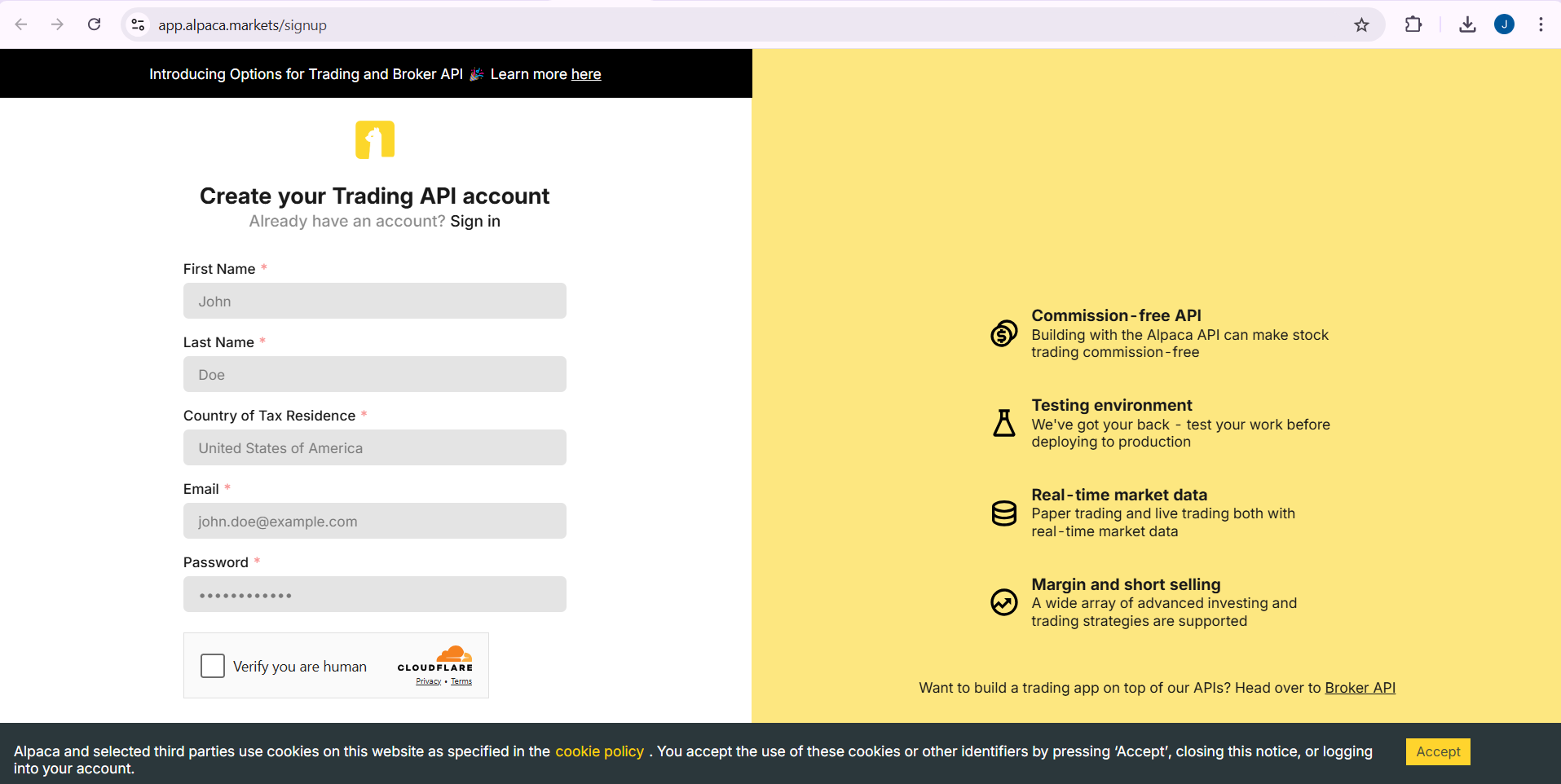

- Go to Alpaca Trading's website, click “Sign Up”, and create an account with your name, email, and password.

- Open the confirmation email and click the link to activate your account.

- Upload a government-issued ID and provide basic financial and trading details.

- Connect your bank account and deposit money into your trading account.

- Pick a live or demo account and begin trading U.S. stocks and ETFs.

OPEN A REAL ACCOUNT

Alpaca Trading Platforms

Alpaca's web platform is a very simple and intuitive tool for trading U.S. stocks and ETFs. It supports essential features such as fractional shares and extended trading hours, offering a streamlined experience for investors seeking simplicity.

Its most apparent characteristic is API-based trading—a platform built for developers and algorithmic traders; it is an interface or protocol through which different data-processing systems provide services to other applications, making it their system of choice.

For traders on the move, Alpaca's mobile app ensures seamless access to the markets. It enables users to manage portfolios, execute trades, and view real-time market data from their smartphones or tablets, combining convenience with functionality.

Alpaca also has a paper trading platform, simulating real-time trades with virtual money. This is great for beginners testing their skills or experienced traders refining their strategies without any financial risk.

What Can You Trade on Alpaca Trading

Alpaca Trading focuses mainly on providing commission-free trading in stocks and ETFs on the U.S. stock exchange. Their fractional share investment allows any user with a relatively small capital base to invest in very expensive stocks as a means of getting more users into high-priced stocks. Thus, this platform is appropriate for traders of all skill levels.

In addition to traditional trading, Alpaca also provides developer-friendly APIs to build automated strategies or custom applications. That makes it ideal for the programmatic trader or business interested in incorporating trading functionality into their platforms. It doesn't, however, support cryptocurrencies, forex, or commodities for trading, thus limiting the assets it can offer.

Although Alpaca is more specialized toward equities and ETFs, it does provide things like real-time market data and extended hours trading; therefore, traders have greater flexibility in making decisions promptly. Its core features are suited for the average investor or trader who might want to invest or trade a stock with minimal fees but easy access.

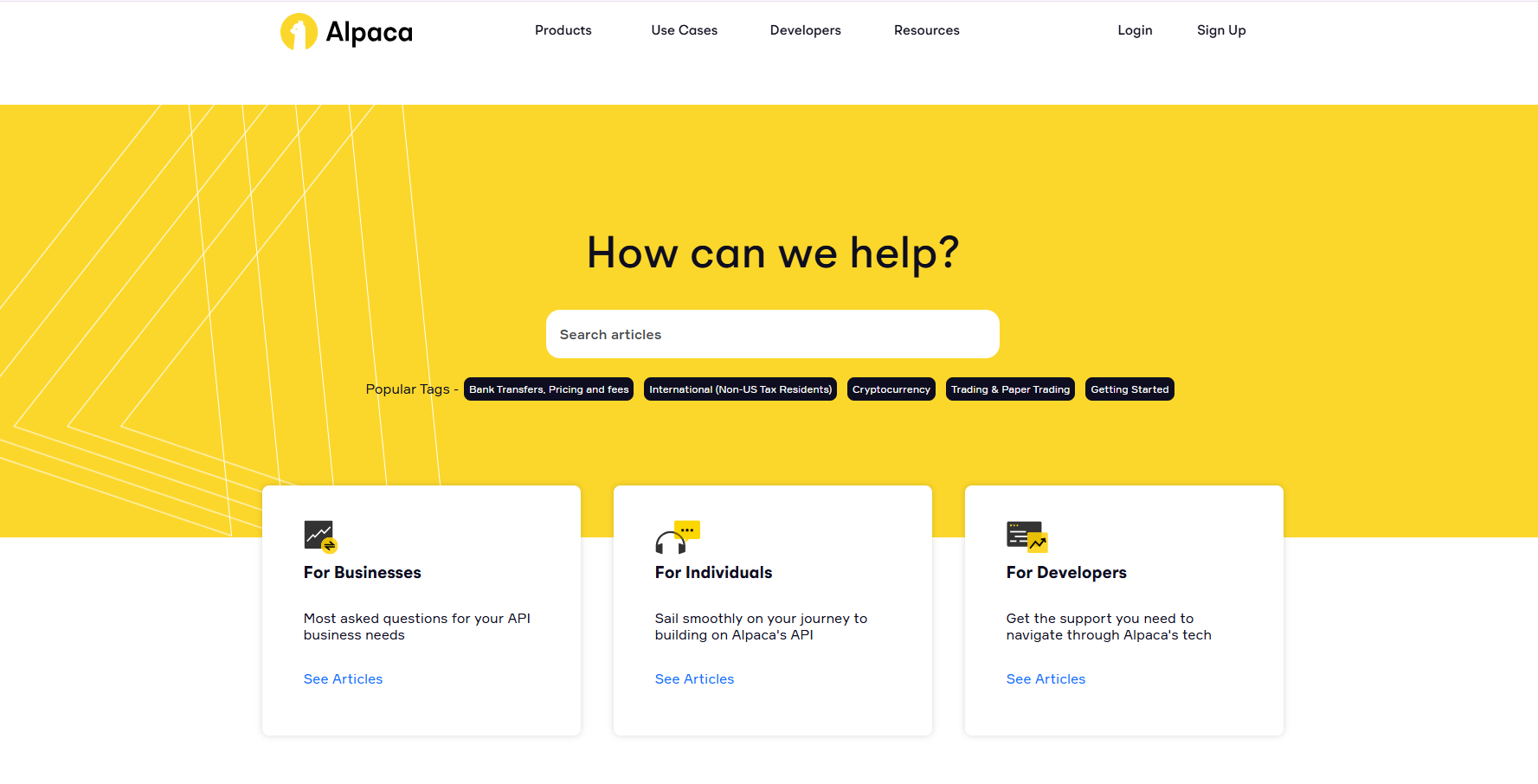

Alpaca Trading Customer Support

Alpaca Trading has exemplary customer support that is dependable and accessible. The platform has its support team available 24/7, ensuring that any issues are attended to promptly through channels like live chat, email, and phone. Users can access help via the search bar or support sections like For Individuals, For Developers, For Businesses, ensuring traders get help relevant to their issues quickly.

Alpaca Trading has exemplary customer support that is dependable and accessible. The platform has its support team available 24/7, ensuring that any issues are attended to promptly through channels like live chat, email, and phone. Users can access help via the search bar or support sections like For Individuals, For Developers, For Businesses, ensuring traders get help relevant to their issues quickly.

Alpaca Trading VS Other Brokers

#1. Alpaca Trading vs XM

Alpaca Trading and XM both serve traders but with different strengths. Alpaca Trading is known to focus on commission-free trading for U.S. stocks and ETFs, targeting algorithmic traders and developers via the easy-to-use APIs, and supports fractional shares as well as extended hours trading. Alpaca does not offer forex or international assets and is only allowed to trade in the United States.

XM, on the other hand, is a forex and CFD specialist, offering many assets, including stocks, indices, and commodities. It offers platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) and features social trading, among others. XM charges transparent fees, which vary according to the type of account, in terms of spreads and commissions, with demo accounts and educational material for new traders.

Verdict: XM is the better option for traders who want diverse assets and platforms, and Alpaca is ideal for developers and those looking for commission-free U.S. stock trading.

Also Read: XM Review 2024- Expert Trader Insights

#2.Alpaca Trading vs RoboForex

Alpaca Trading offers U.S. stocks and ETFs on a commission-free model. This broker targets developers and algorithmic traders, offering easy-to-use APIs and features like fractional shares and extended hours trading. This is perfect for traders that prioritize automation and programmatic strategies but it is strictly limited to the U.S. markets with no forex or CFD support.

RoboForex specializes in a wide variety of asset classes, from forex to stocks, indices, cryptocurrencies, and commodities. It offers different types of accounts and platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary solutions. RoboForex provides high leverage and promotions like cashback programs, making it popular among traders who want more flexibility and diversity in instruments. However, its commission-based structure and CFD trading might not be ideal for everyone.

Verdict: RoboForex is more suitable for traders looking for global asset variety and advanced platform options, whereas Alpaca Trading is ideal for those focused on U.S. stocks and looking for a commission-free environment for algorithmic trading.

Also Read: RoboForex Review 2024- Expert Trader Insight

#3 Alpaca Trading vs Exness

Alpaca Trading is an entirely commission-free platform with only U.S. stocks and ETFs, allowing access to fractional shares and ease of APIs for automated trading. It is well suited for U.S.-based investors and algorithmic traders but does not allow for forex or global assets.

Exness offers a wide range of assets such as forex, stocks, commodities, and cryptocurrencies. It supports multiple platforms such as MetaTrader 4 and 5 and offers high leverage, making it suitable for global traders. Exness charges spreads and some commissions but offers comprehensive educational resources.

Verdict: Alpaca Trading is perfect for U.S. stock traders and developers, whereas Exness suits better for worldwide traders seeking forex and a wider variety of assets.

Also Read: Exness Review 2024- Expert Trader Insight

Conclusion

Alpaca Trading offers a modern, efficient platform tailored for tech-oriented traders and cost-conscious investors. Its commission-free trading, API integration, and advanced tools like paper trading and historical data make it a powerful solution for those focused on stock and cryptocurrency trading.

The platform is particularly beneficial for developers and businesses looking to leverage automation, as well as traders exploring international markets. However, the lack of extensive customer support and a limited range of assets may be drawbacks for some users.

Whether you’re a beginner testing strategies or an experienced trader seeking efficient solutions, Alpaca provides the tools you need to succeed. Explore the platform to see if it aligns with your trading goals and style.

Alpaca Trading Review FAQs

What is Alpaca Trading?

Alpaca Trading is a commission-free trading platform that allows its users to trade in stocks and ETFs. Attached are tools for either individual investors or developers, plainly including APIs for anyone wanting to build custom trading applications.

Does Alpaca charge any fee?

Alpaca allows free trade in stocks and ETFs. Other than that, they may charge for margin accounts and wire transfers. Review the full fee schedule for more.

What can be traded on Alpaca?

U.S. stocks and ETFs can be supported on Alpaca. Currently, trading is not provided for crypto and foreign exchange.