AMEGA Review

Amega is one of the trustworthy forex brokers that has become well-known for its extensive selection of offerings. Amega FX has established itself as a reliable option for traders all over the world because of a strong dedication to customer satisfaction and a focus on offering a secure and transparent trading environment.

In-depth analysis of Amega's salient attributes, market dynamics, customer service, and overall user experience will be covered in this study. This article seeks to offer a thorough analysis of Amega in 2023 using insights from knowledgeable traders.

By providing a detailed overview of Amega's features, trading conditions, customer support, and user experience, this review equips readers with the necessary information to evaluate the broker's suitability for their trading needs. It sets realistic expectations for readers, enabling them to make informed decisions when considering Amega as their FX broker of choice.

What is AMEGA?

AMEGA is a well-established forex broker that has been serving traders since 2022 It provides a wide range of financial instruments and trading services to clients worldwide. AMEGA's primary focus is on creating a secure and transparent trading environment while offering competitive trading conditions and innovative features.

AMEGA was founded in 2022 with the goal of providing a reliable and user-friendly trading experience to traders of all levels. The company has since grown its client base and expanded its services to cater to the evolving needs of the forex market.

AMEGA is a reputable forex broker that offers a secure and transparent trading environment. With its regulated status, user-friendly platforms, a diverse range of trading instruments, competitive trading conditions, and responsive customer support, AMEGA aims to meet the needs of traders at different experience levels.

Advantages and Disadvantages of Trading with AMEGA?

Trading with AMEGA presents a variety of advantages and disadvantages that traders should consider when selecting a forex broker. These factors contribute to the overall trading experience, and understanding them can help traders align their choice with their trading goals and preferences.

Benefits of Trading with AMEGA

Trading with AMEGA offers several benefits that traders may find appealing. Here are some of the key advantages:

Security and Regulation

Amega Global Ltd is authorized and regulated under the Financial Services Commission (FSC), Mauritius. Traders can have confidence in the broker's adherence to industry standards and the implementation of necessary security measures to safeguard their funds and personal information.

Wide Range of Trading Instruments

AMEGA provides access to a diverse range of trading instruments, including currency pairs, metals, shares, indices, energy, commodities, and CFDs. This allows traders to explore different markets, diversify their portfolios, and take advantage of various trading opportunities.

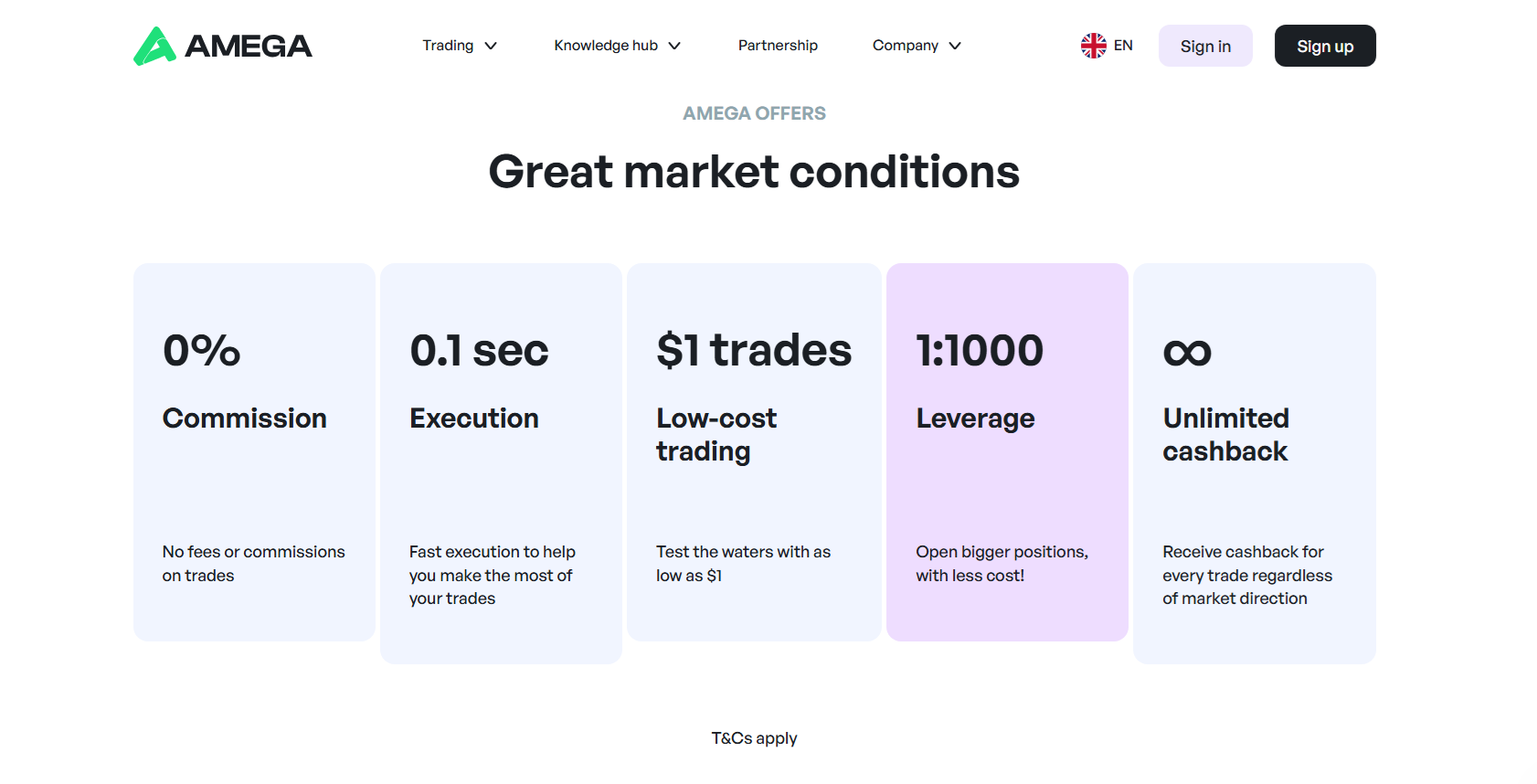

Competitive Trading Conditions

AMEGA offers competitive trading conditions, including tight spreads starting from 0.1 pips. This can potentially lower trading costs and enhance profitability.

Responsive Customer Support

AMEGA prides itself on providing excellent customer support. The support team is available and can be reached through various channels, including live chat and email. Traders can rely on timely assistance and professional guidance to address their queries or concerns.

Educational Resources

While AMEGA's educational resources may not be as extensive as some other brokers, it still provides educational materials and a comprehensive FAQ section. These resources can help traders enhance their trading knowledge and skills, especially for those who are new to the forex market.

Multiple Deposit and Withdrawal Options

AMEGA offers a variety of convenient deposit and withdrawal methods, including bank transfers, credit/debit cards, and electronic payment systems. Traders have flexibility in choosing the option that suits their preferences. Quick and reliable processing times for deposits and withdrawals are also emphasized.

AMEGA Pros and Cons

When choosing a forex broker, understanding the pros and cons can provide a balanced perspective to aid decision-making. Here are some key advantages and disadvantages associated with AMEGA:

Pros

- User-Friendly Interface

- Security Measures

- Fast Execution Speed

- Currency Available in USD and NGN

- New Amega App

- Minimum Deposit of $1

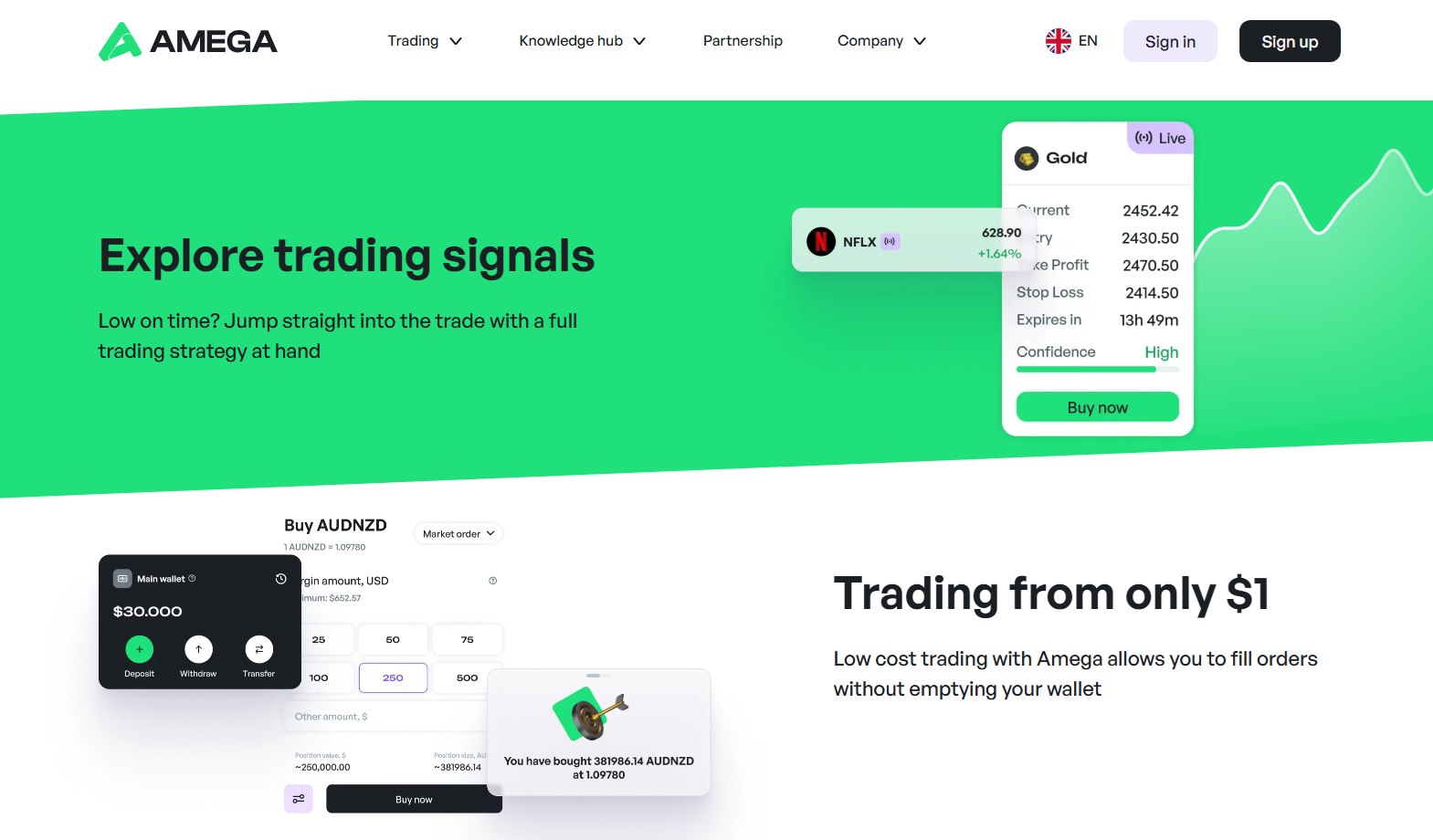

- Features like Ideas Hub and Trading Signals

Cons

- Lack of Cryptocurrency Asset Class

- Inactivity Fees

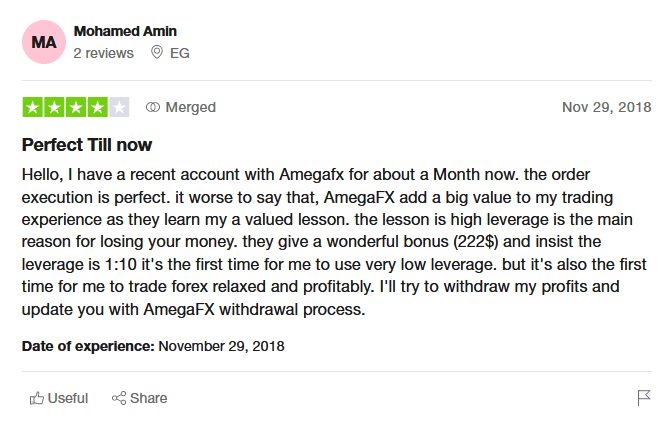

AMEGA Customer Reviews

Based on customer reviews, AMEGA has received positive feedback from traders. They also expressed that their account balance has remained stable, and they have seen a doubling of their initial investment. Overall, the trader highly recommends AMEGA as a trustworthy platform.

Keep in mind that reviews can be subjective and are often based on personal experiences, so it's wise to look for patterns and consistent feedback among multiple reviews. Remember, while user reviews can be helpful, they should not be the only factor considered when choosing a forex broker.

AMEGA Spreads, Fees, and Commissions

Choosing a broker with competitive spreads, fees, and commissions is a key factor in maximizing your trading profits. It's not just about the trading platform's capabilities or the variety of markets available to trade.

Spreads

The spreads start from 0.1 pips, indicating tight pricing. Variable spreads can fluctuate based on market liquidity and volatility, while fixed spreads remain constant regardless of market conditions.

Fees

AMEGA does not charge a specific rollover fee, also known as a swap fee. However, it's important to note that positions held overnight may incur swap charges or credits based on the interest rate differentials between the currencies being traded. These swap rates can be found within the MetaTrader 5 (MT5) platform or on AMEGA's website.

AMEGA does charge margin interest on leveraged positions held overnight. Margin interest is the cost associated with borrowing funds to maintain a leveraged position. Traders should be aware of the applicable margin interest rates, which can be obtained from AMEGA's website or by contacting their customer support.

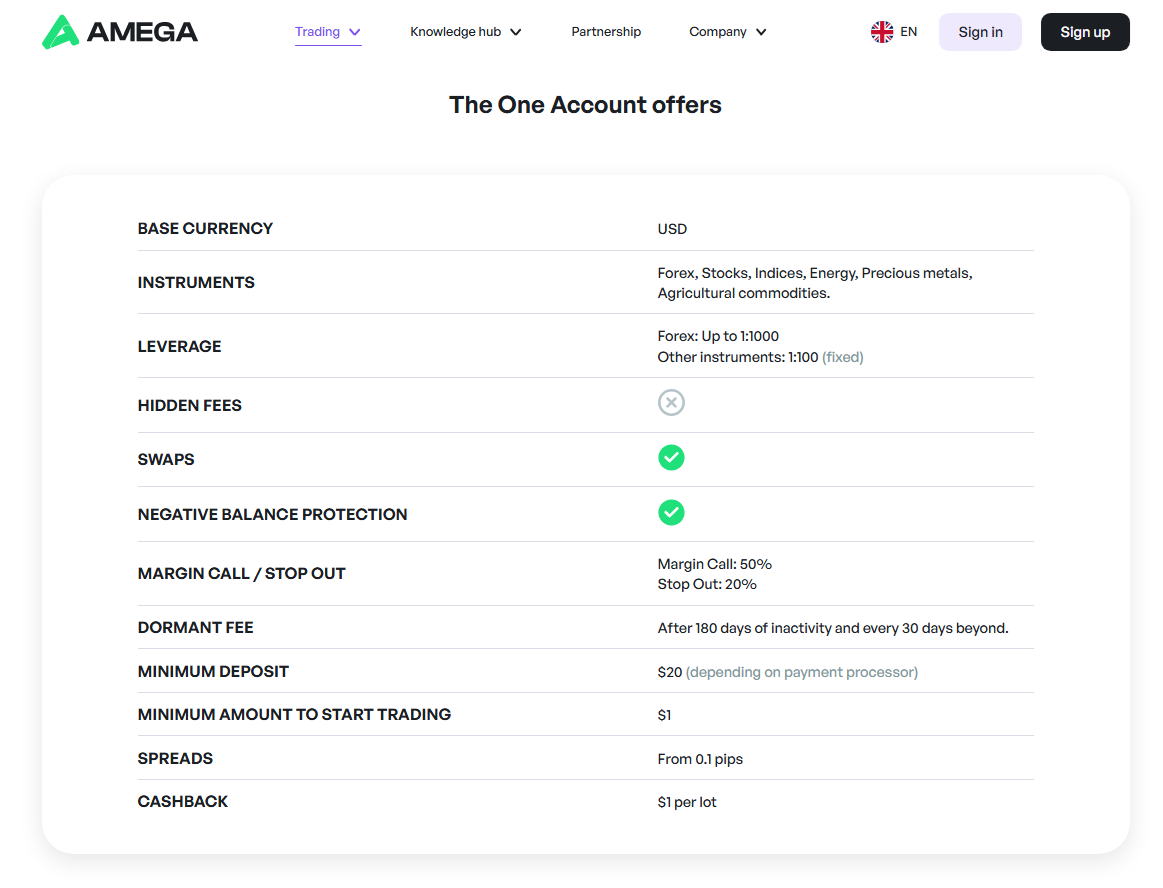

Account Types

AMEGA One Account

AMEGA's “One Account” offers a unique trading experience by providing a single account type with multiple features, eliminating the need to choose between different account types. This account provides competitive conditions, such as raw spreads starting from 0.1 pips, low commissions, and leverage up to 1:1000. It supports various trading platforms, including MetaTrader 5, WebTrader, and Mobile Trader, and offers instant order execution. The “One Account” is designed for flexibility, catering to both beginner and experienced traders.

How To Open Your Account?

- Go to the AMEGA website.

- Click “Sign Up” at the top of the page.

- Enter your personal details in the registration form.

- Verify your email by clicking the link sent to your inbox.

- Log in to the client portal with your new credentials.

- Complete the verification process by uploading necessary documents.

- Select your preferred trading platform and account settings.

- Fund your account and begin trading.

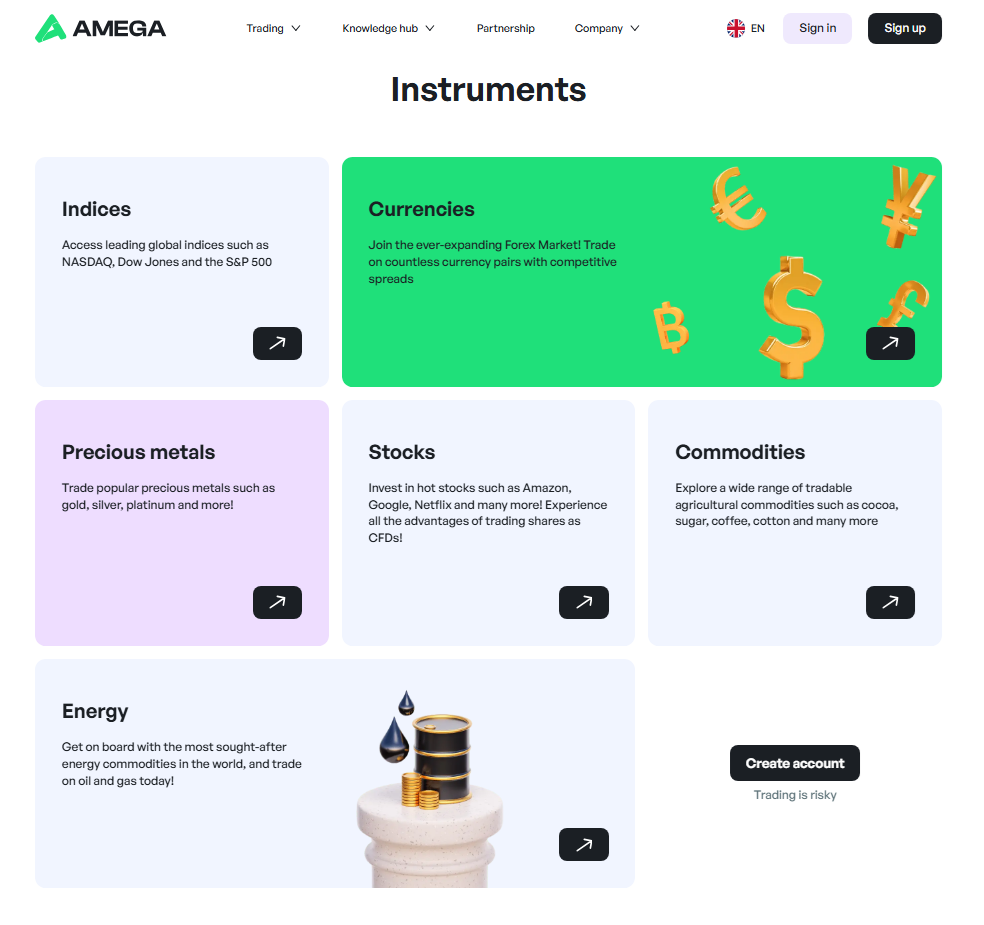

What Can You Trade on AMEGA?

AMEGA offers a diverse range of trading instruments for both novice and experienced traders. This allows anyone to diversify their portfolio according to their interests and risk tolerance. Let’s delve into the instruments available on AMEGA:

Forex (Foreign Exchange)

AMEGA offers around 31 currency pairs. This means traders can speculate on the price movements of major, minor, and exotic currency pairs. Numerous pairs’ availability provides traders ample opportunities to capitalize on different market conditions.

Metals

Traders have the option to trade on 5 different metals. Metals, especially precious ones like gold and silver, often serve as safe-haven assets during economic uncertainties.

Shares

There are 25 stocks available for trading on AMEGA. This allows traders to invest in shares of different companies across various sectors and industries. By diversifying among other stocks, traders can potentially mitigate the risk associated with individual companies’ performance.

Indices

With 8 indices available, traders can speculate on the price movements of the top shares in a specific market or region. Indices provide a summarized view of a particular stock market’s health, offering traders a way to invest in the broader market rather than individual stocks.

Energy

AMEGA offers 3 different energy commodities for trading. The energy sector, including oil and natural gas, plays a pivotal role in the global economy. Thus, it attracts significant trading activity, especially when geopolitical events can influence supply and demand.

Commodities

Traders can speculate or invest in 7 different commodities on AMEGA. Commodities trading can include agricultural products like wheat and coffee or other resources. They are fundamental for daily life, and hence, their demand and prices can be influenced by various factors ranging from weather patterns to global economic conditions.

AMEGA Customer Support

AMEGA offers customer support services to assist traders with their inquiries, technical issues, and account-related matters. Here's an overview of AMEGA's customer support:

Supported Languages: AMEGA provides customer support in a wide range of languages to cater to its global client base. Supported languages include Albanian, Arabic, Azerbaijani, Bulgarian, Chinese, Czech, English, French, German, Greek, Hebrew, Hindi, Indonesian, Italian, Japanese, Korean, Latvian, Persian, Polish, Portuguese, Romanian, Russian, Spanish, Turkish, Ukrainian, Uzbek, and Vietnamese. This ensures that customers can communicate comfortably in their preferred language.

Customer Service Channels: AMEGA offers multiple channels for customer support:

- Forums: Traders can participate in AMEGA's forums to interact with other traders, share experiences, and seek assistance from the community.

- Manuals: AMEGA provides detailed manuals and guides on its website, covering various aspects of trading, account management, platform usage, and more. These resources serve as self-help tools for traders to find answers to common queries.

- Newsletter: AMEGA sends out newsletters to keep traders informed about important updates, promotions, and educational content. Subscribing to the newsletter allows traders to stay connected with the latest developments from AMEGA.

- Chat: Live chat support is available on AMEGA's website. Traders can initiate a chat session with a support representative to receive real-time assistance and quick answers to their queries.

- Email: Traders can reach out to AMEGA's customer support team via email. Email communication allows traders to provide detailed information and receive responses to their inquiries.

Customer Service Hours: AMEGA's customer service operates from 7:00 to 14:00 GMT, Monday to Friday. During these hours, customers can reach out to the support team for assistance.

It's important to note that this schedule may not cover all time zones, and customers located in different regions may need to consider the available hours when seeking support.

Advantages and Disadvantages of AMEGA Customer Support

When considering the customer support provided by AMEGA, it's important to assess both the advantages and disadvantages to gain a comprehensive understanding. Here are some potential advantages and disadvantages of AMEGA' customer support:

Security for Investors

Understanding the limitations and implications of the broker's regulatory status is crucial in assessing the overall security measures and investor protections offered by AMEGA.

Withdrawal Options and Fees

AMEGA provides a wide range of deposit and withdrawal options for its clients. The broker offers flexibility in choosing the most convenient method for funding and withdrawing funds from trading accounts.

Withdrawal Options

At AMEGA, ensuring a smooth and efficient withdrawal process is paramount. Here's a breakdown of their withdrawal options:

- Popular Withdrawal Methods: The platform accommodates various well-known and trusted withdrawal methods to cater to a global clientele. Some of the most popular methods include:

- SticPay

- Dusupay

- Skrill

- Neteller

- OVO

- Dana

- Wire Transfers

- Minimum Deposit: Traders can start with a modest amount, as the minimum deposit required is just $20.

- Account Currency: To make transactions more convenient for its diverse user base, AMEGA offers account balances in two major currencies: USD and NGN.

- Withdrawal Timing: Efficiency is key at AMEGA. Withdrawals made during working hours are typically approved within a mere 10 minutes, ensuring traders have swift access to their funds.

AMEGA Vs Other Brokers

When comparing AMEGA to other brokers, it's essential to consider various factors that can impact the trading experience. Here, we'll explore the comparisons between AMEGA and AvaTrade, RoboForex, and Alpari to help you make an informed decision.

#1. AMEGA Vs AvaTrade

AMEGA is a reputable forex broker that offers a range of trading services and features. AMEGA is known for its competitive spreads, flexible leverage options, and commission-free deposits and withdrawals. The broker supports multiple payment methods, ensuring convenient transactions for clients.

AMEGA also prioritizes the security of investors, implementing measures such as regulation, segregated accounts, and advanced data protection. The customer support provided by AMEGA is multilingual and available through various channels, including forums, manuals, newsletters, chat, and email.

AvaTrade is a well-established broker in the forex industry, known for its extensive range of trading instruments and platforms. The broker offers a wide selection of currency pairs, as well as other instruments such as stocks, indices, commodities, and cryptocurrencies.

AvaTrade provides several account types, including Standard, Islamic, and Options accounts, allowing traders to choose based on their preferences and trading strategies. The broker offers competitive spreads and supports various trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Verdict:

AMEGA stands out for its commission-free deposits and withdrawals, and multilingual customer support. On the other hand, AvaTrade offers a wider range of trading instruments and platforms, along with a comprehensive educational and research section.

Traders who prioritize a particular trading instrument or platform may lean towards AvaTrade, while those seeking flexible account options and strong customer support may prefer AMEGA.

#2. AMEGA Vs RoboForex

AMEGA is a reputable forex broker that offers a range of trading services tailored to meet the needs of different traders. AMEGA is known for its competitive spreads, flexible leverage options, and commission-free deposits and withdrawals.

RoboForex is a well-established forex broker that offers a wide range of trading platforms and account types. The broker provides multiple account options, such as Standard, ECN, and Prime accounts, catering to the diverse needs of traders. RoboForex is known for its competitive spreads, extensive range of trading instruments, including currency pairs, stocks, indices, commodities, and cryptocurrencies, and support for popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and their proprietary platform, R Trader.

Verdict:

AMEGA excels in offering commission-free deposits and withdrawals, and multilingual customer support, which may be appealing to traders seeking flexibility and personalized assistance.

On the other hand, RoboForex stands out with its extensive range of trading instruments, multiple trading platforms, and comprehensive educational resources, making it an attractive option for traders who prioritize a wide selection of instruments and advanced trading tools.

#3. AMEGA Vs Alpari

AMEGA is known for its competitive spreads, flexible leverage options, and commission-free deposits and withdrawals. The broker supports multiple payment methods, ensuring convenient transactions for clients. AMEGA places a strong emphasis on investor security, implementing measures such as regulation, segregated accounts, and advanced data protection.

On the other hand, Alpari is a well-established broker known for its strong reputation in the industry. It offers a wide range of tradable instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

Alpari provides access to popular platforms like MT4, MT5, and Alpari Invest. The broker offers multiple account types to cater to different trading preferences. Additionally, it maintains strong regulatory oversight and investor protection.

However, traders should consider that Alpari may have higher trading costs compared to some competitors and limited educational resources. Customer support response times may also vary.

Verdict:

AMEGA stands out with its commission-free deposits and withdrawals, and multilingual customer support. The broker's emphasis on investor security is also noteworthy. Choose Alpari for its reputation, regulatory oversight, multiple account types, and access to popular platforms. Traders should evaluate their needs and weigh the pros and cons of each broker before making a decision.

Conclusion: AMEGA Review

AMEGA is a reputable forex broker with a range of trading services and features. Its strengths include competitive spreads starting from 0.1 pips, and a strong commitment to investor security through regulatory measures.

The broker provides excellent customer support in multiple languages and offers commission-free deposits and fast withdrawals 24/7. These features make AMEGA a reliable choice for traders seeking flexibility, favorable trading conditions, security, and efficient customer service.

AMEGA Review FAQs

Can I trade on AMEGA using a mobile device?

Yes, AMEGA provides mobile trading capabilities through its mobile applications for both iOS and Android devices. Traders can access their accounts, monitor market conditions, execute trades, and manage their positions conveniently from their mobile devices.

Does AMEGA offer any educational resources or trading tools?

Yes, AMEGA provides a range of educational resources and trading tools to support traders in their journey. These include tutorials, webinars, market analysis, economic calendars, and trading calculators. These resources are designed to enhance traders' knowledge and provide insights for informed trading decisions.