AUS Global Review

AUS Global introduces itself as a robust trading platform with a variety of products, competitive costs, and a customer-first approach, which includes 24/7 customer support and safe, convenient financial transactions. However, there have been multiple statements regarding issues with withdrawals and lack of transparency. With these red flags in mind, especially the high risks associated with less-regulated brokers, traders should consider more strictly regulated brokers to ensure a higher level of security and operational transparency.

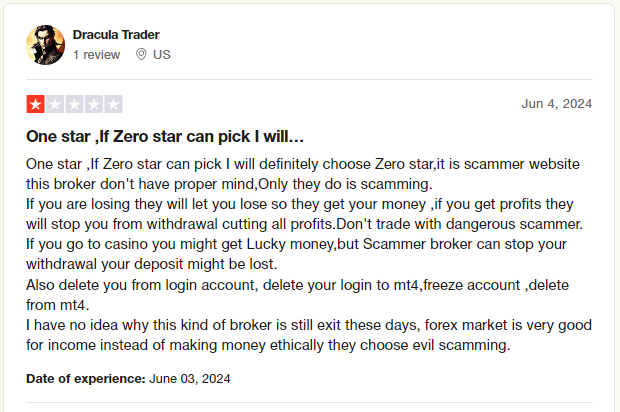

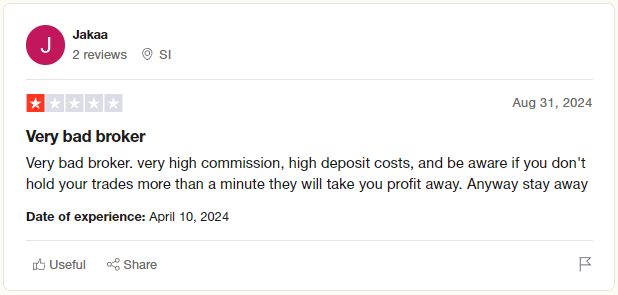

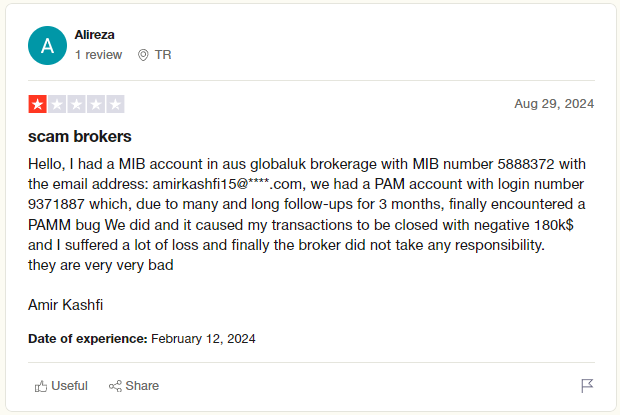

AUS Global has received a barrage of complaints from traders highlighting its shady operations and the significant losses they've experienced when trading with the broker. Traders have experienced severe issues like a PAMM account bug leading to massive losses which the broker refused to take accountability. Numerous report aggressive and unfair practices, including excessively high commissions, hefty deposit requirements, and problematic withdrawal policies that include stripping traders of their profits if trades are held for less than a minute. Also, numerous reports state that AUS Global freezes and deletes trader accounts without notice or valid reason after traders have turned a profit, under the cowling of breached terms that were not stated.

What is AUS Global?

AUS Global operates as the internet brokerage brand of the AUS Group, with a significant global presence encompassing offices in key locations such as Cyprus, London, Dubai, Turkey, Seychelles, Mauritius, Thailand, Malaysia, Vanuatu, Melbourne, Vancouver, and Wellington. The broker is regulated by several respected bodies including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities & Investment Commission (ASIC), and the Financial Sector Conduct Authority (FSCA). This extensive regulatory framework allows AUS Global to offer online trading services to both retail and institutional clients around the world.

AUS Global is experiencing significant credibility issues due to suspicious regulatory claims and vague operational transparency. Despite the declaration of regulation by credible entities like CySEC, such claims have been widely disputed by multiple traders and sources. The broker offered leverage of up to 1:500 which exceeds limits set by established regulators in the EU, US, or Australia, escalating financial risks for traders. There are also issues regarding the transparency of client fund protection and the withdrawal process, with multiple traders reporting difficulties in fund withdrawals and poor customer support. Traders are warned to trade with AUS Global with caution and consider more strictly regulated and transparent trading options to secure their investments and ensure a fair trading environment.

AUS Global Website Status

AUS Global, which operates through multiple domains, faces careful inspection for high-leverage trading and suspicious regulatory claims. These issues, coupled with operational challenges such as difficult withdrawals and poor customer service raise concerns about the broker's transparency and reliability.

AUS Global claims to be registered with various financial authorities, operating out of Mauritius, known for its lenient regulations compared to stricter jurisdictions like the UK, US, or Australia. Notably, the broker's UK-suggestive domain name does not reflect actual licensing from the UK’s Financial Conduct Authority (FCA), meaning they lack the authorization to offer trading services to UK residents. This discrepancy raises concerns about the legitimacy of their operations and regulatory compliance.

AUS Global Customer Reviews

The majority of user experiences with AUS Global are negative, highlighting operational issues such as mishandled PAMM account bugs resulting in significant losses which the broker failed to address. Customers also complained about the broker's high fees and restrictive withdrawal practices that accuse traders of illegal activities to prevent the withdrawal of funds. Many traders also reported sudden account deletions and denied access which worsened the transparency and trust issues. Lastly, poor customer service further hurt its reputation, making AUS Global a broker many users recommend avoiding due to its controversial practices and lack of strict regulatory compliance.

AUS Global Regulatory Status

AUS Global claims it is regulated by authorities like CySEC (Cyprus Securities and Exchange Commission) but these claims are questionable. The company is primarily registered in Mauritius, a country with less strict regulatory oversight compared to other financial centers such as the UK, US, or Australia. Additionally, AUS Global uses a UK-based domain but it is not licensed by the UK's Financial Conduct Authority (FCA) which raises serious concerns about the broker's legitimacy and its regulatory standing.

Unregulated brokers, like AUS Global, impose major risks which include the lack of trader protection (no segregated accounts or compensation schemes). They are prone to scams due to the absence of strict guidelines. These brokers may also engage in market manipulation, such as price manipulation or slippage, which can cause traders to incur substantial losses. Additionally, traders often face difficulties accessing their funds due to the lack of financial controls or transparency. For these reasons, it is generally safer to trade with brokers regulated by reputable authorities such as the FCA, CFTC, or ASIC to ensure a higher level of security and trust in trading activities.

Conclusion: Is AUS Global a Scam?

Yes, AUS Global is a scam.

AUS Global shows several red flags about its legitimacy, with suspicious regulatory claims and a history of poor user experiences. The majority of traders reported issues such as difficulties in withdrawing funds, unjustified account termination without notice, and high fees contributing to its reputation as a scam broker. Due to these numerous red flags, it is highly advisable to avoid trading with AUS Global and instead opt for brokers regulated by reputable authorities like the FCA, CFTC, or ASIC to ensure a safer and more reliable trading environment.

Asia Forex Mentor Reminds You:

Asia Forex Mentor is dedicated to identifying and exposing scam brokers to safeguard traders and investors. The rise of unregulated brokers offering forex and CFDs trading services across various jurisdictions has raised significant concerns. These brokers pose substantial risks to traders and investors. We strongly urge extreme vigilance against unauthorized brokers to protect your investments and ensure a secure trading experience.