BDSwiss Review

With a primary focus on Forex (foreign exchange) trading, BDSwiss is a reputed online broker that provides trading services in a number of financial markets. Since its founding in 2012, the business has expanded to become a well-liked option among traders all over the world.

BDSwiss offers access to a variety of financial assets, such as currency pairs, commodities, indices, equities, and cryptocurrencies, as an international broker. As a result, traders can diversify their portfolios and seize various market opportunities.

A prominent online broker, BDSwiss provides a wide array of trading services across numerous financial markets. BDSwiss seeks to give traders a smooth and satisfying trading experience with an emphasis on regulation, security, several trading platforms, a variety of tradable instruments, educational resources, and customer service.

We go into the details of BDSwiss in this review, providing an unbiased assessment of its features, services, benefits, drawbacks, comparison to other well-known brokers, and more. We will be familiar with the security measures and safe measurement practices used by BDSwiss to secure its customers.

What is BDSwiss?

BDSwiss is an established online brokerage firm that offers a wide range of financial trading services to clients around the world. The company was founded in 2012 and has since become a prominent player in the industry.

With its headquarters in Cyprus, BDSwiss operates under the regulations and oversight of reputable financial authorities, including CySEC (Cyprus Securities and Exchange Commission) and the FSC (Financial Services Commission) of Mauritius.

BDSwiss specializes in facilitating trading activities in the Forex market, which involves the buying and selling of currencies. However, the broker also provides access to other financial instruments such as commodities, indices, stocks, and cryptocurrencies.

By offering a diverse selection of tradable assets, BDSwiss caters to the preferences and strategies of a wide range of traders, allowing them to diversify their portfolios and capitalize on various market opportunities.

With a strong emphasis on regulation and security, BDSwiss ensures that its clients' funds and personal information are protected. The broker adheres to strict regulatory guidelines, and client funds are segregated in separate accounts for enhanced security.

BDSwiss offers traders a choice of powerful trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as their proprietary BDSwiss WebTrader. These platforms provide advanced charting tools, real-time market data, and a range of analytical features to assist traders in making informed decisions. Additionally, traders can access their accounts and trade on the go through BDSwiss's mobile trading applications.

In line with its commitment to educating traders, BDSwiss provides a wealth of educational resources. These resources include tutorials, webinars, articles, and a comprehensive glossary of trading terms. The aim is to empower traders with the knowledge and skills necessary to navigate the financial markets effectively and improve their trading performance.

Customer support is another area where BDSwiss excels. The broker offers multilingual support to cater to clients from different regions. Traders can reach out to the support team via phone, email, or live chat for prompt assistance with any queries or issues they may encounter during their trading journey.

Advantages and Disadvantages of Trading with BDSwiss?

Trading with BDSwiss presents a variety of advantages and disadvantages that traders should consider when selecting a forex broker. These factors contribute to the overall trading experience, and understanding them can help traders align their choice with their trading goals and preferences.

Benefits of Trading with BDSwiss

Indeed, before diving into the benefits of trading with BDSwiss, it's important to understand that the choice of a broker can significantly impact your trading journey. The right broker not only provides a platform for executing trades but also offers the tools, resources, and services to facilitate successful trading outcomes.

As a well-established and respected broker, BDSwiss brings numerous advantages to the table that can enhance your trading experience. Here, we delve into the key benefits of choosing BDSwiss as your trading partner.

Wide Range of Trading Assets

BDSwiss offers a diverse selection of trading assets, including currency pairs, commodities, indices, stocks, and cryptocurrencies. This allows traders to access various markets and find opportunities across different asset classes.

Freely Available Training Materials and Online Lectures

BDSwiss provides freely available training materials and periodic online lectures on relevant trading topics. These resources can help traders improve their knowledge, develop trading strategies, and stay updated with market trends.

Convenient Fund Management

BDSwiss offers multiple options for depositing, withdrawing, and transferring funds between accounts. This flexibility makes it easier for traders to manage their finances efficiently and access their funds when needed.

Access to Analytical Data

BDSwiss provides a wealth of analytical data that is freely available to traders. This includes market research, technical analysis, and other data-driven insights. Access to such data can assist traders in making well-informed trading decisions.

Full Access to Trading Instruments

BDSwiss grants traders access to all available trading instruments, regardless of the type of account they hold. This means that all clients can explore and trade a wide range of assets without restrictions or limitations.

BDSwiss Pros and Cons

When choosing a forex broker, understanding the pros and cons can provide a balanced perspective to aid decision-making. Here are some key advantages and disadvantages associated with BDSwiss:

Pros

- Regulatory Compliance

- Multiple Trading Platforms

- Diverse Tradable Instruments

- Competitive Trading Conditions

- Multilingual Customer Support

Cons

- Basic Proprietary Mobile App

- Limited Progress Tracking in Beginner's Education

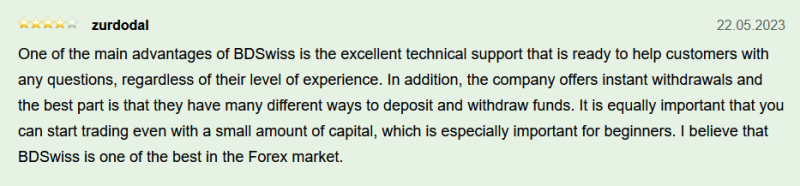

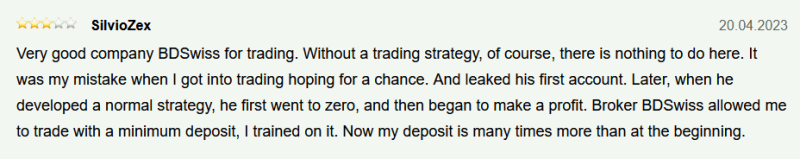

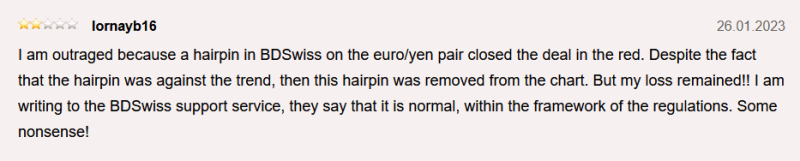

BDSwiss Customer Reviews

Customer reviews often serve as invaluable resources when selecting a forex broker, as they provide insights into the experiences of other traders. They can reveal the strengths and weaknesses of a broker's services, platform functionality, and customer support, among other key factors.

However, interpreting these reviews requires a discerning eye to separate individual experiences from consistent patterns.

Keep in mind that reviews can be subjective and are often based on personal experiences, so it's wise to look for patterns and consistent feedback among multiple reviews. Remember, while user reviews can be helpful, they should not be the only factor considered when choosing a forex broker.

BDSwiss Spreads, Fees, and Commissions

Choosing a broker with competitive spreads, fees, and commissions is a key factor in maximizing your trading profits. It's not just about the trading platform's capabilities or the variety of markets available to trade.

Costs associated with each trade can quickly add up and impact your bottom line, especially for active traders. In this section, we'll examine the fee structure at BDSwiss and how it may affect your trading experience.

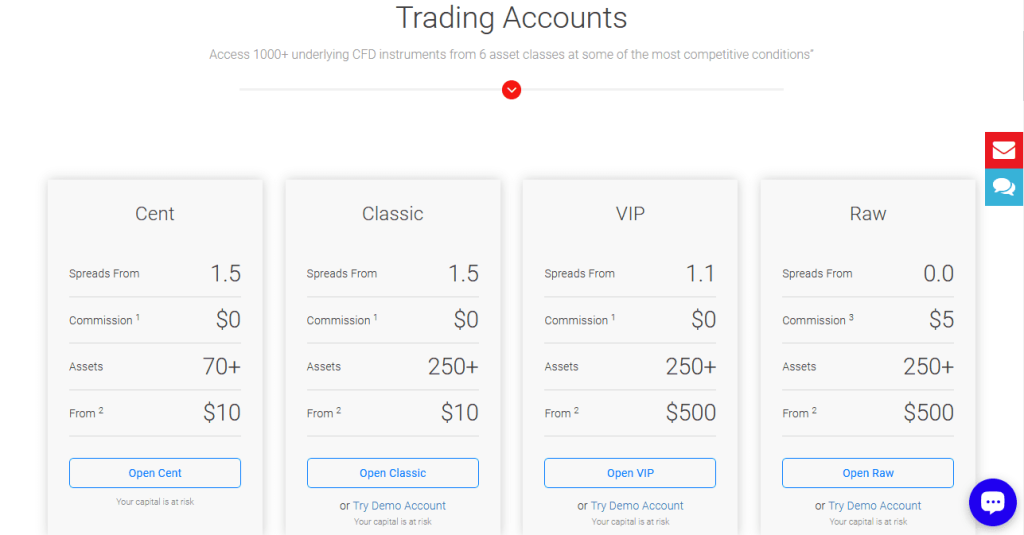

Spreads

- Classic Account: Spreads start from 1.5 pips.

- VIP Account: Zero spreads for indices, and spreads for other instruments starting at 1.1 pips.

- Paw Account: Spreads start from 0 pips (excluding trend analysis tools).

Fees and Commissions

- Account Replenishment: There is no commission for depositing funds into the account.

- Withdrawal Fees: BDSwiss covers the costs of withdrawing funds in most cases. However, there are exceptions:

- Withdrawal via bank transfer for amounts less than 100 EUR may incur a fee.

- Withdrawal of less than 20 EUR through electronic payment systems may also be subject to a fee.

- In such cases, the broker charges a fee of 10 EUR for the withdrawal of funds.

It's worth noting that BDSwiss aims to provide convenient and cost-effective services to its clients by covering most withdrawal fees. However, certain withdrawal scenarios may attract a fee for smaller amounts or specific withdrawal methods.

Account Types

BDSwiss offered four main types of trading accounts, each catering to different types of traders based on their trading needs, experience, and capital. Please note that specifics may have changed, and I recommend checking BDSwiss' official website for the most accurate, up-to-date information. Here's an overview:

Classic Account

The Classic Account offered by BDSwiss is designed to cater to traders of all experience levels. With a minimum spread value of $15, this account type provides access to a wide range of tradable instruments.

Traders can enjoy round-the-clock support, daily analysis, and free webinars, which can help them stay informed about market trends. Additionally, basic access to Autochartist and trend analysis tools is available, along with limited trading alerts. The Classic Account is suitable for traders who prefer a comprehensive trading experience with essential features and support.

VIP Account

The VIP Account at BDSwiss is tailored for traders seeking enhanced trading conditions and exclusive benefits. With a minimum spread value of $11, this account type offers zero spreads for indices and competitive spreads for other instruments.

VIP Account holders enjoy personalized assistance from a dedicated account manager, granting them access to exclusive webinars and VIP alerts on Telegram. Additionally, traders gain access to advanced analysis tools, including performance statistics in Autochartist and premium trend analysis tools. The VIP Account is ideal for traders who value personalized support and advanced trading features.

Raw Account

The Raw Account is designed for experienced traders who seek tight spreads and direct market access. With a minimum spread value of $1, this account type offers some of the lowest spreads available on BDSwiss' platform.

Traders with the Raw Account benefit from lower spreads and commissions, making it suitable for those who actively trade and require competitive pricing. While the Raw Account requires a higher minimum deposit of $5,000, it provides traders with access to advanced trading conditions.

InvestPLUS Account

The InvestPLUS Account is tailored for traders interested in long-term investment opportunities. With a minimum spread value of $0.1, this account type allows traders to access over 1,000 CFDs and offers daily analysis and basic access to Autochartist.

Traders using the InvestPLUS Account receive support from a personal manager and benefit from limited trading alerts. Moreover, this account type includes daily dividend payments, making it suitable for traders who prioritize long positions and seek potential income from their investments.

Each account type at BDSwiss caters to different trading preferences and objectives, offering a range of features, spreads, and benefits. Traders should carefully consider their trading style, experience level, and specific requirements when selecting the most suitable account type for their trading activities.

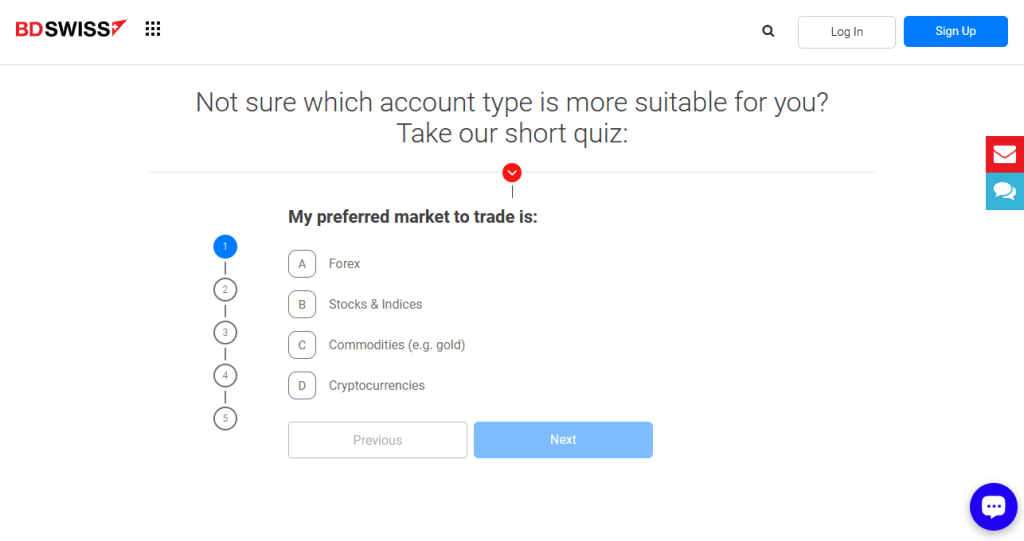

How To Open Your Account?

Opening an account with BDSwiss is a straightforward process. Here's a step-by-step guide. Be sure to check BDSwiss' official website for any changes to this process.

Visit the BDSwiss website: Start by going to the BDSwiss official website.

Sign Up: Click on the “Register” or “Open Live Account” button, usually located at the top right of the website.

Complete the Registration Form: You'll be asked to fill out a form with personal details, including your name, email address, phone number, and country of residence.

Choose an Account Type: Select the account type that best fits your trading needs and deposit requirements – Classic, VIP, Raw, InvestPLUS Account.

Verify Your Identity: To comply with financial regulations, BDSwiss will require proof of identity and proof of residence. This can usually be completed by uploading a scanned copy of a valid passport or ID for proof of identity, and a utility bill or bank statement for proof of residence.

Fund Your Account: Once your account is verified, you can deposit funds. BDSwiss offers several funding options, including bank transfer, credit/debit card, and various online wallets. Select the method that suits you best and follow the instructions to complete the deposit.

Start Trading: After your deposit has been processed, you can start trading. Download the trading platform, log in with your account details, and begin your trading journey.

What Can You Trade on BDSwiss?

BDSwiss provides a diverse range of financial instruments for trading, allowing traders to access multiple markets from a single platform. While specific offerings may evolve over time, here are some of the common instruments you can trade on BDSwiss:

Currency Pairs: BDSwiss provides a wide selection of major, minor, and exotic currency pairs, allowing traders to participate in the global forex market and take advantage of currency fluctuations.

CFDs (Contracts for Difference): BDSwiss offers CFDs on various underlying assets, including indices, stocks, commodities, cryptocurrencies, and ETFs. CFDs enable traders to speculate on the price movements of these assets without owning the underlying asset itself.

Indices: Traders can trade CFDs on major global indices, such as the S&P 500, NASDAQ, FTSE 100, DAX 30, and many others. This allows traders to take positions on the overall performance of a specific market or sector.

Stocks: BDSwiss provides access to a broad range of CFDs on individual stocks from global markets, including popular companies like Apple, Amazon, Google, Microsoft, and more. Traders can benefit from price movements in these stocks without owning the actual shares.

Commodities: Traders can trade CFDs on popular commodities like gold, silver, crude oil, natural gas, and others. These commodities provide opportunities for traders to diversify their portfolios and take advantage of price movements in the global commodity markets.

Cryptocurrencies: BDSwiss offers CFD trading on a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple, and more. Traders can speculate on the price movements of these digital currencies without the need for a cryptocurrency wallet.

ETFs (Exchange-Traded Funds): ETFs represent a basket of assets and can be traded as CFDs on BDSwiss. They allow traders to gain exposure to a specific sector, index, or asset class.

BDSwiss provides traders with a wide range of tradable instruments across multiple asset classes, offering opportunities for diversification and the ability to take advantage of various market conditions and trends.

BDSwiss Customer Support

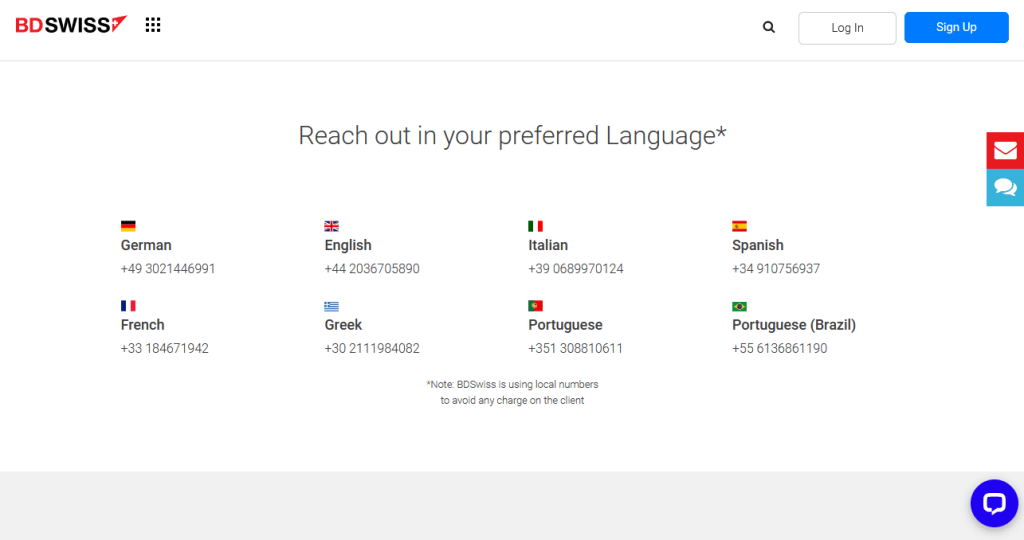

BDSwiss prides itself on providing reliable and efficient customer support to assist traders with their inquiries and concerns. The broker offers multiple channels for customer support, ensuring that assistance is readily available when needed.

Here's an overview of BDSwiss' customer support:

- Feedback Form: Traders have the option to fill out a feedback form on the BDSwiss website to reach out to customer support.

- Phone: BDSwiss provides phone numbers for specific countries, including Germany, Greece, Italy, France, England, Spain, and Portugal. Traders can call these numbers for direct communication with the support team.

- Online Chat: A live online chat feature is available on the broker's website, allowing traders to communicate with customer support specialists in real-time.

- Email: Traders can also contact BDSwiss by sending an email to the broker's designated email address.

- Social Networks and Messengers: BDSwiss maintains a presence on various social media platforms and messengers such as Facebook, Twitter, LinkedIn, Instagram, and YouTube. Traders can connect with the broker through these channels as well.

With multiple communication options available, including the feedback form, phone, online chat, email, and social media platforms, BDSwiss ensures that traders have various avenues to interact with customer support specialists and seek assistance as needed.

It's worth noting that the availability of customer support channels, response times, and language options may vary based on factors such as the trader's location and the specific service package they have chosen.

Advantages and Disadvantages of BDSwiss Customer Support

When considering the customer support provided by BDSwiss, it's important to assess both the advantages and disadvantages to gain a comprehensive understanding. Here are some potential advantages and disadvantages of BDSwiss' customer support:

Security for Investors

BDSwiss prioritizes the security of investor funds and operates under regulatory oversight to ensure a safe trading environment.

Here are some key aspects of security for investors provided by BDSwiss:

It is important to note that the advantages of robust security measures typically outweigh the potential disadvantages. Investors should prioritize the safety of their funds and personal information when selecting a broker, understanding that security measures are in place to protect their interests in the long run.

Withdrawal Options and Fees

BDSwiss offered various withdrawal options for traders to access their funds. However, it's important to note that specific withdrawal options and associated fees may have changed since then.

To obtain the most accurate and up-to-date information, I recommend visiting the official BDSwiss website or contacting their customer support.

Here are some general considerations regarding withdrawal options and fees:

To withdraw funds from a personal account, traders are required to submit a withdrawal request through the designated section of their personal account on the BDSwiss platform.

BDSwiss offers a range of options for depositing and withdrawing funds. These include Visa, Mastercard, and Maestro bank cards, as well as electronic payment systems such as Giropay, Sofort, EPS, Ideal, Dotpay, Skrill, and Neteller. Additionally, transactions can be conducted via online banking and wire transfers.

The broker ensures prompt processing of withdrawals, guaranteeing instant crediting of funds to a trading account, card, bank account, or e-wallet.

When it comes to fees, BDSwiss does not charge a commission for account replenishment, and they cover the costs associated with withdrawing funds. However, there are exceptions. For withdrawals made via bank transfer for amounts below 100 EUR, as well as withdrawals below 20 EUR through electronic payment systems, the broker imposes a fee of 10 EUR.

It's important to note that to initiate a withdrawal, traders must complete a BDSwiss account verification process by submitting relevant documents to confirm their identity.

By offering a variety of withdrawal options and covering the withdrawal costs for most cases, BDSwiss aims to provide convenience and efficient fund management for its traders. However, it's essential to consider any applicable fees and adhere to the necessary verification procedures when making withdrawals.

BDSwiss Vs Other Brokers

When comparing BDSwiss to other brokers, it's essential to consider various factors that can impact the trading experience. Here, we'll explore the comparisons between BDSwiss and AvaTrade, RoboForex, and Alpari to help you make an informed decision.

#1. BDSwiss Vs AvaTrade

Both BDSwiss and AvaTrade are well-known brokers in the forex trading industry, but they have some differences that are worth considering.

In terms of regulation, BDSwiss is regulated by multiple reputable authorities, including CySEC, FSC, and FSA, while . Both brokers demonstrate a commitment to compliance and client protection through their regulatory oversight.

When it comes to trading platforms, BDSwiss offers a comprehensive selection, including its proprietary platform, mobile and web-based apps, and popular choices like MetaTrader 4 and 5. AvaTrade also provides a range of platforms, including AvaTradeGO, MetaTrader 4, MetaTrader 5, and their own platform called AvaOptions. Traders can choose the platform that best suits their trading preferences and needs.

In terms of tradable instruments, both brokers offer a wide range of options. BDSwiss provides access to currency pairs, CFDs on indices, stocks, commodities, cryptocurrencies, and ETFs. Similarly, AvaTrade offers forex trading, CFDs on stocks, indices, commodities, and cryptocurrencies. Traders can select the broker that offers the specific instruments they are interested in trading.

Verdict:

If having multiple regulatory licenses is a priority, BDSwiss may be the preferred option with its various regulatory approvals. On the other hand, AvaTrade's strong regulatory oversight also provides a sense of security for traders.

In terms of tradable instruments, both brokers offer a diverse range, so traders should consider their specific trading preferences and desired markets.

#2. BDSwiss Vs RoboForex

In terms of regulation, BDSwiss is regulated by reputable authorities such as CySEC, FSC, and FSA. This ensures that the broker operates in accordance with regulatory standards and offers a certain level of client protection. RoboForex, on the other hand, is regulated by IFSC and adheres to the guidelines set by the International Financial Services Commission.

When it comes to trading platforms, BDSwiss offers a variety of options, including its proprietary platform, mobile and web-based apps, as well as popular platforms like MetaTrader 4 and 5. RoboForex also provides the popular MetaTrader platforms, along with their own proprietary platform called R Trader. Traders can choose the platform that suits their trading preferences and needs.

In terms of tradable instruments, both brokers offer a wide range of options. BDSwiss provides access to currency pairs, CFDs on indices, stocks, commodities, cryptocurrencies, and ETFs. RoboForex also offers a diverse range of instruments, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies. Traders can select the broker that offers the specific instruments they wish to trade.

Verdict:

BDSwiss stands out for its strong regulation by reputable authorities, providing a sense of security for traders. It also offers a comprehensive range of trading platforms, including its proprietary platform. On the other hand, RoboForex provides a solid trading environment and a variety of instruments, along with its own proprietary platform.

#3. BDSwiss Vs Alpari

In terms of regulation, BDSwiss is regulated by multiple reputable authorities, including CySEC, FSC, and FSA. This ensures that the broker operates in compliance with regulatory standards and offers a certain level of client protection. Alpari, on the other hand, is regulated by the Financial Services Commission (FSC) of Belize and the International Financial Services Commission (IFSC) of Mauritius. While both brokers demonstrate a commitment to regulatory compliance, BDSwiss has a broader range of regulatory oversight.

When it comes to trading platforms, BDSwiss offers a comprehensive selection, including its proprietary platform, mobile and web-based apps, as well as popular platforms like MetaTrader 4 and 5. Alpari also provides access to the popular MetaTrader platforms, which are widely recognized for their advanced features and user-friendly interface. Traders can choose the platform that suits their trading preferences and needs.

In terms of tradable instruments, BDSwiss offers a diverse range of assets for trading, including currency pairs, CFDs on indices, stocks, commodities, cryptocurrencies, and ETFs. Similarly, Alpari provides a wide selection of instruments, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies. Traders can select the broker that offers the specific instruments they are interested in trading.

Verdict:

Both BDSwiss and Alpari have their strengths and cater to the needs of different traders. BDSwiss stands out for its multiple regulatory licenses, providing a higher level of regulatory oversight. Additionally, BDSwiss offers a broader range of trading platforms, giving traders more options.

On the other hand, Alpari is known for its reliable MetaTrader platforms, which are widely used and trusted in the industry.

Conclusion: BDSwiss Review

BDSwiss is a well-established broker in the forex trading industry, offering a range of features and services to traders. With its multiple regulatory licenses from reputable authorities like CySEC, FSC, and FSA, BDSwiss demonstrates a commitment to operating in compliance with regulatory standards and providing a level of client protection.

The broker offers a variety of trading platforms, including its proprietary platform, mobile and web-based apps, as well as popular platforms like MetaTrader 4 and 5, giving traders flexibility in choosing their preferred trading environment. BDSwiss provides a wide range of tradable instruments, including currency pairs, CFDs on indices, stocks, commodities, cryptocurrencies, and ETFs, allowing traders to diversify their portfolios.

BDSwiss offers a user-friendly mobile app that allows clients to access their accounts, execute trades, and monitor their portfolio on the go, while providing transparent trading fees for their online trading services, empowering traders to practice their trading skills and develop effective trading strategies through their demo account feature.

While there may be some areas for improvement, such as the basic functionality of the proprietary mobile app and the 10% inactivity fee, BDSwiss overall offers a solid trading experience with competitive spreads, access to analytical tools, and various communication channels for customer support. Traders looking for a regulated broker with a diverse range of trading instruments may find BDSwiss to be a suitable option for their forex trading needs.

BDSwiss Review FAQs

What is the minimum deposit requirement to open an account with BDSwiss?

The minimum deposit requirement to open an account with BDSwiss is $100 for the Classic account. However, it's worth noting that different account types may have varying minimum deposit requirements.

Does BDSwiss offer Islamic (swap-free) accounts?

Yes, BDSwiss does offer Islamic accounts, also known as swap-free accounts, which are designed to accommodate traders who follow Shariah principles. These accounts are tailored to eliminate overnight interest (swap) charges on positions held overnight.

Can I trade with BDSwiss if I am a resident of the United States?

No, BDSwiss does not accept clients from the United States. While the broker serves clients from many countries around the world, including Europe, Asia, and Africa, it is important to check the list of accepted countries on the BDSwiss website to ensure eligibility based on your country of residence.