The best crypto brokers in the Philippines offer Filipino traders diverse options to trade cryptocurrencies and access the growing crypto market. These platforms act as financial service providers, enabling users to buy, sell, and trade digital assets like Bitcoin and Ethereum. With crypto trading gaining popularity, choosing the right crypto broker with features like advanced security measures, low trading fees, and a user-friendly interface is essential for crypto investors.

Filipino traders often seek crypto exchanges in the Philippines supporting bank transfers, fiat currency conversions, electronic money issuer, and decentralized exchanges for seamless crypto transactions in the crypto world. For experienced traders, features like futures trading, copy trading, and crypto loans add versatility. Meanwhile, beginners benefit from platforms with low minimum deposits, accessible customer support, and intuitive tools to manage crypto investments. Whether it's exploring passive income opportunities or safeguarding assets through anti-money laundering protocols, finding the best crypto exchange tailored to individual needs ensures a safe and rewarding cryptocurrency trading experience.

Key Factors to Consider When Choosing a Crypto Broker

When choosing a crypto broker, several factors are crucial to ensure a smooth trading experience and secure management of crypto investments. Filipino investors should start by identifying the best crypto brokers in the Philippines that are compliant with Bangko Sentral ng Pilipinas regulations. Look for brokers that support fiat currency deposits, like the Philippine Peso, via bank transfers or mobile wallets. Evaluate the user-friendly interface, customer support, and whether the platform offers crypto loans, copy trading, and other services for both beginners and experienced traders.

Analyze trading fees, withdrawal fees, and the minimum deposit required, as these impact profitability. Ensure the broker offers a variety of digital assets, including options for futures trading, spot trading, and trading CFDs, along with robust advanced security measures. Platforms like crypto trading platforms with decentralized exchanges or centralized exchanges are ideal for accessing the crypto market. Filipino users should also consider income opportunities like passive income opportunities or initial coin offerings and ensure anti-money laundering compliance and be aware the cryptocurrency trading risky things are involved. Always verify legal tender acceptance and assess tools for trading strategies to navigate the cryptocurrency market effectively.

The 5 Best Crypto Brokers in the Philippines

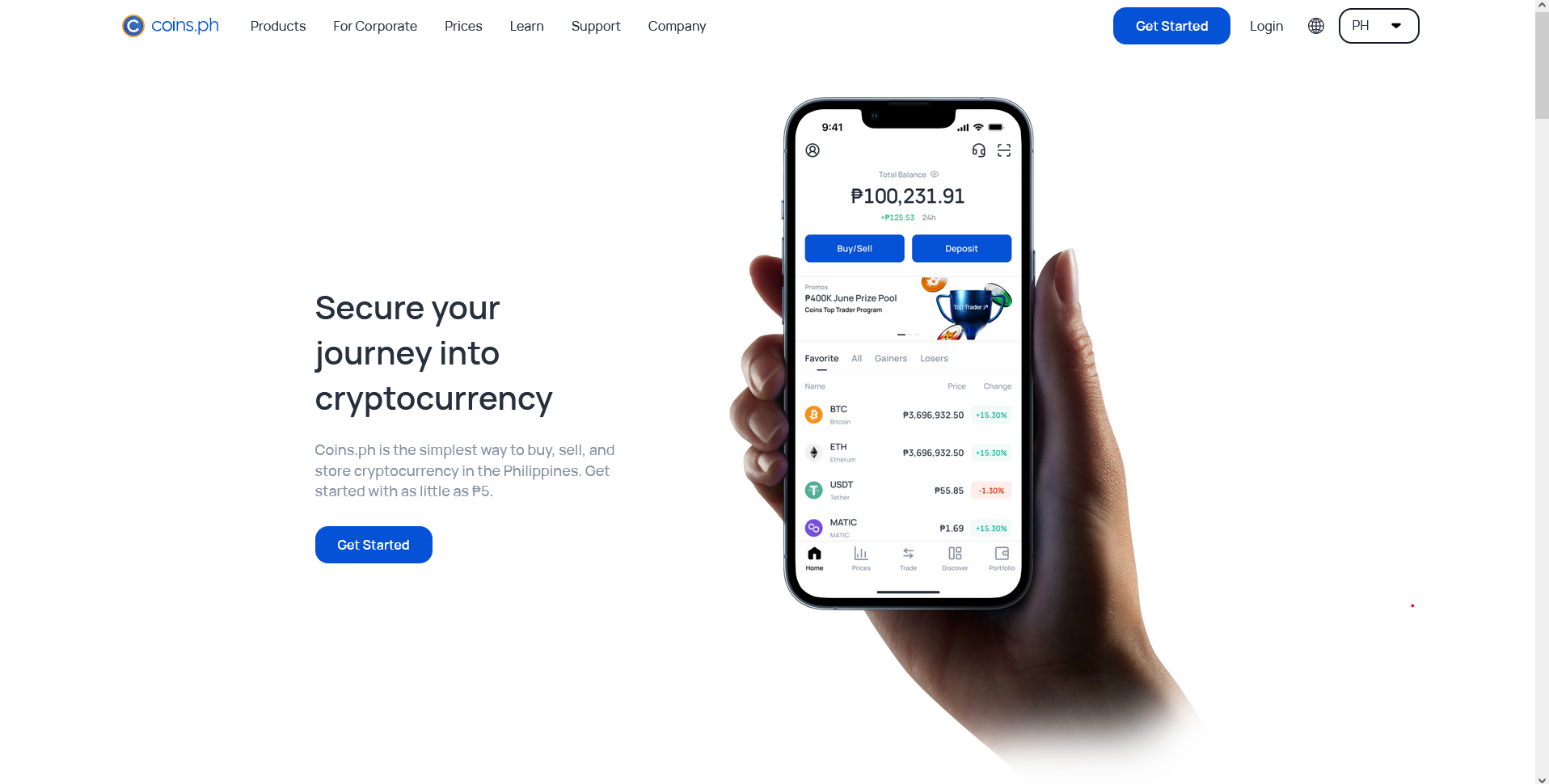

#.1 Coins.ph

What is Coins.ph?

Coins.ph, established in 2014, is a Philippine-based mobile blockchain-enabled platform that allows users, including the unbanked, to access financial services directly from their smartphones. The platform offers a digital wallet facilitating remittances, bill payments, mobile airtime purchases, and online shopping at over 100,000 merchants. Operating primarily in the Philippines and Thailand, Coins.ph aims to enhance financial inclusion across Southeast Asia.

Advantages and Disadvantages of Coins.ph

Coins.ph Commissions and Fees

Coins.ph maintains a transparent fee structure, with trading fees varying based on transaction types and user activity levels. The platform distinguishes between maker and taker fees, where makers (those who add liquidity) are charged lower fees compared to takers (those who remove liquidity). Additionally, withdrawal fees are dynamic, adjusting in real-time according to network conditions and transaction complexities.

#2. PDAX

What is PDAX?

PDAX, or the Philippine Digital Asset Exchange, is a BSP-licensed cryptocurrency exchange established in 2018. It enables users to trade digital assets directly with the Philippine Peso, offering a secure and accessible platform for Filipino investors. With a low entry point of PHP 200, PDAX caters to both beginners and experienced traders.

Advantages and Disadvantages of PDAX

PDAX Commissions and Fees

PDAX implements a transparent fee structure, with trading fees ranging from 0.40% to 0.50%, depending on the order type. Cryptocurrency withdrawal fees vary per asset; for instance, withdrawing Bitcoin incurs a fee of 0.0006 BTC. Additionally, network fees apply when sending crypto, differing across various tokens.

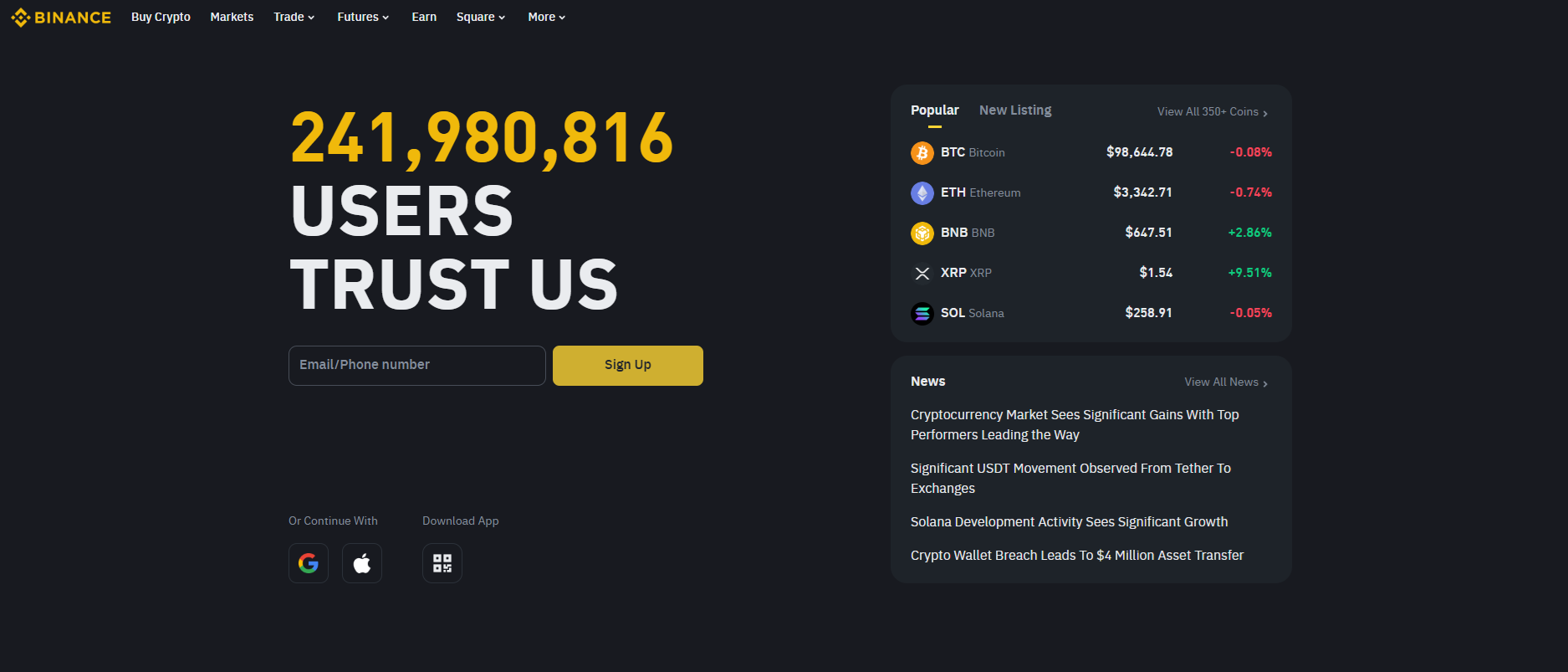

#3. Binance

What is Binance?

Binance is a leading cryptocurrency exchange founded in 2017 by Changpeng Zhao and Yi He. It offers a comprehensive platform for trading a wide array of digital assets, including Bitcoin and Ethereum. Users benefit from features such as spot trading, futures contracts, staking, and lending services. Over time, Binance has expanded its services globally, becoming one of the largest exchanges by trading volume.

Advantages and Disadvantages of Binance

Binance Commissions and Fees

Binance employs a tiered fee structure based on users' 30-day trading volume and BNB holdings. The base trading fee is 0.1% for both makers and takers, which can be reduced by 25% when using Binance Coin (BNB) for fee payments. Deposit fees vary depending on the method and currency, with many crypto deposits being free. Withdrawal fees are dynamic, reflecting network conditions and specific asset costs.

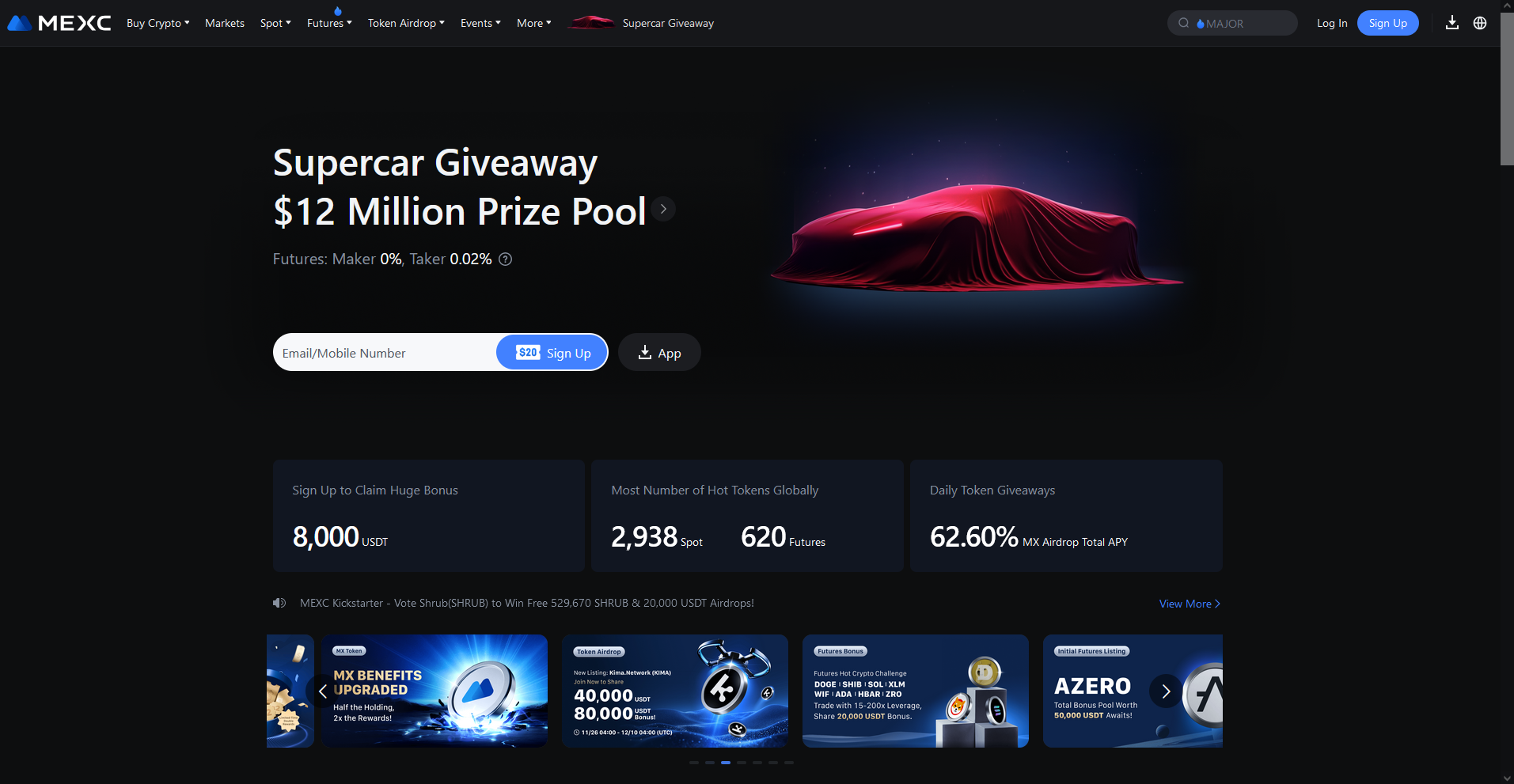

#4. MEXC

What is MEXC?

MEXC is a cryptocurrency exchange established in 2018, offering a wide range of digital assets for trading. It provides services such as spot and futures trading, with leverage options up to 200x. The platform is accessible to users in over 170 countries, supporting more than 2,800 cryptocurrencies.

Advantages and Disadvantages of MEXC

MEXC Commissions and Fees

MEXC offers competitive trading fees, with 0% maker fees and 0.1% taker fees for spot trading. For futures trading, the platform charges 0% maker fees and 0.01% taker fees. Users holding the platform's native MX token can receive additional discounts on trading fees.

#5. Bybit

What is Bybit?

Bybit is a cryptocurrency exchange established in 2018, offering a platform for trading digital assets. It provides services such as spot trading, derivatives trading with up to 100x leverage, and various investment products. Bybit caters to both novice and experienced traders, emphasizing a user-friendly interface and robust security measures.

Advantages and Disadvantages of Bybit

Bybit Commissions and Fees

Bybit employs a maker-taker fee model for its trading activities. For spot trading, both maker and taker fees start at 0.1% for non-VIP users. In derivatives trading, the maker fee is 0.01%, while the taker fee is 0.06%. These fees can be reduced through higher trading volumes or participation in the platform's VIP programs.

Tips for Safe and Successful Trading

Engaging in cryptocurrency trading requires careful preparation and a strong understanding of the crypto market. Start by choosing the best crypto brokers in Philippines or reputable crypto exchange platforms that offer advanced security measures and retail investor accounts to trade crypto. Whether you're a beginner or an experienced trader, ensure the platform provides a user-friendly interface for seamless navigation. Check their trading fees, such as taker fees or withdrawal fees, and verify if they support bank transfers and the Philippine peso. Platforms with customer support and compliance with Bangko Sentral ng Pilipinas regulations ensure legitimacy and security.

To maximize returns, focus on trading strategies and monitor the crypto exchange market. Start with platforms offering minimum deposits, crypto loans, or copy trading to diversify your crypto investments. Be cautious of initial coin offerings and assess your risk tolerance before investing in digital currencies. Filipino users can benefit from legal tender support, enabling them to pay bills or deposit funds using a mobile wallet or bank account. Always prioritize platforms with transparency, whether trading on centralized exchanges, decentralized exchanges, or engaging in spot trading and futures trading.

Also Read: The 5 Best Binary Brokers in the Philippines in 2024: A Comprehensive Guide

Conclusion

Crypto trading in the Philippines has seen a significant rise, with crypto investors exploring platforms offering a user-friendly interface and advanced security measures. Top crypto exchange provide services like spot trading, copy trading, and crypto loans, catering to both experienced traders and filipino users. While crypto assets trading is risky, features like low trading fees, intuitive interfaces, and seamless bank transfers enhance the trading experience.

Platforms approved by Bangko Sentral ng Pilipinas ensure compliance with anti-money laundering regulations, enabling secure crypto transactions for filipino investors. As the crypto exchange market evolves, choosing crypto brokers in Philippines with options for fiat currency deposits and digital currencies like Bitcoin remains crucial for successful crypto investments.

FAQS

What is a crypto broker?

A crypto broker is a platform that facilitates the buying, selling, and trading of cryptocurrencies for users.

Are crypto brokers in the Philippines regulated?

Yes, many crypto brokers in the Philippines are regulated by the Bangko Sentral ng Pilipinas (BSP) to ensure security and compliance.

What fees do crypto brokers charge?

Fees vary by broker and may include transaction fees, withdrawal fees, and trading commissions.