Finding the right forex broker can make or break your trading experience, especially in Europe, where regulations and offerings vary widely. With over 9 million active traders across the continent, choosing the right platform is more crucial than ever! This guide dives into the top 10 forex brokers in Europe, highlighting their features, advantages, and why they stand out in 2024. Whether you're a beginner or an experienced trader, we've got you covered.

Why Choose a Forex Broker in Europe?

Choosing a Forex broker in Europe is appealing due to its strong regulatory environment. Authorities like MiFID (Markets in Financial Instruments Directive) and ESMA (European Securities and Markets Authority) enforce strict rules to protect traders. These regulations ensure transparency, accountability, and segregation of client funds, minimizing risks of fraud or malpractice.

EU-based brokers also offer notable advantages. They prioritize safety with high operational standards and provide competitive trading conditions, including lower fees and tighter spreads. Additionally, traders benefit from investor compensation schemes and stringent data protection laws, making the European market a secure and efficient choice for forex trading.

Top Features to Look for in a Forex Broker

When selecting a Forex broker, prioritize user-friendly trading platforms that are intuitive and feature-rich, catering to both beginners and experienced traders. Competitive spreads and low commissions are essential to minimize trading costs and maximize profitability.

Ensure the broker provides access to diverse markets like Forex, CFDs, stocks, and commodities, allowing portfolio diversification. Reliable customer support and comprehensive educational resources help traders navigate challenges effectively. Finally, choose brokers with strong regulation and security measures to protect funds and ensure a safe trading experience.

The 10 Best Forex Brokers in Europe for 2024

Selecting a reliable forex broker is crucial for successful trading. Below is a curated list of the top 10 forex brokers in Europe for 2024, highlighting their key features, platforms, and regulatory statuses.

#1. Eightcap

What is Eightcap?

Eightcap is a global online broker established in 2009, offering access to over 800 financial instruments, including forex, commodities, indices, and cryptocurrencies. It provides traders with multiple platforms, such as MetaTrader 4, MetaTrader 5, and TradingView, to accommodate diverse trading preferences.

Advantages and Disadvantages of Eightcap

Eightcap Commissions and Fees

Regarding commissions and fees, Eightcap offers two account types: the Standard Account, which features no commissions and spreads starting from 1 pip, and the Raw Account, which provides spreads from 0.0 pips with a commission of $3.50 per side (totaling $7.00 per round lot). This structure allows traders to choose between commission-free trading with wider spreads or tighter spreads with a fixed commission.

OPEN AN ACCOUNT NOW WITH EIGHTCAP AND GET YOUR WELCOME BONUS

#2. Pepperstone

What is Pepperstone?

Pepperstone is an Australian-based online broker established in 2010, offering trading services across various asset classes, including forex, stocks, and commodities. Operating internationally, it holds regulatory licenses in multiple jurisdictions, such as the UK, Germany, Cyprus, Kenya, the Bahamas, and the UAE.

Advantages and Disadvantages of Pepperstone

Pepperstone Commissions and Fees

Regarding commissions and fees, Pepperstone provides two primary account types: the Razor Account, featuring spreads as low as 0.0 pips with a commission of AUD $7 per round turn per standard lot, and the Standard Account, which is commission-free with spreads starting from 1.0 pips. Additionally, the broker charges swap rates for positions held overnight and fees for international bank wire withdrawals, while deposit fees and inactivity fees are not applied.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

#3. OANDA

What is OANDA?

OANDA is a globally recognized online broker established in 1996, offering trading services in forex and CFDs across various asset classes, including commodities and indices. Renowned for its transparent pricing and robust regulatory oversight, OANDA caters to both novice and experienced traders.

Advantages and Disadvantages of OANDA

OANDA Commissions and Fees

OANDA employs a spread-based pricing model, with no separate commission charges on trades. The average spread for the EUR/USD pair is approximately 1.61 pips, which is higher than the industry average. Additionally, OANDA charges an inactivity fee of $10 per month after 12 months of inactivity.

OPEN AN ACCOUNT NOW WITH OANDA AND GET YOUR WELCOME BONUS

#4. IG Group

What is IG Group?

IG Group is a UK-based online trading provider offering access to spread betting and CFD trading, enabling clients to speculate on various financial markets without owning the underlying assets. Established in 1974, it operates globally and is listed on the London Stock Exchange as a constituent of the FTSE 250 Index.

Advantages and Disadvantages of IG Group

IG Group Commissions and Fees

Commissions and fees at IG Group vary depending on the specific financial instruments and markets traded. For instance, spread betting and CFD trading typically involve costs embedded within the spread, while stock trading may incur separate commission charges. Clients are advised to review IG Group's official fee schedule for detailed information on applicable charges.

OPEN AN ACCOUNT NOW WITH IG GROUP AND GET YOUR WELCOME BONUS

#5. IC Markets

What is IC Markets?

IC Markets is a globally recognized online forex and CFD broker, established in 2007 and headquartered in Sydney, Australia. It offers traders access to a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies, through advanced trading platforms like MetaTrader 4, MetaTrader 5, and cTrader.

Advantages and Disadvantages of IC Markets

IC Markets Commissions and Fees

IC Markets provides competitive trading conditions with low spreads and transparent fee structures. The Standard Account operates on a spread-only model with no commissions, while the Raw Spread Account features spreads starting from 0.0 pips, accompanied by a commission of $3.50 per lot per trade. Notably, IC Markets does not charge deposit or withdrawal fees, and there are no inactivity fees, making it a cost-effective choice for traders.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#6. eToro

What is eToro?

eToro is a social investment and multi-asset brokerage company that offers a platform for both manual and social investing, including features like CopyTrader™. It provides access to a wide selection of stocks, currencies, commodities, cryptoassets, and ETFs, catering to a diverse range of investors.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro charges $0 commissions on stock and ETF trades, making it an attractive option for cost-conscious investors. However, it imposes a 1% fee on both the entry and exit of cryptocurrency trades, which can accumulate with frequent trading. Additionally, eToro requires a minimum deposit of $100 to open an account.

OPEN AN ACCOUNT NOW WITH ETORO AND GET YOUR WELCOME BONUS

#7. FP Markets

What is FP Markets?

FP Markets is an Australian-based forex and CFD broker established in 2005, offering a wide range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. The broker is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with international financial standards.

Advantages and Disadvantages of FP Markets

FP Markets Commissions and Fees

FP Markets provides two main account types: the Standard Account, which is commission-free with spreads starting from 1.0 pips, and the Raw Account, featuring raw spreads from 0.0 pips with a commission of $6 per round-turn lot. This structure caters to both novice and experienced traders, offering competitive pricing across various trading platforms.

OPEN AN ACCOUNT NOW WITH FP MARKETS AND GET YOUR WELCOME BONUS

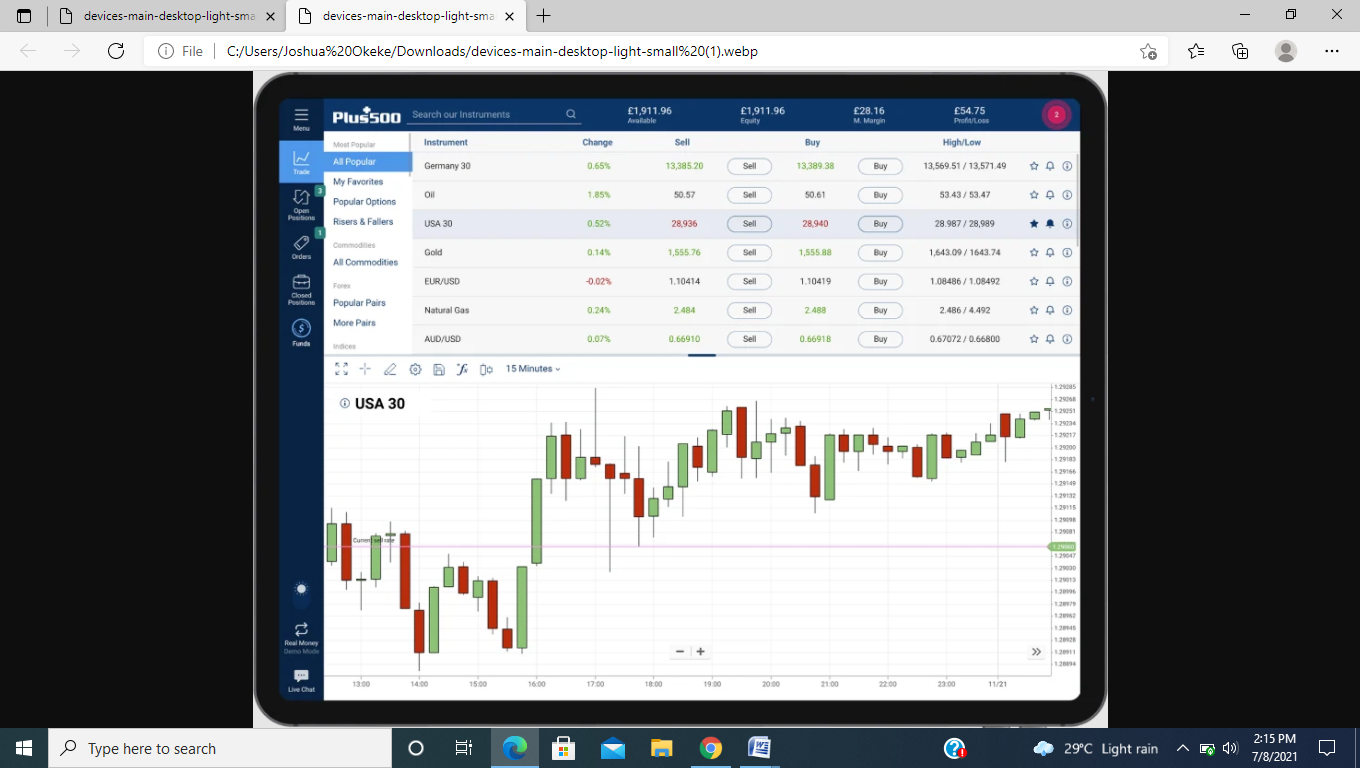

#8. Plus500

What is Plus500?

Plus500 is a London-based financial firm offering an online trading platform for contracts for difference (CFDs), share dealing, futures trading, and options on futures. Operating in over 60 countries, it is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Advantages and Disadvantages of Plus500

Plus500 Commissions and Fees

Plus500 primarily generates revenue through the bid-ask spread on trades, meaning it does not charge traditional commissions. However, traders should be aware of potential fees such as overnight funding charges, currency conversion fees, and inactivity fees for dormant accounts.

OPEN AN ACCOUNT NOW WITH PLUS500 AND GET YOUR WELCOME BONUS

#9. XM

What is XM?

XM is a satellite radio service that was one of the two primary providers in the United States before merging with Sirius Satellite Radio to form Sirius XM in 2008. It offered a wide range of music, news, sports, and entertainment channels to subscribers across the country.

Advantages and Disadvantages of XM

XM Commissions and Fees

Regarding commissions and fees, XM's subscription plans varied based on the selected package, with options ranging from à la carte offerings to comprehensive channel lineups. Pricing was influenced by factors such as the number of channels, premium content, and additional services like traffic and weather updates.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

#10. AvaTrade

What is AvaTrade?

AvaTrade is a globally recognized online brokerage firm established in 2006, offering a diverse range of trading platforms and instruments, including forex, CFDs, and cryptocurrencies. The company is regulated by multiple authorities, ensuring a secure trading environment for its clients.

Advantages and Disadvantages of AvaTrade

AvaTrade Commissions and Fees

AvaTrade operates on a commission-free model, with its revenue primarily derived from spreads on trades. While deposits and withdrawals are free, the broker imposes an inactivity fee of $50 per quarter after three consecutive months of inactivity, and an annual administration fee of $100 after 12 months of non-use.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

When choosing a forex broker, consider factors such as regulatory status, trading platforms, fees, and the range of available instruments to ensure they align with your trading needs and preferences.

Comparing Fees and Spreads Across Brokers

When evaluating forex brokers, it's essential to consider their commission structures, spreads on popular currency pairs, and any additional fees that may impact your trading costs. Below is a comparative analysis of ten prominent brokers:

Analysis of Commission Structures

- Eightcap, Pepperstone, IC Markets, FP Markets, XM: These brokers offer both spread-only and commission-based accounts. Their commission-based accounts typically charge $3.00–$3.50 per lot per side, paired with low or zero spreads.

- OANDA, IG Group, eToro, Plus500, AvaTrade: These brokers primarily operate on a spread-only model. They do not charge separate commissions, instead incorporating costs into the spreads.

Comparison of Spreads for Popular Currency Pairs

- Low Spread Brokers: Eightcap, Pepperstone, IC Markets, FP Markets, and XM consistently offer the tightest spreads, starting from 0.0 pips on major pairs like EUR/USD.

- Moderate Spread Brokers: IG Group and Plus500 provide competitive spreads, starting from 0.6–0.8 pips, making them a good choice for traders prioritizing simplicity.

- Higher Spread Brokers: OANDA, eToro, and AvaTrade have slightly wider spreads, starting from 1.0–1.1 pips, but they often compensate with user-friendly platforms or added features.

Overview of Hidden Fees

- Withdrawal Fees: Brokers like eToro and Plus500 charge a flat fee for withdrawals, while others may impose charges based on withdrawal methods, such as bank transfers or e-wallets.

- Inactivity Fees: Inactivity fees vary significantly, with brokers like eToro applying them after 12 months, while Plus500 and AvaTrade enforce them after three months of no activity.

- Swap Fees: Overnight financing fees are standard across brokers and depend on the position size and currency pair traded.

- Additional Fees: Guaranteed stop-loss orders are optional but may incur extra charges for added trading certainty.

Considering these factors ensures traders select a broker whose fee structure aligns with their trading strategy and financial goals. Choosing brokers with transparent pricing and competitive spreads can significantly enhance trading profitability.

Regulation and Security in European Forex Trading

Role of Regulatory Bodies: Regulatory authorities like CySEC, FCA, and BaFin play critical roles in maintaining the integrity of the forex market. CySEC oversees brokers in Cyprus and aligns with EU MiFID II regulations, ensuring consistent standards across Europe. The FCA in the UK enforces stricter compliance, including segregated client funds and negative balance protection. BaFin, Germany's regulator, focuses on financial stability and robust supervision of brokers operating within the country.

Impact on Broker Practices and User Safety: Regulations enforce transparency in broker operations, such as clear fee structures, fund protection, and fair trading practices. They also mandate measures like anti-money laundering (AML) compliance and data protection, reducing risks for traders. Regulated brokers are less likely to engage in fraudulent activities, offering higher safety standards for users.

Steps to Verify Broker Credentials: To confirm a broker’s legitimacy, check their regulatory license on the official websites of CySEC, FCA, or BaFin. Verify the broker's name and license number against the regulatory database. Additionally, look for reviews and avoid brokers without clear regulatory information. Ensuring a broker is regulated provides an extra layer of security for traders.

How to Choose the Best Broker for Your Needs

Matching Broker Features to Your Trading Goals: Selecting the right broker depends on your trading objectives and trading strategies in the Forex industry. Day traders may prioritize brokers offering low spreads and fast execution, while long-term investors might look for robust analytical tools and diverse asset offerings. For example, if trading forex, ensure the broker provides access to major currency pairs, tight spreads, and platforms like MetaTrader 4 or 5 for advanced trading tools.

Importance of Demo Accounts for Beginners: Demo accounts allow new traders to practice without risking real money. They help beginners understand the broker's platform, test strategies, and gain confidence in trading before transitioning to a live account. A broker offering an unlimited demo account is particularly beneficial for extended learning.

Key Questions to Ask When Evaluating Brokers: Before choosing a broker, ask about their regulation, trading fees, spreads, and withdrawal policies. Confirm the range of tradable instruments, platform usability, and availability of customer support. Additionally, inquire about educational resources and risk management tools, which are critical for both beginners and experienced traders.

Also Read: The 10 Best Forex Brokers in Asia in 2024 • Reviewed by Asia Forex Mentor

Conclusion

Choosing the right forex broker in Europe is essential for successful and secure trading in 2024. This list of the 10 best forex brokers simplifies the process, providing reliable and top-rated options. Ready to get started? Research your options, try demo accounts, and take your trading to the next level today!