India's trading landscape is rapidly evolving, with a growing demand for access to global markets. Indian investors are seeking the best international brokers in India to facilitate seamless forex trading, stock market investments, and other financial instruments. Selecting the right broker is crucial for success, as the trading platform, fees, and features directly impact performance.

This guide identifies the best forex brokers and online brokers based on criteria like regulatory compliance, availability of advanced trading tools like online trading, and access to a wide range of investment opportunities in trading forex. Whether you're a seasoned investor or just started trading, choosing a regulated entity with features like negative balance protection and robust platforms is key to achieving your trading goals while managing risks effectively.

Key Factors to Consider When Choosing an International Broker

When selecting the best international brokers in India, several key factors should guide your decision. First, ensure regulatory compliance by checking if the broker is licensed by bodies like the Commodity Futures Trading Commission or local authorities like the Reserve Bank of India. This guarantees that you’re working with regulated entities that prioritize safety and negative balance protection. Additionally, assess the broker's strong reputation and trustworthiness to avoid legal issues.

A user-friendly platform is vital for both novice and seasoned investors. Look for brokers like Interactive Brokers offering advanced trading tools, extensive educational resources, and tailored support for Indian investors. Fee structures, including commission-free trades, currency conversion costs, and minimum deposits, significantly impact profitability. Brokers providing access to global markets, multiple currencies, and investment opportunities such as forex trading, mutual funds, and fixed-income products are ideal for experienced traders. Ultimately, select the right broker that aligns with your trading strategy and supports your trading goals.

The 5 Best International Brokers in India in 2024

#1. Interactive Brokers

What is Interactive Brokers?

Interactive Brokers is a multinational brokerage firm that provides a comprehensive electronic trading platform for a wide array of financial instruments, including stocks, options, futures, forex, bonds, and funds. Renowned for its low commissions and advanced trading tools, it caters to both individual and institutional investors across more than 150 global markets. The firm offers two primary programs: IBKR Lite, which provides commission-free trades on U.S. stocks and ETFs, and IBKR Pro, designed for professional traders seeking advanced features and services.

Advantages and Disadvantages of Interactive Brokers

Interactive Brokers Commissions and Fees

Interactive Brokers has built a reputation for competitive commissions and fees, offering two main programs: IBKR Lite and IBKR Pro. IBKR Lite caters to individual investors with commission-free trading for U.S. stocks and ETFs. In contrast, IBKR Pro is tailored for professional and institutional investors, featuring a fixed pricing system where stock trades incur a fee of $0.005 per share, with a minimum of $1 and a maximum of 1% of the total trade value. This structure allows traders to manage costs effectively while accessing a broad range of investment options.

OPEN AN ACCOUNT NOW WITH INTERACTIVE BROKERS AND GET YOUR WELCOME BONUS

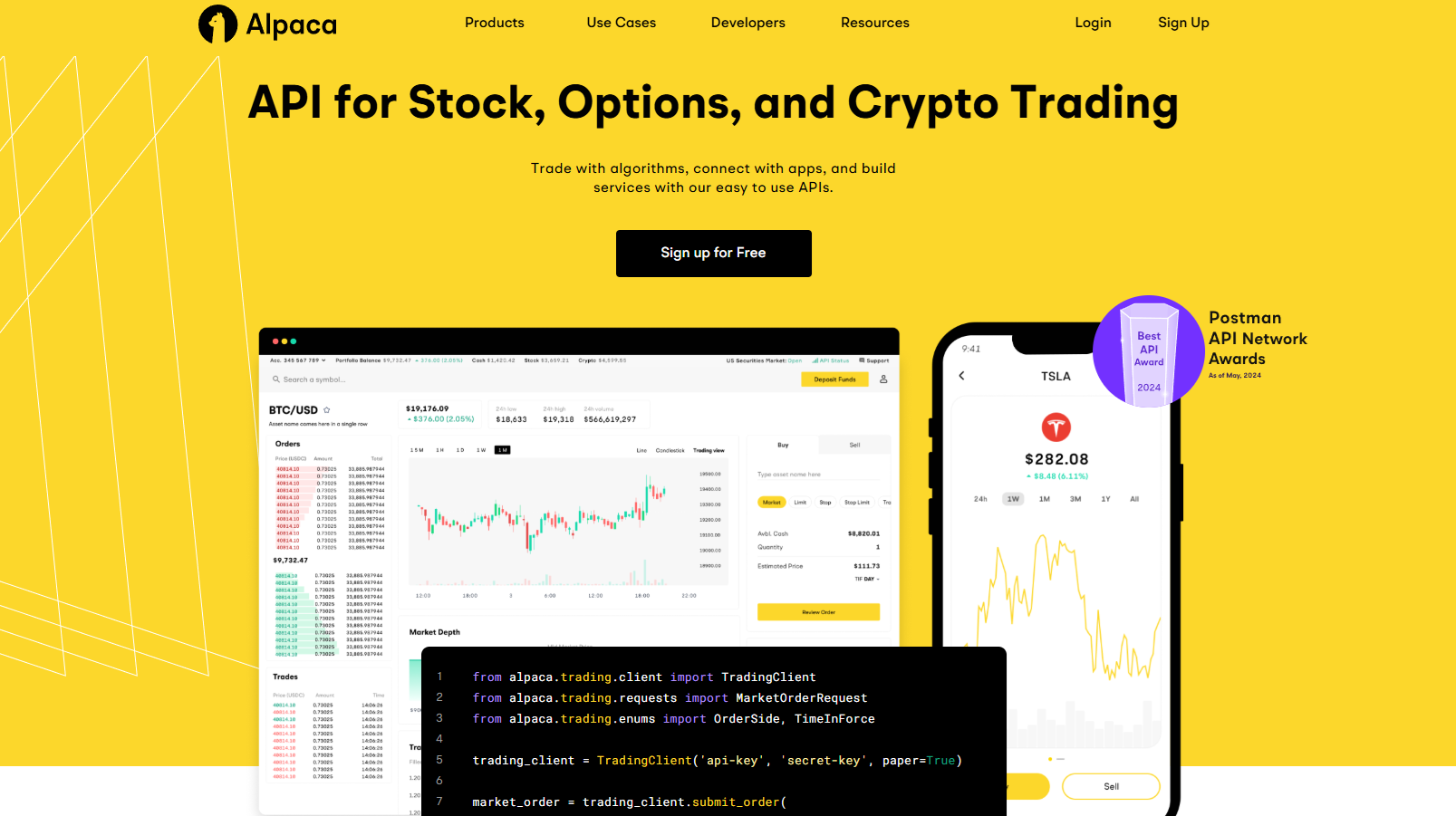

#2. Alpaca Trading

What is Alpaca Trading?

Alpaca Trading is a commission-free trading platform designed for algorithmic trading of stocks and ETFs. It offers an API-first approach, enabling developers to integrate their trading strategies easily. Ease of automation and scalability are key highlights, making it popular among tech-savvy traders. The platform supports U.S. markets and integrates seamlessly with various tools.

Advantages and Disadvantages of Alpaca Trading

Alpaca Trading Commissions and Fees

Alpaca Trading operates with a zero-commission policy, allowing traders to execute trades without incurring fees. However, there may be regulatory or clearing fees charged by third parties. The platform provides cost transparency, ensuring users are aware of any additional charges. No hidden fees and cost-effective trading make it appealing for algorithmic traders.

OPEN AN ACCOUNT NOW WITH ALPACA TRADING AND GET YOUR WELCOME BONUS

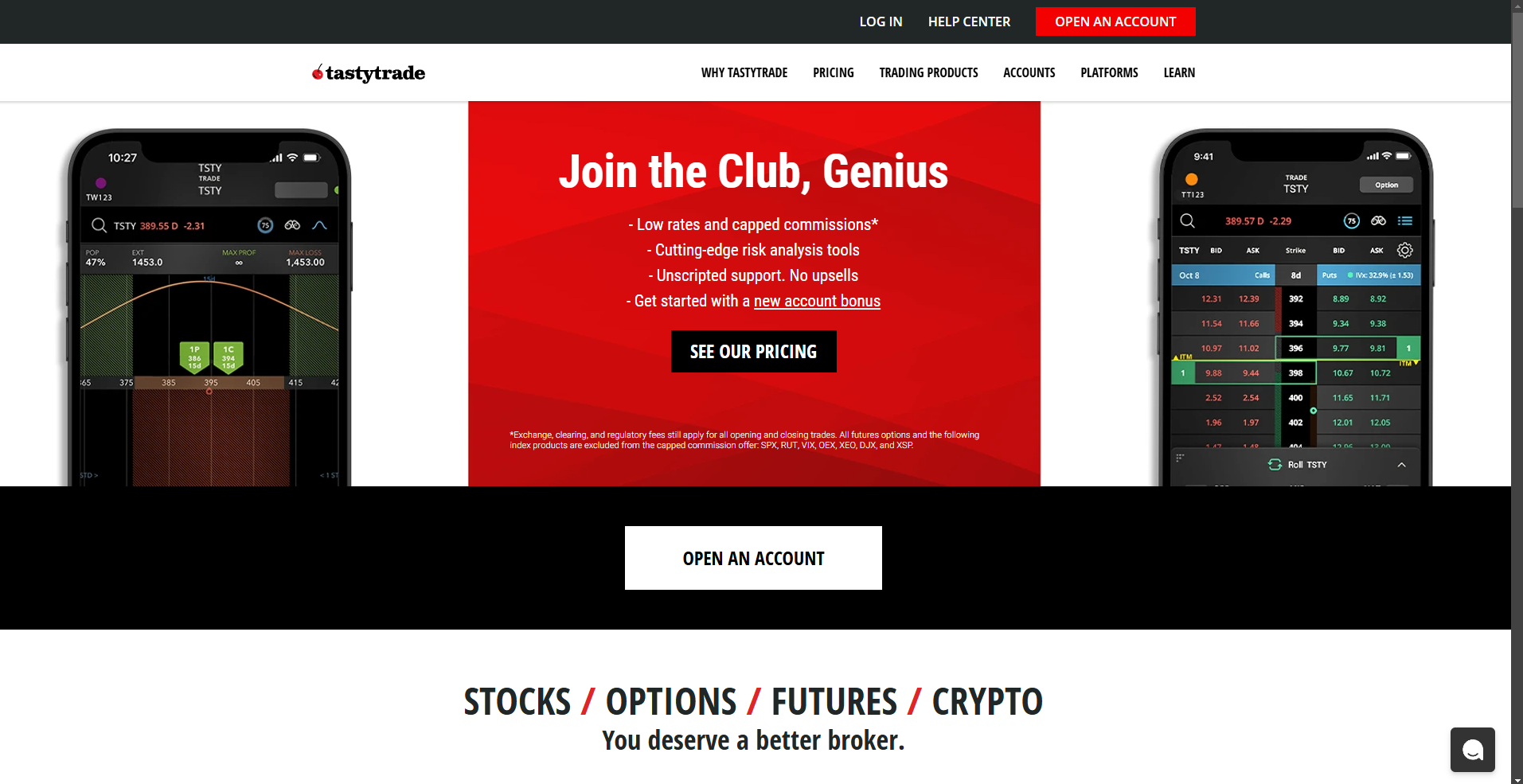

#3. tastytrade

What is tastytrade?

Tastytrade is an online brokerage platform specializing in options, futures, and stock trading, designed to cater to active traders seeking a comprehensive and efficient trading experience. Founded in 2011 by Tom Sosnoff, it emphasizes low commissions and a user-friendly interface to facilitate sophisticated trading strategies. In 2021, Tastytrade was acquired by IG Group for $1 billion, enhancing its offerings for retail investors.

Advantages and Disadvantages of tastytrade

tastytrade Commissions and Fees

Tastytrade offers competitive pricing with $0 commissions on stock and ETF trades and $1.00 per contract to open options trades, capped at $10 per leg, with no closing commissions. Futures trades are priced at $1.25 per contract for both opening and closing transactions, while micro futures are $0.85 per contract each way. Cryptocurrency trades incur a 1% fee per transaction, with Zero Hash receiving a 35 basis point markup/markdown of the executed order price, of which Tastytrade receives 65%. It's important to note that applicable exchange, clearing, and regulatory fees still apply to all opening and closing trades, except for cryptocurrency orders, which are not subject to these fees.

OPEN AN ACCOUNT NOW WITH TASTYTRADE AND GET YOUR WELCOME BONUS

#4. NinjaTrader

What is NinjaTrader?

NinjaTrader is a futures-only broker that provides a comprehensive trading platform tailored for active traders. It offers access to a wide range of futures products, including commodities, stock index futures, and cryptocurrency futures contracts. The platform is recognized for its advanced charting capabilities and customizable technical analysis tools, catering specifically to the needs of futures traders.

Advantages and Disadvantages of NinjaTrader

NinjaTrader Commissions and Fees

NinjaTrader's commission structure varies based on the selected account plan. The Free Plan charges $0.35 per side for Micro contracts and $1.29 per side for standard contracts. Upgrading to the Monthly Plan at $99 per month reduces commissions to $0.25 per side for Micro contracts and $0.99 for standard contracts. The Lifetime Plan, requiring a one-time payment of $1,499, offers the lowest rates at $0.09 per side for Micro contracts and $0.59 for standard contracts. Additional fees, such as exchange, clearing, and NFA fees, apply across all plans.

OPEN AN ACCOUNT NOW WITH NINJATRADER AND GET YOUR WELCOME BONUS

#5. CMC Markets

What is CMC Markets?

CMC Markets is a UK-based financial services company offering online trading in shares, spread betting, contracts for difference (CFDs), and foreign exchange across global markets. Headquartered in London, with hubs in Sydney and Singapore, it is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. The company provides access to over 12,000 financial instruments, including shares, indices, commodities, and treasuries.

Advantages and Disadvantages of CMC Markets

CMC Markets Commissions and Fees

CMC Markets charges commissions on share CFD trades, with rates varying by market. For example, UK share CFDs incur a commission of 0.10% with a minimum charge of £9.00, while U.S. share CFDs are charged at 2 cents per share with a $10.00 minimum. Additionally, spreads are incorporated into the pricing of other instruments, and overnight holding costs may apply for positions held open beyond the trading day. Clients should review the specific fee structures relevant to their trading activities to fully understand the associated costs.

OPEN AN ACCOUNT NOW WITH CMC MARKETS AND GET YOUR WELCOME BONUS

Benefits of Using International Brokers for Indian Traders

Using international brokers offers Indian traders significant advantages in global market access and portfolio diversification. These brokers often provide competitive trading tools, allowing forex traders and stock market participants to implement robust trading strategies. By opening a forex account with the best international brokers in India, traders gain access to forex trading, currency pairs, and global markets, diversifying their investments beyond local assets. With advanced trading platforms, such as those offered by Interactive Brokers Group, users can leverage user-friendly platforms, direct access, and extensive resources.

Additionally, international brokers cater to experienced investors and advanced traders with features like negative balance protection, regulatory compliance, and access to a wide range of financial instruments. Traders benefit from educational resources, research tools, and robust platforms to support informed decision-making. Many brokers offer commission-free trades and multiple currencies, enabling seamless transactions through bank accounts or wire transfers. Selecting the right broker, such as Interactive Brokers, ensures legal issues are addressed while enjoying superior platform features for investment opportunities.

Challenges Indian Traders May Face with International Brokers

Indian traders using international brokers encounter several challenges that demand careful attention. Currency conversion risks and costs can significantly impact profits, especially when dealing with multiple currencies. Ensuring regulatory compliance with both Indian and international standards, such as those enforced by the Commodity Futures Trading Commission and Reserve Bank of India, is crucial. Additionally, tax implications on global trading gains add complexity for indian investors, requiring them to stay informed about policies.

Choosing the best international brokers in India, such as Interactive Brokers, helps mitigate these issues. A forex broker offering negative balance protection, user-friendly platforms, and educational resources supports experienced traders and beginners alike. Features like commission-free trades, copy trading, and access to global markets with a wide range of financial instruments enhance opportunities for forex traders while managing risk. Advanced trading tools and up-to-date information are essential for navigating the forex market and achieving trading goals effectively.

Also Read: The 5 Best Stock Brokers in India in 2024: Expert Rankings

Conclusion

Selecting the right international broker is a cornerstone for success in the forex market and the stock market. With access to advanced trading tools, robust trading platforms, and resources like educational materials, traders can align their trading goals with the right features. Brokers like Interactive Brokers Group cater to experienced traders and seasoned investors, offering tools such as the Trader Workstation and support for multiple currencies. From forex trading and mutual funds to fixed income products and copy trading, the best brokers ensure regulatory compliance and provide user-friendly platforms. Additionally, negative balance protection, direct access to global markets, and commission-free trades enhance the trading experience.

Indian investors should assess their needs, from minimum deposit requirements to investment opportunities, before committing. Whether exploring the best forex brokers or researching brokers with a strong reputation, choosing a regulated entity ensures legal issues are minimized. With access to educational resources, up-to-date information, and support for wide ranges of instruments, traders can manage risk effectively. Take the time to evaluate your needs and make an informed decision—picking the right broker can unlock a world of opportunities in international brokers and global markets.

FAQs

Can Indian traders use international brokers?

Yes, as long as they follow RBI and SEBI regulations under the LRS.

What is the minimum deposit for international brokers?

It varies; some have no minimum, while others like Interactive Brokers require more.

Are there extra costs for Indian traders?

Yes, such as currency conversion and remittance fees.