Trading has become increasingly popular in Indonesia as more individuals seek opportunities in the foreign exchange market and other financial instruments. The rise of online accessibility, powerful trading platforms, and educational resources has made forex trading a viable option for both beginner traders and active traders. However, the forex industry comes with a high risk of losing, making it essential to choose a trusted forex broker to minimize risks and enhance trading efficiency.

Selecting the best international brokers in Indonesia is critical, as these brokers provide well-regulated forex broker services, competitive trading costs, and advanced tools like trading signals and copy trading features. In this article, we will explore the top five international forex brokers offering services to Indonesian forex traders, focusing on factors such as trading fees, demo accounts, negative balance protection, and their compliance with the Financial Services Authority to ensure customer trade forex using legal practices in the Indonesian market.

The 5 Best International Brokers in Indonesia in 2024

#1. eToro

What is eToro?

eToro is a widely recognized social trading platform that allows users to trade various assets, including stocks, forex, and cryptocurrencies. It is popular for its innovative CopyTrading feature, enabling users to mimic the trades of successful investors. The platform caters to both beginners and seasoned traders, offering a user-friendly interface and a robust suite of analytical tools.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro operates with a commission-free stock trading model, making it an attractive choice for cost-conscious investors. However, it charges spreads for other assets, which may vary depending on the instrument. Additional fees, such as withdrawal fees and inactivity fees, apply under specific conditions. Despite these, eToro remains competitive due to its transparency and affordable pricing structure for most users.

OPEN AN ACCOUNT NOW WITH ETORO AND GET YOUR WELCOME BONUS

#2. Exness

What is Exness?

Exness is a globally recognized forex and CFD broker offering a range of trading instruments, including currencies, commodities, and indices. Known for its low spreads and user-friendly platforms, Exness provides robust trading tools suitable for both beginners and experienced traders. The broker operates under strict regulatory oversight, ensuring a secure and transparent trading environment.

Advantages and Disadvantages of Exness

Exness Commissions and Fees

Exness charges competitive spreads starting from 0.0 pips on certain accounts, making it attractive for cost-conscious traders. Commissions apply only to specific account types, ensuring flexibility for different trading needs. Additionally, there are no hidden fees, though some withdrawal methods may incur charges. Its transparent fee structure is a significant advantage for traders.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

#3. XM

What is XM?

XM is a globally recognized forex and CFD broker offering trading CFDs and forex services across various financial instruments. It provides a user-friendly platform suitable for both beginner and experienced traders. Low spreads and a diverse range of trading tools make XM a competitive choice in the industry.

Advantages and Disadvantages of XM

XM Commissions and Fees

XM operates primarily on a commission-free structure for most accounts, relying on spreads for revenue. The spreads are competitive, starting from as low as 0.6 pips on major currency pairs. However, the Zero account charges commissions on trades, which appeals to high-volume traders seeking tighter spreads. Other fees include inactivity charges, applicable after prolonged dormancy.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

#4. OctaFX

What is OctaFX?

OctaFX is a globally recognized forex and CFD broker known for its user-friendly platforms and competitive trading conditions. It caters to both novice and experienced traders, offering services like tight spreads, zero commissions on deposits, and withdrawals. The broker provides access to popular trading platforms such as MetaTrader 4 and MetaTrader 5, ensuring versatility and reliability.

Advantages and Disadvantages of OctaFX

OctaFX Commissions and Fees

OctaFX provides a low-cost trading environment with tight spreads and no commission on deposits or withdrawals. Most account types feature commission-free trading, making it accessible for beginners. However, overnight swap fees apply for holding positions, which could increase costs for long-term traders. Transparency in fee structures makes OctaFX appealing to those prioritizing cost-efficiency.

OPEN AN ACCOUNT NOW WITH OCTAFX AND GET YOUR WELCOME BONUS

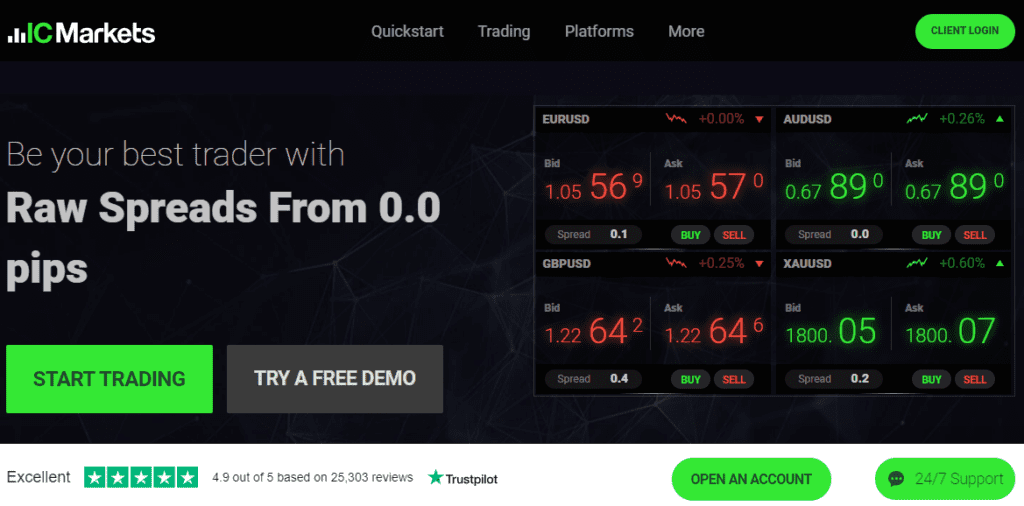

#5. IC Markets

What is IC Markets?

IC Markets is a leading online forex and CFD broker, known for its low spreads and reliable execution speeds. It caters to both beginner and professional traders with user-friendly platforms like MetaTrader and cTrader. The broker offers a wide range of tradable instruments, including forex,

Advantages and Disadvantages of IC Markets

IC Markets Commissions and Fees

IC Markets offers competitive pricing with low commission rates for ECN accounts and no commission on standard accounts. Spreads start from as low as 0.0 pips on major forex pairs, ensuring cost-effective trading. However, additional costs such as swap rates for overnight positions and inactivity fees can apply. The fee structure is transparent, catering to traders seeking cost efficiency.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

How to Choose the Right Broker in Indonesia

Choosing the right broker in Indonesia requires careful evaluation of key factors such as regulation, fees, platforms, and local support. A regulated broker ensures compliance with the Financial Services Authority, protecting Indonesian traders from forex scams. Look for brokers offering low trading costs, tight spreads, and features like negative balance protection to minimize the high risk of losing money rapidly. Platforms with powerful trading tools, trading signals, and educational resources are ideal for beginner traders, while advanced options like algorithmic trading and copy trading cater to active traders.

For first-time forex traders, focus on brokers providing demo accounts, which allow practice without real risk. Opt for brokers with swap-free trading and support for the Indonesian rupiah. It's also crucial to verify the broker's reputation, ensuring they're among the best international brokers in Indonesia or best forex brokers Indonesia. Evaluate their trading platforms, conversion fees, and access to market research. A well-regulated forex broker can help you navigate the forex market and reduce the chances of retail investor accounts losing money.

Also Read: The 5 Best International Brokers in China in 2024: Market Leaders

Conclusion

When selecting the best international brokers in Indonesia, it’s essential to focus on standout features that align with individual trading goals. Top brokers offer diverse trading platforms, competitive trading costs, and robust trading services to cater to forex traders and indonesian forex traders alike. Key factors to consider include tight spreads, swap-free trading, negative balance protection, and access to powerful trading tools such as trading signals and algorithmic trading.

Choosing a broker depends on your needs, whether you’re a beginner trader seeking educational resources or an advanced trader looking for low trading costs and complex instruments. Ensure the broker is a regulated broker, complies with the financial services authority, and safeguards against forex scams. With the right broker, indonesian traders can navigate the forex market confidently, avoiding risks like retail investor accounts lose money and leveraging tools for success in the forex trading legal landscape.

FAQs

What is the minimum deposit required to start trading with these brokers?

Minimum deposits vary by broker, ranging from $5 with Exness to $200 with IC Markets.

Are these brokers regulated for Indonesian traders?

Yes, all listed brokers are internationally regulated and comply with standards of the financial services sector suitable for Indonesian clients.

Which broker is best for beginners?

eToro is ideal for beginners due to its intuitive platform and social trading features whether forex or CFD trading.