Choosing the right forex broker can make all the difference in your trading success, especially when it comes to keeping costs low. In the fast-paced world of forex, low spread brokers are essential for minimizing fees and maximizing profits. A low spread means you pay less to enter and exit trades, leaving more room for profit, especially for active traders like scalpers and day traders. In 2026, finding a reliable broker with competitive spreads is key to staying ahead in the game.

In this article, we’ll guide you through the five best low spread forex brokers in 2026, helping you identify the ones that offer the most value for your trading style. Whether you’re a seasoned trader or just starting out, selecting a broker with low spreads and strong support can significantly enhance your trading performance. Let’s explore the top choices and see how they can help you cut costs and boost your trading potential!

What Are Low Spread Forex Brokers and Why Do They Matter?

In forex trading, the term “spread” simply refers to the difference between the buy (ask) price and the sell (bid) price of a currency pair. Think of it as the cost you pay to enter a trade. The smaller the spread, the less you’re paying to trade, which means more of your profits stay in your pocket.

For active traders, especially those who make a lot of trades daily, low spreads are essential. Why? Because every time you open and close a position, you’re paying the spread. If the spread is high, it eats into your profits. But with a low spread broker, those costs are minimized, making your trading more profitable in the long run. It’s like shopping around for a product you need — wouldn’t you want to pay the lowest price possible?

The impact of spreads on your overall trading costs is often underestimated by new traders. Over time, even a small difference in spread can add up to a significant cost. For example, if you’re trading with a spread of 2 pips versus a spread of 0.5 pips, that difference could translate into hundreds or even thousands of dollars in fees, especially if you’re trading frequently.

Scalpers (traders who make quick trades throughout the day) and day traders benefit the most from low spread brokers. These traders rely on tiny price movements, so paying less in spreads means they can turn a profit more easily. On the other hand, if you’re a long-term trader who holds positions for weeks or months, spreads might not be as critical since you’re aiming for larger price moves. But overall, low spread brokers are great for anyone who wants to keep their costs down and maximize their returns.

Criteria for Selecting the Best Low Spread Forex Brokers

When you’re choosing a low spread forex broker, there are a few key factors to keep in mind to ensure you’re getting the best deal and experience.

1. Regulation and reliability

First and foremost, always go with a regulated broker. Regulation ensures that the broker is playing by the rules and is overseen by financial authorities. This adds a layer of protection for your funds. A reliable broker is not just about offering low spreads — they also need to have a good reputation, fast execution, and solid customer support.

2. Transparency in spread fees

One of the biggest red flags when picking a broker is hidden fees. Make sure the broker is transparent about their spread fees. Some brokers advertise low spreads but then tack on additional fees or commissions. Others might offer low spreads during certain times of the day but increase them when the market is volatile. Always double-check what you’re signing up for to avoid nasty surprises.

3. Execution speed, trading platforms, and liquidity providers

Execution speed matters because even if a broker offers low spreads, if they’re slow to execute your trades, you might still end up with a bad price due to slippage. Look for brokers with fast execution times, especially if you’re a scalper or day trader. Additionally, a user-friendly trading platform can make a big difference in your trading experience. You want something that’s intuitive and gives you the tools you need to analyze the market and place trades quickly.

The liquidity providers that a broker works with also affect the spreads. Brokers that connect to more liquidity providers tend to offer lower spreads because they have access to more competitive pricing.

4. Other potential fees

Besides spreads, there are other fees that can affect your trading. For example, some brokers charge commissions in addition to spreads, which could end up costing you more overall. You should also look out for withdrawal fees, inactivity fees, or fees for holding positions overnight (often called swap fees). All these fees can add up and impact your bottom line, so it’s important to understand the total cost of trading with a particular broker.

The 5 Best Low Spread Forex Brokers in 2026

#1. AvaTrade

What is AvaTrade?

AvaTrade is a globally recognized forex and CFD broker established in 2006, known for its low spreads and strong regulatory framework. With access to a variety of assets, including forex, commodities, and cryptocurrencies, AvaTrade stands out for offering fixed spreads, which means the spread remains stable, even during volatile market conditions. This consistency makes it a great option for traders who value predictability in their costs. AvaTrade also supports multiple platforms like MetaTrader 4/5 and AvaTradeGo, making it suitable for both beginners and experienced traders.

Advantages and Disadvantages of AvaTrade

AvaTrade Commissions and Fees

When it comes to commissions and fees, AvaTrade operates on a spread-only model, meaning they don't charge commissions on trades. Instead, they profit from the spreads themselves. For forex pairs, typical spreads start from around 0.9 pips for major pairs like EUR/USD, which is quite competitive. There are no deposit or withdrawal fees, but traders should be aware of an inactivity fee of $50 after three months of no activity and a $100 administration fee after 12 months.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. XM

What is XM?

XM is an international online trading broker established in 2009. It operates in more than 190 countries and has built a solid reputation in the financial industry. XM is regulated by CySEC, FSC, FSA, DFSA, FSC, and FSCA, which gives traders the option to work with its global entities under strict oversight. The broker is known for its fast trade execution, flexible account types, and access to over 1,000 trading instruments, such as forex, CFDs, indices, commodities, stocks, and cryptocurrencies. With multi-language support and beginner-friendly platforms, XM has become a preferred choice for both new and experienced traders.

Advantages and Disadvantages of XM

XM Commissions and Fees

XM’s trading fees vary depending on the account type chosen. The Micro and Standard accounts do not include any commission charges and start with spreads around 1.6 pips on major FX pairs under normal conditions. Conversely, the Zero (or “Zero Spread”) account provides spreads as low as 0.0 pips, with a commission of USD 3.50 per lot per side (USD 7 round-trip). XM also imposes swap or overnight fees for trades left open overnight and may charge an inactivity fee for accounts that are not used for a long time.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

#3. FXChoice

What is FXChoice?

FXChoice is an established ECN broker that caters to traders looking for competitive spreads and solid trading platforms. Known for its support of MetaTrader 4 and MetaTrader 5, FXChoice offers spreads starting as low as 0.1 pips on its ECN accounts, making it a top choice for traders seeking low-cost trading. With a leverage of up to 1:200, the broker is regulated by the International Financial Services Commission (IFSC), providing traders with a safe and efficient trading environment. The availability of multiple account types also makes it suitable for both beginners and experienced traders.

Advantages and Disadvantages of FXChoice

FXChoice Commissions and Fees

FXChoice operates a simple and transparent fee structure. ECN accounts have a commission of $3.50 per side per lot, which is competitive in the industry. For standard accounts, there are no commissions, but the spreads are slightly wider. The broker does impose an inactivity fee of $10 per month after 90 days of no trading, so it's ideal for active traders who regularly participate in the market. Additionally, while withdrawals via wire transfers may take a few days, there are no significant hidden charges to be concerned about.

OPEN AN ACCOUNT NOW WITH FXCHOICE AND GET YOUR WELCOME BONUS

#4. Pepperstone

What is Pepperstone?

Pepperstone is a top-rated forex broker known for its low spreads and fast execution speeds, making it one of the best choices for traders looking to minimize costs. With platforms like MetaTrader 4, MetaTrader 5, and cTrader, Pepperstone provides flexibility and advanced tools to suit both beginners and experienced traders. Its Razor account offers spreads starting from 0.0 pips on major currency pairs, which is particularly attractive for scalpers and high-frequency traders. Additionally, Pepperstone is regulated by trusted authorities such as the FCA and ASIC, ensuring a secure and transparent trading environment.

Advantages and Disadvantages of Pepperstone

Pepperstone Commissions and Fees

Pepperstone maintains a competitive and transparent structure. On the Razor account, a commission of $3.50 per side, per standard lot is charged on MetaTrader platforms, while the cTrader account offers even lower commissions at $3 per side. For traders who prefer to avoid commissions, the Standard account comes with wider spreads but no commission fees. Pepperstone also has no fees for most withdrawals, but an inactivity fee of $15 applies after six months of no trading activity.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

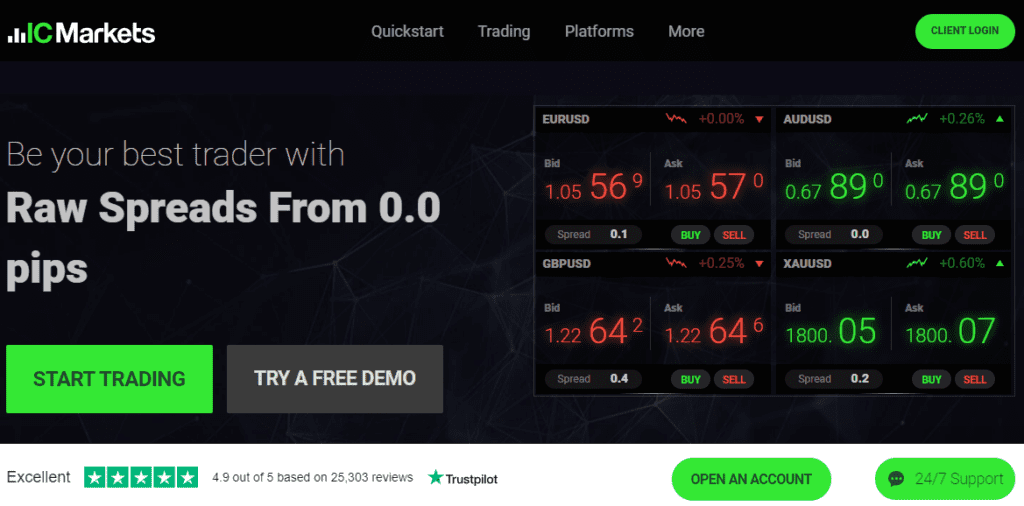

#5. IC Markets

What is IC Markets?

IC Markets is a well-regarded CFD broker known for offering a wide range of trading instruments, including Forex, commodities, indices, cryptocurrencies, bonds, and futures. Established in 2007 and regulated by reputable authorities like ASIC, CySEC, and the FSA, IC Markets provides a secure trading environment. The broker is particularly popular among algorithmic traders due to its fast execution speeds, low latency, and competitive pricing, making it ideal for both retail and institutional traders who seek a reliable and cost-effective platform.

Advantages and Disadvantages of IC Markets

IC Markets Commissions and Fees

In terms of commissions and fees, IC Markets is known for its competitive fee structure. The broker offers three types of accounts: Standard, Raw Spread, and cTrader, each with different pricing models. The Standard account is commission-free, relying on slightly higher spreads, while the Raw Spread and cTrader accounts charge a commission starting at $3.50 per lot per side, with spreads as low as 0.0 pips. The broker does not charge fees for deposits or withdrawals, except for international bank transfers which incur a fee of $20. Additionally, IC Markets has no inactivity fees, making it cost-effective for both active and occasional traders.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

How Low Spread Brokers Help Maximize Your Trading Profits

When it comes to forex trading, low spread brokers can have a significant impact on your profitability. Let’s break it down with a simple comparison. Say you’re trading major currency pairs like EUR/USD. If you’re using a low spread forex broker with a spread of 0.1 pips versus a spread forex broker with a 2.0 pip spread, the difference adds up quickly. For active traders, especially those making multiple trades per day, lower spreads mean you keep more of your profits. Over time, this can add up to a big difference in your overall returns.

For high-frequency traders like scalpers, low spreads are even more critical. These strategies rely on capturing small price movements, so every pip counts. A zero spread broker or brokers offering tight spreads allow these traders to make a profit from even minor price changes without getting wiped out by high costs. Using a zero spread account or raw spread account can cut down on trading costs, helping you profit faster.

To maximize savings, don’t just look at spreads—watch out for other fees like commissions, swap charges (for overnight positions), or withdrawal fees. Opt for zero spread trading accounts if you want to minimize spread costs entirely. Also, make sure you’re using a trading platform with fast execution speeds and low slippage to get the best price possible when entering or exiting trades.

Key Features to Look for in a Low Spread Forex Broker

When choosing the best forex broker, it’s important to focus on a few key features to ensure a smooth trading experience:

- Regulation and Safety: Regulation is crucial. A forex broker that is regulated by a respected financial authority ensures that your funds are safe and that the broker is held accountable. Look for brokers regulated by the FCA, ASIC, or CySEC, for example. These regulators make sure that brokers provide fair trading conditions and keep client funds segregated. Always prioritize regulated low spread forex brokers for peace of mind.

- Trading Platforms: A user-friendly trading platform is essential for your success. The platform should be easy to navigate and offer a range of tools for analyzing the forex market. Brokers that support MetaTrader 4 (MT4) or MetaTrader 5 (MT5) are often favored by experienced traders because of their advanced charting and algorithmic trading capabilities. Some brokers also provide their own platforms or mobile apps, which can be convenient for trading on the go.

- Customer Service and Support: You don’t want to be stuck without help when you need it. Choose a broker that offers responsive customer support, ideally available 24/5. Having a knowledgeable support team can make a huge difference, especially when dealing with issues like withdrawals, platform glitches, or account questions.

- Types of Accounts Offered: A good broker will provide multiple account types to suit different trader needs. Look for brokers that offer demo accounts to practice without risk, VIP accounts with lower fees, and zero spread accounts or raw spread accounts for those who want to minimize trading costs. These options allow you to tailor your trading experience.

- Trading Tools and Education: Ensure the broker offers strong educational resources and trading tools. Many brokers provide webinars, tutorials, and market analysis to help you improve your skills. Experienced traders might benefit from tools like trading signals, economic calendars, and news feeds. Brokers that invest in education help traders of all levels succeed in the forex market.

Conclusion

In the competitive forex market, finding the right broker can make all the difference in maximizing your trading potential. Low spread forex brokers are essential for reducing costs, especially for active traders and those using high-frequency strategies. By choosing a zero spread broker or an account with tight spreads, you keep more of your profits and minimize the impact of trading costs. Beyond spreads, look for brokers that offer strong regulation, user-friendly trading platforms, and responsive customer service. Make sure they provide valuable tools and educational resources to help you succeed, whether you're just starting out or you're an experienced trader!

Also Read: The 5 Best High Leverage Forex Brokers in 2026: Maximize Your Trading Potential