BoE's Close Decision to Lower Rates

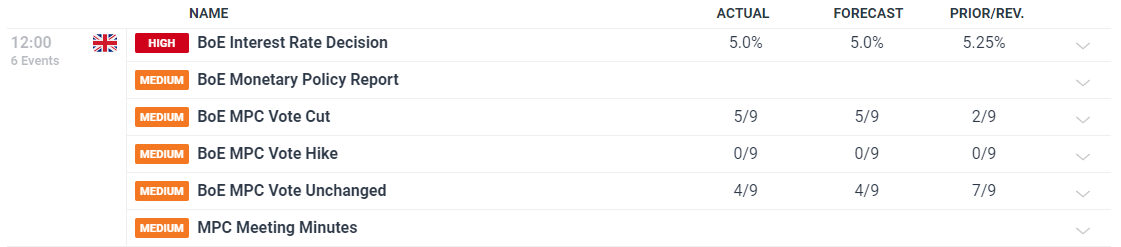

The Bank of England (BoE) narrowly voted 5-4 in favor of a rate cut. The Monetary Policy Committee (MPC) members who supported the cut described the decision as “finely balanced.”

Prior to the vote, markets had estimated a 60% probability of a 25-basis point cut, indicating a belief that the BoE could potentially move before the European Central Bank (ECB) and the Federal Reserve (Fed).

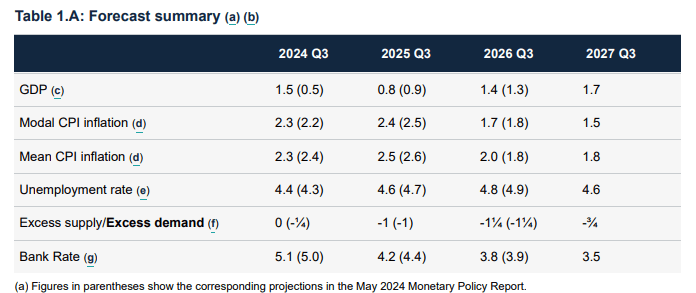

Concerns over services inflation persist, and the BoE emphasized its close examination of potential second-round effects in its medium-term inflation outlook. Upcoming inflation calculations will exclude earlier reductions in energy costs, likely keeping CPI above 2%.

Monetary Policy Report Highlights

The latest Monetary Policy Report indicated a sharp but unsustained GDP recovery, inflation near previous estimates, and a slower rise in unemployment compared to the May forecast.

The BoE noted progress towards the 2% inflation target, stating, “Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.” This contrasts with previous statements that did not acknowledge progress on inflation. Markets expect another rate cut by the November meeting, with a strong possibility of a third cut by year-end.

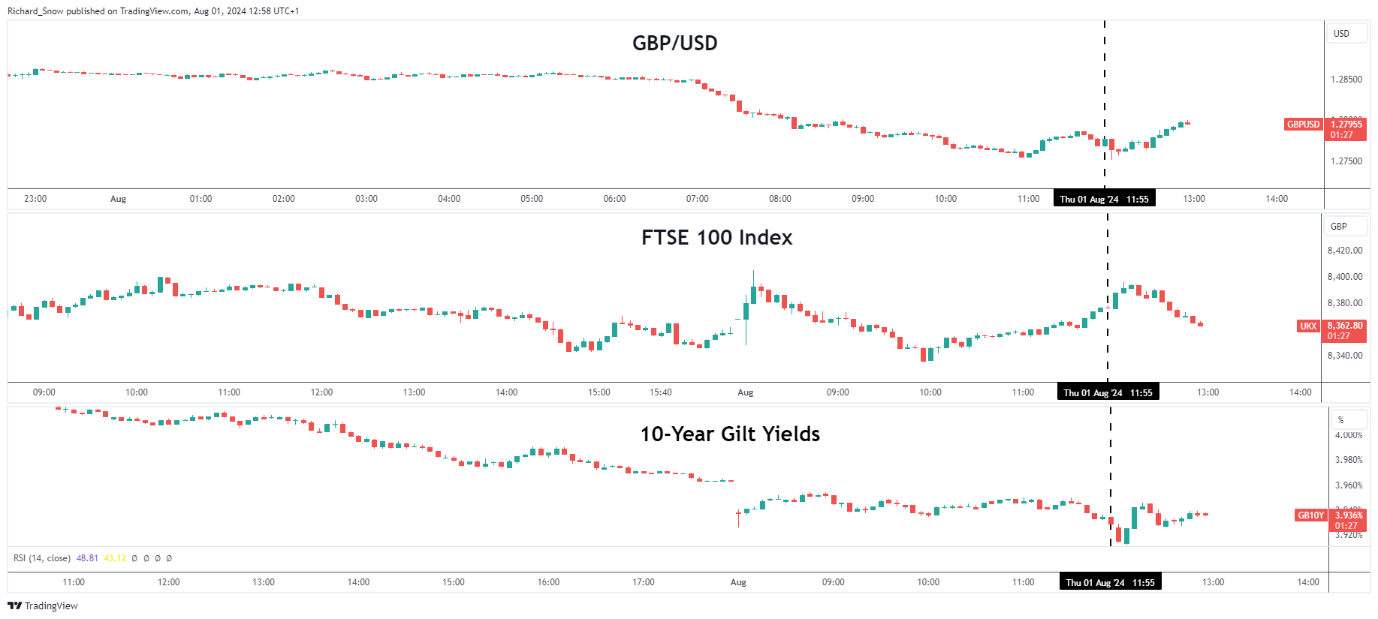

Market Reaction: GBP, FTSE 100, Gilts

In the FX market, sterling saw a significant correction in July, especially against the yen, franc, and US dollar. With 40% of the market expecting a hold at today's meeting, there is potential for further bearish movement, although much of the current move may already be priced in. Sterling remains susceptible to more downside. The FTSE 100 index showed little reaction to the announcement and has been influenced by major US indices in recent trading sessions.

UK bond yields (Gilts) initially fell but recovered to levels seen before the announcement. Most of the decline occurred before the rate decision. UK yields have led the decline, with sterling lagging. Consequently, the bearish trend for sterling may continue.

Record net-long positions in sterling, as indicated by the CFTC’s Cot report, suggest that significant bullish positions could unwind rapidly following the rate cut, contributing to the bearish momentum.