BoJ Deputy Governor Calms Volatile Markets

Bank of Japan (BoJ) Deputy Governor Shinichi Uchida issued remarks that contrasted Governor Ueda’s hawkish tone, bringing momentary calm to the yen and Nikkei index. On Monday, the Japanese index saw its worst day since 1987 as large hedge funds and money managers sold global assets to unwind carry trades.

Uchida emphasized that recent market volatility could “obviously” impact the BoJ’s rate hike path if it affects the central bank’s economic and inflation outlooks. The BoJ is focused on achieving its 2% price target sustainably, a goal threatened by a rapidly appreciating yen. A stronger yen lowers import costs and overall local prices but also makes Japanese exports less attractive, potentially hindering modest economic growth and reducing spending and consumption as revenues shrink.

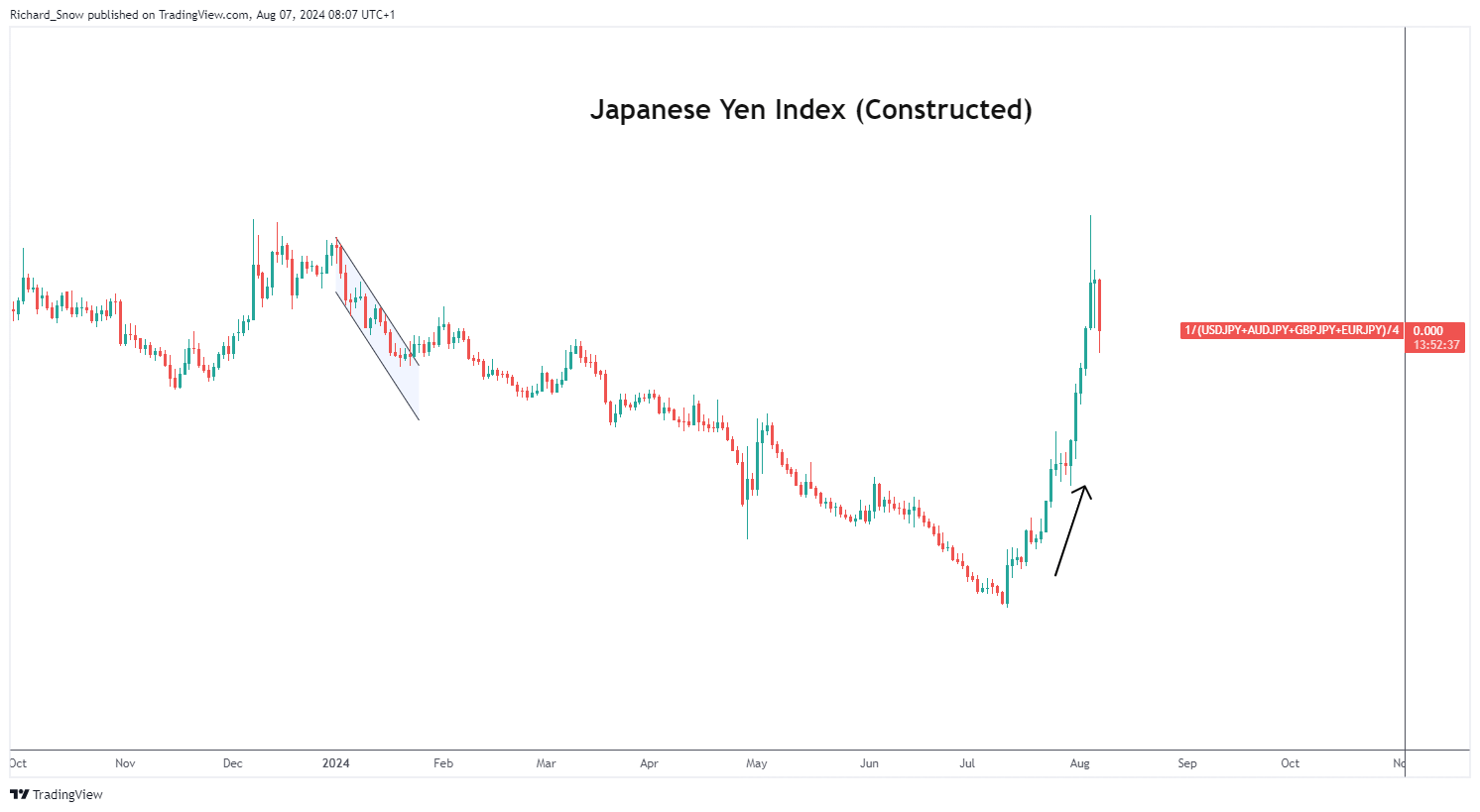

Uchida stated, “As we're seeing sharp volatility in domestic and overseas financial markets, it's necessary to maintain current levels of monetary easing for the time being. Personally, I see more factors requiring us to be cautious about raising interest rates.” Uchida’s dovish comments balance Ueda’s hawkish rhetoric from July 31 when the BoJ hiked rates more than the market anticipated. The Japanese Index below indicates a temporary pause in the yen’s recent advance.

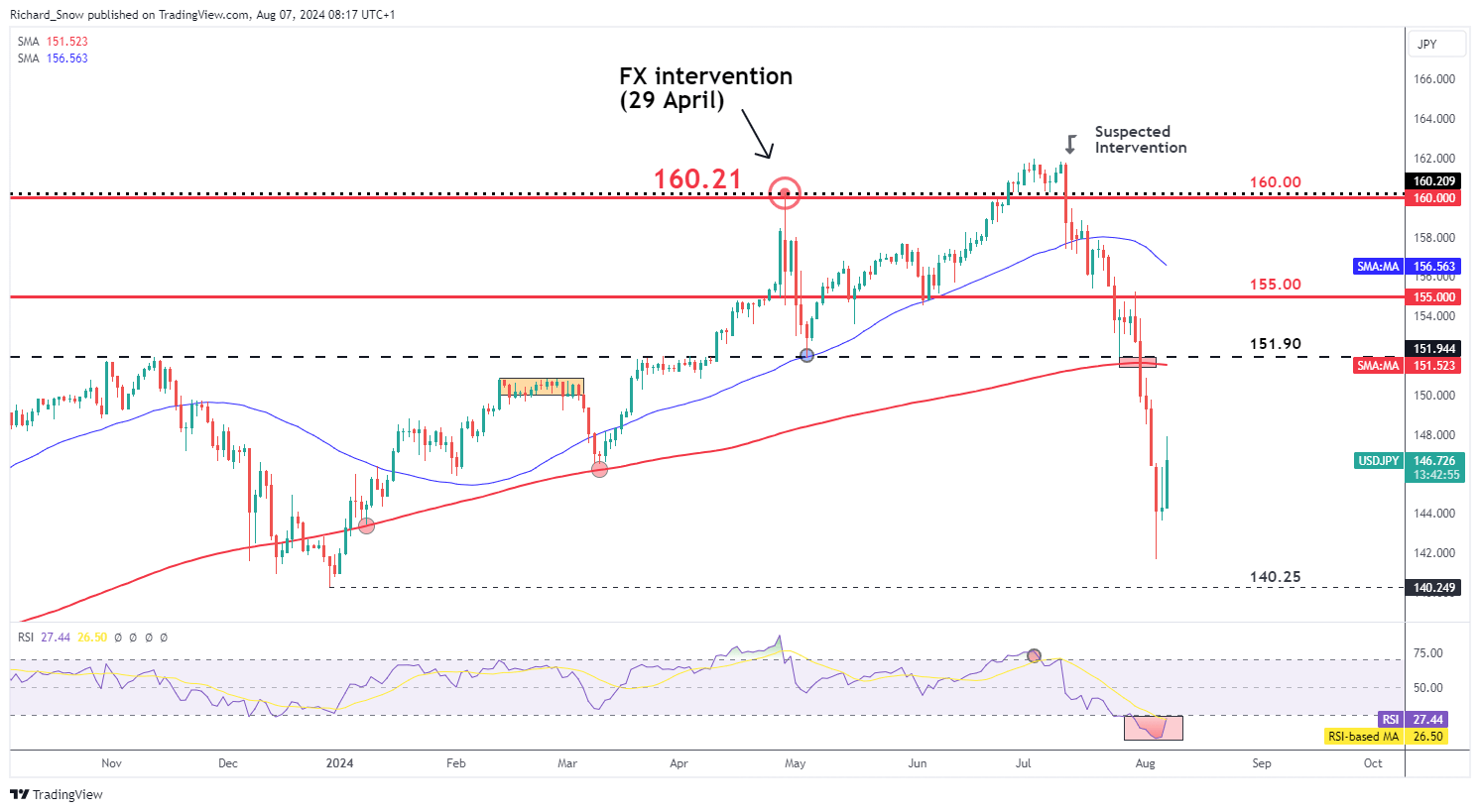

USD/JPY Rebounds on Dovish BoJ Comments, Temporary Relief Seen

The relentless USD/JPY sell-off appears to have found temporary relief after Uchida’s dovish comments. The pair has dropped over 12.5% in just over a month, driven by two suspected FX interventions following lower US inflation data.

The BoJ hike added to the bearish USD/JPY momentum, pushing the pair through the 200-day simple moving average (SMA) easily. The recent low at 141.70 is the nearest support level, followed by 140.25, the December 2023 swing low. Resistance stands at 152.00, corresponding with the peak in USD/JPY in 2022 just before Japanese officials intervened to strengthen the yen. The RSI is attempting to recover from oversold territory, offering a chance for a short-term correction.