The urge to follow the herd is strong in trading. Retail investors often buy heavily during optimistic periods and scramble to sell when pessimism sets in. However, savvy traders know that lucrative opportunities sometimes lie in going against the current.

Contrarian trading defies prevailing market sentiment. It's not about blindly betting against the crowd but rather identifying situations where the majority might be misguided and capitalizing on those moments. Tools like IG's client sentiment gauge can reveal periods of extreme exuberance or negativity that might signal an impending reversal.

However, relying solely on contrarian indicators isn't foolproof. Their true power lies in their integration with a well-rounded trading strategy that includes both technical and fundamental analysis. This approach allows traders to delve deeper into market dynamics, uncovering hidden insights that the masses might miss.

Let's explore how IG's client sentiment data and current retail investor positioning can inform trading decisions for three key British pound FX pairs: GBP/USD, EUR/GBP, and GBP/JPY. By analyzing these examples, we'll show how contrarian thinking can help unlock attractive trading setups.

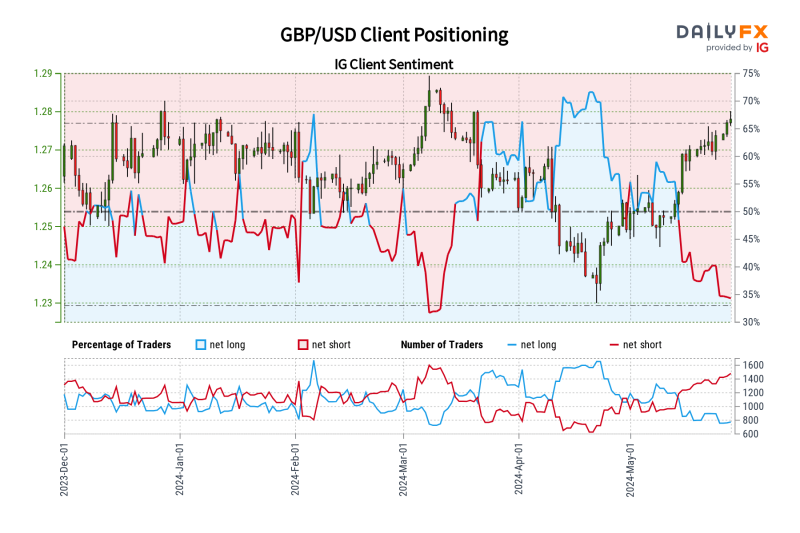

GBP/USD Sentiment Analysis

IG's data reveals an interesting scenario for GBP/USD. A significant 68.16% of traders are positioned for the pair to weaken, with a short-to-long ratio of 2.14 to 1. This pessimism is intensifying, with net-short clients surging 6.72% in a day and 12.43% over the past week. Conversely, bullish wagers have dwindled by 5.09% and 21.24% over the same periods.

We often take a contrarian approach, and this lopsided bearishness suggests GBP/USD might have room to climb further. The growing number of net-short bets, coupled with the recent acceleration of this trend, strengthens the case for a bullish contrarian bias. In simpler terms, the crowd's heavy short positioning might signal further upside for the pound.

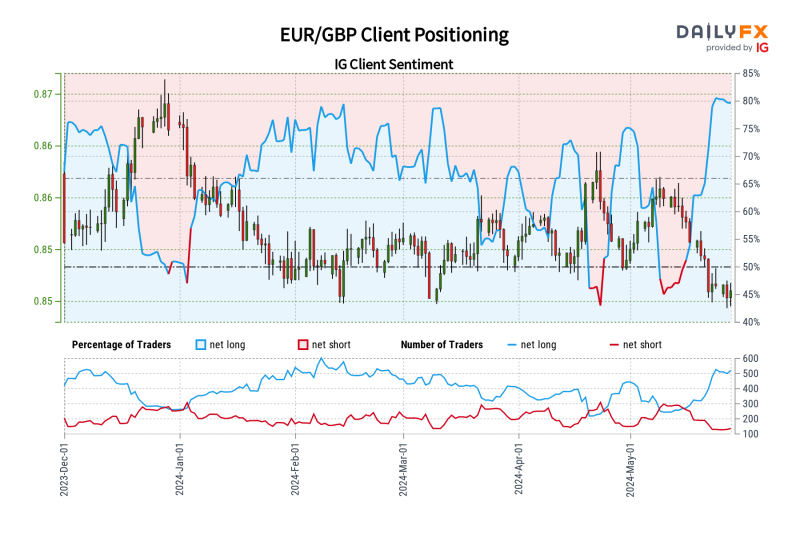

EUR/GBP Sentiment Analysis

IG data shows that 79.82% of the retail crowd trading EUR/GBP are positioned for strength, resulting in a long-to-short ratio of 3.96 to 1. Net-long positions are flat compared to the previous session and 42.78% higher relative to last week. Bearish bets are also rising (up 7.14% from yesterday), but this is outweighed by a substantial decline from last week (down 24.16%).

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long EUR/GBP signals that the pair could rise in the near term. However, our confidence in this prediction is limited. The current positioning is less bullish compared to yesterday but more net-long than last week, resulting in a mixed trading bias for EUR/GBP based on the combination of current sentiment and recent changes.

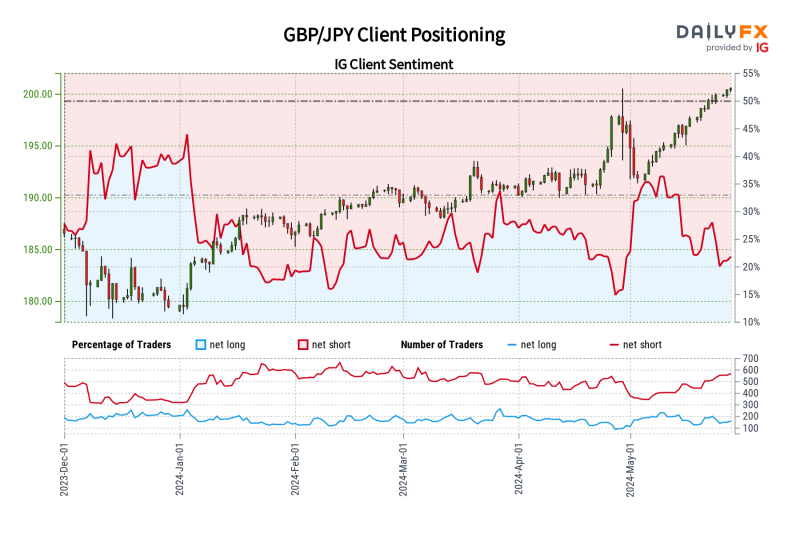

GBP/JPY Sentiment Analysis

According to IG data, 76.28% of clients speculating on GBP/JPY have a bearish outlook for the pair, with a short-to-long ratio of 3.22 to 1. While the number of net-short traders has slightly declined compared to the previous session, it has increased by 19.96% over the past week. On the other hand, bullish positions are up 5.71% from yesterday but down 7.96% compared to last week.

With our unique interpretation of crowd behavior, the current dominance of sellers suggests that GBP/JPY could head higher. Despite this, our confidence in this scenario remains limited due to the slight decrease in bearish bets since yesterday. As a result, the interplay of present sentiment and recent shifts in positioning gives us a mixed perspective on GBP/JPY.