If you’ve been scouting for ways to diversify your trading strategies, then the call credit spread strategy is worth your utmost consideration. It’s a great, profitable strategy that traders of all trade experience can master.

In this blog post, we’ll take an in-depth look at the realm of call credit spreads and their pros and cons. We’ll also discuss times it’s effective to use a call credit spread, ways you can profit from these trades, and how to ensure maximum profit potentials while avoiding maximum loss and only aiming at limited risk.

Without further ado, let’s break down each of these in detail.

Also Read: What Is a Bull Call Spread?

Contents

- What Is A Call Credit Spread?

- Call Credit Spread Setup Trade

- Call Credit Spreads Advantages

- What Do You Risk With Bear Call Spreads?

- Why Would You Risk $130 Only To Make $70 On The Bear Call Spread Trade?

- Call Credit Spread Trade Management

- Prime Call Credit Spread Example

- Conclusion

What Is A Call Credit Spread?

A call credit spread (also sometimes known as a bear call credit spread) is a kind of options strategy traders use to capitalize on bearish, neutral, or bullish price movements of an underlying stock. This range is what makes a bear call credit spread the perfect way to maximize returns and define risk in call options trading.

Note: When selling a bear call credit spread, you must follow the rules of options strategy trading while simultaneously leveraging Implied Volatility (IV) ranks. More on these later on in the guide.

Call Credit Spread Setup Trade

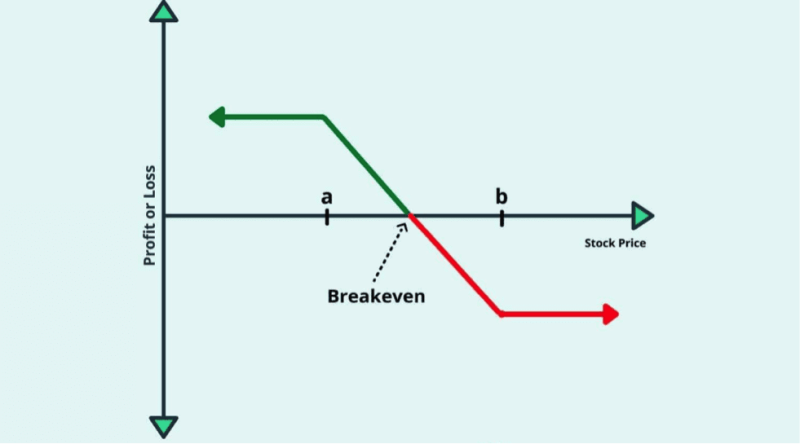

The call credit spread options strategy comprises selling low strike call options (short leg) and exchanging them for premium income, then ultimately using a portion of that premium income to purchase a higher strike call option (a long leg) while simultaneously collecting credits in the process. The two calls have the same expiration date and the same underlying asset.

By selling away the lower short call strike option leg, you also agree to sell shares at the lower strike price by the pre-agreed expiration date. Conversely, by purchasing a higher strike price call option, you have a right to purchase the shares at that higher strike by the same expiration date that was agreed upon.

When Do We Use Call Credit Spreads?

We’ve already hinted that you want to sell a bear call credit spread when looking for a bearish to neutral position with defined risk. If you’re expecting a huge move lower, you can use an additional investment strategy, like buying a long put that’ll award you the maximum profit potential.

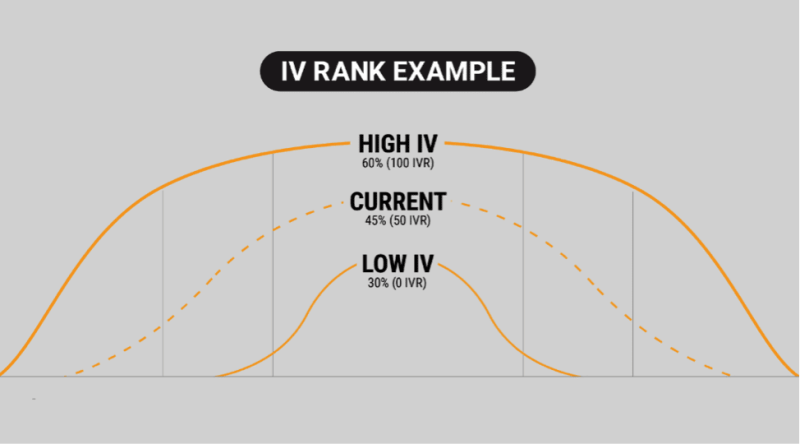

Ideally, selling a credit spread amidst high volatility would be best. Doing that permits you to take advantage of higher-priced options. And no, it's not necessarily required. It's just that trading credit spreads during higher volatility market conditions awards you better performance than trading the credit spreads in lower volatility markets.

Should You Use Monthly or Weekly options?

The bear call credit spread can be used with both monthly and weekly options. The key here is to ensure you’re only trading options with massive liquidity because your fill prices could leave a huge dent in your bottom line.

When you’re starting out with a credit spread strategy, experts recommend starting with monthly options with 20 to 40 days left to their expiration date.

As you grow more comfortable with your bearish strategy, you can graduate to the more challenging weekly options. These weekly alternatives react way faster to stock price changes and are way less forgiving than their monthly counterparts.

Call Credit Spreads Advantages

The main advantage of the bear call spread is, without a doubt, the win probability. Since you purchase the call options with the higher strike price, it helps offset the risk of having to sell the same call options at a lower strike price. In the end, this carries far less risk compared to if you had short call traded the underlying stock.

Additional advantages of the bear call spread strategy include the following:

IV (Implied Volatility)

Call credit spreads benefit if there’s a contraction or decrease in IV. High IV results usually result in higher option premiums, whereas low IV results in lower option premiums. As we already noted earlier, you should always sell call credit spreads when IV is high to intake rich premiums, then close the trade for a realized max profit when IV reverts to its mean.

Time Decay

Traders benefit from theta or time decay in combination with falling stock prices. Time decay works to the advantage throughout a call credit spread option’s lifecycle while the time value of the option contract decreases.

On the other hand, Theta loses value exponentially as the option expiration date approaches.

Also Read: Everything About Credit Spread

What Do You Risk With Bear Call Spreads?

A massive advantage of bear call spreads is that they’re really risk defined kinds of trades with limited risk. You won’t be exposed to unlimited risk as you would with some other options trading strategies. Your maximum risk is just the difference between the different strikes subtracted from the initial credit received when you placed the trade.

For example, if you sell a $2 wide bear call spread for $0.70, your risk would be $130 or $1.30 per vertical spread. In worse-case scenarios where you’re dead wrong on our bear call spread trade, $130 is the maximum loss you can expect per trade per vertical spread.

After reading the next sections of this guide, you’ll think this is a bad deal. But fret not! I’ll explain why bear call spread trades are worth it immediately after.

The Maximum Profit?

The maximum potential profit on your bear call spreads is the price you collect to place your trade on. Using the example above, if you sell a bear call credit spread for $0.70, then your potential maximum gain is $70 per spread.

You’ll make money provided the ETF or stock price stays below the option’s strike price: the option you’re selling as the spread’s part.

This brings us to the next section of this detailed bear call credit spread guide:

How Do You Profit From a Call Credit Spread Trade?

Given what a call credit spread consists of, there are five distinct ways you can make money on your trades. When selling a bear call spread, you can make money if the stock price moves sideways, down, or up. Basically, as long as the stock price stays below the option’s strike price.

You can also make money on your bear call spread trade from time decay adding up. In simpler words, you’ll make money with each day passing as the options get cheaper.

Lastly, you can make money from your bear call spread trade when volatility decreases. Here, the option will need to get as cheap as possible so you can buy the entire spread back and close your position at a cheaper price than you sold it when you opened your bear call spread trade.

Why Would You Risk $130 Only To Make $70 On The Bear Call Spread Trade?

We know risking 2x what you stand to gain doesn’t really sound attractive. That said, the reason most other successful traders don’t mind that ratio is that these kinds of trades have a really high probability of success.

With five distinct ways of making money on your bear call spread trade, the odds are extremely forgiving.

Call Credit Spread Trade Management

As you may already know, the only way to book the maximum potential profit is if you hold to the expiration date. But most experts do not recommend going with that approach. Most of them typically recommend closing out of your trades early when you can keep between 50 and 75 percent of the max profit on the call credit spread trade.

Let’s take the example from earlier. If you collected $0.70 to open a trade, you should look to close it when you can purchase it for anything between $0.17 and $0.35. That’ll allow you to book between 50 and 75 percent of the $0.70 you collected to place on the call credit spread trade.

Prime Call Credit Spread Example

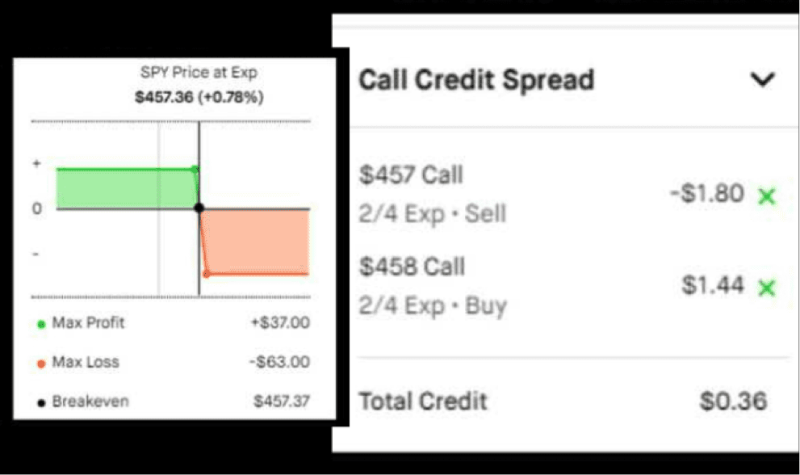

In the example pictured above, you’ll see a bear call credit spread created for SPY. By selling the $457 and purchasing the $458 call, the trader can expect a net premium received as the time value decays from the vertical spread.

That’ll only happen if the stock price of the underlying asset stays beneath the break even point of $457.36 when the expiration time approaches. In this example, the same expiration date is only 72 hours, which is an extremely small amount of time value in the realm of vertical spread trading.

As we pointed out earlier, the maximum profit potential, in this case, should be calculated by the difference in the contracts’ net premium, which happens to be $37 for the net credit received. The maximum loss, on the other hand, can be quickly calculated by subtracting the credit received from the difference in the different strike prices for the same underlying stock. In this case, this happens to be $63.

This bear call spread example also perfectly exemplifies the less-than-desirable profit-to-loss ratio of this limited reward strategy. But remember, the win percentage at the end of the day will always be in your favor. So stay patient, and you’ll be able to solve the dilemma.

Conclusion

Having a toolbox filled with diversified options strategies is essential in today’s trading environment. You’ll need to be able to adjust and overcome anything that the market throws at you. And as you can see, the call credit spread is one of the greatest ways to place more conservative bear call spread trades with an impressive profit potential but without the maximum risk.

What’s more? The call credit spread is one of the best low-stress approaches, explaining why it’s a go-to limited reward strategy for most successful traders. You won’t even need to always be right about the market price or direction to make money. The positions are much more forgiving as they award you a high success probability.

Finally, remember, a bear call spread strategy is only an ideal play if you believe that the price of the underlying stock price will only fall by a limited change between the expiration date and the trade date: lest the trades expire worthless. It’s a trade-off between risk and potential reward.