City Traders Imperium Review

Proprietary trading firms, often known as “prop shops,” allow traders to use the firm’s capital to make trades, maximizing potential profits. Instead of charging a commission, these firms typically share a portion of the profits made from trades.

Situated in the heart of London, City Traders Imperium emerges as one such distinguished prop trading firm. They stand out by offering to fund successful forex traders, with an impressive scale ranging from $20,000 to a staggering $4,000,000. Successful traders, post-evaluation, can relish a profit split ranging from 70% to an unprecedented 100%.

Diving into this review, I’ll be sharing my firsthand experiences with City Traders Imperium, combined with insights gathered from fellow traders. From understanding the platforms they offer to dissecting their thorough evaluation procedures and unique trading features, this article aims to cover all you need to know.

However, transparency is key. Thus, I will also be shedding light on any limitations or challenges the firm may present, enabling you, as a trader or investor, to make a calculated choice on the best prop trading avenue for your journey.

What is City Traders Imperium?

City Traders Imperium is a proprietary trading firm founded in 2018 by two seasoned professionals in the UK. The firm caters specifically to traders who seek to elevate their trading game.

If you’re someone who stands out in the evaluation phase, there’s an enticing offer on the table: a profit split that can be anywhere between 70% and 100% on successful trades.

However, it’s crucial to note that City Traders Imperium is tailored for genuine market players. They place their bets only on traders who actively participate in the market, steering clear of those who merely mimic other traders’ moves.

Their offerings are versatile, catering to both intraday traders and those eyeing long-term strategies. For those seeking a more direct approach, City Traders Imperium rolls out a unique direct funding program, ensuring traders have the requisite capital to forge ahead in their trading journey.

Advantages and Disadvantages of Trading with City Traders Imperium

Benefits of Trading with City Traders Imperium

After trading with City Traders Imperium, I’ve come to recognize several standout benefits that set this prop firm apart. The sense of community is palpable; diving into the world of City Traders Imperium means immersing yourself in a group of seasoned traders. Their collective wisdom, insights, and unwavering support can significantly enrich your trading journey.

One of the foremost advantages is the sheer thrill of the markets without the associated stress. As a funded trader, you can relish the potential profits without being bogged down by the constant pressure of full-time trading. It’s a setup that promises excitement without overwhelming commitment.

Financially, City Traders Imperium stands as a game-changer. By offering traders more purchasing power than they’d typically have using their own capital, the firm amplifies your potential returns. And once you hit that payout milestone, the beauty of it is that the risks associated with your account virtually vanish. Essentially, you’re trading with heightened potential but reduced personal risk.

City Traders Imperium Pros and Cons

Pros:

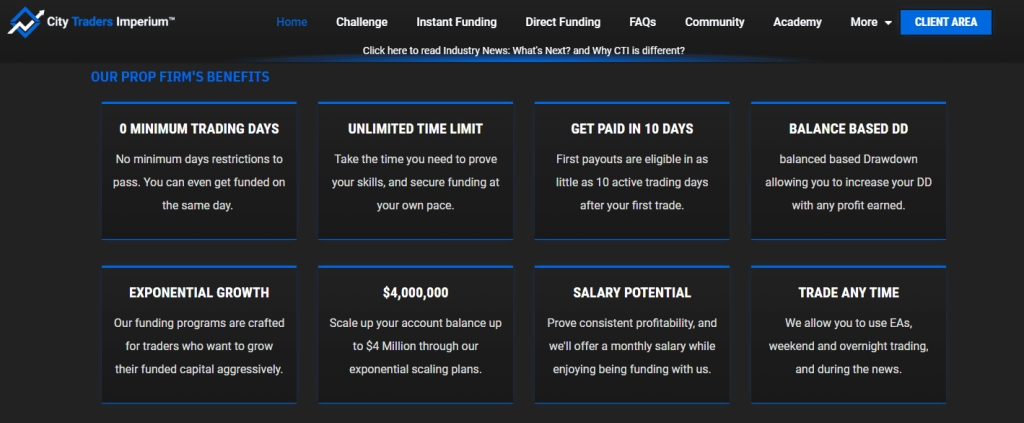

- Competitive profit split reaching 100%

- Options for one-step, two-step evaluation, and direct funding

- Funding available up to $4,000,000

- Supports diverse trading approaches

- Weekly payouts across all funding schemes

- Free retake available for the Day trading challenge

Cons:

- Limited asset choices compared to rivals

- No trading of cryptocurrencies, stock CFDs, commodities, or exotic currency pairs

- Restrictions on specific trading strategies like Martingale, copy trading, high-frequency, and arbitrage

- Absence of a demo account; subscription fee required to test trading conditions.

Difficulties Met by the Traders Who Participated in the Brokers Challenge

30 Active Minimum Trading Days

Many traders, especially those used to scalping or day trading on a more casual basis, might find the mandate of 30 active minimum trading days challenging. This could be due to multiple reasons:

- Managing other commitments

- Handling the mental strain of daily trading

- Simply finding enough viable trading opportunities every day

How to Overcome the Difficulty

Stay organized and disciplined. Create a monthly trading calendar in advance. By setting specific days and times for trading, you can ensure regular participation and evenly spread out your trades. It’s also beneficial to set daily goals and stick to a pre-defined strategy, ensuring that you’re not trading to meet the active day requirement.

5% Relative Drawdown Rule

The 5% relative drawdown rule means traders can’t allow their account to drop by more than 5% from its peak value. For aggressive traders or those who are used to taking bigger risks, this might limit their typical trading style and could be a source of stress, especially in volatile markets.

How to Overcome the Difficulty

Adopt a robust risk management strategy. This involves setting clear stop-loss orders on every trade and being mindful of the total exposure at any given time. Traders should also diversify their trades and avoid putting too much capital into a single position. Continuous monitoring and regular reviews can help in making timely adjustments to prevent hitting the drawdown limit.

Low Leverage Compared to Competitors

Leverage allows traders to control a larger position with less money. When a broker offers lower leverage compared to others, traders might feel restricted, especially if they’re accustomed to maximizing returns using higher leverage. However, it’s important to remember that while higher leverage can amplify profits, it can also magnify losses.

How to Overcome the Difficulty

Reevaluate and adapt your trading strategy. This might involve trading with smaller position sizes, being more judicious in selecting trades, or even expanding your knowledge to understand other trading techniques better suited to lower leverage. Regularly reviewing the market and being updated on the news can also help in identifying high-probability trades, ensuring every position counts.

City Traders Imperium Customer Reviews

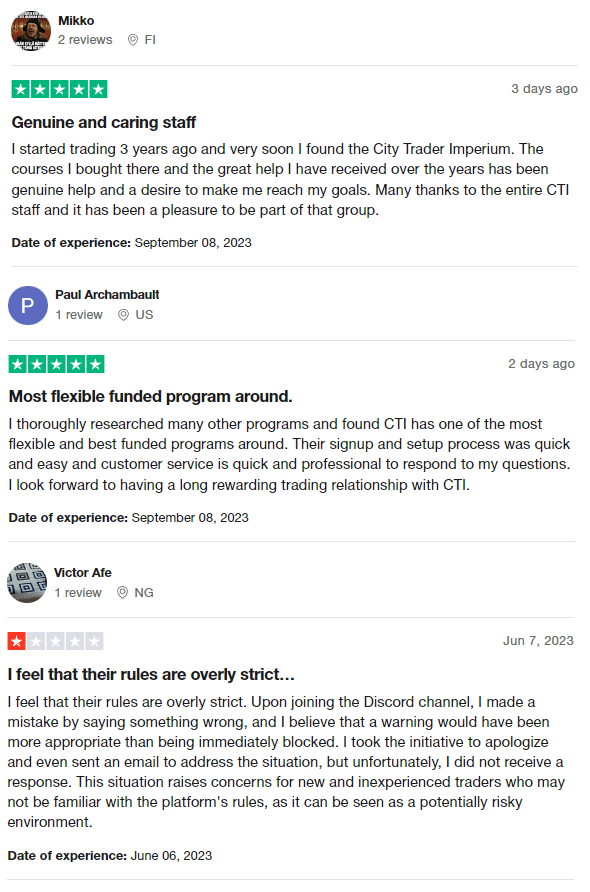

With a notable 4.8-star rating on Trustpilot, City Traders Imperium (CTI) garners a mix of feedback from its user base. Many traders laud CTI for its valuable courses, exceptional customer service, and flexible funded programs. They appreciate the professional and prompt responses to inquiries, with some emphasizing their satisfaction with the ease of the sign-up process.

However, some users have raised concerns about strict community guidelines, especially on platforms like Discord, where they feel a more lenient approach, such as warnings instead of immediate blocking, would be more appropriate for newcomers unfamiliar with platform rules.

City Traders Imperium Fees and Commissions

Navigating the fees and commissions landscape when trading can be a tad complex, but after diving deep into City Traders Imperium’s structure, I’ve gleaned some straightforward insights.

Here’s the deal: When you’re a funded trader with City Traders Imperium, you won’t find yourself shelling out extra cash to the firm for each trade you make. The reason? The prop firm makes its earnings from the success of its traders, scooping up a fraction of the trader’s profits.

Now, there’s a catch if you venture into trading CFDs. Every time you trade a CFD, you’ll need to cough up a fee to the broker. This fee isn’t a fixed sum but is embedded in the spread. To give you an idea, the spread can be as low as 1 pip for pairs like EUR/USD, and it operates on a floating basis.

Lastly, a heads up for when you’re cashing out your earnings: banks and online payment systems might slice off a bit as withdrawal fees. It’s always wise to factor these in when calculating your net take-home.

Account Types

After diving into City Traders Imperium’s offerings and testing them firsthand, I’ve summarized their account types to provide a clearer understanding for prospective traders:

Challenge Account

- Program: 2-Step funding program.

- Best For: Those with a higher risk appetite, searching for increased leverage and a wider drawdown range.

- Funding Range: $5,000 to $100,000.

- Duration: 45 days allotted for each stage.

- Profit Sharing: Potential to acquire up to 100% of profits.

- Profit Goal: 10% in the first phase and 5% in the second.

- Daily Loss Limit: 4% determined from the start of the day’s balance.

- Associated Cost: Varies from $59 to $509, based on the chosen funding amount.

Instant Funding Account

- Program: 1-Step Funding Program.

- Best For: Traders of diverse styles, especially those with a moderate risk inclination, seeking versatility and substantial growth.

- Funding Range: $5,000 to $100,000.

- Duration: No specific time frame.

- Profit Sharing: Traders have the opportunity to bag up to 100% of profits.

- Profit Goal: Set at 9%.

- Daily Loss Limit: 5%, derived from the starting account balance.

- Associated Cost: Pricing falls between $99 and $949, contingent upon the selected funding tier.

Direct Funding Account

- Program: No-Step Funding Program.

- Best For: Traders eager to bypass the initial level of the instant funding process, enabling immediate access to profit disbursements.

- Funding Range: $5,000 to $100,000.

- Duration: No fixed time constraint.

- Profit Sharing: As with the others, traders can aim for up to 100% of their gains.

- Profit Goal: Set at a solid 10%.

- Daily Loss Limit: 5%, taken from the initial fund balance.

- Associated Cost: The fee spectrum starts at $299 and can go up to $5,999, depending on the funding amount.

How to Open Your Account

- Visit the firm’s official website.

- Click on the “Funding Programs” option.

- Select your preferred funding program.

- Click on “Get Funded”.

- Fill in your first and last names, email, and phone number.

- Provide details about your trading experience, address, and country of residence.

- Agree to the terms of service.

- Make the payment for the chosen tariff plan; afterwards, the firm will send login credentials to the provided email.

City Traders Imperium Customer Support

Effective communication with your prop firm is essential in navigating the world of trading. Based on my personal experience, City Traders Imperium facilitates this with a variety of communication avenues. Traders can reach out via online chat, email, or even through their Discord channel, making it easy to have concerns addressed promptly.

However, it’s worth noting that live chat isn’t operational on Saturdays, Sundays, or public holidays. If you do find yourself needing assistance during these times, you can leave a request, and the firm ensures that they’ll respond via email.

Advantages and Disadvantages of City Traders Imperium Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

City Traders Imperium has established a clear procedure for profit withdrawals. To initiate a withdrawal, traders must send a detailed email to t he firm, ensuring all trading positions are closed. Depending on the chosen financing plan, traders can access their profits.

For instance, under the Standard and Classic Evaluation plans, withdrawals are possible after reaching a 50% target profit. These funds are then transferred to the card initially used for the subscription fee.

For those who’ve opted for Direct Funding, withdrawals are permissible once net profits exceed the initial amount. Various methods like bank transfers, Wise, Revolut, and PayPal are available.

New entrants in the Day Trading Challenge have specific conditions, such as a bi-weekly withdrawal option after achieving a 15% profit target. Additionally, cryptocurrency enthusiasts have the option to withdraw in USDC on the Polygon/Matic network.

What Makes City Traders Imperium Different from Other Prop Firms

In my experience, City Traders Imperium stands out prominently in the vast ocean of prop firms. What sets them apart initially is their unwavering commitment to genuine trader development.

Another distinguishing factor is their funding flexibility. The company offers various funding programs, each designed to cater to a different risk appetite and trading style. From challenges with higher drawdown and more leverage to direct funding without initial evaluation stages, it’s not a one-size-fits-all approach but a well-thought-out structure that values the uniqueness of each trader.

Lastly, the profit-sharing model is exceptionally competitive. With the potential to earn up to a 100% profit split, they demonstrate a level of trust and partnership with their traders that’s rare in the industry.

How Can Asia Forex Mentor Help You Pass City Traders Imperium’s Evaluation?

At Asia Forex Mentor, we’re committed to guiding traders through the challenges of the forex market, especially if you’re aiming to clear City Traders Imperium’s rigorous evaluation process. Founded in 2008, right in the heart of Singapore, my initial goal was modest.

I just wanted to share my knowledge of forex trading with a close circle of friends. To my surprise, this small circle grew rapidly into a thriving community, prompting me to refine and adapt my teaching approach.

In no time, I found myself giving live lessons and was even approached by trading corporations and banks to mentor their teams. All of these experiences culminated in the creation of the AFM Proprietary One Core Program, a comprehensive course that helps traders develop their trading strategies, hone their market analysis skills, and maintain steady trading account management.

This beginner-friendly program consists of 26 main lessons, encompassing over 60 subtopics, each accompanied by a high-quality online video. Each lesson, enriched with examples and insights I’ve personally chosen, ensures that traders get a holistic understanding, setting them on a path of low-risk, high-reward trading.

Our Journey at Asia Forex Mentor

Throughout my time at Asia Forex Mentor, I’ve had the honor of mentoring an array of traders, ranging from those at the retail level to individuals working in banks to professionals in esteemed trading institutions and investment firms.

Witnessing their transformations has been inspiring; many who entered as greenhorns now thrive as full-time forex traders, with some even managing substantial funds.

The core of my teaching is encapsulated in the One Core Program. Within its chapters, I’ve distilled years of experience, focusing not just on technical strategies but also on often-overlooked aspects like trading psychology.

I emphasize the criticality of maintaining a trading diary and also share my unique ‘set-and-forget’ strategy. The program further demystifies concepts like the distinctions between different stop-loss levels and introduces tools like our exclusive auto stop-loss.

If you’re curious, you can dip your toes in with our seven-day free trial. However, for those already sensing the potential and eager to dive deep, the program, usually priced at $997, is available at a direct price of $940, letting you bypass the trial and dive straight into the wealth of knowledge.

Conclusion: City Traders Imperium

City Traders Imperium has undeniably carved a niche for itself in the prop trading sector. Based on my insights and the feedback from users, its funding programs stand out, offering traders an opportunity to prove their skills and get rewarded handsomely. Their flexible profit splits and scalability, with potentials of up to 100%, are notable points of commendation.

However, no firm is without its downsides. While City Traders Imperium offers a plethora of advantages, potential clients should be mindful of certain limitations. For instance, the restrictions on specific trading styles and the absence of certain assets that its competitors might offer are points to consider.

In conclusion, while City Traders Imperium has much to offer for those looking to partner with a prop trading firm, as with any financial decision, one should weigh the pros and cons and consider what aligns best with their trading style and goals.

Also Read: SurgeTrader Review 2024

City Traders Imperium Review FAQs

Does City Traders Imperium offer a demo account?

No, they do not provide a demo account. To test their trading conditions, a subscription fee is required.

What is the maximum funding offered by City Traders Imperium?

They offer funding up to $4,000,000.

How often can traders withdraw their profits?

Withdrawal frequencies vary depending on the funding program and trading milestones achieved.