Position in Rating | Overall Rating | Trading Terminals |

241st  | 2.0 Overall Rating |  |

CWG Markets Review

Selecting the right FX or Forex broker is more relevant to success in any deal because it directly points at the access to some sort of trading tools or otherwise to fees and total trading experience. A good provider allows for a secure usage experience, with features based upon your needs, or could eventually create unnecessary challenges for money risks.

What makes CWG Markets stand out is the flexible account options, competitive fees, and streamlined deposit and withdrawal procedures. It is able to serve traders in all levels through robust tools and a performance- and convenience-tailored platform. Checking if CWG Markets is legit can be considered by first taking into account their regulatory status, trading conditions, and customer feedback. It has some strengths. It has competitive fees and options for flexible accounts, but has mixed reviews and operates off shore.

In this review, we will delve into the strengths and weaknesses of CWG Markets, including its account options, commissions, and other key features. This analysis combines expert insights and real trader experiences to help you determine if CWG Markets aligns with your trading goals.

What is CWG Markets ?

CWG Markets Ltd is a global financial services provider offering Contract for Difference (CFD) trading across various instruments, including forex, stock indices, futures, energy, and precious metals. As a non-trading member of the London Stock Exchange, the company caters to both retail and institutional traders worldwide.

Traders with CWG Markets can access over 500 trading instruments with competitive spreads and leverage options up to 1000:1. The platform supports multiple account types to accommodate different trading strategies and preferences. Additionally, major currency pairs are available for trading, providing opportunities for both novice and experienced traders.

CWG Markets emphasizes client fund security by holding client funds separately in top international banks, ensuring they are not used for company operations or other investments. The company operates under the regulation of the Financial Conduct Authority (FCA) in the UK and the Vanuatu Financial Services Commission (VFSC), adhering to global regulatory standards.

CWG Markets Regulation and Safety

CWG Markets is regulated under tight supervision for the protection of its clients' interests and building trust. In the UK, CWG Markets (UK) is an approved investment firm that is fully authorized and regulated by the Financial Conduct Authority (FCA) under firm reference number 785129. Moreover, it is a member of the London Stock Exchange, which shows that it follows all financial standards and adheres to transparency.

Internationally, CWG Markets (VU) is licensed and regulated by the Vanuatu Financial Services Commission (VFSC) with registration number 41694. This global regulatory framework ensures that CWG Markets operates with integrity and accountability across different jurisdictions.

CWG Markets segregates all client into top-tier international bank accounts. This means the company does not use such funds for its operations and other investments, thereby giving further security to the traders.

CWG Markets Pros and Cons

Pros

- Regulated broker

- Multiple platforms

- Diverse instruments

- Competitive spreads

Cons

- High deposit

- Limited support

- Regional restrictions

- Inactivity fees

Benefits of Trading with CWG Markets

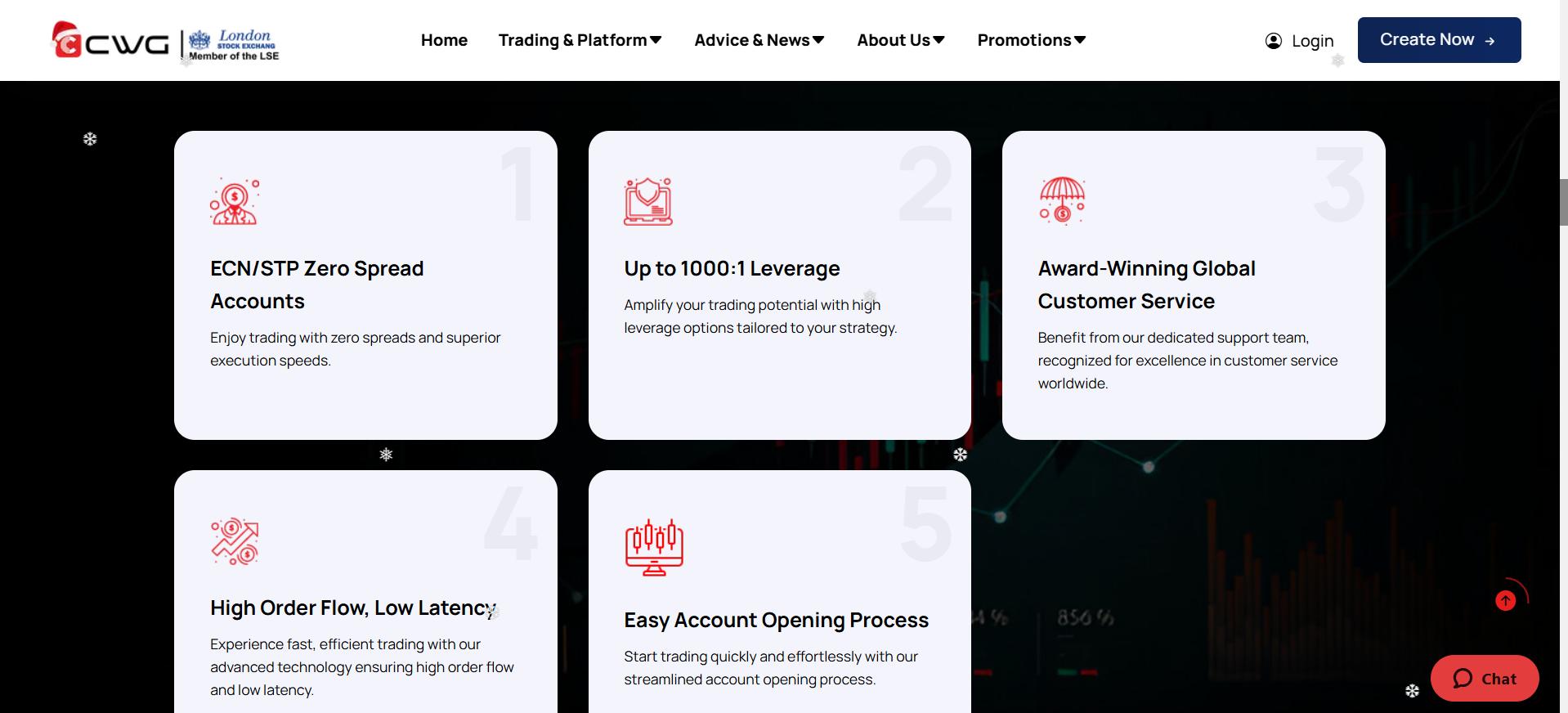

Exceptional Trade Execution

CWG Markets provides the best trade execution, ensuring your orders are processed quickly and accurately. This efficiency allows you to take advantage of market opportunities as they come up.

Competitive and Transparent Pricing

Enjoy consistently low spreads and transparent pricing structures to maximize your trading potential without hidden costs.

Advanced Trading Platforms

Utilize cutting-edge platforms such as MetaTrader 5, which are equipped with professional charting tools and real-time data, for executing informed trading decisions across various devices.

Wide Variety of Trading Instruments

Access over 500 trading instruments, including forex, indices, commodities, and precious metals, allowing for a diversified trading portfolio tailored to your strategies.

High Leverage Options

Amplify your trading potential with leverage options up to 1000:1, providing flexibility to implement various trading strategies effectively.

Award-Winning Customer Support

Dedicated support from a world-recognized customer support team is available 24/5, meaning that your questions are answered quickly and professionally.

Secure and Regulated Environment

Trade with confidence because CWG Markets operates under tight regulatory standards, with client funds kept separately in the world's leading international banks for maximum security.

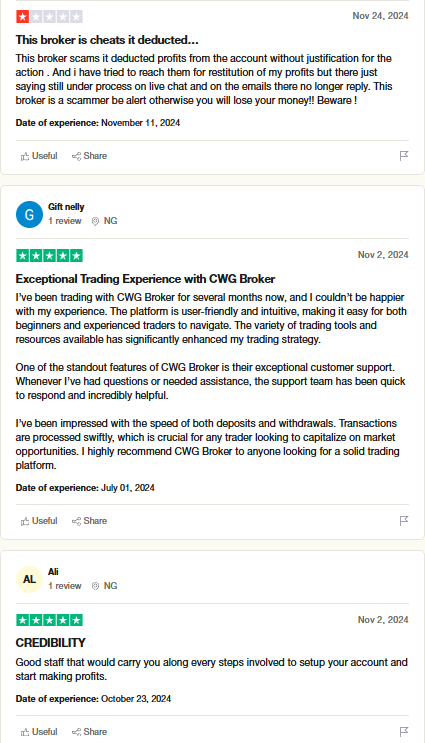

CWG Markets Customer Reviews

CWG Markets has a strong, reputable platform suited for both beginners and experienced traders. Many users point out that its design is user-friendly: it's easy to navigate, and there are many trading tools around which increase the entire trading experience. The help desk of the site is nice in regard to response time and help in solving issues promptly. Customer review indicates that CWG Markets is indeed a good and legitimate broker because it offers reliable services and strong security measures to protect clients funds and private data.

Transactions on CWG Markets are processed in a timely manner, which is important for taking advantage of the market opportunities. However, there are complaints by some users over how some of its account holders' accounts are deducted in unresolved disputes. Yet, many encourage the use of the platform since most find it fast and effective in account opening and trade facilitation.

CWG Markets Spreads, Fees, and Commissions

CWG Markets offers a competitive structure of spreads and commissions for all the trading requirements. The brokerage does not charge any fee for deposit and withdrawal but absorbs costs of the payment providers up to five withdrawals every month. Subsequent withdrawals come with a fee of $5. Transfers sent internationally, and below $500, cost a $25 bank fee. Where the transfer exceeds $500, the brokerage absorbs all bank fees.

CWG Markets also provides flexible leverage options, which range from a maximum of 1:1000 depending on the instrument traded. This allows the trader to manage their risk exposure. The transparent fee policies make the platform accessible and appealing to both new and experienced traders.

Account Types

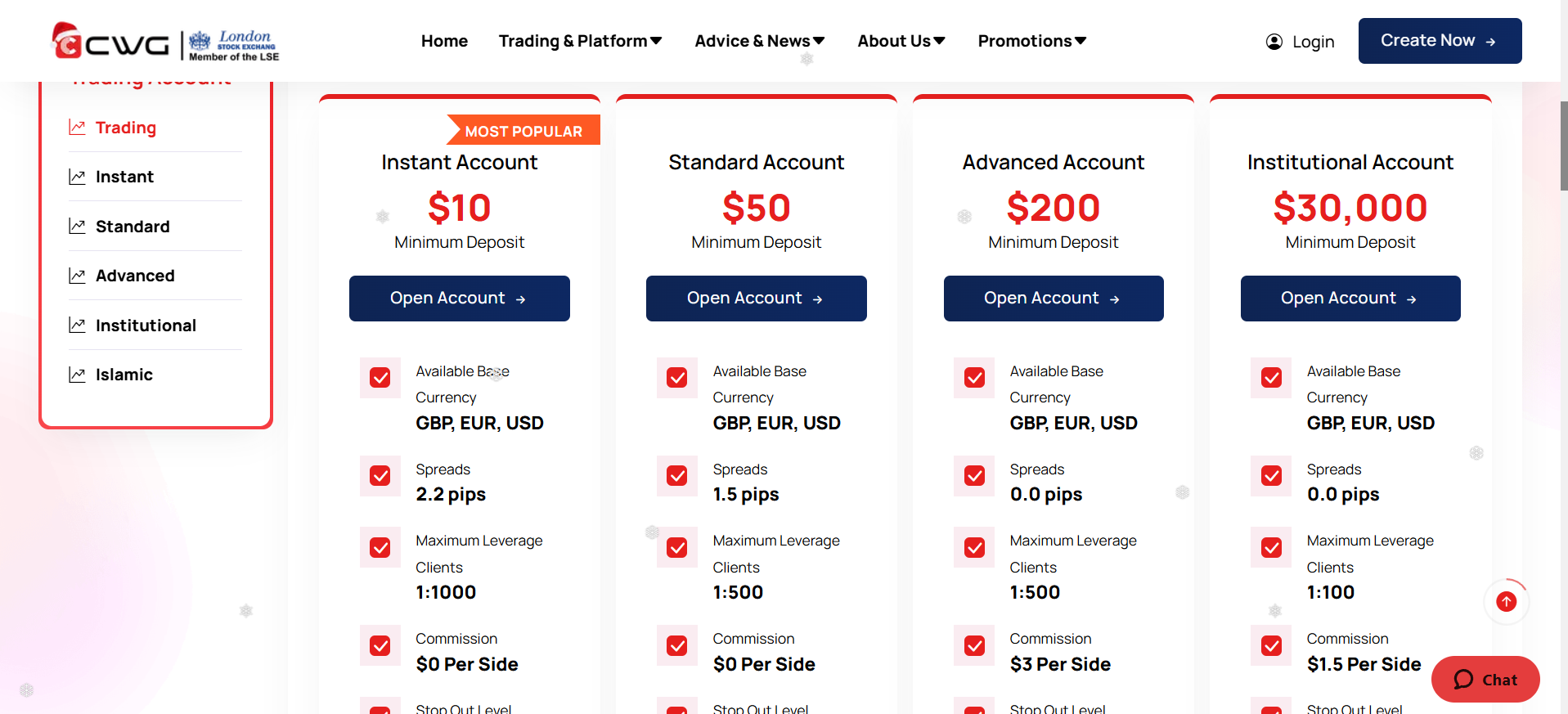

CWG Markets offers a variety of trading accounts to suit different trader needs, each with specific features and benefits. Here's a breakdown of each account type:

Instant Account

This is the most preferable account for beginners. Here, the minimum deposit is at $10, and trading spreads start from 2.2 pips. The leverage is up to 1:1000, and there is a zero commission per side, coupled with a stop-out level that is at 50%. Request for an Islamic account is possible if desired.

Standard Account

Standard Account It has a minimum deposit of $50, and spreads from 1.5 pips. It offers leverage up to 1:500, with no commission per side and a 50% stop-out level. Islamic accounts are also offered.

Advanced Account

The Advanced Account caters to experienced traders and is offered with a minimum of $200, but has spreads as low as 0.0 pips. It offers leverage up to 1:500, and commission for both sides is at $3, with a stop-out level at 50%. Islamic accounts can be requested.

Institutional Account

It's tailored for professional traders and institutions. Institutional Account requires a minimum deposit of $30,000, with spreads from 0.0 pips, up to 1:100 leverage, and $1.5 per side in commission. A 50% stop-out level is provided. Islamic accounts are available on request.

How to Open Your Account

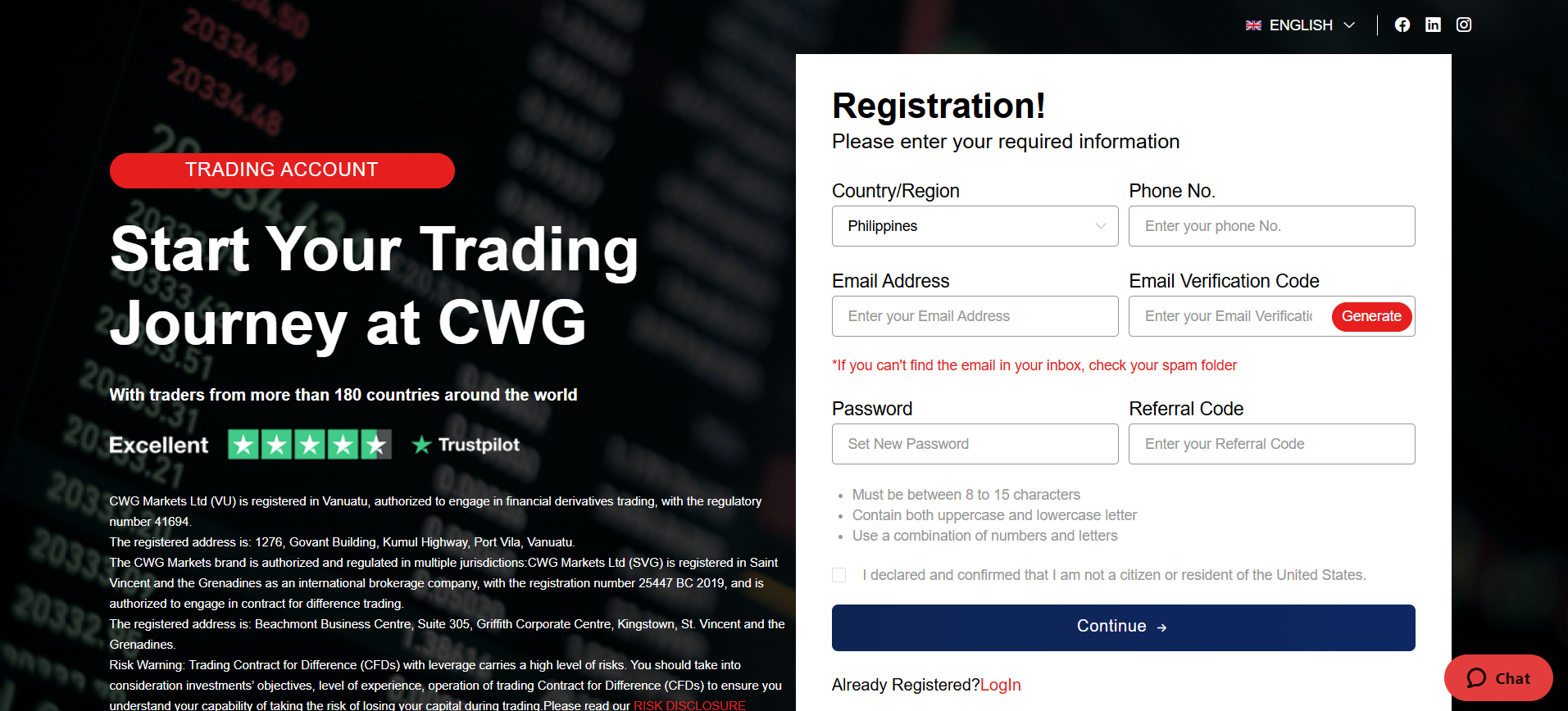

Step 1: Go to the CWG Markets Website

Go to the CWG Markets website. On the home page, look for the “Create Now” or “Open Account” button and click it to start the registration process.

Step 2: Fill in the Registration Form

Enter your country/region, email address, phone number, and create a secure password. Confirm your details and check your email inbox for the verification code.

Step 3: Verify Your Email Address

Enter the verification code sent to your email into the designated field on the registration form. If the email isn't visible, check your spam folder.

Step 4: Submit Your Identification Documents

After logging in, upload the required identification documents for verification. These typically include a government-issued ID and proof of address.

Step 5: Fund Your Account

Once your account is verified, proceed to fund it through the available deposit methods. Choose a payment option that suits your preferences to start trading.

Step 6: Start Trading

After completing the above steps, access the trading platform, explore the available tools, and begin your trading journey with CWG Markets.

CWG Markets Trading Platforms

CWG Markets is a fintech company that offers a diverse range of trading instruments. These include Forex, stock indices, futures, commodities, and precious metals. Markets are accessed by traders through the MetaTrader 5 (MT5) platform, which comes in desktop, web, and mobile versions. The tool supports advanced technical analysis and strategy building, making it ideal for all traders, from beginners to professional ones. A well-defined trading strategy is essential to take advantage of a market opportunity, and, in this regard, the features of CWG Markets platform are robust. However, the broker also avails Copy Trading, and users can replicate strategies performed by top traders, making even beginners trade.

CWG Markets offers support for more than 300 individual stocks from major exchanges like Nasdaq and NYSE, traded through CFDs on the MT5 platform. It caters to diverse trading needs with flexible account types, competitive spreads, and multiple payment options. The trading platform ensures seamless trading on the go and provides opportunities to profit from both rising and falling markets, making it a reliable choice for global traders.

What Can You Trade on CWG Markets

Forex Trading

Forex (foreign exchange) trading allows you to trade currency pairs like EUR/USD, USD/JPY, and GBP/USD. CWG Markets offers access to over 40 currency pairs, providing a platform to take advantage of price fluctuations in the global currency market. With competitive spreads and advanced tools, it's suitable for traders of all levels looking to explore the $6.6 trillion daily forex market.

CFD Stock Trading

Stock CFDs let you trade shares of global companies like Apple, Tesla, or Amazon without owning the underlying stocks. This gives you the opportunity to profit from price movements in both rising and falling markets. CWG Markets provides over 100 CFD stocks with high liquidity, making it a flexible choice for diversifying your portfolio.

Commodity Futures

You can trade commodity futures such as coffee, sugar, or corn on CWG Markets. These allow you to speculate on the price changes of raw materials, offering a way to hedge risks or diversify your investments. The platform supports flexible trading strategies with detailed market insights to help you succeed.

Precious Metals

CWG Markets provides trading in gold, silver, platinum, and palladium. Precious metals are often used as safe-haven investments during economic uncertainty. With options for both long and short trades, you can profit regardless of market direction.

Energy Products

Energy trading focuses on commodities like crude oil and natural gas. These assets are known for their price volatility, which creates opportunities for traders. CWG Markets allows you to trade energy products with leverage, providing flexibility for both day traders and long-term investors.

Indices

Trading indices like the S&P 500, NASDAQ, or FTSE 100 lets you speculate on the performance of entire markets rather than individual stocks. CWG Markets offers access to over 18 global indices, allowing traders to diversify their strategies and gain insights into broader market trends.

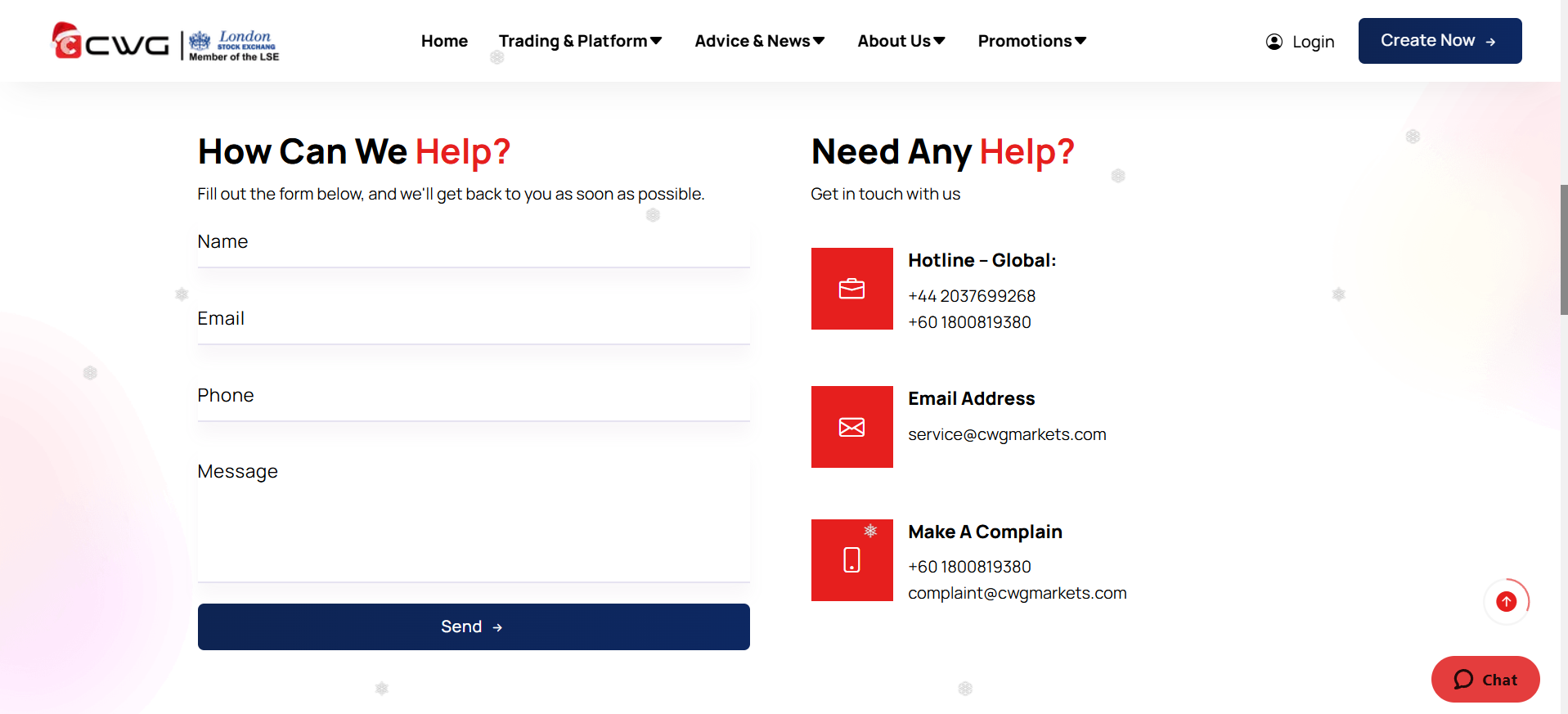

CWG Markets Customer Support

CWG Markets provides 24/7 customer support to help with your trading questions and account problems. You can reach their expert support team through email at service@cwgmarkets.com. For instant help, CWG Markets provides a global hotline at +44 2037699268 and another contact number at +60 1800819380. These lines are available round the clock to address your concerns.

If you prefer online communication, CWG Markets has an online contact form on their website. You can supply your name, email address, phone number, and message, and their support team will get back to you immediately. For complaints, you can call +60 1800819380 or email complaint@cwgmarkets.com. CWG Markets is dedicated to resolving your issues.

Advantages and Disadvantages of CWG Markets Customer Support

Withdrawal Options and Fees

CWG Markets provides withdrawal options suited to its diverse global clientele. Withdrawals are executed through the same channels a client used for deposits-including bank transfers, credit/debit cards, as well as a number of e-wallets-that ensures a smooth and risk-free transaction process.

The withdrawal fee is zero, while payment provider fees are covered for the first five withdrawals per month. Additional transactions attract a fee of $5 for each. To soften the blow of these fees, clients can actually redeem discount vouchers in the Client Zone's Rewards Mall.

International bank transfers: If the amount withdrawn is more than $500, CWG Markets pays for all the bank fees. However, if the amount is less than $500, then CWG Markets charges a $25 bank fee. In general, to avoid fraud and reduce the risk of money laundering, withdrawals are usually processed through the same payment method that was used to make the initial deposit.

CWG Markets Vs Other Brokers

#1. CWG Markets vs XM

CWG Markets and XM cater to various trading requirements but differ in their method and services. CWG Markets boasts a customized trading experience via flexible account types and low competitive spreads, which appeal to people who want their services. On the other hand, XM has more extensive worldwide outreach, higher leverage options, and a strong educational suite; these all entice traders to focus more on accessible tools and resources. Both of the brokers offer MetaTrader platforms, but XM's frequent promotional bonuses may make it more suitable for traders who are budget-conscious.

Verdict: XM excels in terms of resources and promotional offers, but CWG Markets is more suitable for traders who require customizable account options. The decision comes down to whether the trader requires customization or global accessibility.

#2. CWG Markets vs RoboForex

Both of them suit different needs and vary in approach. While CWG Markets focuses on trading with many instruments, like forex, indices, and commodities, with competitive spreads, RoboForex allows having an array of account types from both amateur and professional traders' standpoints, with special emphasis put on automated tools for trading and bonuses. RoboForex also accepts very low minimum deposits, which will appeal to beginners. CWG Markets differentiated itself with its educational resources and analysis tools that will appeal more to intermediate traders seeking to perfect their strategy.

Verdict: For traders who are looking for flexible products and bonuses, the winner would be RoboForex. However, CWG Markets has the most educational support and various trading tools.

#3. CWG Markets vs Exness

CWG Markets provides a wide range of trading instruments, such as forex, commodities, and indices, with a focus on competitive spreads and advanced trading tools, making it appealing to both beginners and experienced traders. On the other hand, Exness provides an edge in instant withdrawals, tight spreads, and high leverage options, which is particularly catered to professional traders who require fast execution and flexible trading conditions. Both the platforms are regulated, but Exness is operational globally with a larger client base, while CWG Markets is directed at providing a more customized trading experience with deeper customer support.

Verdict: The offering of Exness is best with regards to its global reachability and trader-centric features, including instant withdrawals and higher leverage. CWG Markets, however, suits more for the trader who seeks a more supportive and customizable trading environment.

Also Read: XM Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH CWG MARKETS

Conclusion: CWG Markets Review

CWG Markets provides an extensive trading platform specifically for new and professional traders. Its account types are diversified with competitive spreads, ensuring strong regulatory oversight and thus providing a safe and user-friendly environment. It has such features as MetaTrader 5, 24/7 multilingual support, and very extensive trading instruments.

However, it may have drawbacks such as high deposit requirements and few support channels. Overall, CWG Markets is impressive in terms of its tools and trader-centric approach, which makes it a reliable option for those looking to navigate the financial markets effectively.

Also Read: TradeUltra Review 2024 – Expert Trader Insights

CWG Markets Review: FAQs

Is CWG Markets regulated?

Yes, CWG Markets is regulated by the Financial Conduct Authority (FCA) in the UK and the Vanuatu Financial Services Commission (VFSC), ensuring global compliance and client fund security.

What trading platforms does CWG Markets offer?

CWG Markets provides the MetaTrader 5 platform, available on desktop, web, and mobile. It supports advanced trading tools, Copy Trading, and a user-friendly interface suitable for both beginners and experienced traders.

What are the withdrawal fees on CWG Markets?

CWG Markets charges no fees for the first five withdrawals each month, but a $5 fee applies for additional withdrawals. International bank transfers below $500 incur a $25 fee, while transfers above $500 are fee-free.

OPEN AN ACCOUNT NOW WITH CWG MARKETS AND GET YOUR BONUS