Position in Rating | Overall Rating | Trading Terminals |

234th  | 2.1 Overall Rating |  |

DB Investing Review

DB Investing has been empowering traders worldwide since 2018 by providing the tools and knowledge needed for success in the financial markets. Licensed by leading regulators, including the Financial Services Authority (FSA) of Seychelles and the Emirates Securities and Commodities Authority (ESCA) of Dubai, the firm ensures clients trade in a secure and transparent environment. This commitment to compliance and innovation has earned DB Investing a reputation as a trusted partner for both individual and institutional traders.

With offices in global financial hubs like Dubai, Seychelles, Limassol, Lagos, and Malta, DB Investing is expanding into Latin America and Asia in 2024. The firm’s personalized approach and focus on long-term client relationships set it apart, delivering tailored solutions to meet diverse trading needs as it continues to grow and strengthen its global presence.

This review explores how DB Investing stands out in the financial brokerage industry. It highlights the company’s regulatory compliance, innovative tools, global reach, and client-centric approach, offering valuable insights into why it is a preferred choice for traders worldwide.

What is DB Investing?

DB Investing is a global brokerage firm established in 2018 that provides traders with access to over-the-counter (OTC) markets. Operating as an STP (Straight Through Processing) and ECN (Electronic Communication Network) broker, it enables trading in various assets, including currencies, CFDs on stocks, cryptocurrencies, commodities, metals, and stock indices. This variety makes it suitable for traders seeking diverse investment opportunities.

The broker offers valuable features like leverage, social trading, and Multi-Account Management (MAM) accounts, catering to both novice and experienced traders. Licensed by the Financial Services Authority (FSA) of Seychelles, DB Investing ensures compliance with financial regulations, giving traders an additional layer of trust. However, it does not serve clients from regions such as the U.S., EU, UK, Canada, or countries with restrictions set by the Financial Action Task Force (FATF).

With a focus on user-friendly trading solutions, DB Investing connects clients to global markets while maintaining a commitment to transparency and efficiency. Whether you're looking to trade independently or explore managed accounts, the broker's offerings are designed to accommodate diverse trading needs.

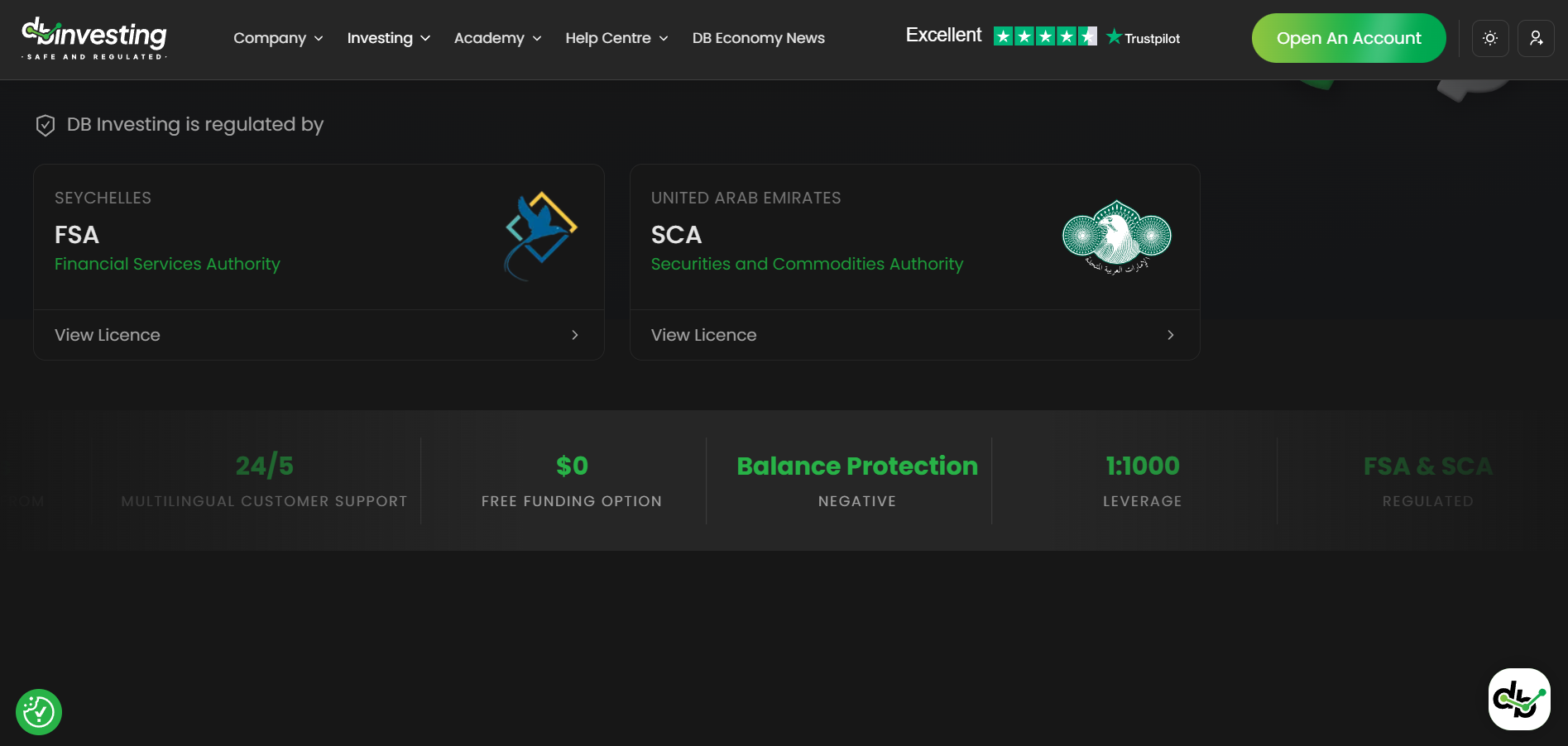

DB Investing Regulation and Safety

DB Investing operates under strict regulatory oversight to ensure the safety and trust of its clients. It is authorized and regulated by the Financial Services Authority (FSA) of Seychelles, holding license number SD053. The FSA, established under the Financial Services Authority Act of 2013, oversees non-bank financial services, ensuring compliance and monitoring activities such as fiduciary services, capital markets, and insurance. This regulation provides traders with confidence that DB Investing adheres to stringent international standards.

In addition to its Seychelles regulation, DBInvest Financial Services LLC is authorized and regulated by the Securities and Commodities Authority (SCA) in the United Arab Emirates under license 20200000197. The SCA enforces Federal Law No. 4 of 2000 to enhance investor protection, regulate securities markets, and build trust through robust legislative and supervisory frameworks. By adhering to these standards, DB Investing reinforces its commitment to transparency and investor safety.

Further strengthening its reliability, DB Investing offers essential safety features such as negative balance protection and mandatory Know Your Customer (KYC) verification. These measures ensure clients are protected from significant losses and their accounts remain secure. By complying with these regulations and offering added safeguards, DB Investing positions itself as a secure and trustworthy choice for global traders.

DB Investing Pros and Cons

Pros

- FSA and SCA regulated

- Negative Balance Protection

- KYC Compliance

- Leverage options

Cons

- Regional Restrictions

- Limited to OTC Markets

- Leverage risks

- Limited Payment Methods

Benefits of Trading with DB Investing

One of the key benefits of trading with DB Investing is its direct connection to liquidity providers (LPs), ensuring faster and more efficient execution of trades. The broker uses a Straight Through Processing (STP) model, which means there is no relay or delay in executing orders. This direct access reduces slippage and ensures that traders can take advantage of market opportunities without waiting.

DB Investing also offers low latency, with execution speeds as fast as 0.60 milliseconds. This means that traders can execute trades quickly, giving them an edge in fast-moving markets. The broker provides raw spreads from LPs, which helps reduce the overall cost of trading, as there are no additional markups on spreads.

Another advantage of trading with DB Investing is the dedicated margin account for traders. This account helps manage leverage and ensures that margin funding is available when needed. The broker’s margin account funding system allows traders to easily manage their capital, enabling them to execute trades with confidence and flexibility.

DB Investing Customer Reviews

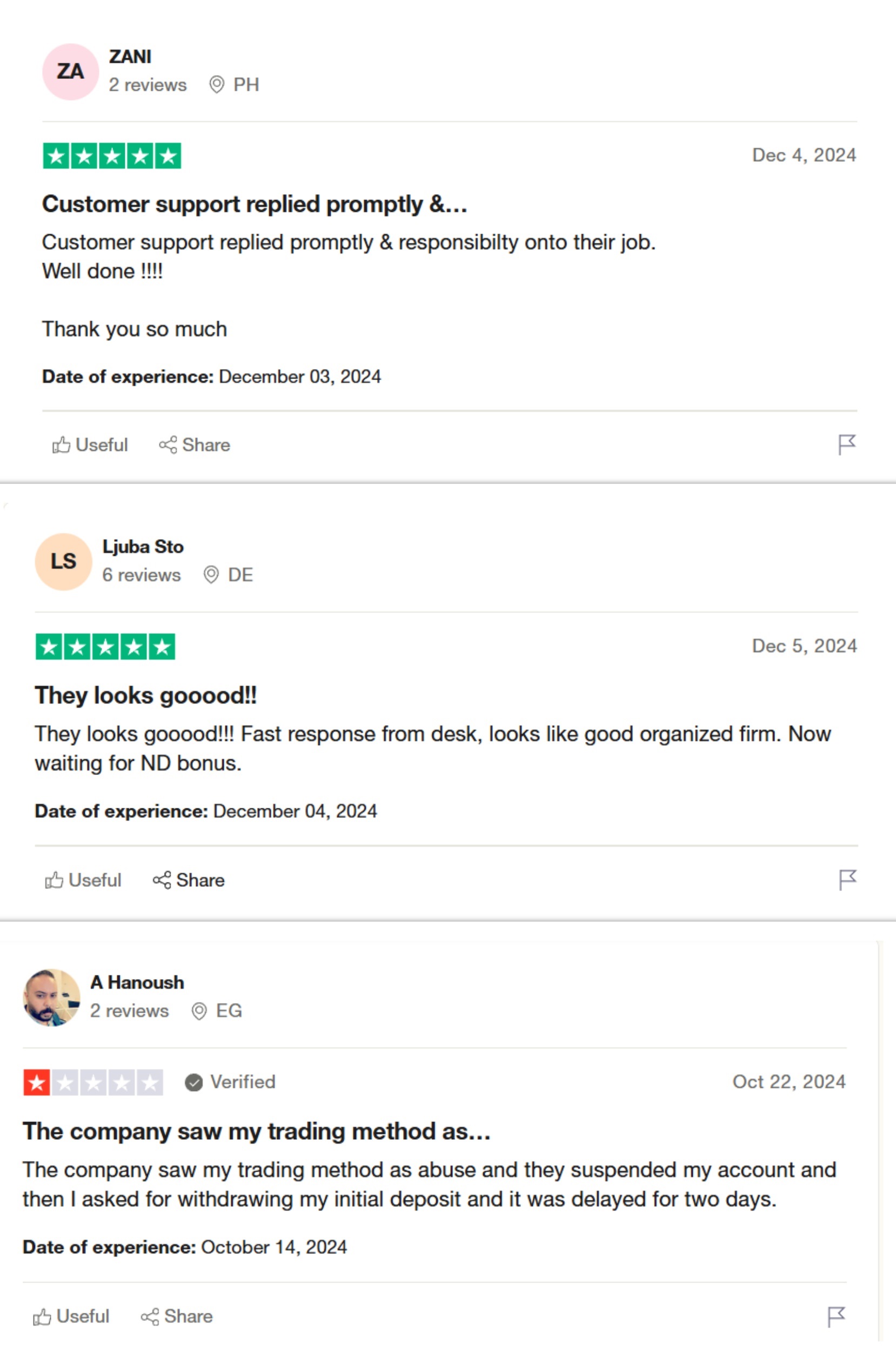

DB Investing has received a mix of reviews from its customers, with many praising the broker's fast customer support and reliable services. Customers have reported that the broker attends to inquiries promptly, and they appreciate the bonus promotions offered. Some users feel that DB Investing is a trustworthy and reliable platform, making it a good choice for those seeking efficient trading and support.

However, there are some negative reviews regarding withdrawal issues. One user shared that after opening an account and trading, their withdrawal request was not processed, and the company cited a violation of terms and conditions. This review raises concerns about potential difficulties in accessing funds, advising caution when dealing with DB Investing due to inconsistent withdrawal processes and unclear terms.

DB Investing Spreads, Fees, and Commissions

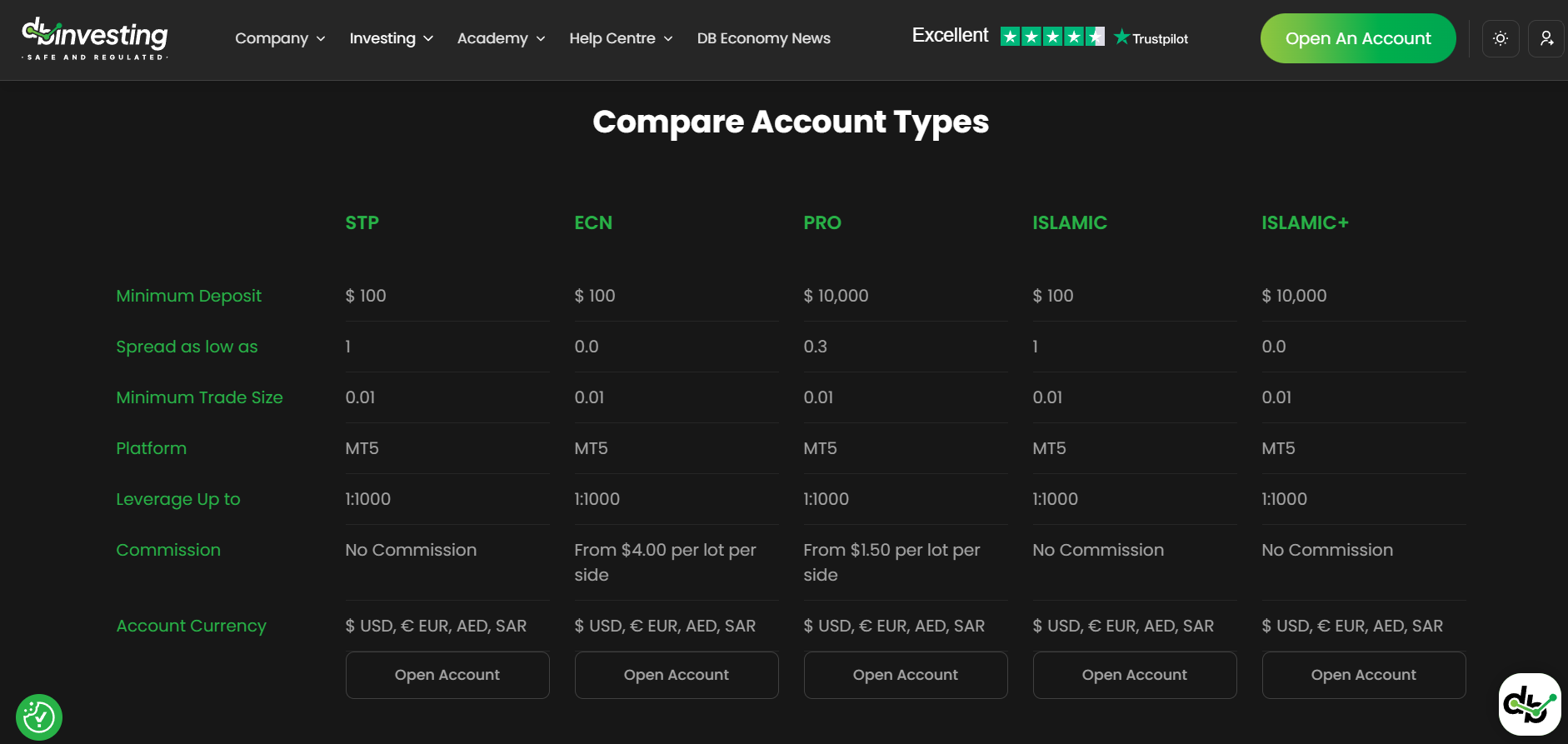

DB Investing offers competitive spreads, fees, and commission structures tailored to various account types. The STP and Islamic accounts feature spreads starting at 1 pip, with no commissions, making them ideal for traders seeking cost-effective options. The ECN and Pro accounts, on the other hand, provide tighter spreads starting from 0.0 and 0.3 pips respectively, but charge commissions as low as $4 and $1.50 per lot per side, catering to professionals prioritizing lower spreads.

All account types on DB Investing operate on the MT5 platform with a leverage of up to 1:1000, offering traders flexibility and advanced tools for trading. Minimum deposits for STP, ECN, and Islamic accounts start at $100, while Pro and Islamic+ accounts require $10,000, catering to different investment capacities. This range ensures traders of varying levels can access accounts aligned with their financial goals and trading styles.

For those following Sharia-compliant principles, DB Investing provides Islamic and Islamic+ accounts with no commissions and spreads starting at 1 pip or 0.0 pips respectively. These accounts combine religious compliance with modern trading capabilities, ensuring inclusivity for all traders.

Account Types

DB Investing offers various account types tailored to diverse trading needs, providing flexibility and competitive features. These accounts include STP, ECN, PRO, Islamic, and Islamic+ options, each designed to suit specific preferences and trading strategies.

STP Account

The STP account requires a minimum deposit of $100, offers spreads as low as 1 pip, and comes with no commission charges. It supports MT5 as the trading platform and provides leverage up to 1:1000, making it ideal for beginners or casual traders.

ECN Account

The ECN account also has a $100 minimum deposit but boasts spreads starting from 0.0. Commissions are charged at $4 per lot per side, with the same MT5 platform and leverage options, making it suitable for traders seeking tighter spreads.

Pro Account

The PRO account is designed for high-level traders, requiring a $10,000 deposit. Spreads begin at 0.3, with a reduced commission of $1.50 per lot per side. It supports advanced trading strategies using the MT5 platform and high leverage.

Islamic Account

The Islamic account offers Sharia-compliant trading with a $100 deposit and spreads starting at 1 pip. It charges no commissions and provides access to MT5, catering to traders seeking faith-based options.

Islamic+ Account

The Islamic+ account is tailored for advanced Islamic traders, requiring a $10,000 deposit. It provides spreads from 0.0, no commissions, and access to the MT5 platform, with leverage up to 1:1000 for professional-level trading.

How to Open Your Account

Opening an account with Gann Markets is simple and fast. Follow these five steps to register and start trading on one of the most user-friendly platforms.

Step 1: Register

Sign up for a free account and get instant access to a demo account with $10,000 in demo funds.

Step 2: Verify

Fill out a questionnaire about your trading experience and submit proof of ID and residence.

Step 3: Fund

Make a deposit using your preferred funding method to start trading with real money.

Step 4: Trade

Open and close trades on your own or auto-copy top traders to handle it for you.

Step 5: Manage

Monitor your account and adjust trades or withdraw profits as needed.

DB Investing Trading Platforms

DB Investing offers robust trading platforms to cater to different trading preferences and needs. The MetaTrader 5 (MT5) platform provides advanced charting tools, a wide range of technical indicators, and support for automated trading through Expert Advisors (EAs). It's designed to enhance trading efficiency and offer a comprehensive trading experience.

Additionally, DB Investing supports ZuluTrade, a social trading platform that allows users to follow and copy the trades of experienced traders. This feature is beneficial for beginners who want to learn from seasoned traders and for those who prefer a more hands-off approach to trading. These platforms ensure that traders of all levels can find tools and strategies that work best for them.

What Can You Trade on DB Investing

DB Investing offers a wide range of trading options, from Forex to stocks, commodities, and cryptocurrencies. Whether you're a beginner or an expert, there's something for everyone. Here's a quick look at the available assets.

Forex

DB Investing offers a platform for trading forex, which involves the exchange of currencies like the US Dollar, Euro, and Japanese Yen. Forex trading is popular due to its high liquidity and the ability to profit from currency price fluctuations. Investors can trade 24/5, taking advantage of global market movements.

Commodities

With DB Investing, traders can access a wide range of commodities such as oil, natural gas, and agricultural products like wheat and coffee. Commodities trading offers opportunities to profit from changes in the supply and demand of essential goods, making it a valuable asset class for portfolio diversification.

Cryptocurrencies

Cryptocurrency trading on DB Investing includes popular digital assets like Bitcoin, Ethereum, and Litecoin. With the growing interest in digital currencies, traders can take advantage of market volatility and invest in cryptocurrencies, which are accessible 24/7 on the platform.

Stocks

DB Investing provides a way to trade stocks of major companies listed on global exchanges. Investors can buy and sell shares of companies across different industries, allowing them to participate in the growth of some of the world’s leading businesses. Stock trading on DB Investing is ideal for both beginners and experienced investors.

Metals

Investors can trade precious metals like gold, silver, and platinum on DB Investing. Metals are often seen as safe-haven assets, making them a popular choice during uncertain market conditions. Trading metals allows investors to hedge against inflation and currency devaluation.

ETFs

DB Investing also offers trading in Exchange-Traded Funds (ETFs), which are investment funds that track the performance of indices, sectors, or commodities. ETFs provide a cost-effective way for traders to diversify their portfolios and gain exposure to a wide range of assets in one investment.

DB Investing Customer Support

DB Investing offers a variety of customer support options to ensure you receive timely and efficient assistance. You can reach their support team via live chat, which provides instant responses to your queries, making it easy to resolve issues quickly. This real-time communication ensures that you have help when you need it the most, boosting customer satisfaction.

For more flexibility, DB Investing is also available on popular messaging platforms such as WhatsApp, Facebook, and Telegram. These platforms allow you to get in touch with customer support at any time and from anywhere, making it convenient for you to receive help on the go. This multi-channel approach ensures that you can choose the platform that best fits your communication preferences.

If you prefer to leave detailed feedback or have non-urgent questions, you can use their email form. This option is ideal for issues that may require a more thorough explanation or for when you don't need an immediate response. By providing this variety of support channels, DB Investing ensures that every customer can find the most convenient method to connect with their team and receive the assistance they need.

Advantages and Disadvantages of DB Investing Customer Support

Withdrawal Options and Fees

DB Investing provides traders with convenient withdrawal options, ensuring efficient access to funds. With trusted methods like Perfect Money, Jeton, and Fasapay, users can transact in multiple currencies, including EUR, USD, and GBP. The minimum withdrawal amount is $100, with no additional fees, and transactions are processed instantly.

The Perfect Money withdrawal option caters to traders preferring simplicity and reliability. Similarly, Jeton offers a digital wallet solution for seamless fund transfers, while Fasapay provides a secure and fast payment alternative for global users. These options ensure flexibility and ease for traders worldwide.

With no hidden fees and instant processing, DB Investing sets a high standard for withdrawal services. This efficient approach helps traders focus on their investments without worrying about delays or unexpected costs.

DB Investing Vs Other Brokers

#1. DB Investing vs XM

DB Investing and XM are both popular brokers with a range of services, but they cater to slightly different types of traders. DB Investing provides access to OTC markets and offers a variety of trading instruments, including currencies, stocks, and cryptocurrencies, with leverage and social trading options. It is regulated by the Seychelles Financial Services Authority, and it uses a direct connection to liquidity providers, ensuring fast execution speeds. XM, on the other hand, operates in nearly 190 countries and offers over 1,000 instruments, including Forex, stocks, and commodities. It is licensed by major regulators like ASIC and CySEC, ensuring a high level of security for its clients. XM also offers high-speed order execution and a wide range of account types, including ultra-low spreads and leverage up to 1:1000 in certain regions.

Verdict: DB Investing suits advanced traders seeking fast execution, while XM offers a wider range of instruments and tools, making it a better choice for those seeking a more established platform.

#2. DB Investing vs RoboForex

DB Investing and RoboForex both offer diverse trading options but cater to different types of traders. DB Investing specializes in OTC markets with a focus on fast execution and direct access to liquidity providers. It provides trading in currencies, stocks, and cryptocurrencies, with a primary focus on CFDs and a leverage feature. RoboForex, on the other hand, offers a much broader range of over 12,000 financial instruments, including Forex, stocks, indices, and futures, with high leverage of up to 1:2000. Additionally, RoboForex provides features like CopyFx for passive income and instant fund withdrawals, which may appeal to a wider audience of both active traders and investors.

Verdict: DB Investing is best suited for advanced traders seeking fast execution, while RoboForex offers more trading instruments, higher leverage, and passive income opportunities, making it a better choice for those looking for versatility and variety in their trading options.

#3. DB Investing vs Exness

DB Investing and Exness both cater to traders seeking competitive conditions, but their offerings differ in terms of services and trading options. DB Investing focuses on fast execution with access to liquidity providers and offers a streamlined trading experience for more advanced traders. In contrast, Exness is a larger broker that serves over 700,000 clients, providing access to a wider variety of assets, including stocks, commodities, indices, and cryptocurrencies. Exness also boasts higher leverage options, starting at 1:unlimited for retail clients, and includes beginner-friendly accounts and social trading features.

Verdict: Exness is better suited for traders looking for a broader range of assets, high leverage, and more diverse account types. DB Investing is ideal for traders seeking faster execution and direct access to liquidity providers in a simpler setup.

Also Read: XM Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH DB INVESTING

Conclusion: DB Investing Review

DB Investing offers a comprehensive trading experience with its diverse range of account types and robust trading platforms like MetaTrader 5 and ZuluTrade. The broker’s competitive spreads, leverage options, and access to multiple financial markets make it appealing for both beginners and experienced traders. The inclusion of various payment methods such as Visa, Mastercard, bank transfers, e-wallets, and Transak for cryptocurrencies further adds to its versatility, ensuring that traders have flexible and secure options for funding their accounts.

However, DB Investing has some limitations, such as regional restrictions that exclude clients from the U.S., EU, UK, Canada, and countries with FATF restrictions. The prohibition of scalping and arbitrage trading may also limit some trading strategies. Despite these drawbacks, the platform's strengths in providing educational resources through its academy, responsive customer support, and a wide array of trading instruments like forex, stocks, cryptocurrencies, commodities, metals, and stock indices make it a solid choice for many traders. Overall, DB Investing stands out as a reliable and versatile broker in the online trading industry, catering to a wide range of trading needs and preferences.

Also Read: Gann Markets Review 2024 – Expert Trader Insights

DB Investing Review: FAQs

What trading platforms does DB Investing support?

DB Investing supports MetaTrader 5 (MT5) and ZuluTrade for diverse trading needs.

What types of accounts are available with DB Investing?

DB Investing offers STP, ECN, PRO, ISLAMIC, and demo accounts to suit different traders.

What are the minimum deposit requirements for DB Investing accounts?

Minimum deposits range from $100 for STP and ECN accounts to $10,000 for PRO accounts.

What are the trading instruments available with DB Investing?

DB Investing offers trading in forex, stocks, indices, futures, cryptocurrencies, commodities, and metals.

OPEN AN ACCOUNT NOW WITH DB INVESTING AND GET YOUR BONUS