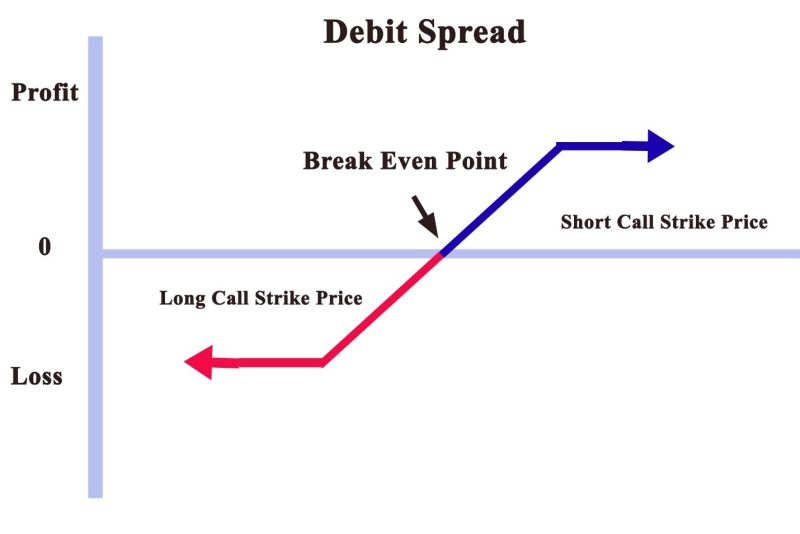

The options strategy that looks to accomplish profits by using the contrast between the payment for the high component of the spread minus the premium paid for the low component of the spread is called the debit spread.

Debit spread presumes two components calls or puts. Both trades are on the same asset and are exercised concurrently. The first is with a lower market price that the option holder sells. The second is with a higher market price that the option holder buys. If at maturity the debit spread is higher between the two market prices. Then the investor will make more profit.

For beginners, Debit Spreads are a great choice. Because the most they can lose is the premium paid for the contract.

Contents

- How is Debit Spread Created?

- Opposite Long and Short Positions

- Strike Price Stays Higher

- Large Strike Prices

- Types of Net Debit Spreads

- Conclusion

- FAQ

How is Debit Spread Created?

Debit spreads are produced with the help of a broker. He can make two orders on options contracts on the identical underlying security. By doing this you are taking a long position. To purchase contracts, you need to place a buy. This would invite a expense.

The trader could counterbalance some of the cost. By creating a short position, you assign a sell-to-open order on the same asset. This is on the presumption that the contracts you buy are more expensive in relation with what you sell. The trader will have to pay more for your long position. Then what will he get from a short position. The outcome on your trading account is debit.

Profit and Losses are Limited

The direction of the price of the underlying security doesn’t matter. When options expire worthless the same applies to the ones you have written. Your loss will be the difference between the funds you invested in buying and what you recuperate through selling.

The losses cannot go higher. That means there is no need to trade on margin when using debit spreads. Your profits are also limited. If the asset moves in the correct direction and you applicate to make a profit. In that case, the holder of the contracts you have written will be able to exercise too which will offset some of those profits.

The best situation is for the price of the underlying security to move reasonably at price. The contracts you own may rise in price and bring you profit. But the contracts you have written expire worthlessly. This means you make a profit on both aspects of the trade.

Opposite Long and Short Positions

The Debit Spread necessitates taking antagonistic short and long positions on options contracts. They are usually created by taking a long position and purchasing contracts that are in or at the money. Constructively decreasing the expense value of taking that position by writing out-of-the-money contracts and selling them.

It doesn’t matter where the strike price is corresponding to the underlying security. On condition that the options that you write are inexpensive than the ones you purchase.

The idea is to decrease your investment in specific options contracts and restrict losses that may happen. If the contracts you purchased expire out of the money and are worthless. Then the same the contracts you have written will be valueless. You will lose your initial investment, but you will recuperate some losses on the ones you sold.

Strike Price Stays Higher

We can take an example; where you create a debit spread. You buy calls of $40 on a stock that was trading at $42. And write calls with a strike price of $45. If the asset goes up to $45, you can utilize the contracts you possess to purchase the stock at $40 and sell it at $40. The strike price you have written is larger than the underlying stock, because it expires worthless.

If you anticipate changes in the underlying security, spreads like this are not a good option. Let’s take our example. When the cost of the stock keeps on going over $45. The profit would rise on your calls, but these same calls will bring you losses.

Large Strike Prices

The best example to illustrate the process is if you buy calls that are at or in the money. Then write inexpensive calls with a larger strike price.

If you were to buy 200 in the money calls, that are trading at $4, then your investment would be $800. But if you then write 200 calls, out of the money with a lower strike price and were trading at $200, then you would recover $200. In this way, you create a debit spread where your total cost is $200.

You can create debit spreads on puts by selling options with a lower strike price than the ones you purchase. The debit spread is created only when you sell or buy different options contracts on the same asset.

Types of Net Debit Spreads

You can use several debits spreads for trading options. The ones you chose will be defined by the situation on the market. The price you forecast and the trading strategies you are using.

Bear Put Spread

The bear put spread is a good choice for beginners that are forecasting that the price of a security will decrease to a small amount. The strategy is a method of diminishing the capital requirements of buying puts, and minimizing the negative effect that time decay has on the price of any options that you own.

Bear Call

It is not recommended for beginners, because it is an advanced strategy. It's used to return a profit when an asset goes down in price. The bear call spread is used when your forecast that an asset will decline in price. You want to use this to make a profit. It's a good substitute to the short call that will minimize losses if the asset rises in price.

You can cash in if the price of the underlying security stays in place. This makes it a good option if you are not sure that you have the right bearish outlook.

Reverse Iron Butterfly Spread

The reverse iron butterfly spread is a volatile options trading strategy. It is used when you expect the price of a security to make a sudden move, but you don’t know the direction. Advanced strategies with four transactions involving calls and puts.

There is a limit to the profits and losses are limited. That way you have an idea what is the capacity for profit and loss.

Butterfly Spread

It is a neutral trading strategy, that involves three transactions and is the most complicated. You are trying to profit from security, which price doesn't move. The profit is limited, as the loss.

It is created using calls when it's known as a call butterfly spread. It can use puts to create a put butterfly spread for essentially the same potential pay-offs.

Conclusion

Options traders have several advantages from debit spreads to get maximum profit. Using the debit spread option strategy is useful because you can downside risk, and make maximum gain in your trading options. Sometimes it is a bullish strategy.

The key takeaways are the profit potential and overall cost are balanced. Use a call debit spread and look for the underlying stock price to minimize maximum loss. Be careful and look for underlying asset in credit spread with same strike price and expiration date.

It enables traders to plan for possible losses and profit. They don't need margin trading. Can be used by investors who are not able to trade on margin. Offer a larger profit than other tactics. The main biggest minus is you are limited on the profit you can earn.

FAQ

What is a debit call spread?

A debit spread is an options strategy the enables the buying and selling of options with different strike prices. The effect is a net debit to the trading account. The amount of all options sold is lower than the sum of all options bought. That’s why the trader must put up money to begin the trade. The bigger the debit spread, the greater the starting money outflow the trader incurs on the transaction.

How do you profit from a debit spread?

This strategy is purchasing one call option and selling another at a higher strike price to help pay the cost. If the stock price moves higher, the spread profits. This is similar to the long call strategy. But to the point where the short call caps further gains.

What is a debit spread example?

A trader buys one June put option with a strike price of $10 for $4 and simultaneously sells one June put option with a strike price of $5 for $1. Therefore, he paid $3, or $300 for the trade.

What is a debit time spread?

The options strategy of buying and selling options of the same class and different strike prices at the same time is debit time spread.