DeltaStock Review

DeltaStock is a brokerage firm offering a variety of trading services belongs to primary category forex brokers and platforms for both beginner and experienced traders. Founded in 1998, it provides access to a wide range of financial instruments, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies.

The broker features its proprietary platform, Delta Trading, alongside the widely-used MetaTrader 4. These platforms support advanced trading tools, charting capabilities, and customization options to suit different trading strategies. Traders can also take advantage of a demo account to test their strategies risk-free.

In summary, DeltaStock offers a reliable, regulated platform with essential tools and educational resources for traders. It’s a solid option for those looking for a broad range of tradable assets and straightforward trading experience within a regulated European framework. This review will provide technical and business strategy for traders looking for live trading account.

What is DeltaStock?

DeltaStock is a European broker offering online trading for various assets, like forex, stocks, indices, commodities, and cryptocurrencies. It was founded in 1998 and provides traders with access to over 1,000 CFDs, with competitive spreads and no commission fees.

The company operates under the Financial Supervision Commission in Bulgaria, following European Union rules for financial security. This regulation provides a safe trading environment, especially for European clients looking for a reliable broker.

DeltaStock is a well-established, regulated broker with a range of assets and a focus on supporting traders with essential tools and educational content.

DeltaStock Regulation and Safety

DeltaStock is a European financial broker established in 1998, offering online trading services across various financial instruments, including forex, shares, indices, commodities, and cryptocurrencies. The company provides access to over 1,000 CFD instruments with zero commissions and tight spreads.

Operating under the regulation of the Financial Supervision Commission (FSC) in Bulgaria, DeltaStock adheres to the Markets in Financial Instruments Directive II (MiFID II), ensuring compliance with European Union financial regulations. With this, retail accounts losing money will less likely happen.

DeltaStock also provides educational resources, including free trading courses, market news, and analysis, to support traders in making informed decisions. Customer support is accessible via phone, email, and live chat, ensuring assistance is readily available.

DeltaStock Pros and Cons

Pros

- Regulated

- Diverse assets

- Advanced platforms

- Competitive fees

Cons

- Limited regulation

- Inactivity fees

- Region-specific focus

- Withdrawal fees

Benefits of Trading with DeltaStock

DeltaStock provides a wide selection of assets, including over 1,000 CFDs on forex, stocks, indices, commodities, and cryptocurrencies. This range allows traders to diversify their portfolios easily. The broker offers two robust trading platforms: the in-house Delta Trading and MetaTrader 5. Both platforms come with essential tools and customization options to support different trading strategies.

DeltaStock is regulated by the Financial Supervision Commission in Bulgaria, following EU standards. This adds a layer of security, making it a reliable choice for European traders. Lastly, DeltaStock provides customer support through phone, email, and live chat, ensuring quick assistance when needed and it's able consult with financial professionals to navigate complex financial markets. This accessible support enhances the trading experience, making it a good option for both new and experienced traders.

DeltaStock Customer Reviews

DeltaStock has received mixed feedback from users. Some traders appreciate the broker’s competitive spreads, variety of trading platform, including Delta Trading and MetaTrader 5, as well as the educational resources and responsive customer support.

However, some users have raised concerns about the broker's regulatory status and a limited range of tradable instruments. There have also been mentions of issues with the withdrawal process and a lack of transparency in fee structures. Potential clients are advised to research and weigh both positive and negative reviews before deciding to trade with DeltaStock.

Customers and retail clients experienced less web traffic data with the editorial and marketing teams as they have proper internet service providers. Regarding on effective investor compensation scheme, customers bank account and live trading accounts are safe and secured.

DeltaStock Spreads, Fees, and Commissions

DeltaStock offers competitive spreads, starting from 0.4 pips for EUR/USD pairs. These spreads can vary based on the trading platform and account type. For instance, on the MetaTrader 4 platform, standard trading spreads for EUR/USD begin at 0.9 pips, while commission-based trading offers spreads from 0.4 pips. On the Delta Trading platform, fixed spreads for EUR/USD start at 2 pips, with target spreads from 0.8 pips.

For share CFDs, DeltaStock charges a commission of 0.10% of the trade value, with a minimum of €2. Trade volumes exceeding €10,000 are subject to a reduced commission of 0.05% of the trade value. ETF CFDs incur a commission of 0.10% of the trade value, with a minimum of €1.

Deposits and withdrawals via credit or debit cards and ePay are subject to a 2% fee. Bank wire transfers within the European Economic Community (EEC) are charged a minimum of 1 BGN. An annual inactivity fee applies if no transactions or open positions exist for the previous calendar year.

Traders should review DeltaStock‘s fee schedule and terms to understand all applicable costs.

Account Types

DeltaStock provides several account types tailored to different trading needs and experience levels. These accounts are designed to offer traders flexibility, whether they are new to trading or have extensive experience in the market.

Delta Trading Account

The Delta Trading Account is designed for traders who prefer DeltaStock’s proprietary Delta Trading platform. It offers advanced tools, real-time data, and multiple order types, providing a more customized trading experience for intermediate and experienced traders.

MetaTrader 5 Account

This account type is for traders who want to use MetaTrader 5. It offers access to MetaTrader 5's extensive features, including automated trading and advanced charting tools, suitable for intermediate and advanced traders who value technical analysis.

Professional Account

The Professional Account is available for experienced traders who meet certain eligibility requirements. This account type provides higher leverage and more advanced trading conditions, catering to traders who understand and manage the risks associated with leveraged trading.

How to Open Your Account

Opening an account with DeltaStock is a straightforward process designed to accommodate both new and experienced traders. The following steps outline how to get started:

Step 1: Visit the DeltaStock Website

Navigate to the official DeltaStock website to begin the account opening process.

Step 2: Choose Account Type

Select the preferred account type that aligns with your trading needs, such as the Standard Account, Delta Trading Account, MetaTrader 5 Account, or Professional Account.

Step 3: Complete the Registration Form

Fill out the online registration form with personal details, including name, email address, and contact information. Ensure all information is accurate to facilitate a smooth verification process.

Step 4: Submit Identification Documents

Provide the necessary identification documents as required by regulatory standards. This typically includes a valid government-issued ID and proof of address.

Step 5: Fund Your Account

Once the account is approved, deposit funds using the available payment methods. DeltaStock offers various options to accommodate different preferences.

Step 6: Start Trading

After funding the account, access the chosen trading platform—Delta Trading or MetaTrader 5—to begin trading across a wide range of financial instruments.

By following these steps, traders can efficiently set up their DeltaStock accounts and commence trading activities.

DeltaStock Trading Platforms

DeltaStock provides two main trading platforms: Delta Trading and MetaTrader 5. These platforms cater to different trader preferences, offering a range of tools and features to enhance trading experiences.

The Delta Trading platform is proprietary to DeltaStock and available in desktop, web, and mobile versions. It offers customizable charts, real-time market data, and advanced trading tools, making it suitable for traders who prefer a specialized platform.

MetaTrader 5 is widely recognized in the trading industry for its robust features. With this platform, DeltaStock clients gain access to automated trading, advanced charting, and a wide selection of indicators, allowing traders to analyze the market with precision.

Both platforms support various order types and offer a user-friendly interface for traders at all levels. This flexibility makes DeltaStock appealing to both new and experienced traders looking for powerful trading options.

What Can You Trade on DeltaStock

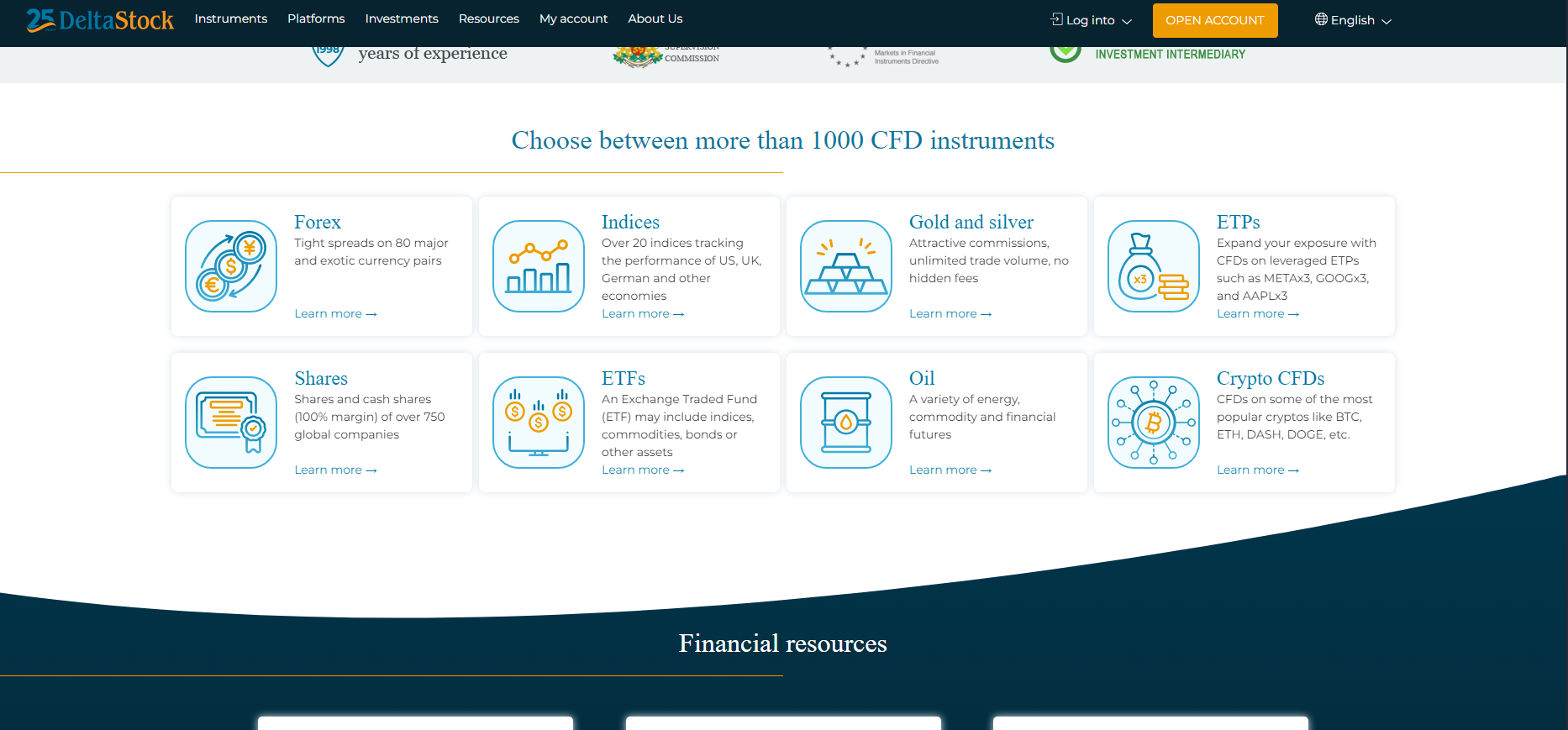

DeltaStock offers a diverse range of financial instruments, enabling traders to access multiple markets and diversify their portfolios. The following categories outline the available trading options:

Forex

Trade over 80 currency pairs, including major, minor, and exotic pairs, providing opportunities in the global forex trading market.

Shares

Access CFDs on more than 750 public companies, allowing traders to speculate on price movements without owning the underlying assets.

Indices

Engage in trading CFDs on major global indices, offering exposure to broader market trends and economic movements.

Commodities

Trade CFDs on commodities such as gold, silver, oil, and agricultural products, giving traders participation in the commodities market.

Exchange-Traded Products (ETPs)

Invest in CFDs on ETPs, including ETFs and leveraged ETPs, to access a variety of asset classes and investment strategies.

Cryptocurrencies

Trade CFDs on popular cryptocurrencies, enabling speculation on digital asset price movements without owning the actual cryptocurrencies.

With these diverse trading options, DeltaStock supports a wide range of trading preferences and strategies. CFDs involves considerable risks, CFDs are especially risky with 74-89% of retail accounts losing money due to high leverage and complexity.

DeltaStock Customer Support

DeltaStock offers customer support from Monday to Friday, 08:45 to 17:45 EET because marketing teams operate independently. Clients can reach the support team via phone at +359 2 811 50 50 or through email at frontoffice@deltastock.bg. The broker is also active on social media platforms, providing additional channels for communication.

The support team is known for its responsiveness and willingness to assist with various issues, including technical problems and account inquiries. This dedication to customer service enhances the overall trading experience for clients.

For additional assistance, DeltaStock provides a help center on their website. This resource offers information on common questions, applications, client portals, deposits and withdrawals, as well as guidance on using MetaTrader 5 and Delta Trading platforms.

Advantages and Disadvantages of DeltaStock Customer Support

Withdrawal Options and Fees

DeltaStock provides several withdrawal methods to accommodate different client preferences. Each option has its own processing times and associated fees.

Bank Wire Transfer

Clients can withdraw funds via bank wire transfers. Transfers within the European Economic Community (EEC) in BGN or EUR incur no fees. However, transfers in other currencies or from banks outside the EEC may involve transfer fees, with a minimum of 1.00 BGN. Processing times typically range from one to two business days.

Credit/Debit Cards

Withdrawals to MasterCard, VISA, and Maestro cards are available. Funds deposited via credit or debit cards will be transferred back to the same card. Processing usually takes up to five business days. No fees or commissions are charged for withdrawals to credit or debit cards.

ePay

For clients registered with ePay.bg, withdrawals can be processed through this system. This method offers a convenient option for clients familiar with ePay services. No fees or commissions are charged for withdrawals via ePay.

Clients should ensure that all withdrawal requests comply with DeltaStock‘s policies and provide accurate information to facilitate smooth transactions.

DeltaStock Vs Other Brokers

#1. DeltaStock vs AvaTrade

DeltaStock and AvaTrade are both established brokers offering a range of trading instruments, including forex, commodities, and indices. DeltaStock, founded in 1998, operates under the regulation of the Financial Supervision Commission (FSC) in Bulgaria, adhering to MiFID II standards. It provides access to over 1,000 CFD instruments with zero commissions and tight spreads. The broker offers its proprietary Delta Trading platform alongside MetaTrader 5, catering to various trading preferences. AvaTrade, established in 2006, is regulated in multiple jurisdictions, including the Central Bank of Ireland and the Australian Securities and Investments Commission (ASIC). It offers a broader range of platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO. AvaTrade provides access to over 1,250 instruments, including forex, commodities, indices, stocks, and cryptocurrencies, with competitive spreads and no commissions on most trades.

Verdict: While both brokers offer comprehensive trading services, AvaTrade stands out due to its broader regulatory oversight and a wider selection of trading platform and instrument. This makes AvaTrade a more versatile choice for traders seeking diverse options and robust regulatory assurance.

#2. DeltaStock vs RoboForex

DeltaStock and RoboForex are both established brokers offering a range of trading instruments, including forex, commodities, and indices. DeltaStock, founded in 1998, operates under the regulation of the Financial Supervision Commission (FSC) in Bulgaria, adhering to MiFID II standards. It provides access to over 1,000 CFD instruments with zero commissions and tight spreads. The broker offers its proprietary Delta Trading platform alongside MetaTrader 5, catering to various trading preferences. RoboForex, established in 2009, is regulated by the International Financial Services Commission (IFSC) in Belize. It offers a broader range of platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary R StocksTrader. RoboForex provides access to over 12,000 instruments, including forex, commodities, indices, stocks, and cryptocurrencies, with competitive spreads and no commissions on most trades.

Verdict: While both brokers offer comprehensive trading services, RoboForex stands out due to its broader range of trading platforms and instruments. This makes RoboForex a more versatile choice for traders seeking diverse options and robust regulatory assurance.

#3. DeltaStock vs Exness

DeltaStock and Exness are both established brokers offering a range of trading instruments, including forex, commodities, and indices. DeltaStock, founded in 1998, operates under the regulation of the Financial Supervision Commission (FSC) in Bulgaria, adhering to MiFID II standards. It provides access to over 1,000 CFD instruments with zero commissions and tight spreads. The broker offers its proprietary Delta Trading platform alongside MetaTrader 5, catering to various trading preferences. Exness, established in 2008, is regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). It offers a broader range of platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary Exness Terminal. Exness provides access to over 100 currency pairs, as well as commodities, indices, and cryptocurrencies, with competitive spreads and no commissions on most trades.

Verdict: While both brokers offer comprehensive trading services, Exness stands out due to its broader regulatory oversight and a wider selection of trading platform and instrument. This makes Exness a more versatile choice for traders seeking diverse options and robust regulatory assurance.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH DELTASTOCK

Conclusion: DeltaStock Review

DeltaStock is a reliable European broker offering diverse trading options for forex, stocks, indices, commodities, and cryptocurrencies. With over 1,000 CFDs available and competitive spreads, it provides a solid choice for traders looking for variety and affordability. To provide a financial insights about stock trading and other tradeable assets, traders must trade and spend responsibly as Cryptocurrencies and options exhibit extreme volatility, while futures can also lead to significant losses.

The broker’s two main platforms—Delta Trading and MetaTrader 5—cater to different trading needs with customizable tools and advanced features. This versatility allows both beginners and experienced traders to tailor their trading approach. DeltaStock is regulated by the Financial Supervision Commission (FSC) in Bulgaria, ensuring it adheres to EU financial standards. While this may not be top-tier regulation, it does add a level of security for traders in Europe.

Customer support is readily available via multiple channels, making it easy for traders to get assistance when needed. Overall, DeltaStock is a reputable broker with essential tools, accessible support, and a secure trading environment, making it a worthwhile option for many traders.

DeltaStock Review: FAQs

Is DeltaStock regulated?

Yes, DeltaStock is regulated by the Financial Supervision Commission (FSC) in Bulgaria. It complies with the EU's MiFID II standards, ensuring a degree of security for European clients.

What platforms does DeltaStock offer?

DeltaStock provides two trading platform: Delta Trading, its proprietary platform, and MetaTrader 5. Both platforms offer advanced trading tools and customization options.

What assets can I trade on DeltaStock?

DeltaStock offers a range of assets, including forex, stocks, indices, commodities, and cryptocurrencies, with over 1,000 CFD instruments available for trading.

OPEN AN ACCOUNT NOW WITH DELTASTOCK AND GET YOUR BONUS