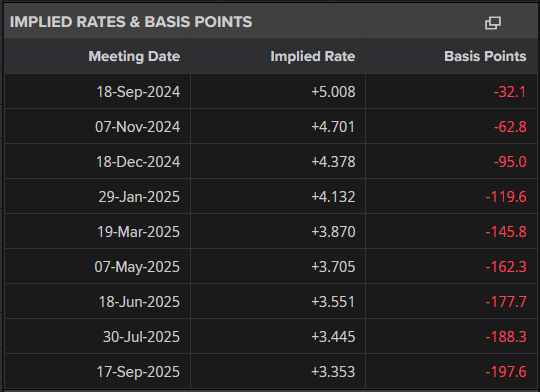

The annual Jackson Hole Symposium, themed “Reassessing the Effectiveness and Transmission of Monetary Policy,” is scheduled for August 22-24. The spotlight is on Fed Chair Jerome Powell’s keynote address on Friday. Traders are closely watching for hints that the Federal Reserve might begin cutting interest rates in September, with markets already pricing in nearly a 100 basis points reduction by the end of the year. Given there are only three FOMC meetings remaining this year, and considering the Fed's typical 25 basis point adjustments, a 50 basis point rate cut appears increasingly likely if market expectations hold.

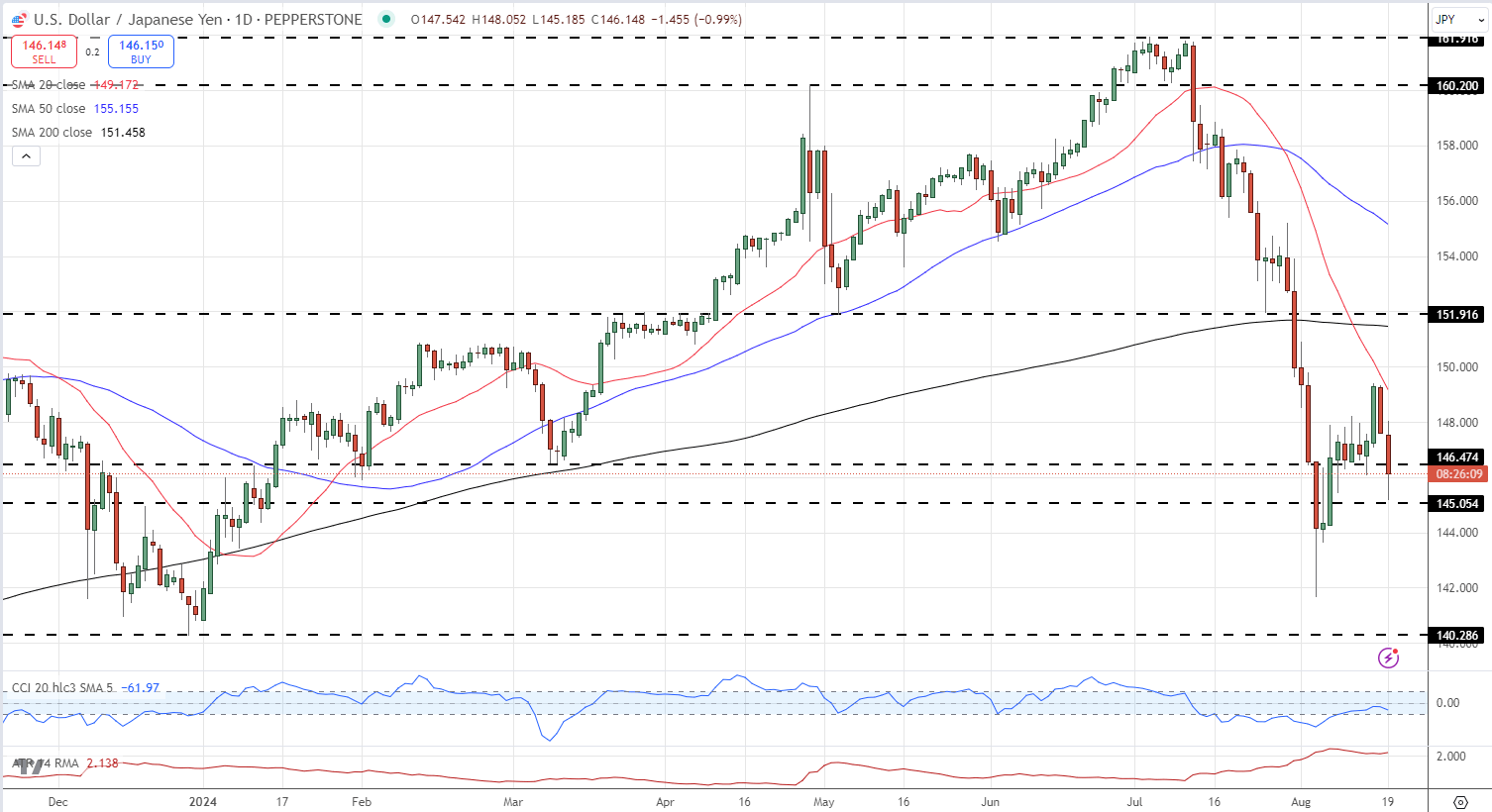

USD/JPY Experiences Significant Volatility

The USD/JPY pair has been highly volatile over the past month, initially losing 20 big figures in just three weeks following the Bank of Japan's second rate hike this year. The pair then saw a sharp rally, gaining nearly 10 big figures on renewed US dollar strength, only to drop again last Friday and today due to a weakening dollar. The next resistance zone for USD/JPY lies between 151.45 (the 200-day simple moving average) and just below 152.00, a former resistance level now turned support. If selling pressure resumes, the 140.28 level could come back into focus.

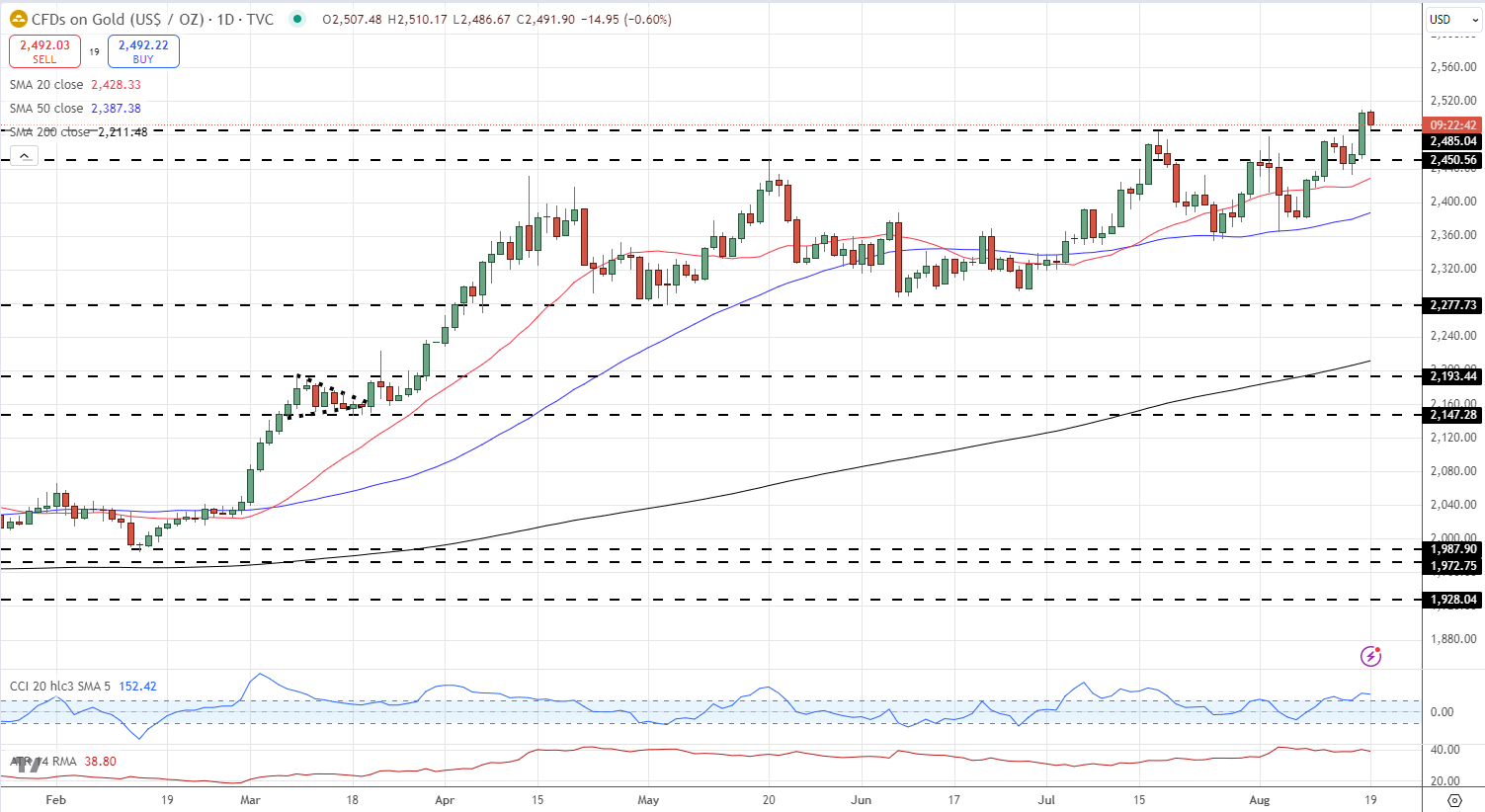

Gold Reaches New Highs Amid Market Uncertainty

Gold surged past a stubborn resistance area, hitting a fresh all-time high last Friday. The metal’s strength is underpinned by expectations of lower interest rates and growing concerns over potential escalation in the Middle East. Support levels are now seen at $2,485/oz. and $2,450/oz., while gold continues to explore new highs.

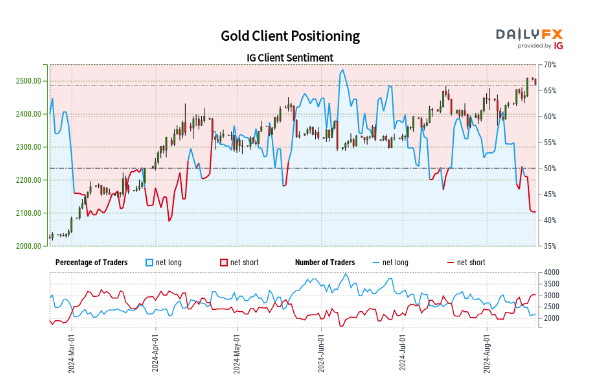

Retail Traders' Positioning Data

Data from retail traders reveals that 43.65% of traders are net-long, with the ratio of short to long traders standing at 1.29 to 1. The number of net-long traders has increased by 11.99% since yesterday but is 13.24% lower than last week. Meanwhile, the number of net-short traders has risen by 5.76% since yesterday and is 30.77% higher than last week.