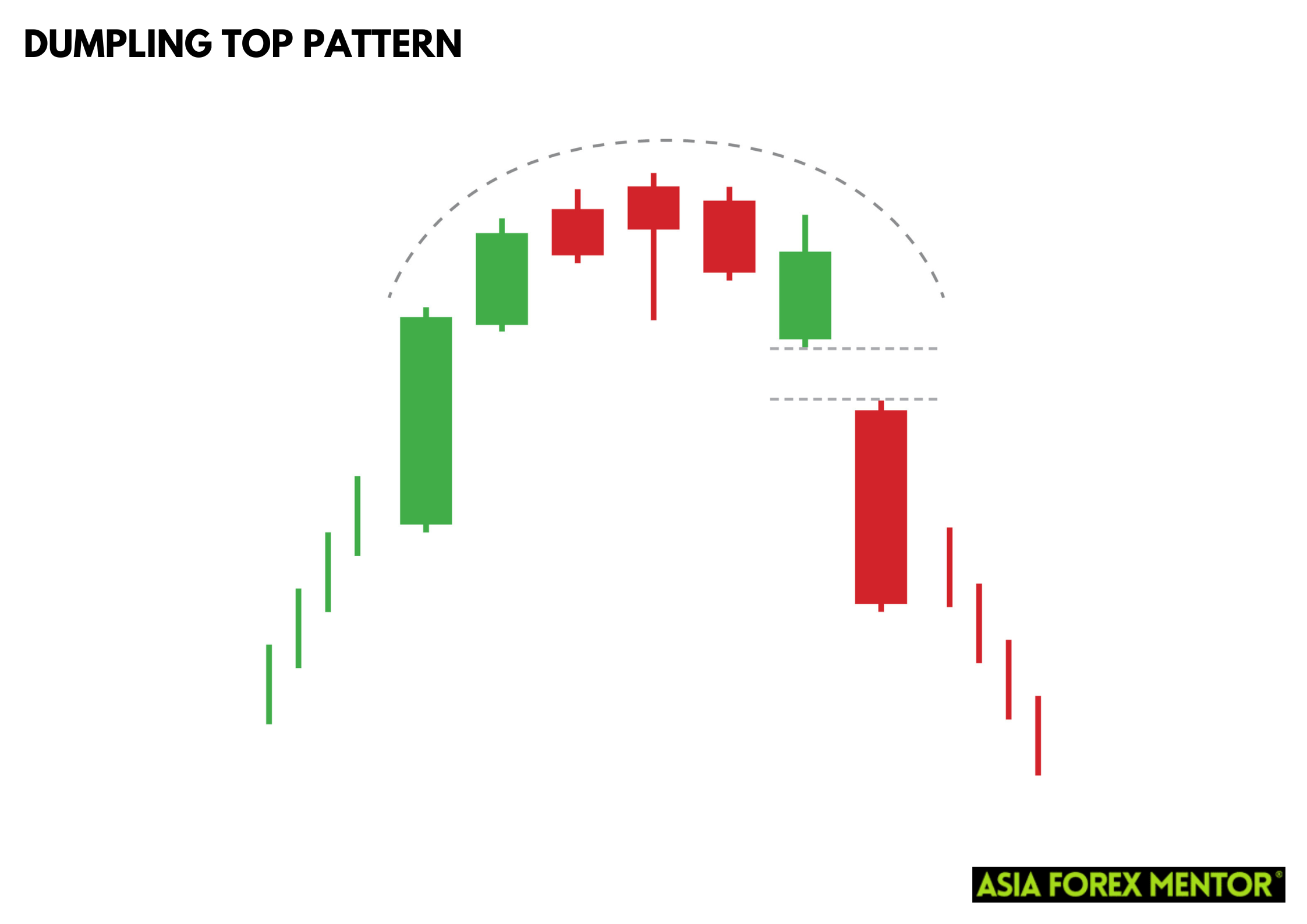

The dumpling top pattern is a unique candlestick pattern that traders use to predict potential bearish reversals in the market. Originating from Japanese candlesticks analysis, this pattern is visually reminiscent of a rounded top, similar to the western rounded bottom top. Often compared to the japanese fry pan bottom, the dumpling top signals the opposite market direction. Understanding and utilizing the dumpling top can help traders anticipate market shifts, providing opportunities to profit from bearish reversal trends.

To effectively trade the dumpling top pattern, traders need to recognize its formation and understand its implications. The pattern suggests a gradual shift from bullish to bearish sentiment, often marked by a bearish gap opening following the rounded top. This structure, akin to a frying pan, indicates weakening bullish momentum and the start of a bearish trend. By spotting these cues, traders can strategically position themselves to benefit from the resulting price action. Market gaps and several Japanese candlesticks forming a smooth, rounded top provide further confirmation for this reversal pattern.

Also Read: Mastering Japanese Candlestick Patterns

What is the Dumpling Top Pattern?

The dumpling top pattern occurs when the price action forms a rounded top, indicating a gradual transition from a bullish to a bearish market sentiment. This pattern starts with a series of small-bodied candlesticks that signify indecision in the market, followed by a bearish gap opening that confirms the reversal. The dumpling top structure is akin to a frying pan, where the first candlesticks create a smooth, rounded top, leading to a downward price action. This pattern suggests that the bullish momentum is weakening, and a bearish trend is about to begin.

As the market forms the dumpling top, traders should watch for several Japanese candlesticks forming a rounded top over time, similar to the western rounded bottom but in reverse. The key signal of this reversal pattern is the bearish gap opening, which typically follows the rounded top formation, marking the shift from bullish to bearish sentiment. Recognizing the dumpling top helps traders anticipate the onset of a bearish trend and take advantage of the impending price action. This pattern provides further confirmation of a weakening bullish trend, allowing traders to make more informed decisions and align their strategies with the current market conditions.

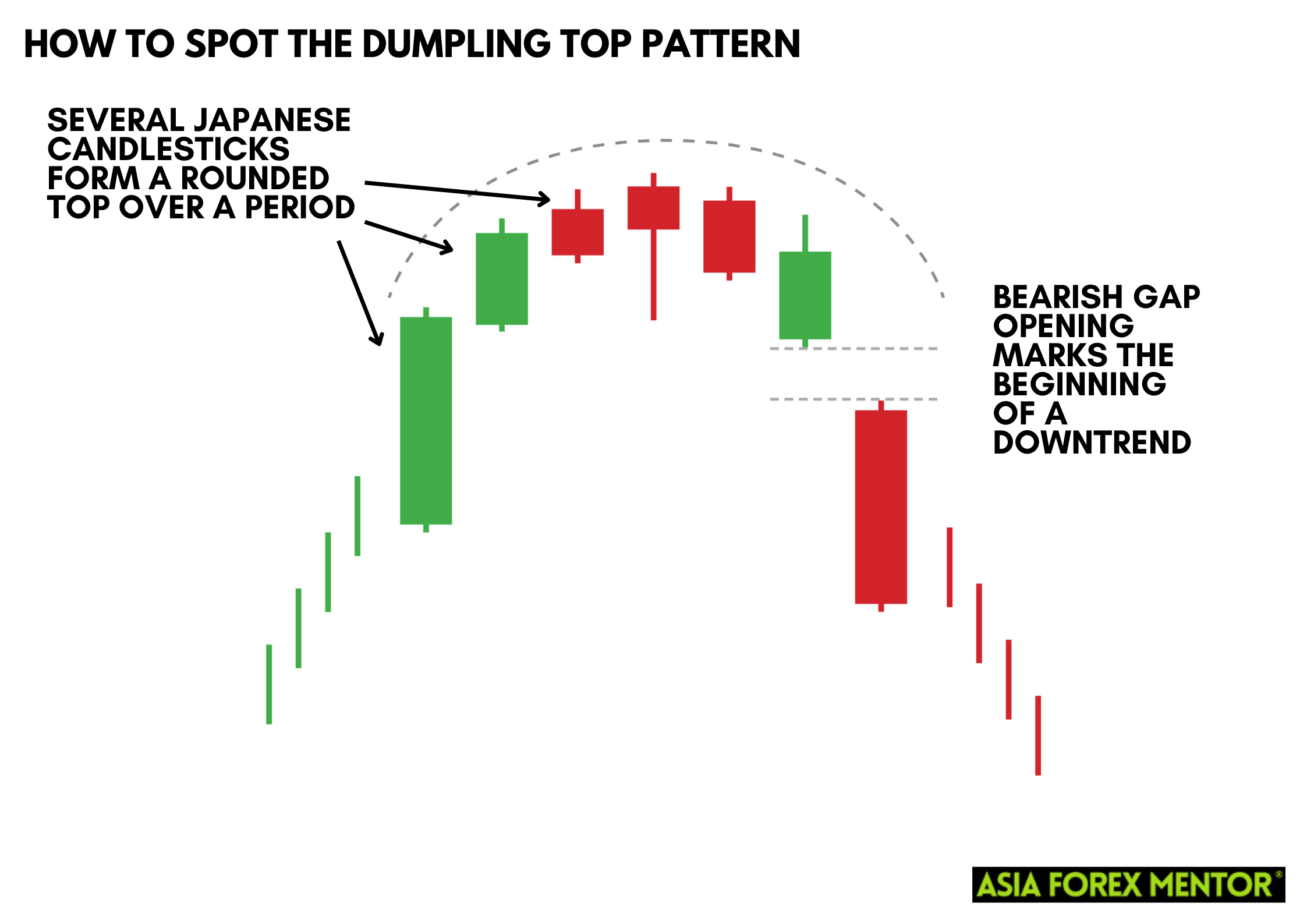

How to Spot the Dumpling Top Pattern

To identify the dumpling top pattern, traders should look for several japanese candlesticks forming a rounded top over a period. This formation is similar to a western rounded bottom, but in reverse. The pattern starts with small bodies indicating a lack of direction, and as the market forms this rounded shape, a sudden drop or a bearish gap opening marks the beginning of a downtrend. It’s crucial to differentiate this from the fry pan bottom, which signals a bullish reversal.

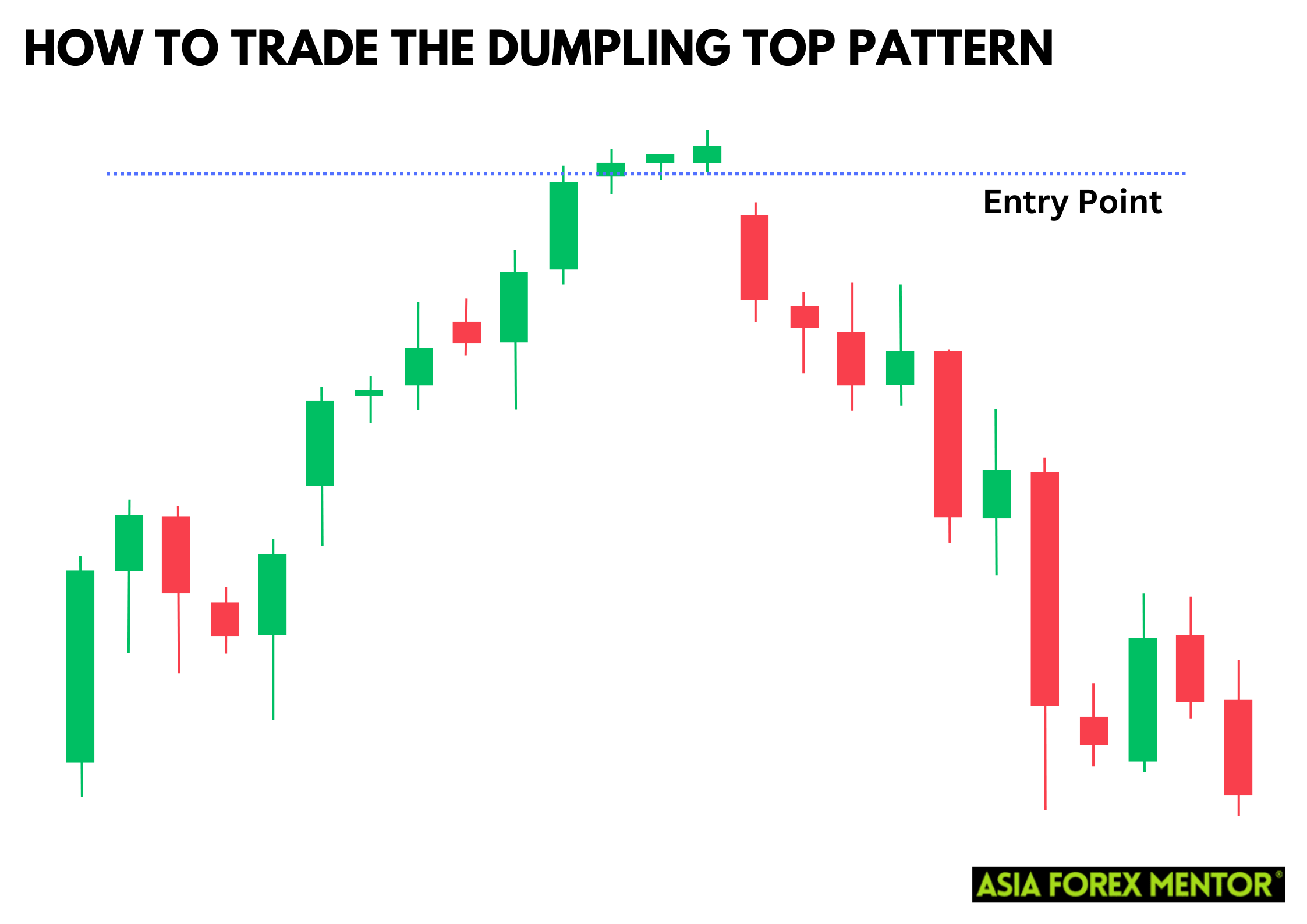

How to Trade the Dumpling Top Pattern

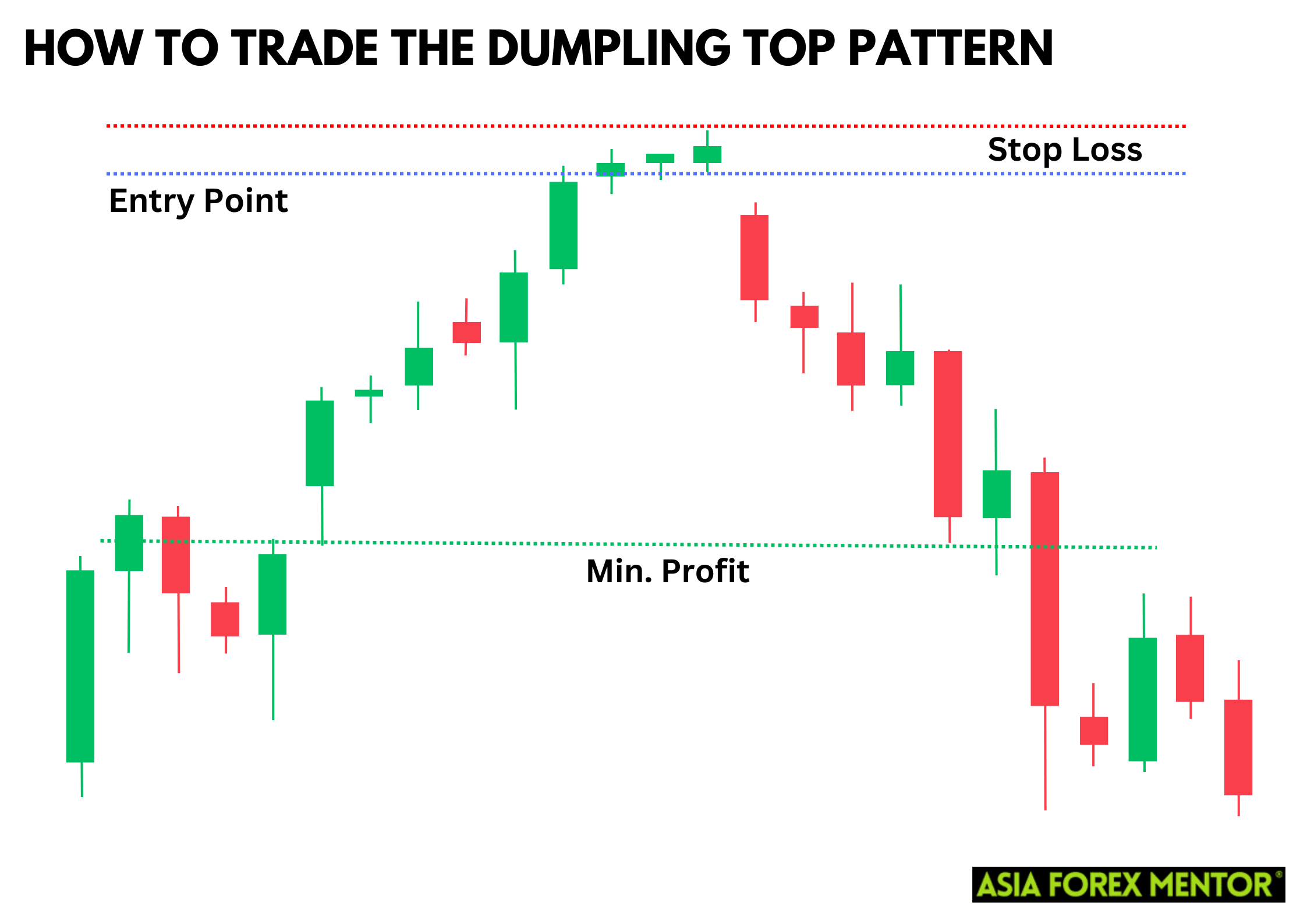

Entry Point

The entry point for trading the dumpling top pattern is typically right after the last candlestick closes and the bearish gap opening appears. This price action confirms the reversal pattern, allowing traders to enter a short position. Recognizing this critical moment helps traders capitalize on the dumpling top‘s indication of a market shift, enhancing their ability to profit from the ensuing bearish trend.

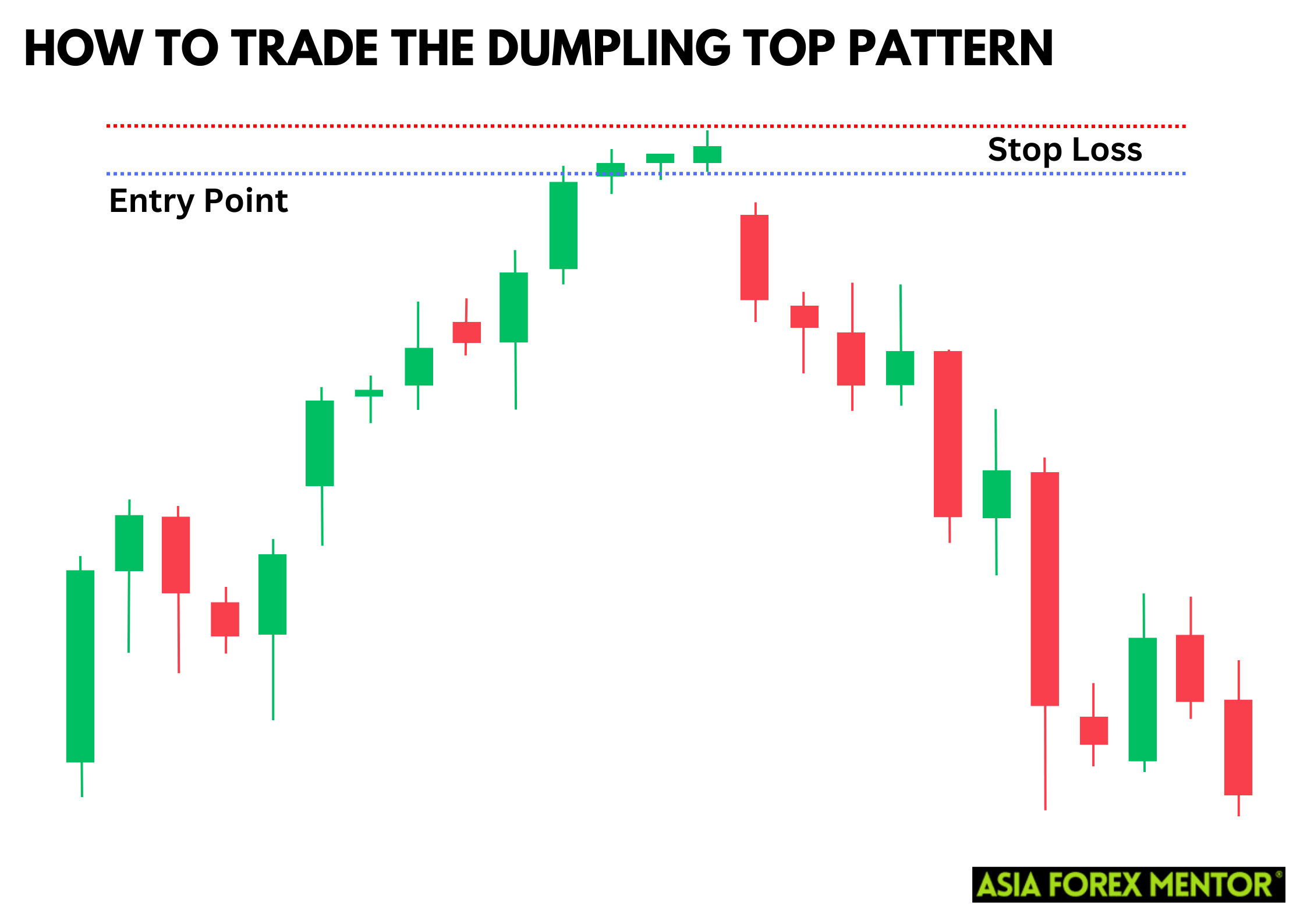

Stop Loss

Setting a stop loss above the highest point of the dumpling top ensures protection against false signals. This stop loss level helps manage risk if the pattern suggests a temporary pullback rather than a sustained downtrend.

Profit Target

The profit target can be set by measuring the height of the dumpling top structure and projecting it downwards from the entry point. This method provides a balanced approach to capturing potential gains while considering the current trend.

Pros and Cons of the Dumpling Top Pattern

Pros

- Clear bearish reversal signals.

- Easy to recognize rounded top.

- Predicts market sentiment shift early.

- Precise entry and stop-loss points.

- Versatile in various trading markets.

Cons

- Potential for misleading signals.

- Infrequent trading opportunities.

- Challenging for novice traders.

Indicators to Use to Confirm the Pattern

To enhance the reliability of the dumpling top pattern, traders can use indicators like the Relative Strength Index (RSI) and Moving Averages. The RSI is particularly useful as it helps identify overbought conditions, signaling that the market may be due for a reversal. When the RSI reaches high levels, it indicates that the bullish momentum is waning, supporting the potential formation of a dumpling top. This further confirmation of market sentiment can make traders more confident in predicting a bearish reversal.

Moving Averages, on the other hand, provide insights into changes in the current trend. By tracking the average price over a specific period, Moving Averages can show the gradual shift in market momentum that often accompanies the formation of a dumpling top. When the shorter-term Moving Average crosses below the longer-term Moving Average, it suggests a bearish trend is starting. Using these indicators in conjunction with the dumpling top pattern helps traders identify more reliable entry and exit points, thereby improving their trading strategies.

Conclusion

The dumpling top pattern is a valuable tool in a trader's arsenal, signaling potential bearish reversals with visual clarity. Recognizing this candlestick pattern and understanding its implications can lead to more informed trading decisions. By identifying the rounded top formation and the subsequent bearish gap opening, traders can anticipate shifts in market sentiment. Utilizing this pattern alongside indicators like the Relative Strength Index (RSI) and Moving Averages provides further confirmation and enhances the accuracy of predicting a bearish reversal, ultimately leading to better strategic trades.

Also Read: How to Trade the Bullish Stalled Candlestick Pattern

FAQs

What is the difference between a dumpling top and a fry pan bottom?

A dumpling top indicates a bearish reversal, while a fry pan bottom signals a bullish reversal.

Can the dumpling top pattern appear in any market?

Yes, this pattern can form in various markets, including stocks, forex, and commodities.

What is the key signal for entering a trade using the dumpling top pattern?

The key signal is the bearish gap opening after the rounded top formation, indicating a shift from bullish to bearish sentiment.