Position in Rating | Overall Rating | Trading Terminals |

50th  | 3.7 Overall Rating |  |

EBC Financial Group Review

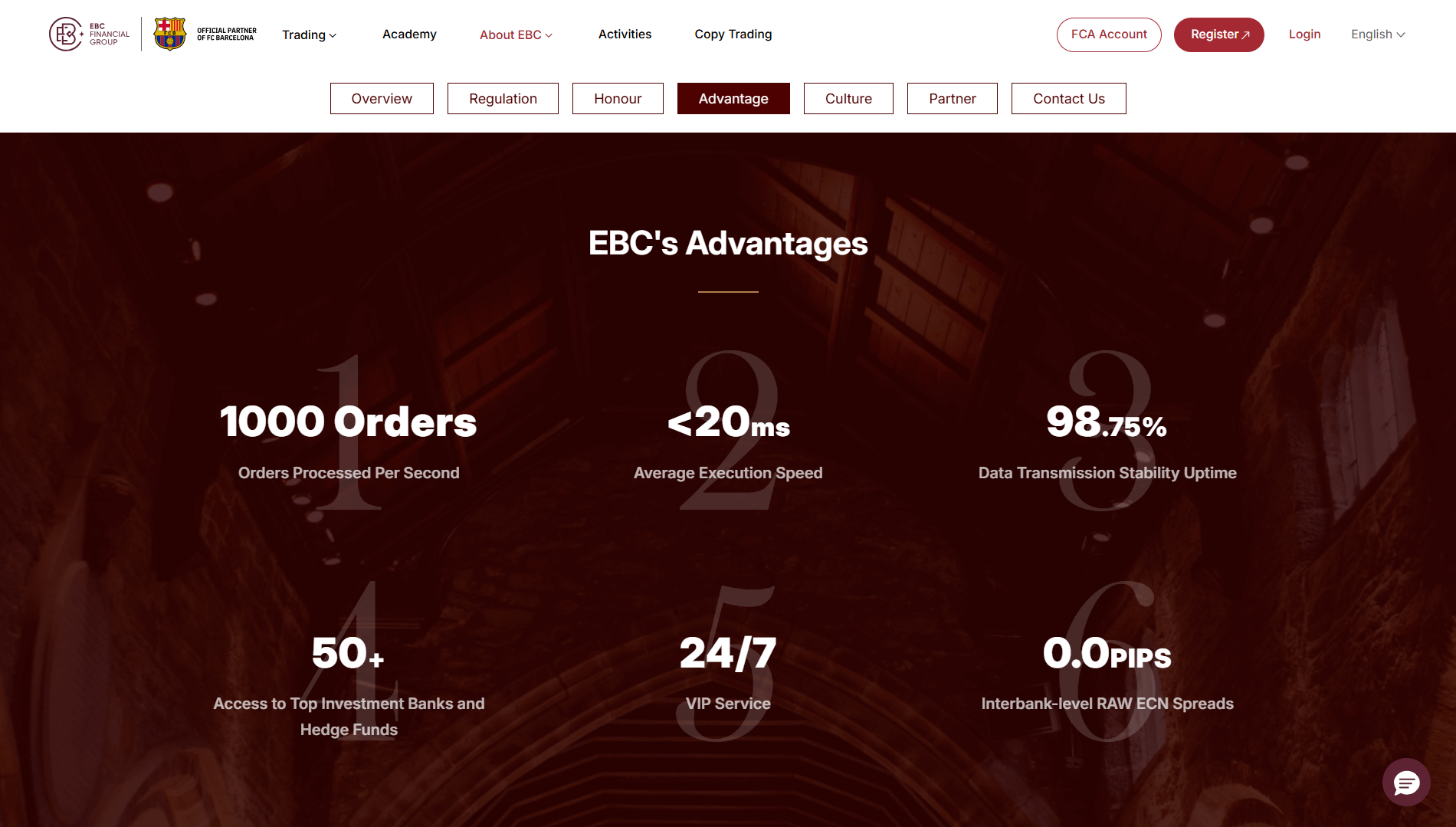

EBC Financial Group is an online trading broker offering access to over 200 global assets, including forex, U.S. stocks, indices, ETFs, cryptocurrencies, precious metals, and energies. With leverage up to 1:500 and a minimum deposit of just USD 50, it caters to traders of all levels. Traders can choose between two live accounts—Standard and Professional—both supported by popular platforms like MetaTrader 4 and MetaTrader 5.

The broker offers advanced trading tools such as TradingView integration, order flow tools, TC analysts’ insights, an AI-powered economic calendar, and an EA library. EBC connects clients to more than 25 institutional liquidity providers, offering favorable spreads (EUR from 0 and gold from 0.6), making it an appealing choice for traders seeking to minimize costs.

EBC Financial Group prioritizes client fund safety, offering corporate-level accounts at Barclays with AAA-rated protection, along with annual insurance coverage exceeding USD 30 million. As a member of the Financial Commission’s Compensation Fund, it provides up to €20,000 protection for eligible clients. The broker has earned industry recognition, including being named “World’s Best Broker” for three consecutive years, and offers a wide range of educational and analytical resources to support traders.

What is EBC Financial Group?

EBC Financial Group is a global online broker that provides traders and investors with access to international financial markets, including forex, CFDs on stocks, indices, ETFs, commodities, and cryptocurrencies. It operates under regulated entities across major jurisdictions such as the UK’s Financial Conduct Authority (FCA) and the Cayman Islands Monetary Authority (CIMA), offering credibility compared to many unregulated brokers.

The company offers two main live account types: the Standard account and the Professional account, both supported by MetaTrader 4 and MetaTrader 5 platforms. Traders benefit from competitive pricing, access to over 25 institutional liquidity providers, and advanced tools like TradingView, AI-powered calendars, and expert market insights to support decision making.

EBC places a strong emphasis on the safety and protection of client funds with measures such as AAA-rated protection, annual insurance coverage exceeding USD 30 million, and participation in the Financial Commission Compensation Fund, which offers up to €20,000 in compensation for eligible clients. The broker has earned industry recognition, including multiple awards for excellence, and provides a wide range of educational and analytical resources to help traders improve.

Benefits of Trading with EBC Financial Group

Trading with EBC Financial Group provides access to a wide range of global markets, including forex, U.S. stocks, indices, ETFs, commodities, and cryptocurrencies, all from a single platform. The broker supports both MetaTrader 4 and MetaTrader 5, allowing traders to use familiar tools while choosing between live accounts with flexible conditions. With leverage up to 1:500 and low spreads on major instruments, EBC helps reduce overall trading costs.

Another major benefit is the advanced trading tools available to clients, such as TradingView charting, order flow tools, an AI-powered economic calendar, and market insights. These resources are designed to help traders make better-informed decisions and offer various ways to analyze market trends. EBC also provides 24/7 online customer service for any questions or technical issues that may arise.

EBC Financial Group prioritizes safety and reliability, operating under regulation by respected authorities like the UK’s Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), and Cayman Islands Monetary Authority (CIMA). The broker maintains segregated client funds with reputable banks and offers additional professional insurance and compensation schemes, providing traders with greater peace of mind regarding their funds.

EBC Financial Group Regulation and Safety

EBC Financial Group operates under multiple global financial licences, meaning it follows formal oversight and compliance standards from recognised authorities around the world. Its key regulated entities include EBC Financial Group (UK) Ltd, authorised by the UK’s Financial Conduct Authority (FCA), EBC Financial Group (Australia) Pty Ltd regulated by the Australian Securities and Investments Commission (ASIC), and EBC Financial Group (Cayman) Ltd overseen by the Cayman Islands Monetary Authority (CIMA). These licences are meant to provide structured supervision and a framework where client funds can be handled with strict rules for transparency and disclosure.

In addition to formal licences, EBC makes efforts to keep client funds separate from company funds by holding them in accounts with reputable banks, including corporate banking relationships with Barclays, which can help protect money even in unusual market situations. The broker also purchases substantial professional insurance coverage each year to back up its operations and offers access to independent compensation protections, like the Financial Commission’s Compensation Fund that may offer up to €20,000 for eligible clients.

Despite these regulatory and safety measures, traders should be aware of regional restrictions and warnings in some countries where local authorities have flagged the company’s activities as not authorised, such as in Brazil where the securities regulator issued an alert about unlicensed operations. This highlights the importance of checking local rules before signing up.

EBC Financial Group Pros and Cons

Pros

- Wide range of assets

- Strong regulation (FCA, ASIC)

- Low spreads

- Advanced trading tools

- Multiple deposit options

Cons

- Limited crypto options

- Basic mobile app

- Mixed user reviews

- Limited account types

- Leverage restrictions

EBC Financial Group Customer Reviews

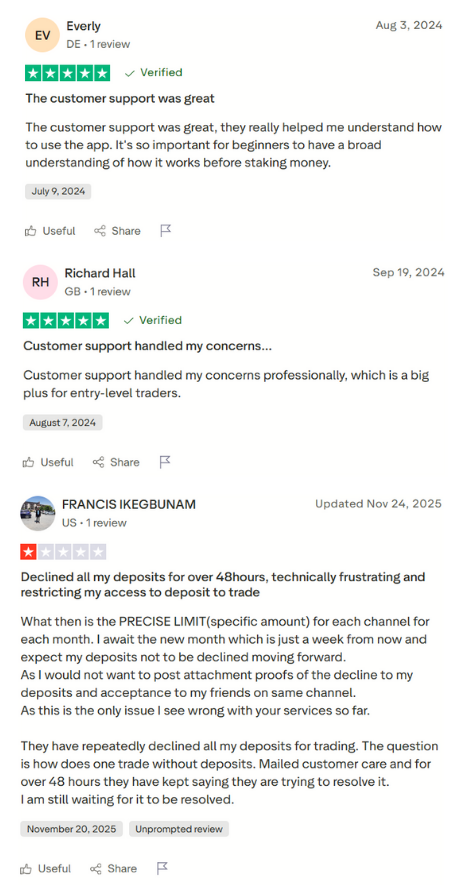

Customer feedback for EBC Financial Group is generally mixed but leans toward positive, with many traders praising the support team for being responsive and helpful in resolving issues. Several reviewers on Trustpilot highlight that the broker’s client service makes them feel valued and that fast execution speed and community copy trading signals are useful for earning profits.

Many users on independent forums and review sites report that deposits and withdrawals are usually processed smoothly, with stable execution and competitive spreads that make daily trading straightforward. Some traders say they feel confident in the platform’s fund security and overall trading environment, with a few noting that the community and personal account managers add value.

However, there are also negative reviews from a small number of traders who experienced issues like declined deposits or confusion over verification and payment processes, which they found frustrating. A handful of complaints also mention concerns about withdrawal experiences or practices on certain platforms, though responses from EBC indicate these may involve unofficial or fraudulent sites impersonating the broker.

Overall, EBC Financial Group tends to receive more positive than negative feedback, with many customers valuing its customer support and execution, but some still raise concerns around payment clarity and administrative procedures that prospective users should consider.

EBC Financial Group Spreads, Fees, and Commissions

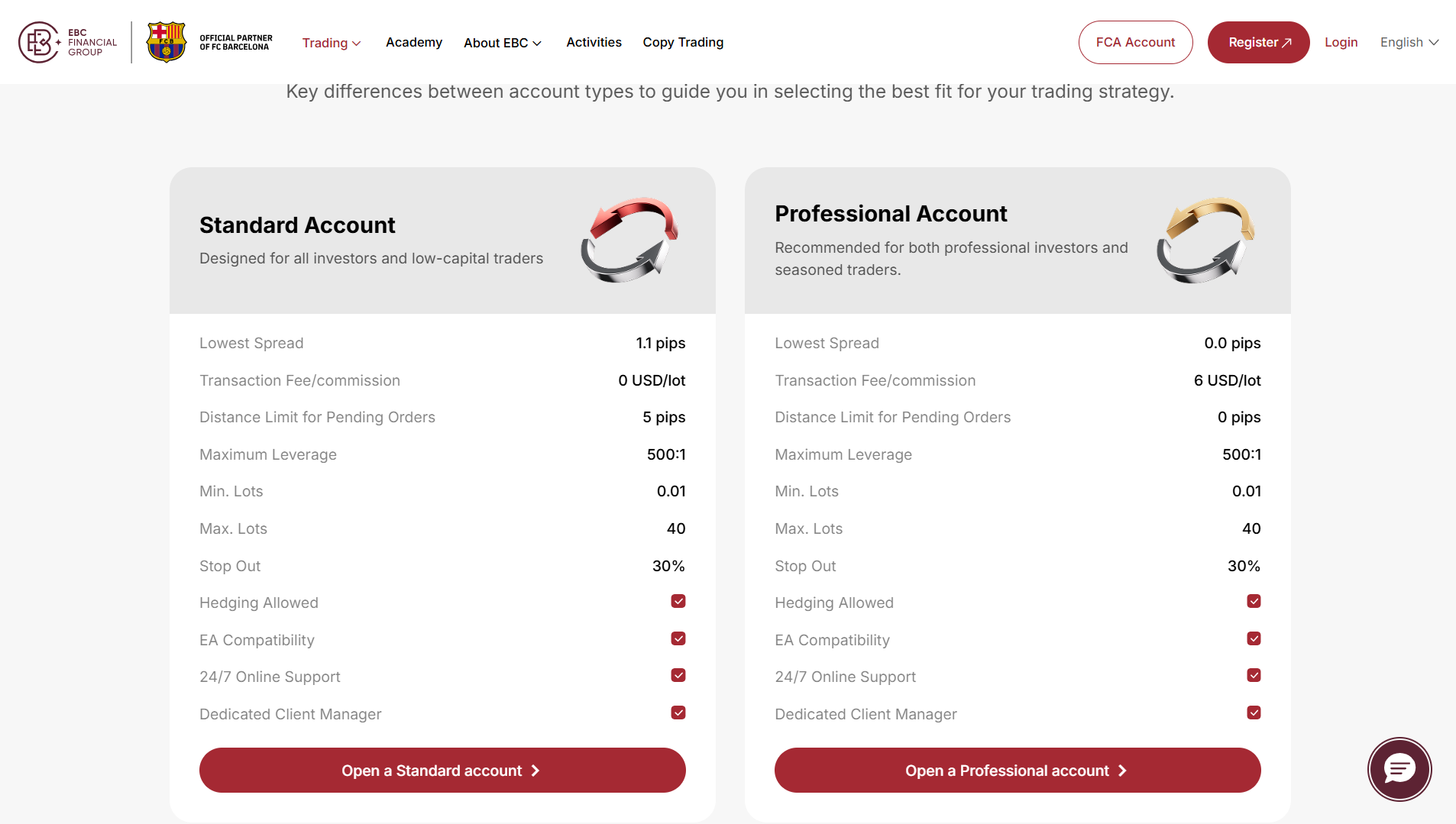

EBC Financial Group’s trading costs mainly come from spreads, which are the difference between the buy and sell price of an asset. On the Standard account, spreads typically start around 1.1 pips on major forex pairs with no extra trading commission, making it simple for many traders. On the Professional account, spreads can be as low as 0.0 pips but include a fixed $6 commission per lot traded, which may suit high‑volume or active traders.

The broker uses variable spreads, so costs can widen during volatile market conditions or lower liquidity times, which is common with most online brokers. EBC does not charge deposit or withdrawal fees, and there are no account inactivity or maintenance fees, helping keep overall trading costs lower. Overnight swap fees apply if positions are held past the daily rollover time, which can affect longer‑term trades.

Overall, EBC Financial Group’s pricing is considered competitive and transparent with clear structures on spreads and commission charges, though traders should always check real‑time spreads and fee details before trading.

Account Types

Standard Account

- Minimum deposit of USD 50

- Spreads starting from 1.1 pips

- No commission fees

- Leverage up to 1:500

- Suitable for new traders and intermediate traders

Professional Account

- Minimum deposit typically around USD 5,000

- Raw spreads from 0.0 pips

- Commission fee per lot (approximately USD 6)

- Leverage up to 1:500

- Designed for advanced traders with higher trading volumes

How to Open Your Account

- Go to the official EBC Financial Group website and click on the “Open an Account” button to begin the registration process.

Click the “Register” button to start creating your account. - Enter your email address, phone number, and set up a password to start the registration process.

- Check your email inbox for a verification code and input it on the website to confirm your email address.

- Fill in your full name, address, and financial background in the provided fields.

- Upload required identification documents such as a government-issued ID and proof of address for account verification.

- Select the account type you wish to open, either Standard or Professional.

- Complete the Know Your Customer (KYC) form to comply with regulatory requirements.

- Fund your account with the minimum deposit (usually USD 50 or more, depending on your account type).

- Download MetaTrader 4 or MetaTrader 5, log in with your account details, and begin trading.

EBC Financial Group Trading Platforms

EBC Financial Group gives traders access to two of the most widely used trading platforms in the online trading space, letting you trade global markets with familiar, reliable software. Both MetaTrader 4 and MetaTrader 5 are supported, and they work on desktop systems, mobile devices, and web browsers, helping you stay connected to markets wherever you are.

MetaTrader 4 is known for its easy‑to‑use interface, robust charting tools, and support for automated trading through Expert Advisors (EAs), making it a popular choice with both beginners and experienced forex traders. It offers a large library of technical indicators and lets you set up custom alerts and one‑click trading.

MetaTrader 5 builds on MT4 with more advanced features and broader market access, including enhanced analytics, more timeframes, and built‑in tools that make it suitable for trading a wider range of asset types like indices and commodities. MT5 also provides market depth information and flexible order types for detailed analysis and execution.

Both platforms are free to download and use with your EBC account, and they support automated trading, real‑time pricing, and portfolio management so you can trade with confidence. Mobile versions let you manage positions and view charts on the go, while desktop and web versions give you a full trading experience with powerful analytical tools.

What Can You Trade on EBC Financial Group

On EBC Financial Group, traders can access a broad selection of tradable assets that cover most major financial markets from one platform. The broker provides forex CFDs on a wide range of currency pairs, letting traders speculate on movements between global currencies. You can also trade precious metals like gold and silver, energies such as crude oil and natural gas, and indices that track major stock markets worldwide.

EBC has expanded its offering to include U.S. stock CFDs, giving traders exposure to shares of major U.S. companies, as well as a growing list of over 100 ETF CFDs linked to global exchange‑traded funds. These ETF products cover sector‑specific themes and broad market exposures without needing to buy the underlying funds directly.

In addition, the broker now offers Bitcoin CFDs and other digital asset CFDs for eligible traders, letting you trade major cryptocurrencies through contracts rather than owning the underlying coins. Overall, EBC’s multi‑asset lineup spans forex, metals, energies, indices, stocks, ETFs, and digital assets, helping traders diversify their strategies.

EBC Financial Group Customer Support

EBC Financial Group offers customer support team around the clock to help traders with questions, technical issues, and account needs. Their team can be reached through various channels including live chat, email, and phone, making it easier for traders to get help in real time or when issues arise. This level of support aims to give clients confidence that assistance is available 24/7 whenever they need it.

The support team is known for being responsive and helpful, especially for onboarding new users and resolving common trading platform questions. Many customers appreciate that EBC also integrates educational resources and market insights into its support offerings, helping traders improve their knowledge as part of the overall experience.

In addition to direct support, EBC Financial Group provides a range of guides, tutorials, and analytical tools on its website, designed to answer common questions and help traders navigate the platform. Whether you’re new to trading or an experienced investor, having reliable support can make accessing global markets through EBC easier and more straightforward.

EBC Financial Group Customer Support Advantages and Disadvantages

EBC Financial Group Withdrawal Options and Fees

EBC Financial Group offers several withdrawal options, including bank transfers, credit/debit cards, and e-wallets like Skrill and STICPAY, to suit traders worldwide. Depending on your region and the method chosen, you can expect withdrawals to be processed within 1-3 business days, with faster processing times for e-wallet options. Withdrawals are typically made to the same payment method used for deposits.

EBC does not charge any internal fees for withdrawals, which means you won’t pay extra to transfer your funds from your trading account. However, you should be aware that third-party services such as banks or payment providers may charge their own fees or conversion costs, which are outside of EBC’s control. It's important to confirm these fees with your provider.

While most EBC clients report smooth withdrawal request experiences, EBC has security measures that may require additional documentation for larger amounts or new accounts, which can cause minor delays. These measures are in place to ensure safety and prevent fraud, a standard process for regulated brokers.

EBC Financial Group Vs Other Brokers

#1 EBC Financial Group vs. AvaTrade

While AvaTrade is a well-established player in the market with a broad regulatory reach and a suite of trading platforms, EBC Financial Group offers favorable spreads and leverage options with a focus on more institutional-grade liquidity. EBC provides traders access to MetaTrader 4 and MetaTrader 5, and its transparent fee structure makes it an appealing option for those seeking cost-effective trading with no internal withdrawal fees.

Verdict: AvaTrade excels with its comprehensive platform offerings and global regulation, but for traders focused on tight spreads, institutional liquidity, and favorable leverage, EBC provides a more focused trading environment. For those who prioritize low trading costs and market access, EBC stands out as an efficient choice.

#2 EBC Financial Group vs. RoboForex

While RoboForex offers a wider range of account types and access to more than 12,000 instruments, EBC Financial Group emphasizes strong regulation with entities like the FCA and CIMA. RoboForex provides high leverage and a broader selection of trading assets, but EBC offers clearer pricing with access to institutional liquidity providers and an attractive spreads structure that suits traders looking for low-cost trading in a highly regulated environment.

Verdict: RoboForex may appeal to traders seeking diversified instruments and flexible leverage, while EBC offers a more secure trading environment with its regulated framework and competitive fees. For those prioritizing trust and transparent pricing, EBC is a more reliable choice.

#3 EBC Financial Group vs. Valetax

While Valetax stands out for offering high leverage of up to 1:2000 and a low minimum deposit of just $1, EBC Financial Group emphasizes fund protection, with strong regulatory oversight from the FCA and CIMA. Valetax offers agility with its high leverage and lower deposit requirements, but EBC excels with its institutional liquidity access and competitive spreads tailored for cost-conscious traders. EBC’s annual insurance coverage of over USD 30 million and compensation schemes provide an extra layer of security.

Verdict: Valetax may appeal to traders looking for maximum leverage and lower entry costs, but EBC offers a more secure and structured trading experience with competitive costs and highly regulated oversight. For traders seeking trust and protection, EBC stands as a more reliable option.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH EBC FINANCIAL GROUP

Conclusion: EBC Financial Group Review

EBC Financial Group offers a well-rounded trading experience with competitive spreads, high leverage, and a broad range of assets including forex, stocks, ETFs, and cryptocurrencies. It stands out for its strong regulatory framework, with licenses from respected authorities like the FCA and CIMA, ensuring a high level of trust and fund protection for traders. The broker’s use of MetaTrader 4 and MetaTrader 5 platforms, coupled with advanced trading tools like TradingView integration, provides an efficient environment for both new and experienced traders.

While it may not offer the same variety of instruments as some competitors, EBC Financial Group focuses on providing cost-effective trading with institutional-grade liquidity and clear fee structures. Its focus on security, including annual insurance coverage and participation in the Financial Commission’s Compensation Fund, adds an extra layer of protection for traders.

Overall, EBC Financial Group is a strong choice for traders seeking competitive pricing, regulatory security, and a transparent trading environment. It is especially appealing for those who prioritize reliable customer support, tight spreads, and regulated protection in their trading experience.

Also Read: MarketsVox Review 2024 – Expert Trader Insights

EBC Financial Group Review: FAQs

Is EBC Financial Group regulated?

Yes, EBC Financial Group operates under several regulated entities, including the UK’s Financial Conduct Authority (FCA) and the Cayman Islands Monetary Authority (CIMA). These regulations provide strong oversight, ensuring the broker meets industry standards for security and compliance, which adds a layer of trust and fund protection for traders.

What trading platforms does EBC Financial Group offer?

EBC offers the highly popular MetaTrader 4 and MetaTrader 5 platforms, which are available on desktop, web, and mobile devices. These platforms are known for their advanced charting, automation options via Expert Advisors (EAs), and comprehensive market analysis tools, making them suitable for both beginner and advanced traders.

What are the withdrawal options and fees with EBC Financial Group?

EBC Financial Group supports a variety of withdrawal methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and STICPAY. The broker does not charge internal fees for withdrawals, though third-party providers (such as banks or e-wallets) may apply their own fees. Withdrawal times typically range from 1-3 business days, depending on the method used.

OPEN AN ACCOUNT NOW WITH EBC FINANCIAL GROUP AND GET YOUR BONUS