Also Read: Equities vs Stocks

Contents

- What is the purpose of the enterprise value formula?

- What is the enterprise value equation?

- EV equation components:

- Effects of the EV formula’s components on the EV

- EV Examples

- EV Ratios

- EV Ratio Limitations

- Summary

What is the purpose of the enterprise value formula?

The enterprise value (EV) formula is used to calculate the total value of a company. EV is especially useful for entities that want to merge with or acquire another company. They need to know the total value of the company, so that they know how much money and financing is necessary to acquire it. In such cases, it represents the company's theoretical takeover price.

Unlike market capitalization, which is calculated by multiplying the outstanding common stock by the current stock price. It does not truly represent the company's equity.

EV, on the other hand, includes the company’s total outstanding debt, cash reserves, and cash equivalents, and minority interests. A company's net debt includes its corporate bonds, debt financing, long-term debt, and short-term debt used to support the company's operations.

The inclusion of the other balance sheet items gives buyers a more complete view of the cost of purchasing the company and the minimum cost of acquiring it.

What is the enterprise value equation?

There are two equations that can be used to do the enterprise value calculation. Its two forms are:

- EV = market capitalization + total debt – cash and cash equivalents

- EV = equity + market value of debt + minority interest – cash and cash equivalents

EV equation components:

● Equity

The equity value of a company’s fully diluted shares, options, warrants, and convertible securities. Note, in the EV equation, preferred stock is treated like debt.

Potential buyers must pay the market price of the outstanding shares if they want to acquire them. Note, the market value is the starting point for making an offer to acquire outstanding shares. It is often necessary to offer shareholders more than the market price if they want to induce them to sell their shares.

● Market Value of Debt

● Short-Term and Long-Term Debt

All short- and long-term debt must be calculated into the overall value of a company. When purchasing a company, the buyer must pay off all the firm’s net debt. If the market value of the debt is unknown, then its book value is used in the EV equation.

● Preferred Stock

Preferred stocks are treated like a hybrid security. They are treated like debt because their holders receive priority over common shareholders and are entitled to fixed payments.

● Minority (Non-Controlling) Interest

If a company owns more than 50% but has less than complete ownership, its interest in the other company is referred to as a minority interest. The company that has the minority interest is called the parent company, and the other company is referred to as its subsidiary.

A company with a minority interest in another firm may incorporate the subsidiary's financial statements into the parent company's balance sheet. In such cases, potential buyers must consider the impact of a subsidiary’s finances on the parent company's total enterprise value.

Moreover, when purchasing the parent company, the buyer must be willing to pay off all the outstanding debts of the subsidiary too. Thus, the EV of a parent company is a better estimate of the parent company's true value than the parent company’s equity market capitalization.

● Cash and Cash Equivalents

Cash and cash equivalents represent a company’s liquid assets. This category includes short-term investments, marketable securities, commercial paper, money market funds, and cash reserves. These assets can be quickly liquidated to pay a company’s outstanding debts.

Effects of the EV formula’s components on the EV

- Each component of the EV equation affects a company’s enterprise value. It will either increase or decrease its value.

- The market capitalization is the minimum amount of money that must be paid to purchase the company’s fully diluted shares. It is likely that a potential purchaser will have to pay more than that to purchase a company’s shares. The higher price per share induces shareholders to sell their assets to the buyer.

- Total debt increases the cost of acquisition because the buyer must pay off all outstanding corporate debt before taking possession of the company.

- Preferred stock is treated like debt in the EV equation, because it is a hybrid security. To buy preferred stock, the purchaser must take over the fixed payments owed to preferred stock owners. Thus, a company’s preferred stock increases its EV.

- Minority interest in a subsidiary that has been incorporated into the parent company’s financial statements may increase or decrease the parent company's EV. If the subsidiary has liquid assets of great value and low debt, then it will decrease the EV of the parent. However, if the subsidiary is not profitable and has a lot of debt, it will increase the EV of the parent company.

Remember, the finances associated with a minority interest that are incorporated into the parent company’s finances must be considered when calculating the net value of a company.

- Cash reserves and cash equivalents decrease a company’s EV. They can be used to pay off the company’s debt and/or offset its corporate liabilities.

Also Read: How to Short ETFs Funds

EV Examples

Now that you have an understanding of EV and how it is affected by changes in its component parts, let’s look at some examples.

● Examples 1:

Company A has a market capitalization (a.k.a. market cap) of US$100 million and no debt. Whereas, Company B has a market cap of US$150 million and US$80 million in debt.

In this scenario, Company A costs less than Company B. A’s true value is US$100 million compared to B's true value of US$230 million (US150 million + US$80 million = US$230 million).

● Example 2:

Company A has a market cap of US$10 million, a total debt of US$2 million, and cash and cash equivalents of US$1.5 million. Its EV is US$9.5 million (US$10 million + US$2 million – US$1.5 million = US$11.5 million).

EV Ratios

EV is often used in ratios to compare companies in the same industry. The ratios are intended to reflect the company’s value in relation to its ability to its operating income or revenue.

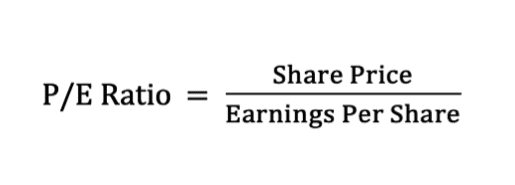

The ratios are more useful than price to earnings (P/E) ratios. When comparing companies with different capital structures in the same industry, it provides a less biased way of assessing them.

Furthermore, they are even more valuable when analyzing a company's capital structure. EV provides a more comprehensive alternative method of comparing different companies in the same market.

The most common EV ratios are:

- EV to EBITDA

- EV to EBIT

- EV to FCF

- EV to Sales

● EBITDA = Earnings Before Interest, Depreciation, Amortization

A company’s gross income before costs of generating the income are subtracted from it.

● EBIT = Earnings Before Interest

A company’s gross income before it makes its interest payments.

● FCF = Free Cash Flow

The money a company has to pay interests and dividends to its investors. Its value is determined by subtracting interest, non-cash expenses, differences in working capital, and capital expenditures from its earnings.

● Sales

The revenues made from selling a company’s goods and/or services.

EV Ratio Limitations

EV ratios can only be used to compare companies in the same industry. The amount of debt that a company must carry to operate to generate income varies from industry to industry. In capital intensive industries (e.g., oil gas), the corporate debt issued to fund operations and generate profit.

In contrast, in other industries, companies may carry little to no debt. To compare companies that maintain different debt loads or have capital intensive operations to those that carry very little debt skews your analysis and gives you an incorrect picture of their performance and potential profitability.

Summary

EV provides a holistic perspective of a company’s value to potential buyers. It can also tell potential investors and buyers how the company compares to others in its industry.

Overall, it is superior to looking at companies' market caps and EV ratios are more useful than P/E ratios.