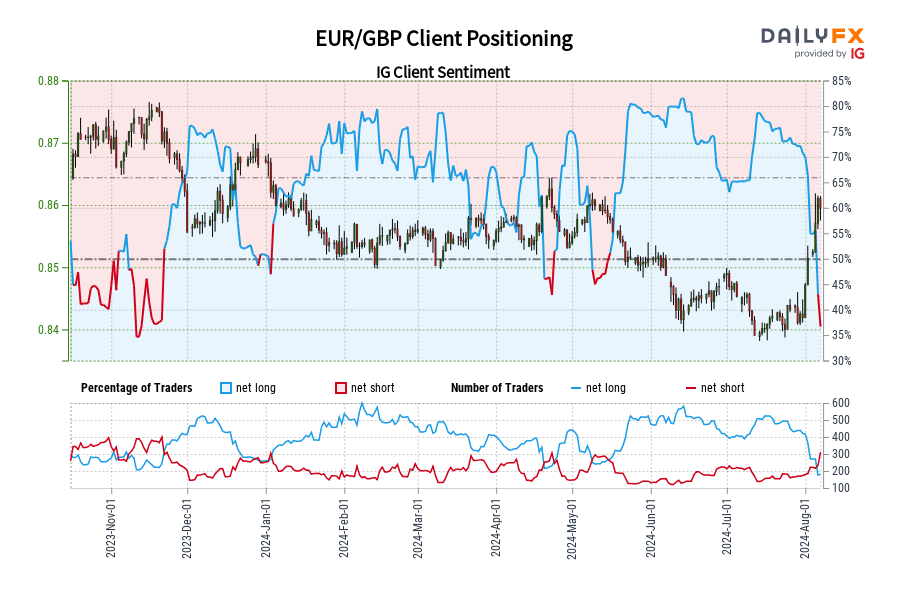

Retail trader data indicates that 34.41% of traders are net-long EUR/GBP, with the ratio of traders short to long at 1.91 to 1. This marks the least net-long position since November 11, when EUR/GBP traded near 0.87. The number of traders net-long is 13.27% lower than yesterday and 59.33% lower than last week, while the number of traders net-short has increased by 16.97% from yesterday and 84.09% from last week.

Implications of Net-Short Trader Sentiment

Analysts often adopt a contrarian perspective on crowd sentiment, and the fact that traders are net-short implies that EUR/GBP prices may continue to rise.

Traders are more net-short compared to both yesterday and last week. This combination of current sentiment and recent changes enhances a EUR/GBP-bullish contrarian trading bias.