EUR/USD Technical Analysis

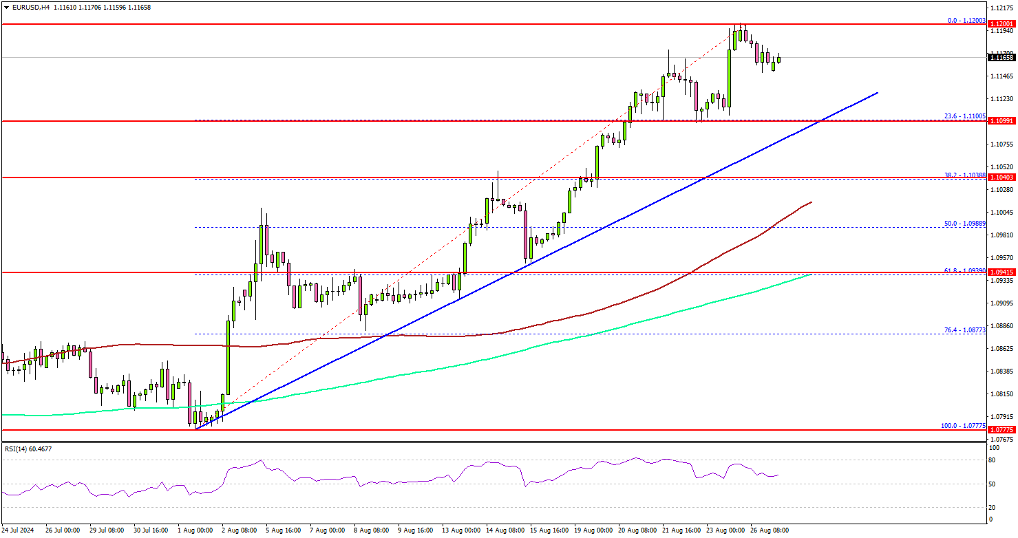

On the 4-hour chart, EUR/USD has established itself above the 1.1100 level, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour). The pair has also crossed the 1.1150 mark and tested the 1.1200 level.

Currently, the pair is consolidating its gains just below 1.1200. The immediate support is found near the 1.1120 level, which coincides with the 23.6% Fib retracement of the recent rise from the 1.0775 swing low to the 1.1200 high.

Additionally, a significant bullish trend line is forming, with support located at 1.1120 on the same chart. The next crucial support level is around 1.1040. If the pair breaks below 1.1040, it could trigger a more substantial decline.

Further support is expected near 1.0980, aligning with the 100 simple moving average (red, 4-hour). This area is also close to the 50% Fib retracement of the upward movement from 1.0775 to 1.1200. A drop below this point may push the pair towards the 1.0920 support level.

On the upside, EUR/USD could encounter resistance around the 1.1185 level. The primary resistance is near 1.1200. A decisive break above 1.1200 could pave the way for a move towards the 1.1250 level.