Exinity Review

Exinity, a multi-regulated broker, provides a trading environment designed to suit both active traders and passive investors. Catering to traders of all experience levels, Exinity distinguishes itself by offering a wide range of financial instruments and supporting diverse trading tools.

This Exinity review gives a comprehensive look at the broker's characteristics including its strengths and imperfections. It identifies common issues such as account options, deposit and withdrawal methods, and commission structures. The study aims to provide a fair perspective by combining professional analysis and reviews from actual traders. The purpose of this review is to help readers decide if Exinity is the best broker for their trading demands using this Exinity review.

What is Exinity?

Exinity is a trading platform under the Exinity Group, it provides services for both casual and professional traders. The company operates world wide, offering an online trading across the field of financial instruments, including forex, stocks, indices, commodities, cryptocurrencies, ETFs, and bonds. Exinity provides a flexible choice for traders with different investment goals because of its large range of resources.

It is known for its secure and low cost trading field, Exinity offers a different kind of account options depending on what's the traders prefer trading styles. Whether a beginner or an experienced trader, individuals can find an account that matches their needs. Exinity monitor their financial cycle by the authorities like the Financial Services Commission (FSC) of Mauritius which provides a good reputation and brings security to the traders.

This broker also assists traders with powerful trading systems and wide educational material supply. These training resources enable traders to improve their strategies. Exinity provides assistance to customers through email, live chat, and phone but availability may be very difficult for different time zones.

Exinity Regulation and Safety

Exinity makes sure a safe trading market by working under the control of several financial authorities. These rules require that the broker stick to strong client fund protection rules like separating client money from company funds and assuring open trading practices. Exinity also follows international guidelines for anti-money laundering (AML) rules and know-your-customer (KYC) policies, so it decreases the risk of fraud and building trust between customers.

Exinity's obedience to legal requirements shows its respect of security and honesty, so giving peace of mind to beginner and expert traders. Exinity promises that its customers may trade with trust knowing their money is well protected by putting these safety measures into effect. For traders, this strong rules and regulations promotes trust and provides a trustworthy environment.

With a goal on building strong relationships with customers, Exinity's priority goes over just its financial health. It also promises that traders can invest without thinking about the security of the service using trust in authorities' management. Plus, it gives amazing tools that give an enjoyable experience, especially to new traders wishing to enter the trading world.

Exinity Pros and Cons

Pros

- Multi-regulated broker

- Wide range of financial instruments

- Competitive spreads and fees

- User-friendly platforms

Cons

- Inactivity fees

- Mixed service reviews

- No U.S. clients

Benefits of Trading with Exinity

Exinity can offer access to different markets, including Forex, commodities, indices, and cryptocurrencies, so it has lots of options to choose according to what are the traders needs. The traders can determine which kind of benefits and resources they need using the information that this review given.

Plus, Exinity provides different account types to fit different trading techniques and hard levels, making it easier to find the best choice for every trader's needs. TExinity Mobile App Users with Exinity Trader accounts can also enter the MetaQuotes MT4 and MT5 platforms. This makes Exinity a best choice for anyone who wants to trade in a most comfortable way.

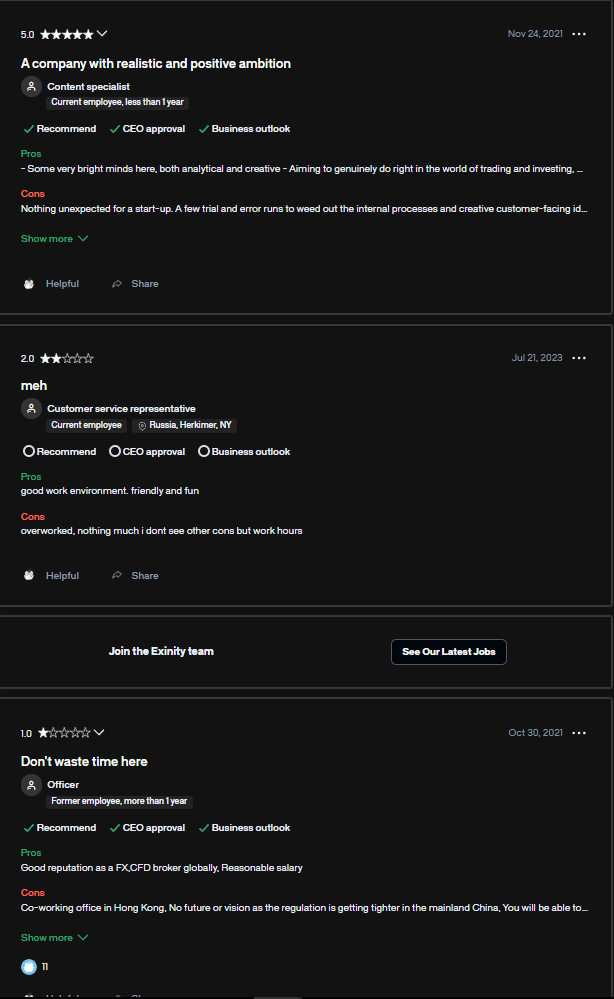

Exinity Customer Reviews

Exinity receives mixed customer reviews, a wide range of items, and competitive levels, which fits to different trading styles and strategies. Some consumers, currently report unexpected interruptions in service response times and a need for better 24/7 customer supports. Overall, Exinity is a great broker, especially for traders looking for big trading opportunities, but it could improve in terms of accessibility and support availability.

Many customers gave an applause to Exinity's user-friendly trading platforms and a wide range of trading markets including currencies and stocks. Exinity has a variety of responses from its customers. On the other hand, some customers want quicker 24/7 customer service. Although it has good trading characteristics, it still need some improvements in the speed.

Exinity Spreads, Fees, and Commissions

Exinity helps its customers to keep trading expenses low via competitive spreads, fees, and commissions. Low spreads offered by the broker, especially for important currency combination, let traders cut expenses no matter their type of investment is short-term or long-term. Traders of all skill levels can benefit from this affordable method.

Since the broker focuses on cutting client expenses, most Exinity accounts never ask for commissions. Smaller spreads often balance out fees for specialist accounts that have a little charge. Exinity does not charge deposit fees but if the selected approach has value, it may contain minimal charge.

Exinity's fair pricing plan ensures that traders immediately know exactly their expenses. Removing hidden fees lets the broker free traders from worrying about unexpected bills and let them focus on their plans. This simple price form helps create good trading requirements.

Account Types

- Exinity World Account: This account is specifically designed for beginners who may want to transition from a demo account to live trading. With a low minimum deposit of just $20, it is ideal for traders looking to start small, and it is optimized for mobile trading through Exinity’s proprietary app. The account provides access to a wide range of CFDs, including energies, indices, and shares, with leverage available up to 1:1000.

- Exinity Trader Account: This account is made for more experienced traders who like to trade quickly or use special computer programs to help them. It needs at least $100 to start and works with popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offering high leverage up to 1:2000. With advanced tools for studying the market and automatic trading, it gives traders more control and flexibility to make smart decisions.

- Exinity Trader Pro Account: This account is made for professional traders, especially those living in the Middle East. To open it, you need to deposit at least $10,000, and traders must show proof of their trading experience or have a portfolio worth at least $500,000. The Pro account gives traders special help with a personal account manager and offers leverage up to 1:500, making it perfect for those who need advanced features and extra support, better than what a demo account offers.

- Swap-free account: Account type like this is good for traders who cannot pay or earn interest due to religious beliefs, replacing overnight swap fees with a flat management charge. They also offer a demo account for those who want to practice trading without risking real money.

How to Open Your Account

Step 1: Visit the Exinity Website

Go to the official Exinity website. On the homepage, look for the “Sign Up” or “Open Account” button, usually located at the top right corner of the page.

Step 2: Choose Your Account Type

Select the type of account you want to open (e.g., Exinity World, Exinity Trader, or Exinity Trader Pro). Each account type will have different features and minimum deposit requirements, the user should choose the one that fits their trading needs.

Step 3: Fill Out the Registration Form

The website should be redirected to a registration form where the user need to provide personal details, including:

- Full Name

- Email Address

- Phone Number

- Country of Residence

Make sure the information entered is accurate to avoid any issues later on.

Step 4: Verify the Identity

To comply with regulatory requirements, it is important to verify the user's identity. This involves uploading a copy of a government-issued ID (like a passport or driver’s license) and proof of address (such as a utility bill or bank statement). Follow the instructions on the platform to upload these documents.

Step 5: Set Up the Trading Account

Once the identity is verified, the user can set up the trading account by selecting:

- Base Currency (like USD or AED)

- Leverage Level (choose based on your risk tolerance and trading strategy)

Step 6: Fund the Account

The user can deposit a fund into the trading account using one of the available payment methods (such as credit/debit cards, bank transfers, or e-wallets like Skrill or Neteller). Make sure to meet the minimum deposit requirement for the chosen account type.

Step 7: Download the Trading Platform

Choose and download the trading platform compatible with the user's account type (such as the Exinity app , MetaTrader 4, or MetaTrader 5). Install the platform on any device and log in using the credentials provided by Exinity.

Step 8: Start Trading

After funding the created account and setting up the platform, the trading is now available and ready. Use the tools and resources provided by Exinity to analyze the markets and execute the trades.

Following these steps can open an account with Exinity and begin your trading journey in a secure and regulated environment.

Exinity Trading Platforms

Exinity offers several trading platforms tailored to different types of traders. The main platforms provided by Exinity are.

- MetaTrader 4 (MT4): One of the most popular trading platforms globally, known for its user-friendly interface and advanced charting tools. It supports automated trading through Expert Advisors (EAs), and offers a wide range of indicators and analytical tools. MT4 is ideal for forex and CFD traders.

- MetaTrader 5 (MT5): The successor to MT4, this platform provides more features, including additional timeframes, more order types, and an economic calendar. It is designed for traders looking for more sophisticated trading strategies and a broader range of assets beyond forex, such as stocks and futures.

- Exinity Trader: A proprietary trading platform designed by Exinity, offering a tailored trading experience with a user-friendly interface. It focuses on fast execution speeds, advanced charting tools, and integrated risk management features. The platform may also support social trading or copy trading options, allowing traders to follow or copy the trades of experienced investors.

These platforms cater to different trader needs, from beginners to advanced professionals, and are available on multiple devices, including desktop, web, and mobile.

What Can You Trade on Exinity

On this Exinity review, it will show what are the access to a wide range of trading instruments across various asset classes. Below are the main options available.

- Forex: Trade major, minor, and exotic currency pairs. Forex trading is a core offering on Exinity, with access to high leverage and tight spreads.

- Indices: Speculate on the price movements of global stock indices, such as the S&P 500, NASDAQ, FTSE 100, DAX, and others. This allows the users to gain exposure to broader market trends.

- Shares/Stocks: Trade shares of major companies listed on global stock exchanges, such as Apple, Tesla, Amazon, and more. Exinity provides access to both U.S. and international stocks.

- Cryptocurrencies: Trade popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple. Cryptocurrency trading allows for speculation on the price movements of digital assets.

- ETFs (Exchange-Traded Funds): Trade ETFs that track specific indices, sectors, or asset classes, providing diversified exposure to multiple assets in one instrument.

These instruments provide a broad range of trading opportunities for different strategies.

Exinity Customer Support

It is designed to provide quick and efficient assistance to traders. They offer support via multiple channels, including live chat, email, and phone. This multi-channel approach ensures that help is always accessible, no matter the trader's location.

Live chat is the most immediate way to connect with a support representative. It is available directly on their website and allows for real-time interaction to resolve queries quickly. This option is ideal for urgent issues that require fast responses.

Email support is another convenient method for less urgent inquiries. Traders can send detailed questions or concerns and expect a response within a reasonable time frame. This channel is best for issues that do not need immediate attention or involve complex details.

In terms of speaking directly, phone support is also available. This service provides a personal touch and can be particularly useful for resolving complex or technical problems. Exinity’s website lists the contact numbers for various regions, ensuring tailored support based on location.

Advantages and Disadvantages of Exinity Customer Support

Withdrawal Options and Fees

- Bank Transfer: Direct withdrawals to a bank account; typically takes 3-5 business days to process.

- Credit/Debit Card: Withdraw funds back to the card; usually processed within 2-5 business days.

- E-Wallets: Options like Skrill, Neteller, and others; withdrawals are often processed within 24 hours.

- Cryptocurrency: Withdrawals in popular cryptocurrencies like Bitcoin; processing times vary based on blockchain confirmation.

Exinity Vs Other Brokers

#1. Exinity vs AvaTrade

Exinity and AvaTrade are both popular brokers offering a variety of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. Exinity provides platforms like MetaTrader 4, MetaTrader 5, and its proprietary Exinity Trader, catering to different trader needs, while AvaTrade offers additional options such as AvaTradeGO, AvaOptions, and DupliTrade for social and options trading, making it suitable for traders seeking diverse platform choices.

You can get help from Exinity through live chat, email, and the phone. Help is offered in different places. But AvaTrade has personal account managers, support in many languages 24 hours a day, 5 days a week, and a lot of tools to help you learn. Which one is best for the users depends on whether the trader want more platform choices or a certain kind of customer service.

#2. Exinity vs RoboForex

Exinity provides access to MetaTrader 4, MetaTrader 5, and its own Exinity Trader platform, while RoboForex also supports MT4 and MT5, plus additional platforms like cTrader and R Trader, appealing to traders who want more platform variety.

When it comes to customer support, both brokers offer multiple contact methods, including live chat, email, and phone. RoboForex provides 24/7 support, which can be a significant advantage for traders needing assistance outside of standard hours, while Exinity offers localized support during business hours for a more tailored experience.

#3. Exinity vs Exness

Exinity and Exness both cater to traders with a wide array of instruments, including forex, stocks, indices, commodities, and cryptocurrencies. Exinity offers platforms like MetaTrader 4, MetaTrader 5, and Exinity Trader, while Exness provides MT4, MT5, and a proprietary web-based platform, known for its high-speed execution and flexibility with leverage.

In terms of customer support, Exness generally has an edge over Exinity due to its 24/7 availability and multilingual support. This round-the-clock service ensures that traders can receive assistance at any time, regardless of their time zone or language preferences, making it highly convenient and reliable.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Exinity Review

This evaluation of Exinity shows that it has a lot of trading systems and tools that work well for all levels of traders, from newbies to pros. There is a lot of competition among Forex dealers, but Exinity stands out because it offers a lot of benefits.

Because it has unique benefits and features, Exinity is better than many other Forex firms, aspire to want to trade in different ways, it's a good option, but traders should also think about their needs for customer service and the site.

This review tells the reason why Exinity might be the best Forex trading tool . It's great for both new and experienced traders because it has tools that are easy to use, a lot of trading choices, and fair rules for everyone.

Also Read: CapitalXtend Review 2024 – Expert Trader Insights

Exinity Review: FAQs

What trading platforms does Exinity offer?

Exinity provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exinity Trader platform, catering to different levels of trading experience and preferences.

Is Exinity regulated?

Yes, ExinIty is regulated by several financial authorities, including the Financial Services Commission (FSC) of Mauritius, which helps provide a level of security and trust for traders.

What is the minimum deposit required to start trading with Exinity?

The minimum deposit at Exinity varies depending on the account type, generally starting as low as $10 for a Standard account, making it accessible for most traders.

OPEN AN ACCOUNT NOW WITH EXINITY AND GET YOUR BONUS