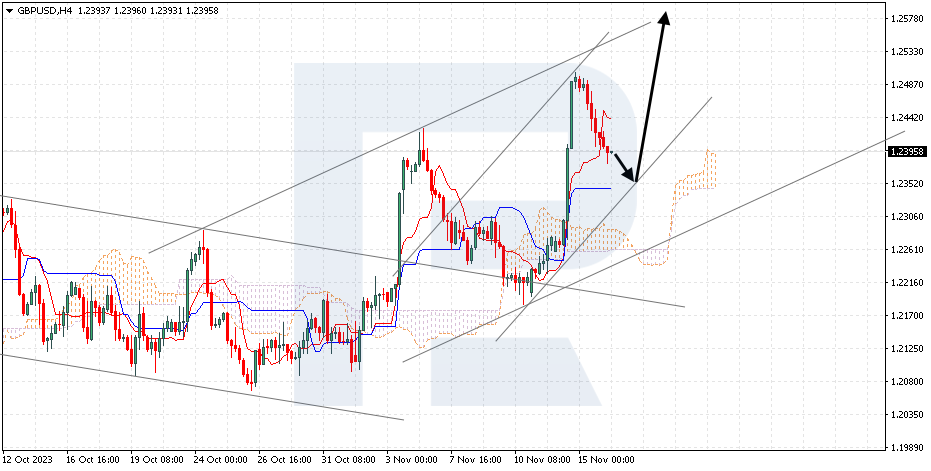

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has found a foothold above the Tenkan-Sen line. The instrument is going above the Ichimoku Cloud suggesting a downtrend. A test of the Kijun-Sen line is expected at 1.2355, followed by a rise to 1.2580. An additional signal confirming the growth could be a rebound from the lower boundary of the bullish channel. The scenario could be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 1.2205, which might indicate a further decline to 1.2110.

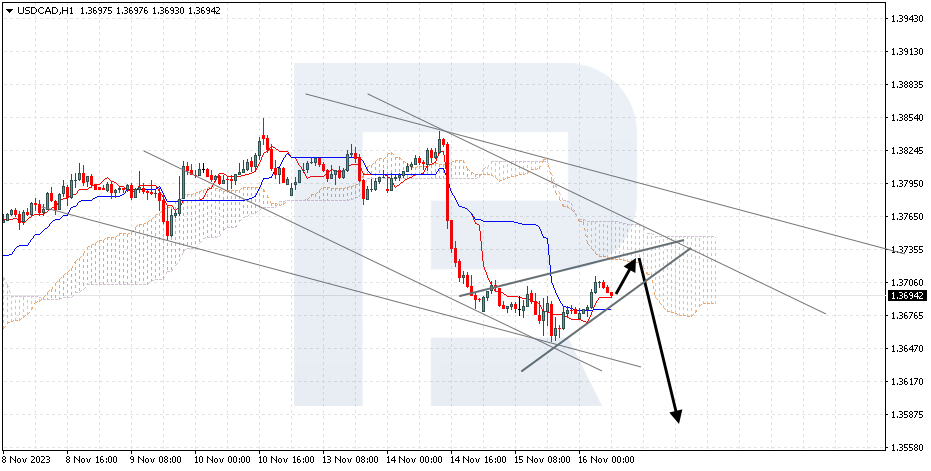

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD is correcting within a Wedge reversal pattern. The instrument is going below the Ichimoku Cloud, revealing a downtrend. A test of the lower boundary of the Cloud is expected at 1.3725, followed by a decline to 1.3575. An additional signal confirming the decrease might become a rebound from the upper Wedge boundary. The scenario could be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold above 1.3720, from where the growth could continue to 1.3630. Meanwhile, the decline might be confirmed by a breakout of the lower Wedge boundary with the price finding a foothold under 1.3670.

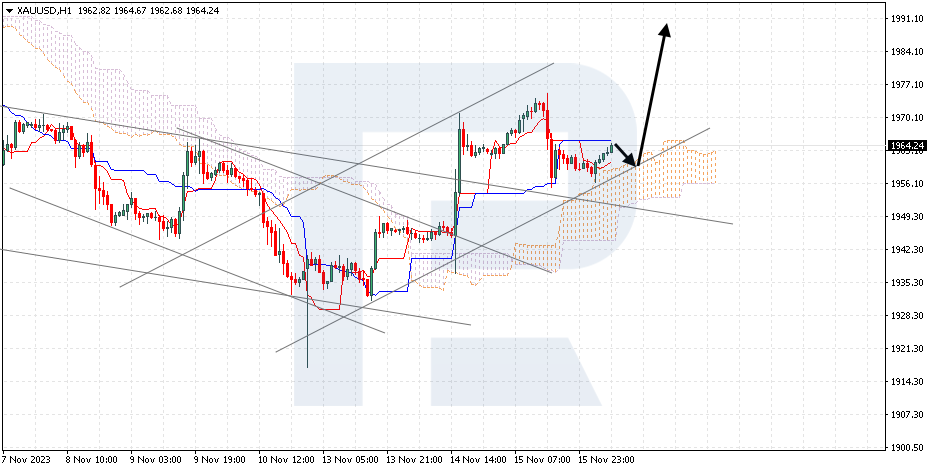

XAUUSD, “Gold vs US Dollar”

Gold is rising within a bullish channel. The instrument is going above the Ichimoku Cloud, revealing an uptrend. A test of the upper boundary of the Cloud at 1965 is expected, followed by a rise to 1995. An additional signal confirming the growth might become a rebound from the lower bullish channel boundary. The scenario could be cancelled by a breakout of the lower boundary of the Cloud with the price securing under 1935, from where it might fall to 1895.