EURUSD, “Euro vs US Dollar”

EURUSD is rising while completing a Wedge pattern. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower boundary of the Cloud at 1.0710 is expected, followed by a decline to 1.0525. An additional signal confirming the decline will be a rebound from the upper boundary of the Wedge pattern. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 1.0765, which will mean further growth to 1.0955. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the reversal pattern with the quotes securing under the 1.0645 level.

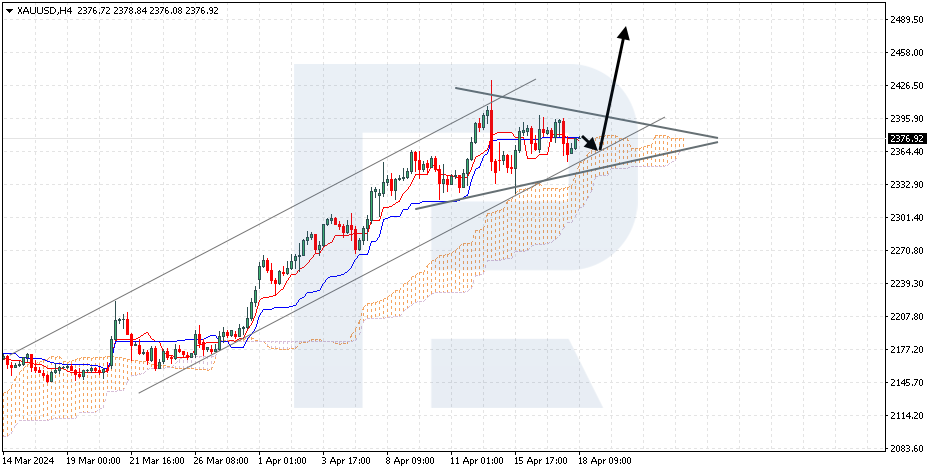

XAUUSD, “Gold vs US Dollar”

Gold is rebounding from the signal lines of the indicator. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the upper boundary of the Cloud at 2365 is expected, followed by a rise to 2480. An additional signal confirming the rise will be a rebound from the lower boundary of the Triangle pattern. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price securing under 2325, which will mean a further decline to 2265. Meanwhile, the growth could be confirmed by a breakout of the upper boundary of the Triangle pattern with the quotes securing above the 2405 level.

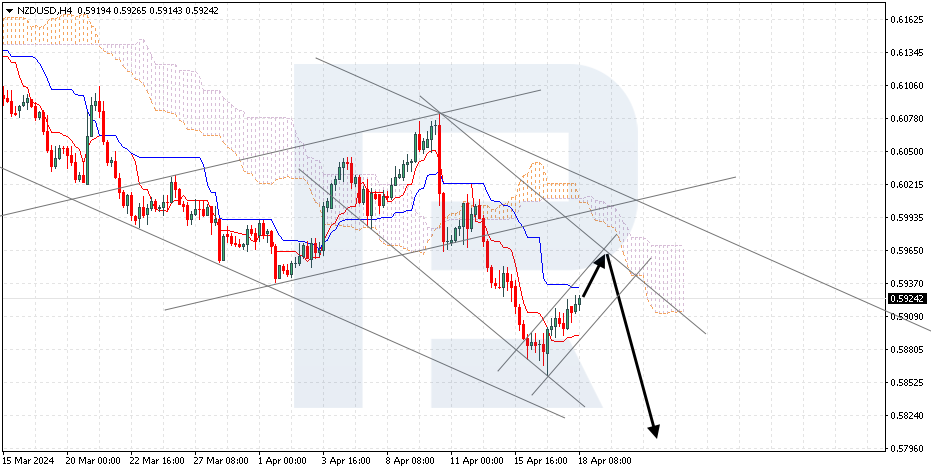

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD has secured above the Tenkan-Sen line. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower boundary of the Cloud at 0.5965 is expected, followed by a decline to 0.5795. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 0.5995, which will mean further growth to 0.6090. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the ascending channel with the quotes securing under the 0.5895 level.