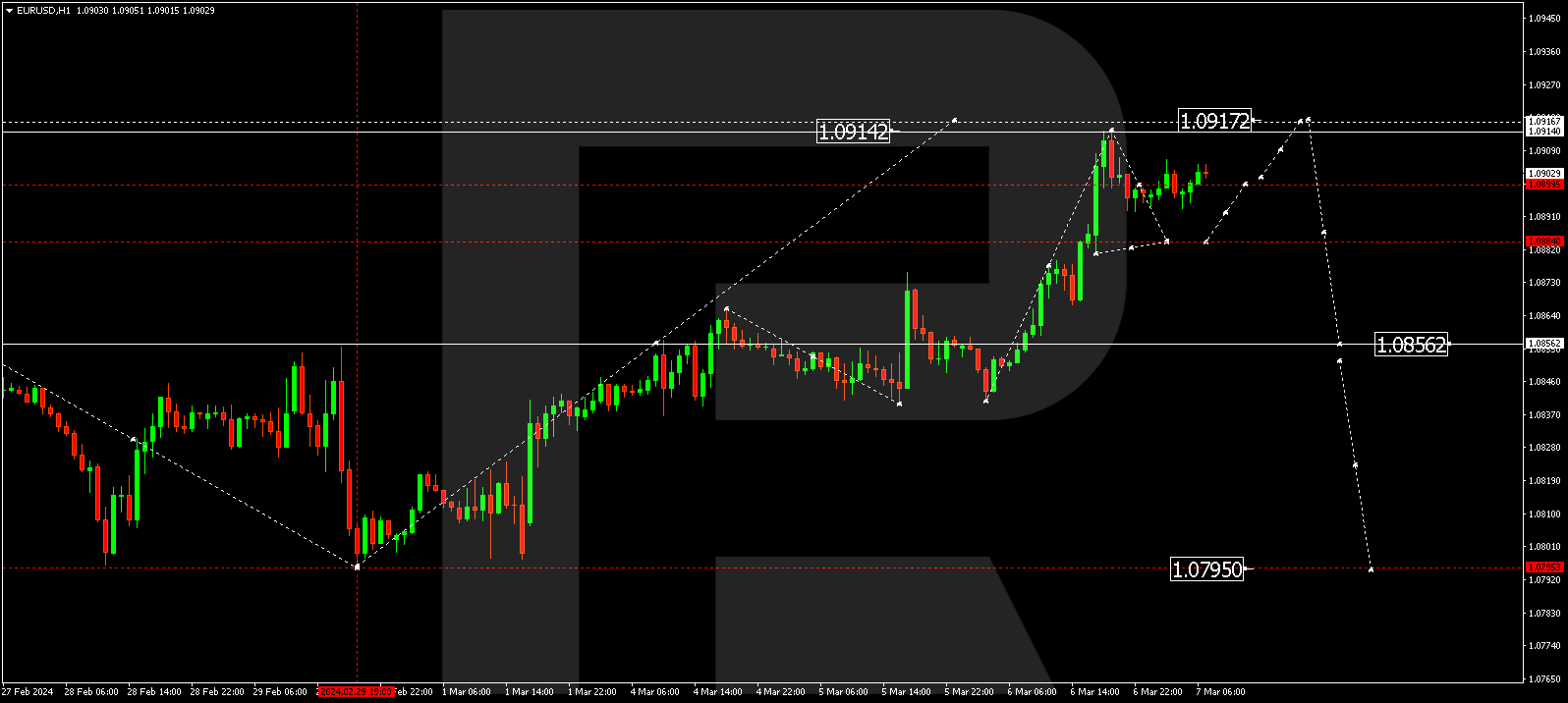

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a growth wave to 1.0914. A consolidation range is expected to form around the 1.0899 level today. With a downward escape from the range, a correction structure could target 1.0884 (testing from above). When the correction is over, a growth structure to 1.0919 is not excluded. Next, a decline wave to 1.0858 is expected, from where the trend might extend to 1.0795. This is the first target.

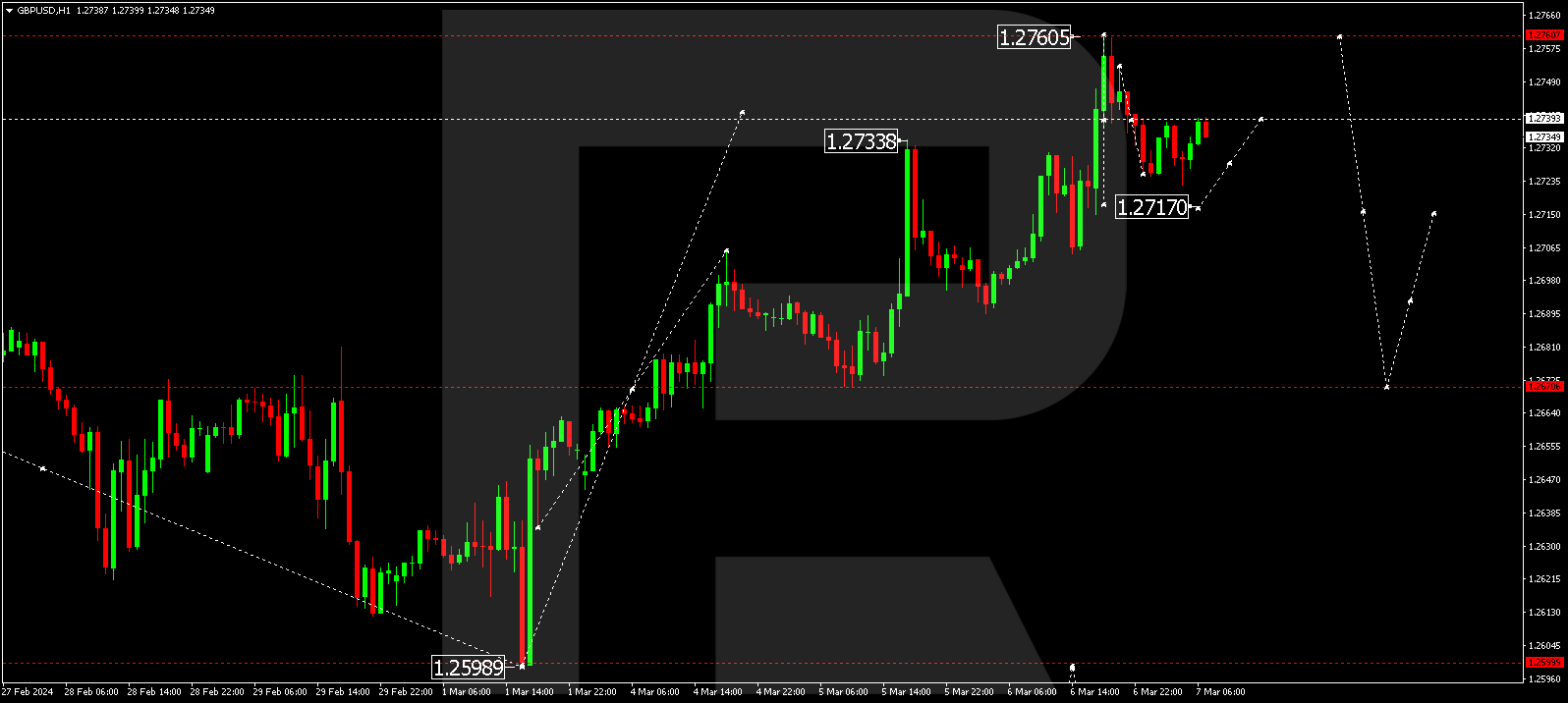

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has performed a growth wave to 1.2760. A correction to 1.2717 might form. Once the correction is over, a growth structure to 1.2770 is not excluded, followed by a decline to 1.2670. This is the first target.

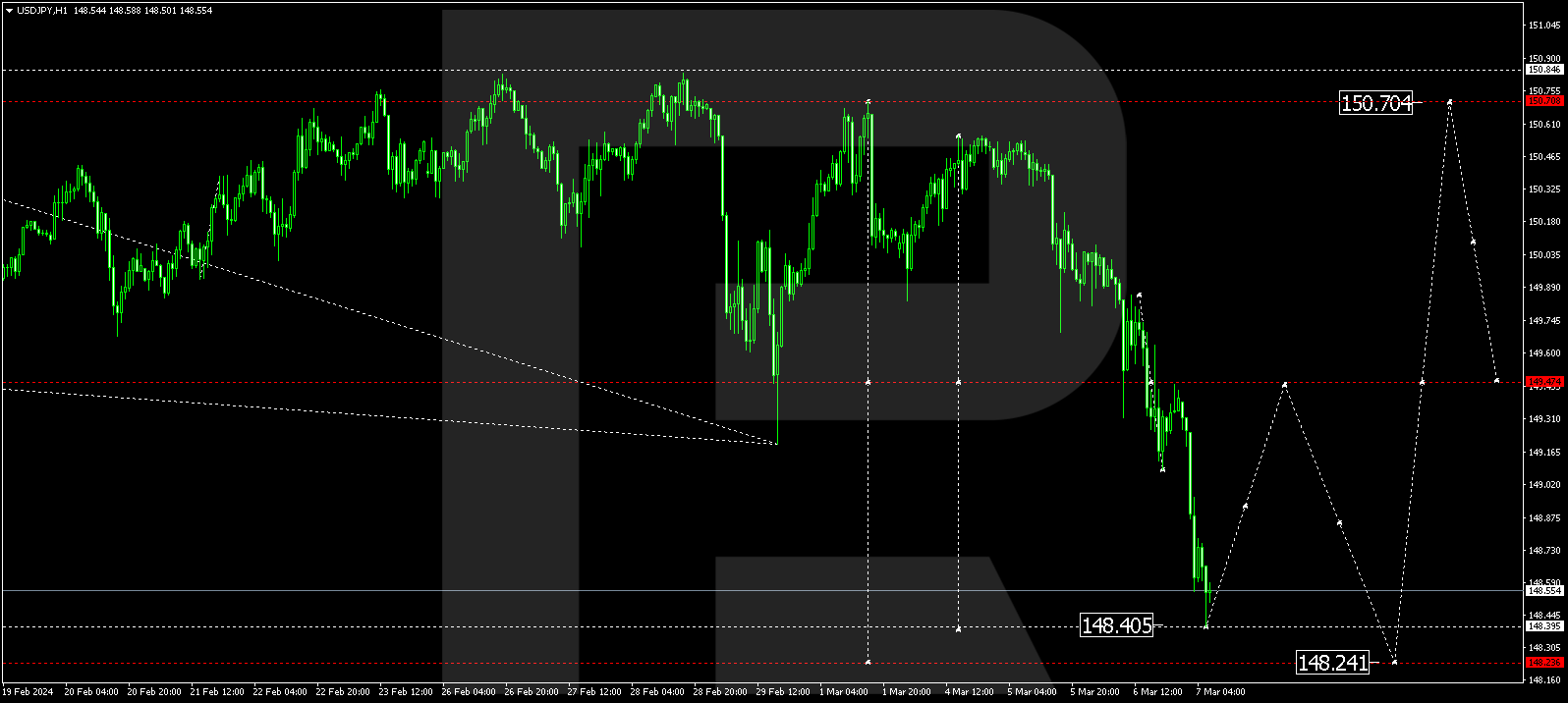

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair formed a consolidation range around 149.47. With a downward escape from the range today, the market extended the growth wave to 148.40. Currently, a new consolidation range is forming above this level. An upward escape from the range and a growth link towards 149.47 (testing from below) is expected. Next, a new correction link to 148.24 might form.

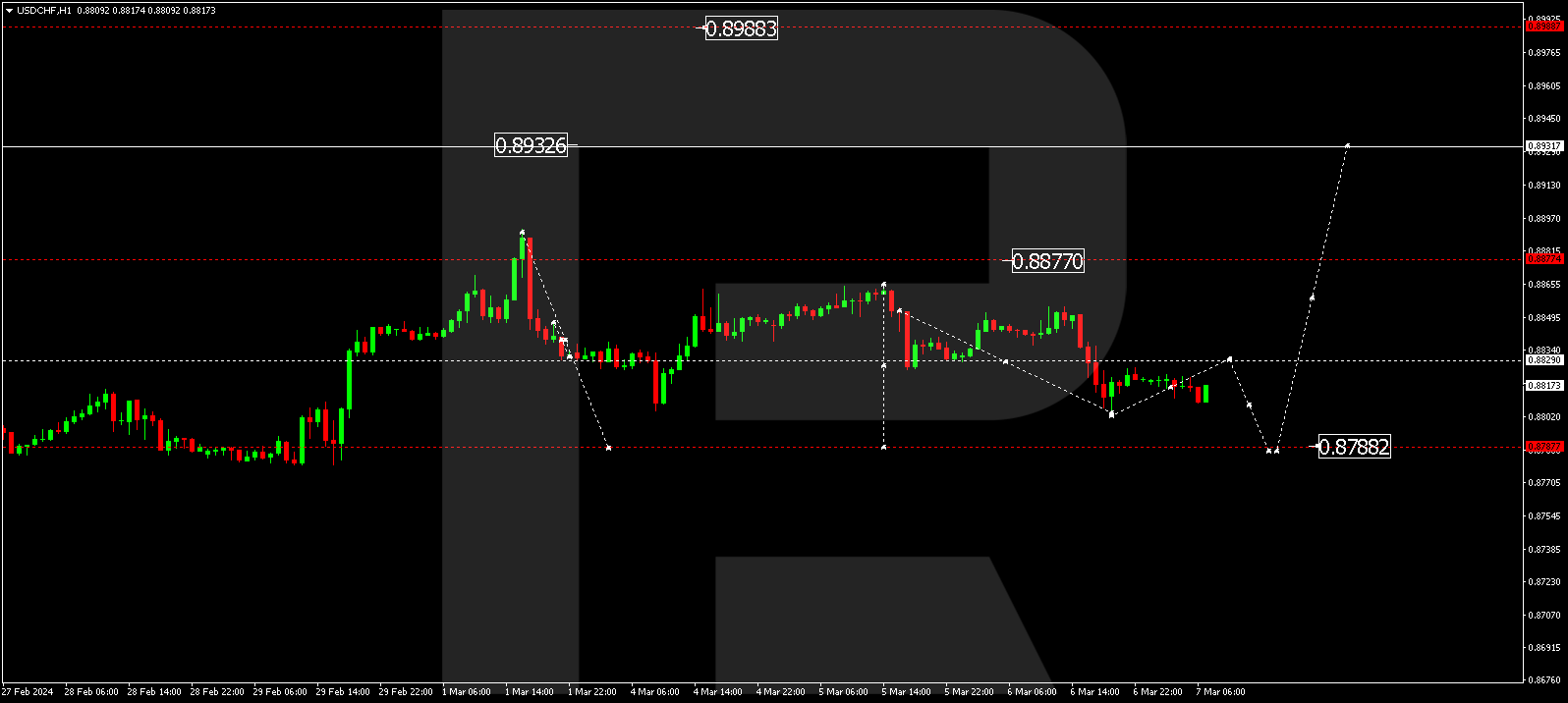

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair continues developing a consolidation range around 0.8838, and today the market has expanded it downwards to 0.8804. A growth link to 0.8838 (testing from below) is not excluded, followed by a decline link to 0.8787. Next, a growth wave to 0.8930 could start. This is the first target.

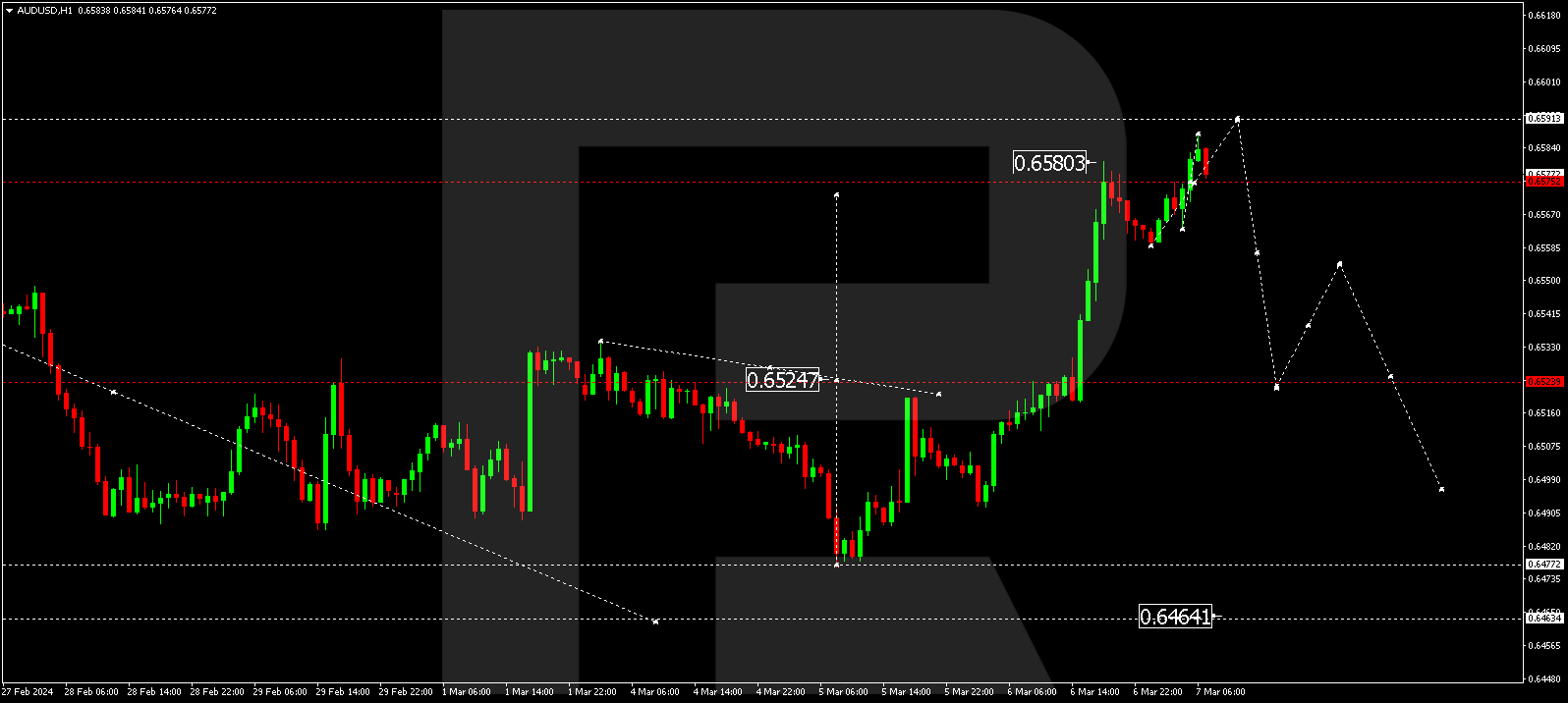

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has performed a growth wave to 0.6580. A consolidation range is forming around this level today, probably expanding to 0.6591. Next, a decline wave to 0.6522 might start. This is the first target.

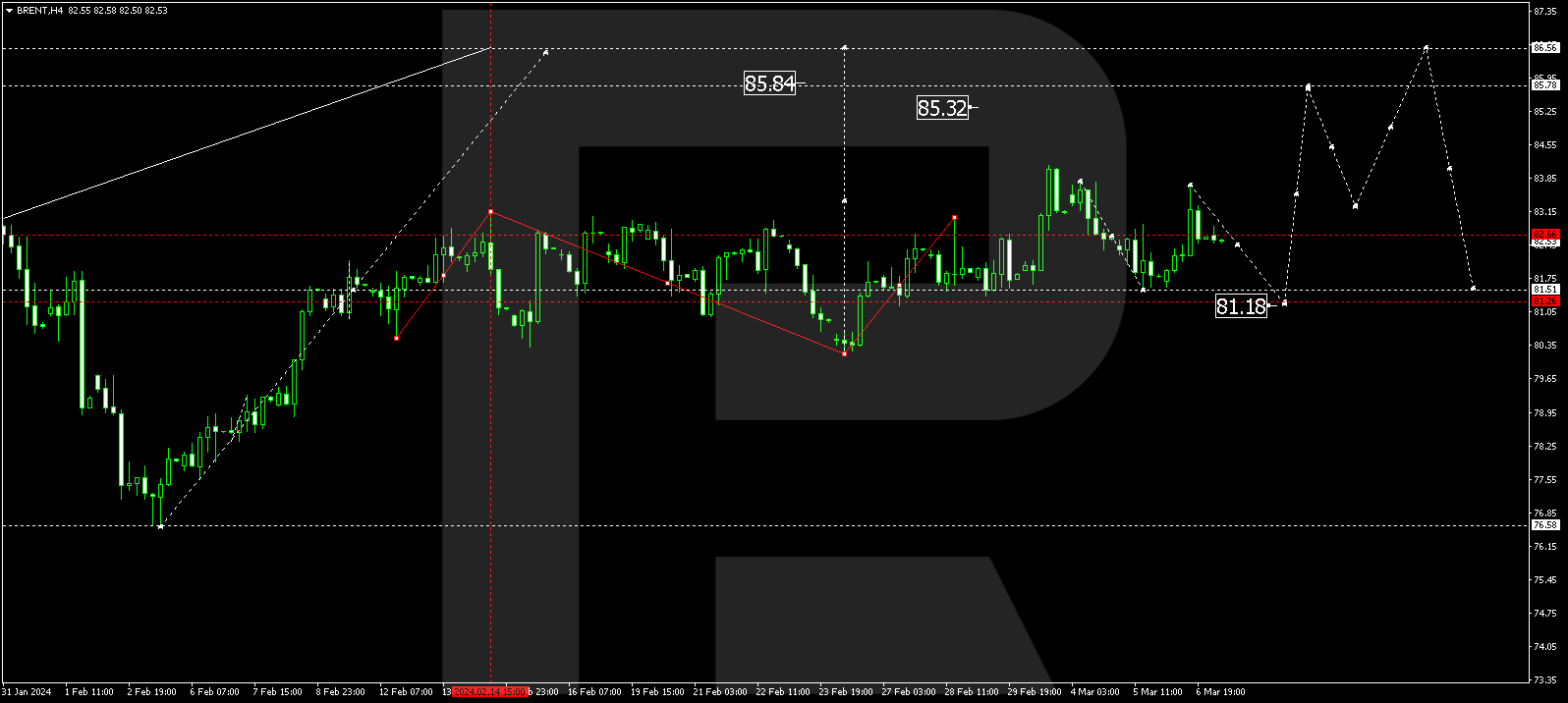

BRENT

Brent has completed a growth link to 83.71. Further correction to 81.81 is expected today. Once this correction is over, a new growth wave to 85.85 might begin, from where the trend could continue to 86.60. This is the first target.

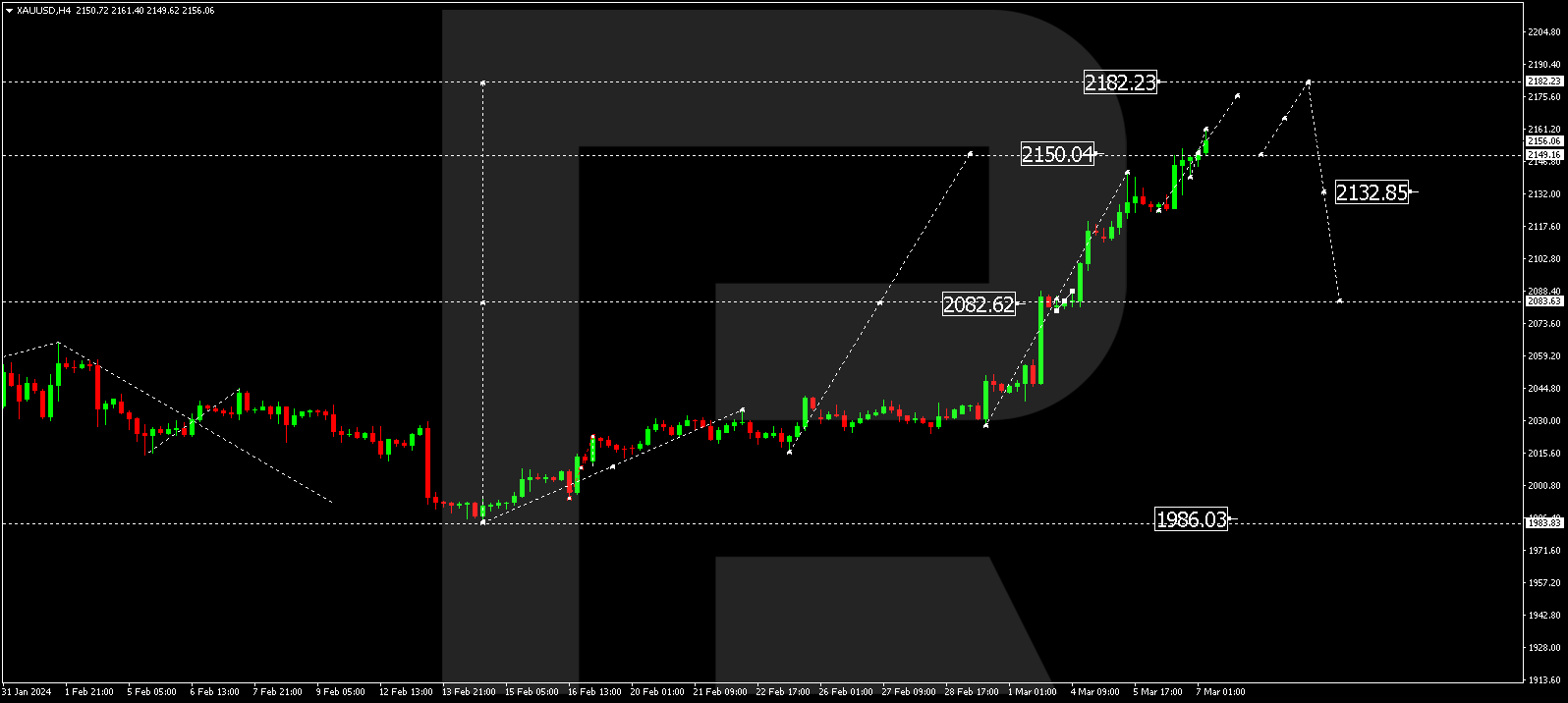

XAUUSD, “Gold vs US Dollar”

Gold has completed a growth wave to 2150.00. Today the market is forming a consolidation range around this level. With an upward escape from the range, the wave might extend to 2182.00. With a downward escape, the potential for a correction to 2083.63 could open. Once the correction is over, the trend might extend to 2196.00. This is a local target.

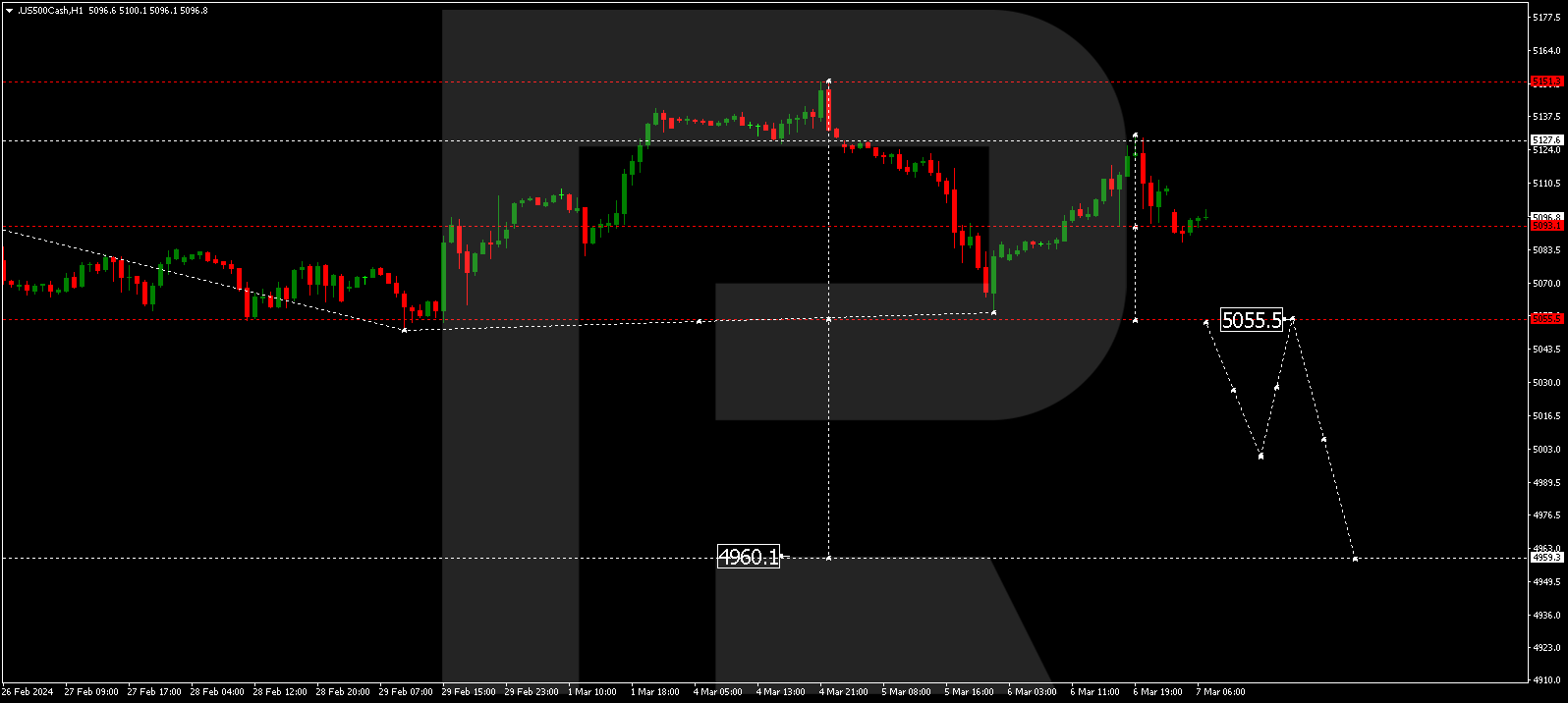

S&P 500

The stock index has completed a correction to 5127.7 and a decline impulse to 5093.0. A consolidation range is expected to develop around this level. With a downward escape from the range, the potential for a wave to 5050.5 might open. This is a local target. Once this level is reached, a correction link to 5090.0 is expected, followed by a decline to 4959.0. This is the first target.