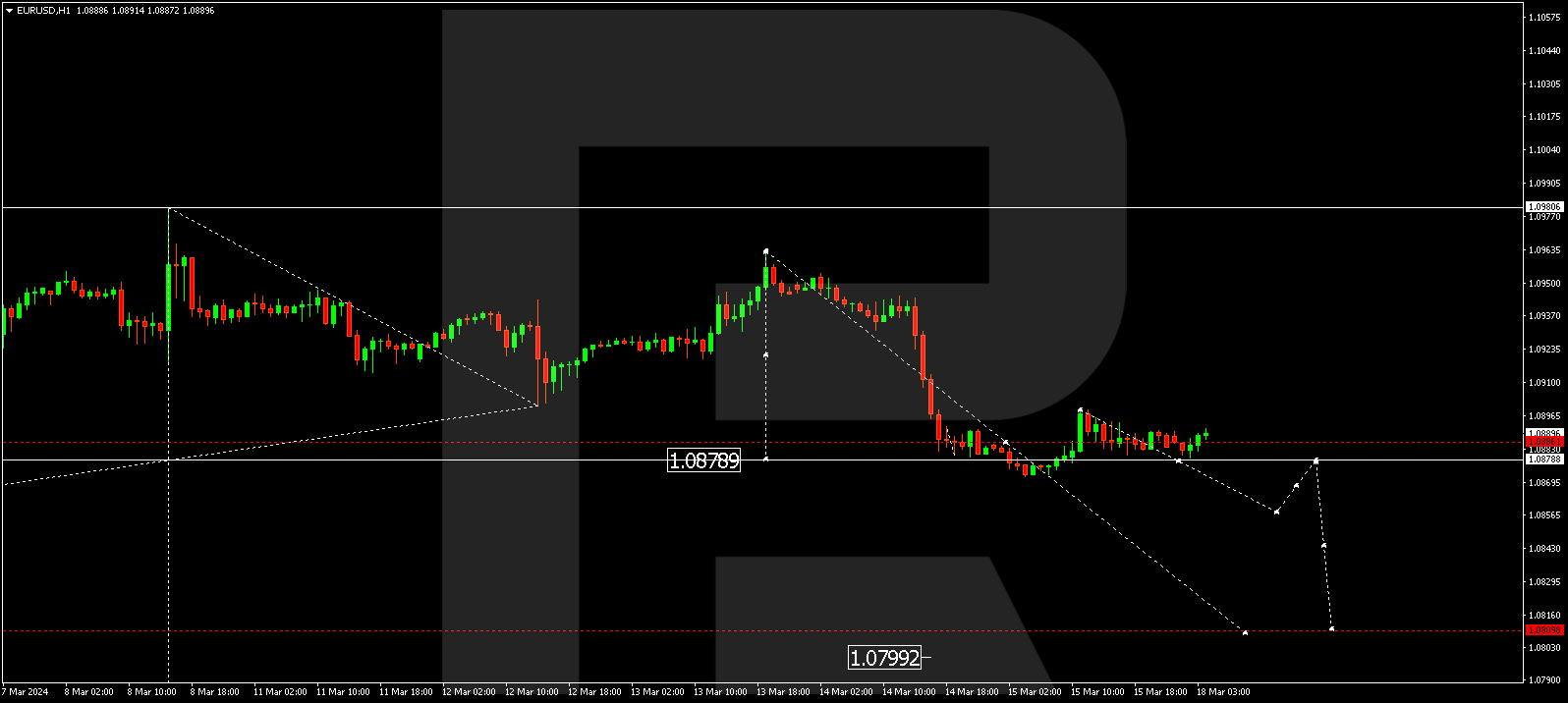

EURUSD, “Euro vs US Dollar”

The EURUSD pair continues developing a consolidation range around 1.0880. Today it is expected to extend to 1.0865. Next, a growth link to 1.0880 might form (testing from below), followed by a decline to 1.0808, from which level the wave could continue to 1.0799. The estimated target is a local one.

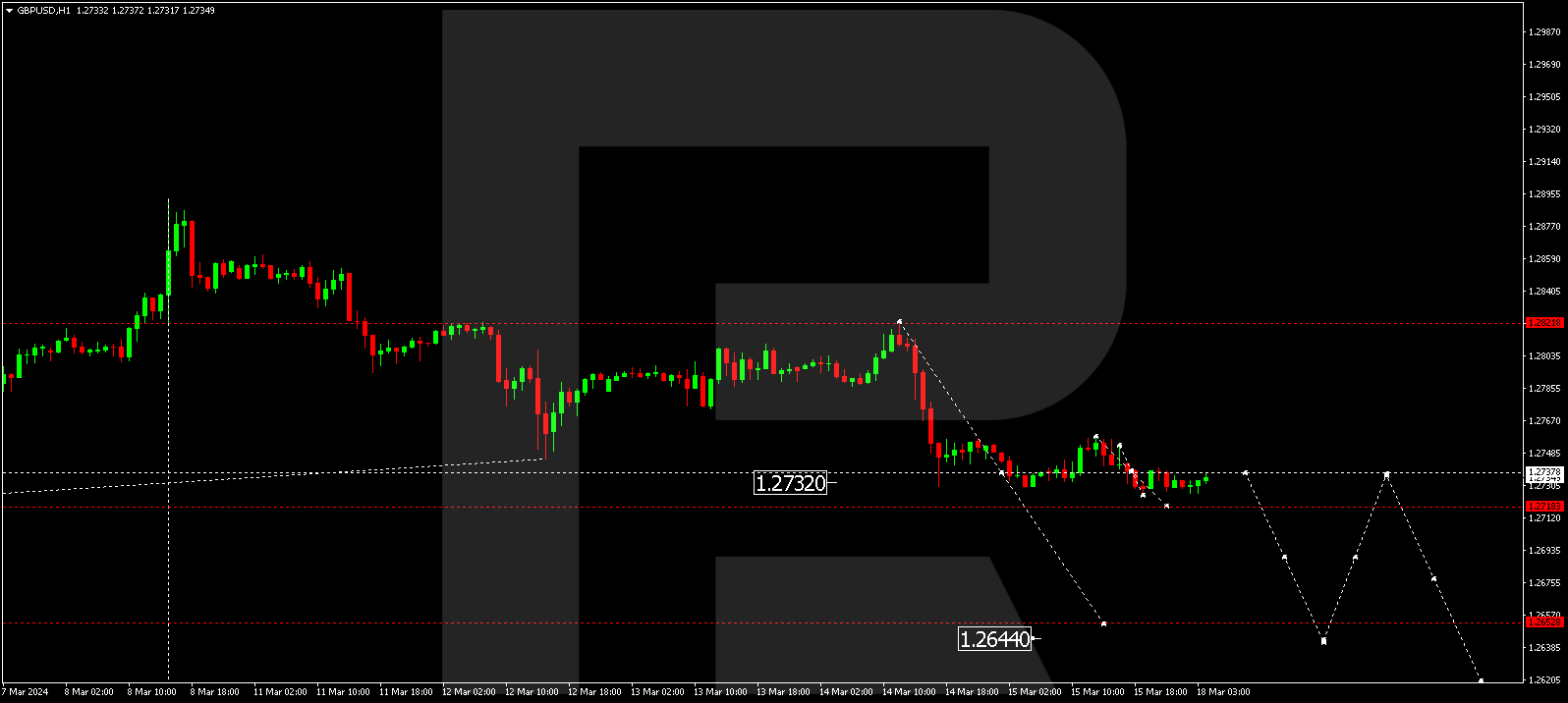

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair continues developing a consolidation range around 1.2737. Today the range could expand to 1.2717. Next, a growth link to 1.2737 could form (testing from below), followed by a decline to 1.2653, from which level the wave might extend to 1.2644. This is a local target.

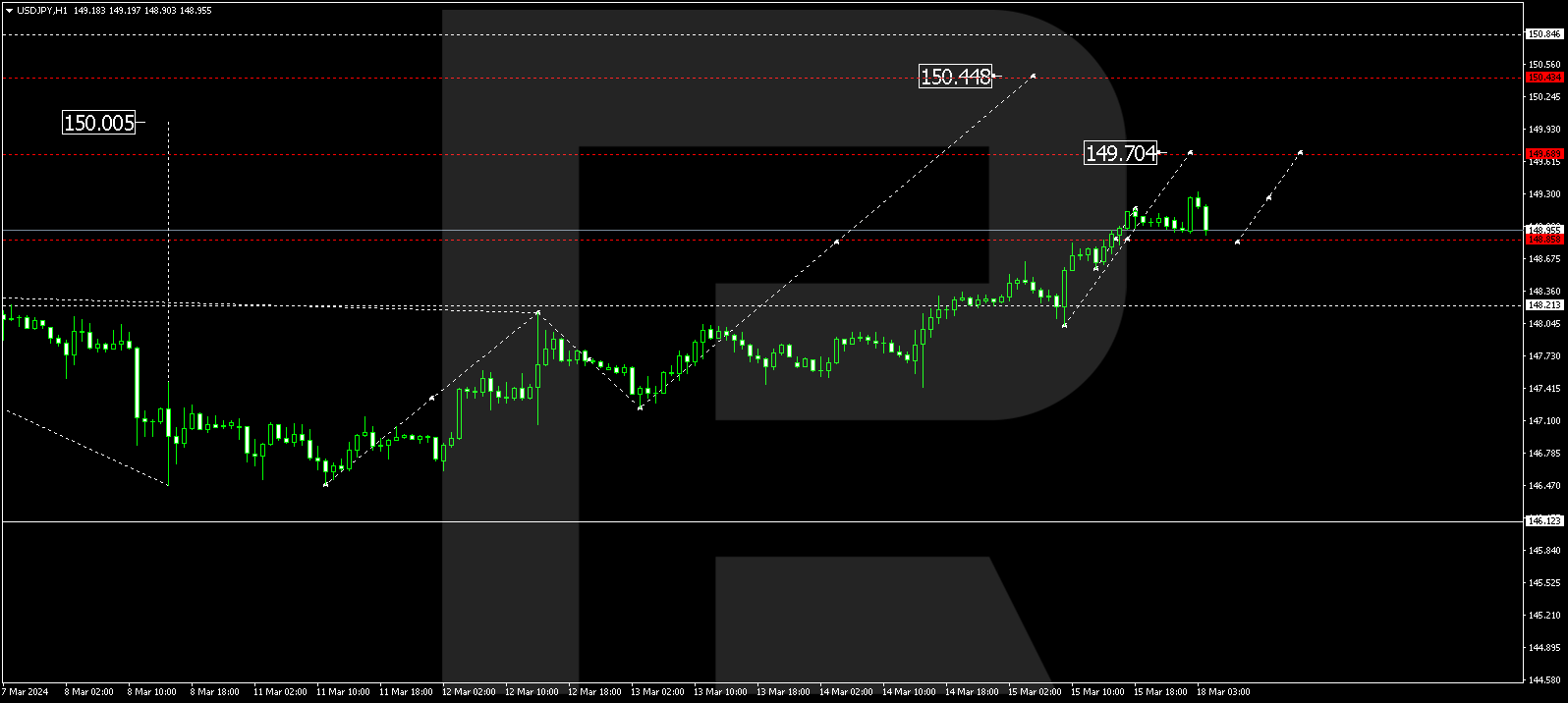

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues developing a consolidation range around the 148.85 level. Today the growth wave is expected to continue to 149.70, from which level the trend could extend to 150.00. This is a local target.

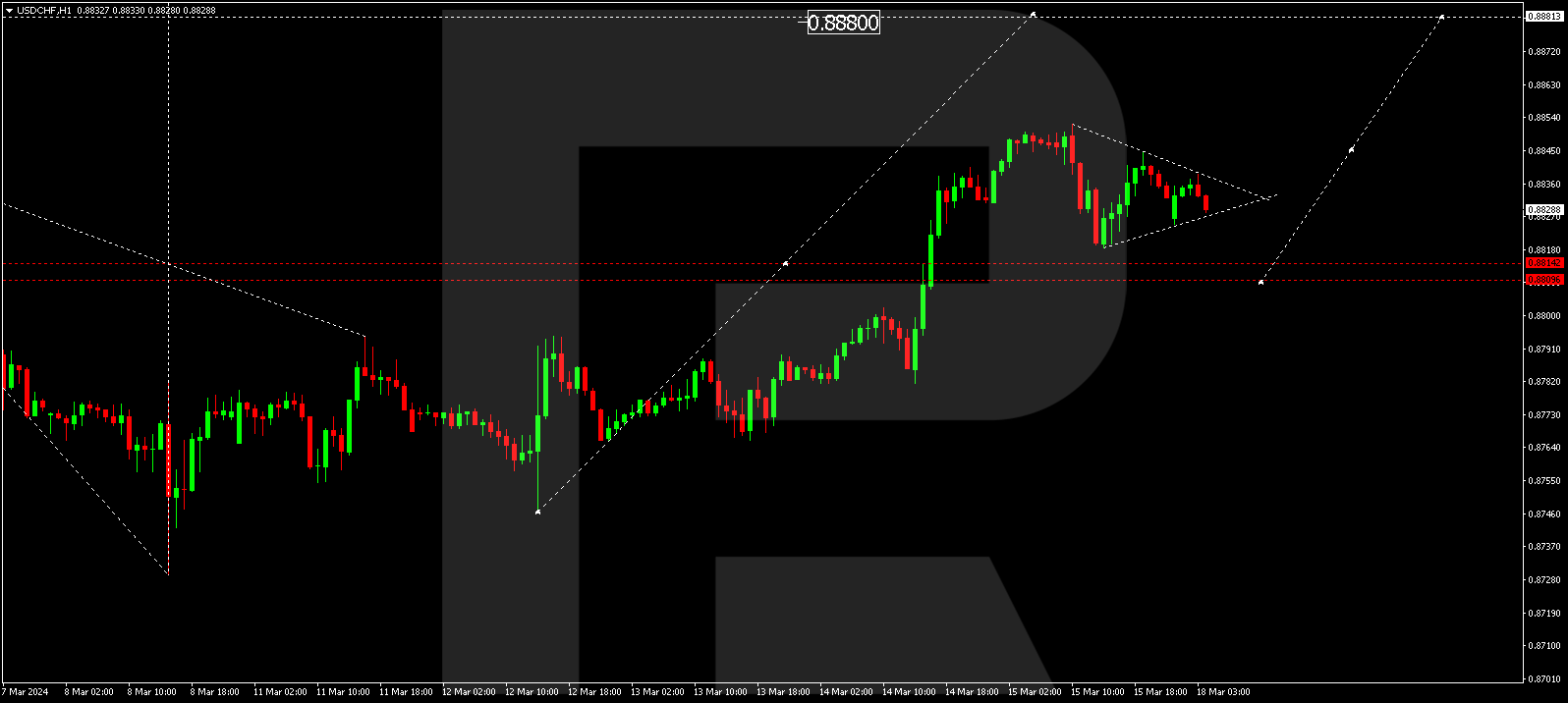

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair continues forming a consolidation range under 0.8852. A correction link to 0.8808 is not excluded today. Once the correction is over, a new wave to 0.8882 might start. This is a local target.

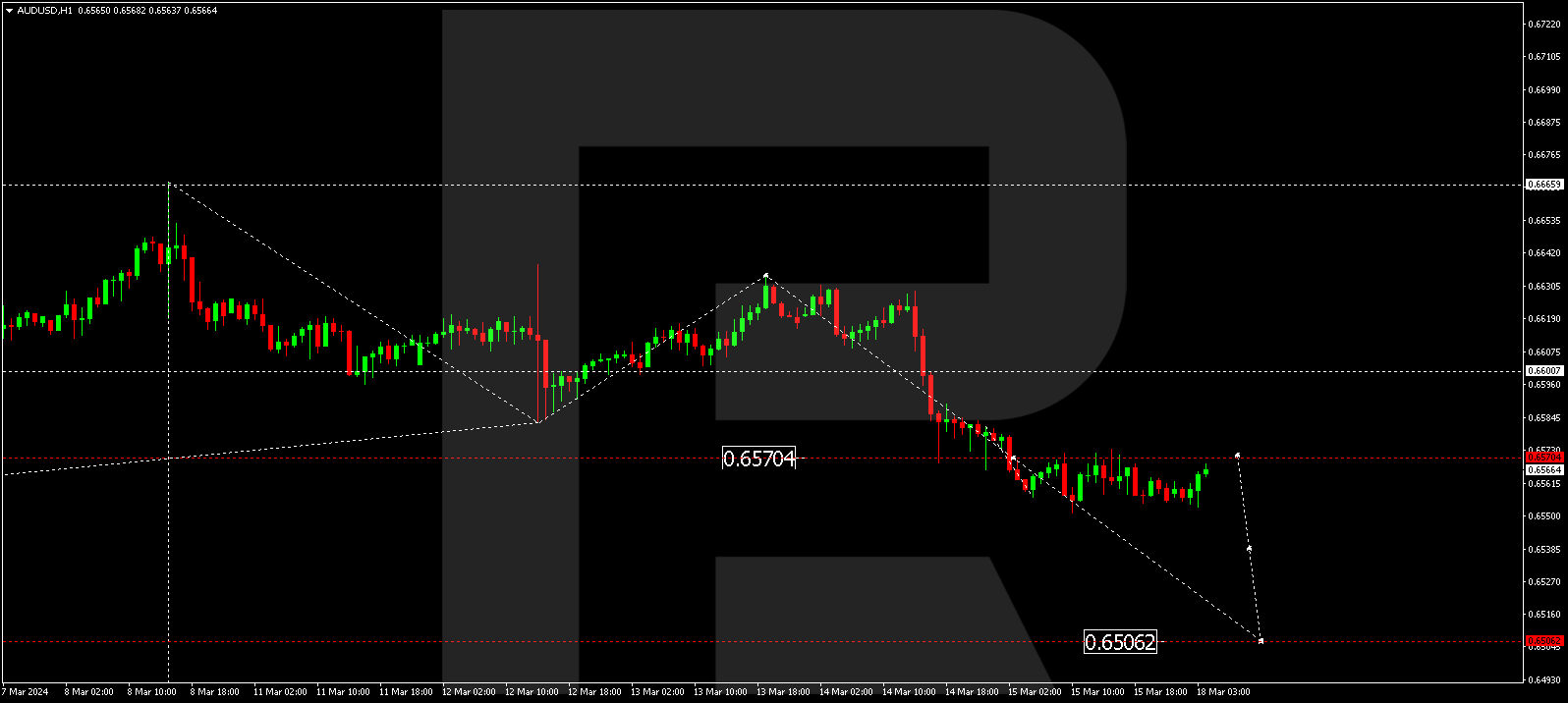

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair continues forming a consolidation range around 0.6570. Today the pair is likely to break the range downwards to 0.6506. This is a local target. Once this level is reached, a correction link to 0.6570 (testing from below) is not excluded. Next, a decline to 0.6477 might follow. This is the first target.

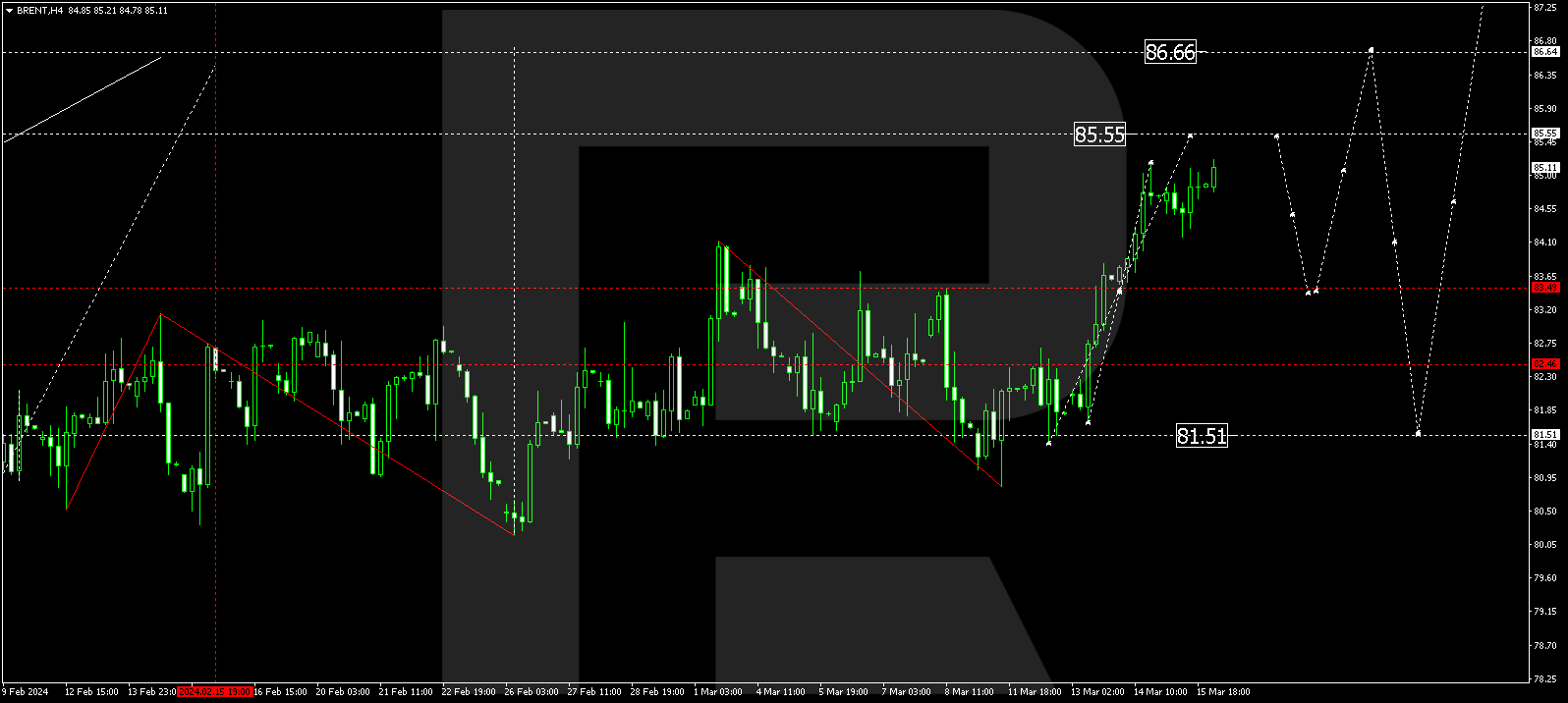

BRENT

Brent continues developing a growth wave structure to 85.55. This is a local target. Once this level is reached, a correction link to 83.50 (testing from above) is not excluded. Next, a growth wave to 86.66 is expected. This is the first target.

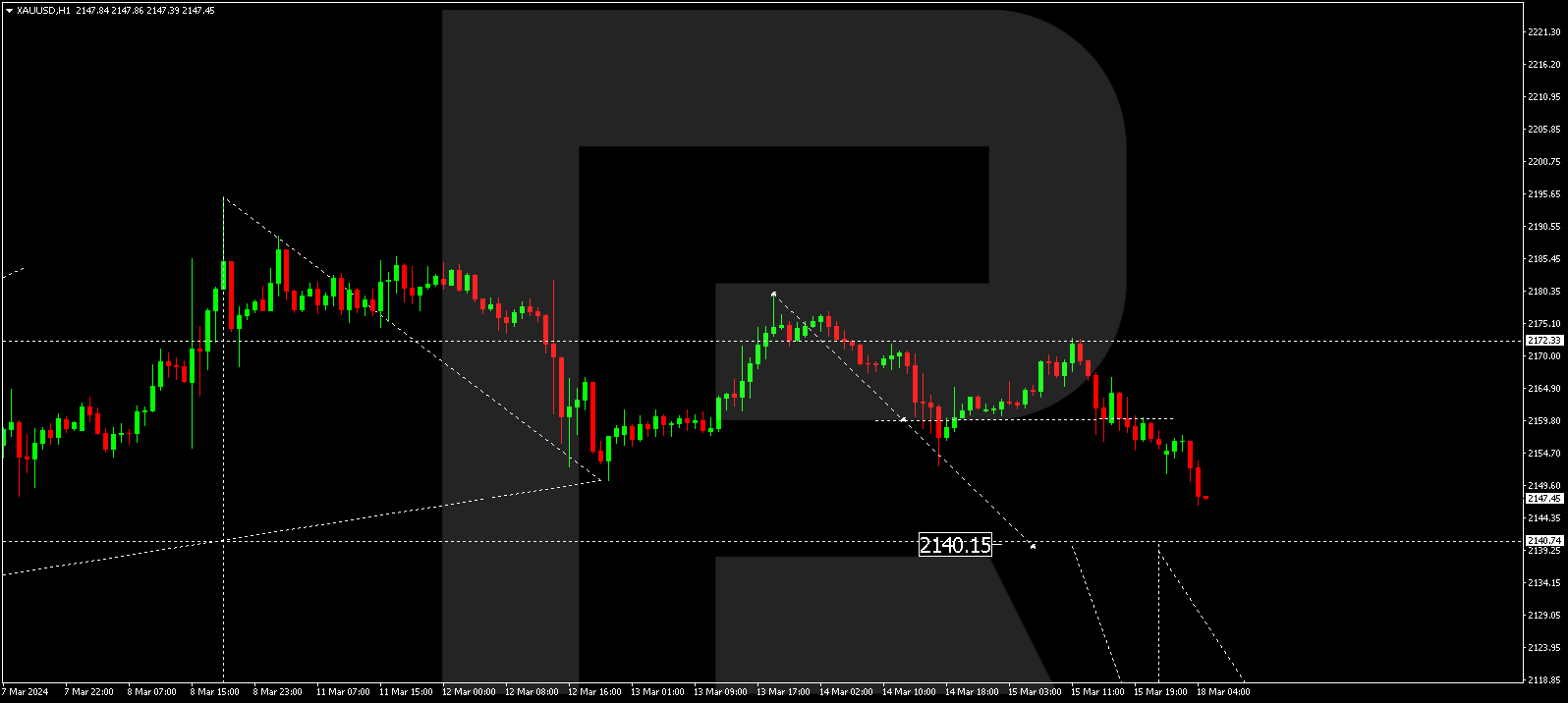

XAUUSD, “Gold vs US Dollar”

Gold continues developing a decline wave to 2140.70. Once this level is reached, a consolidation range is expected to form around this level. Breaking the range downwards, the potential for a decline wave to 2102.76 might open. This is a local target.

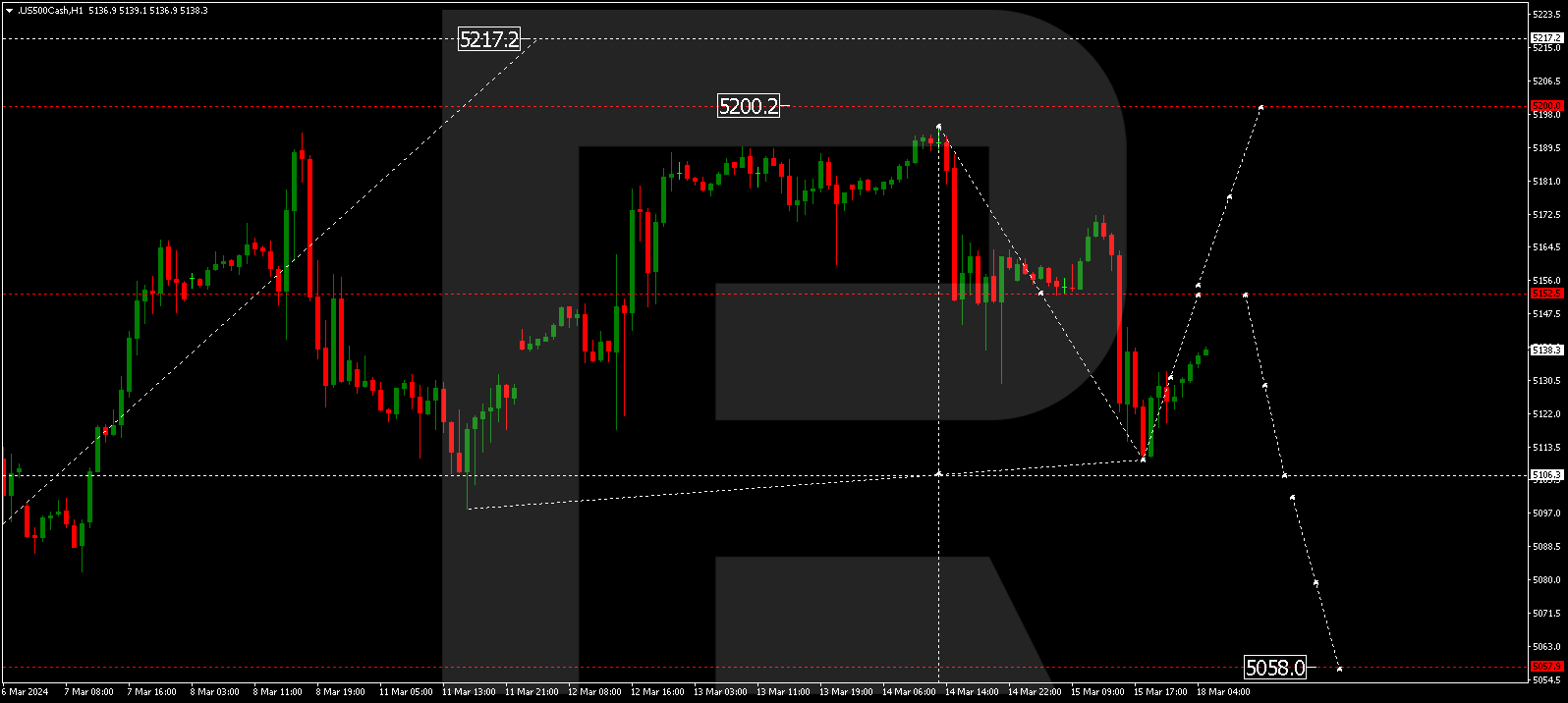

S&P 500

The stock index has formed a decline wave to 5110.0. A correction to 5152.0 could follow today (testing from below). Practically, a wide consolidation range might form around this level. Breaking this range downwards, the potential for a wave to 5058.0 might open. With an upward escape from the range, wave extension to 5200.0 is not excluded, followed by a decline to 5058.0. This is a local target.