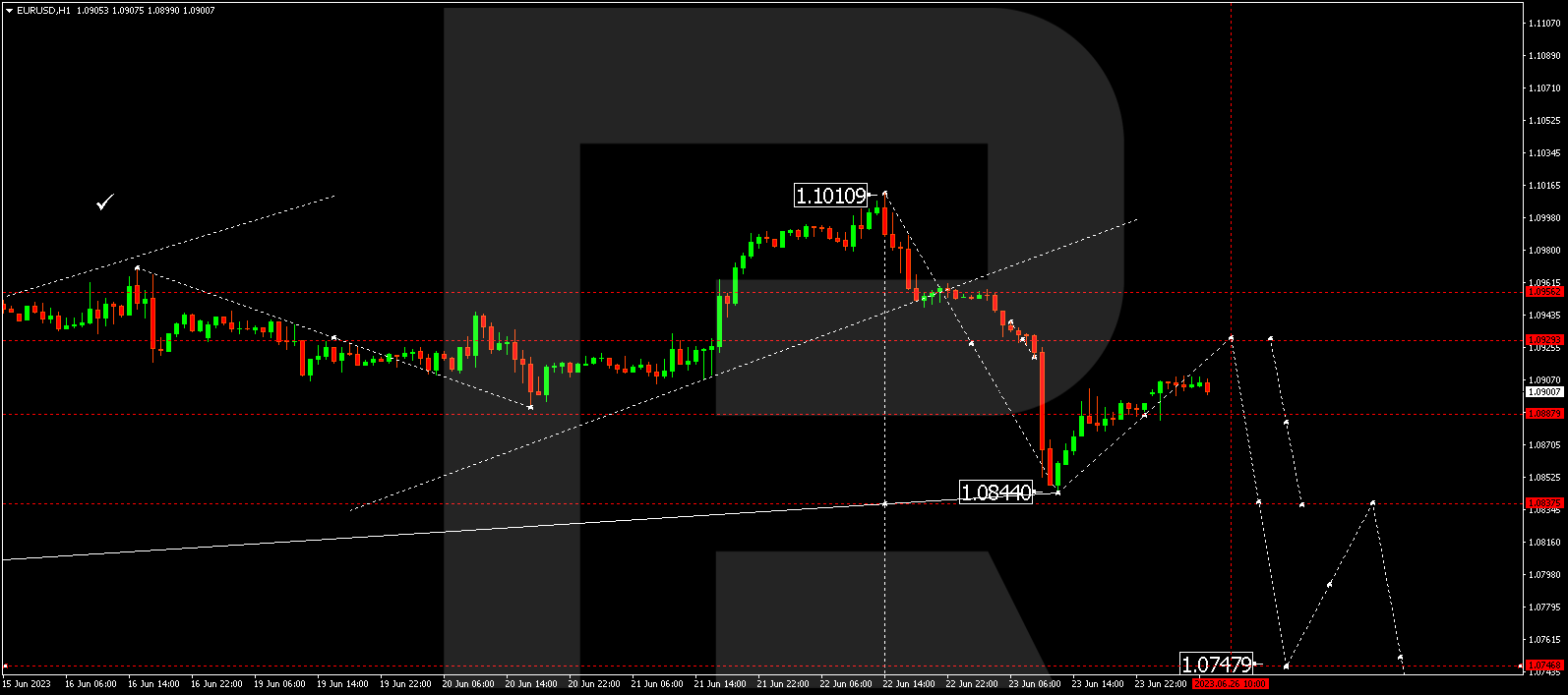

EURUSD, “Euro vs US Dollar”

The currency pair has completed the first declining impulse to 1.0844. Today the market is forming a corrective structure to 1.0930. After the correction is over, a new impulse of decline to 1.0840 might start. And if this level also breaks, the potential for a decline to 1.0750 could open. This is a local target.

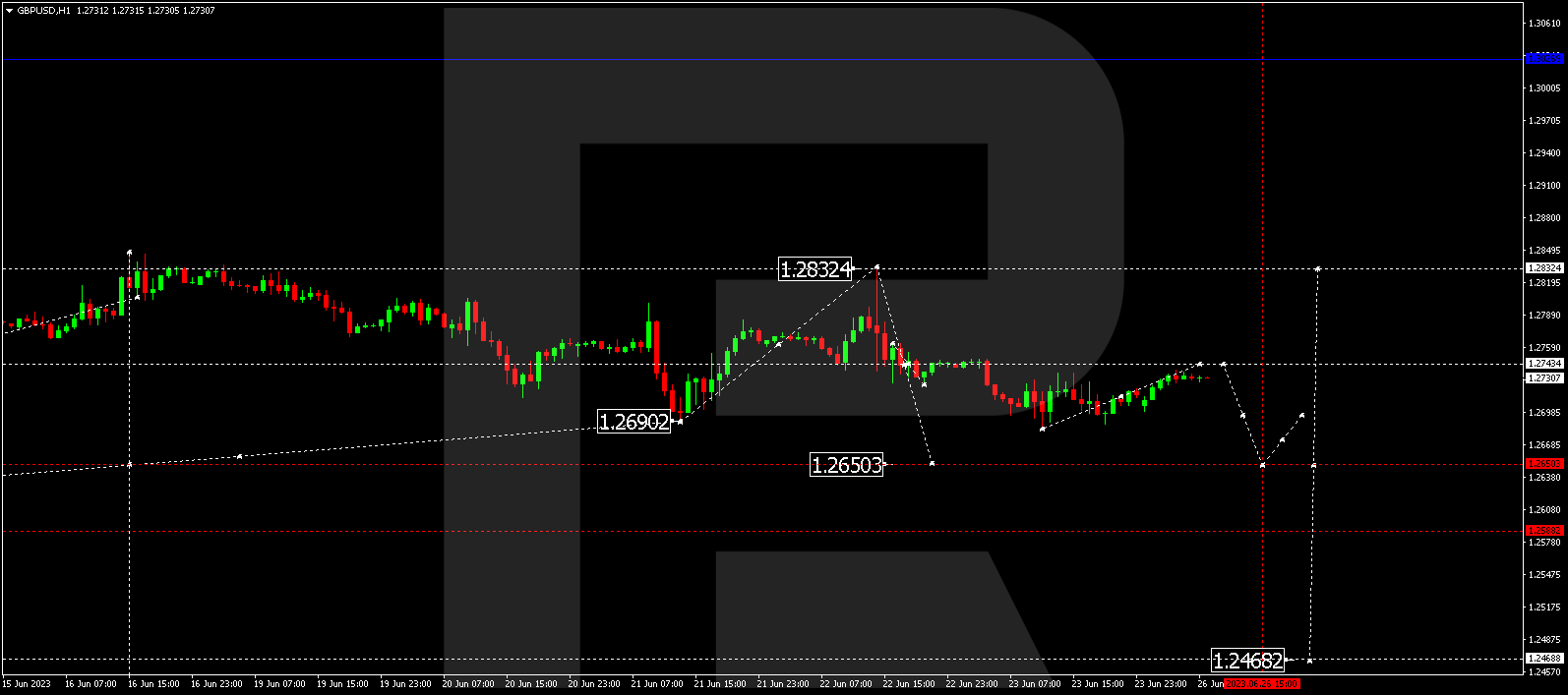

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair is forming a consolidation range around 1.2744. At the moment, the market has extended the range down to 1.2683. A technical test of 1.2744 from below is expected today. Next, the pair might escape the range downwards, reaching 1.2650. And this is just half of the wave of decline.

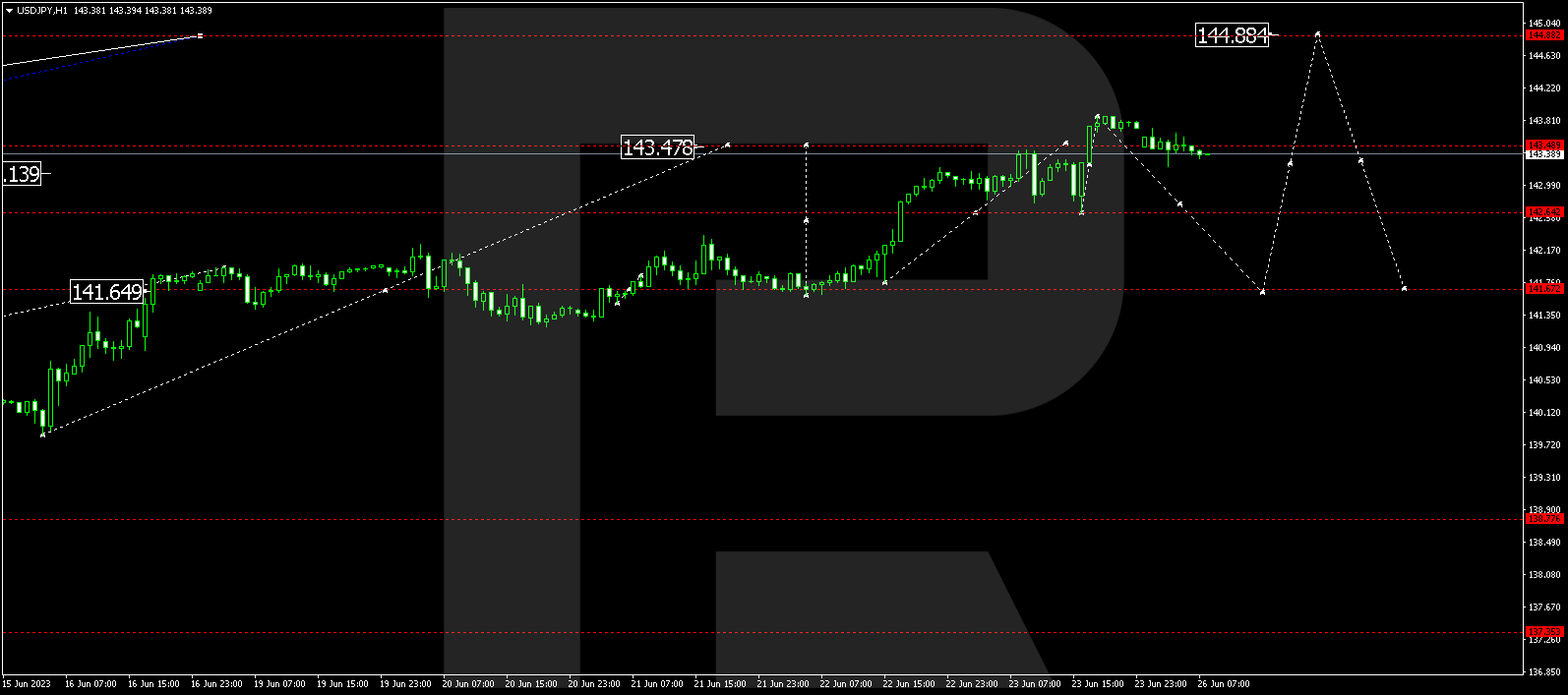

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a wave of growth to 143.85. Today a correction to 141.70 is expected. After it is over, a new link of growth might develop to 144.88.

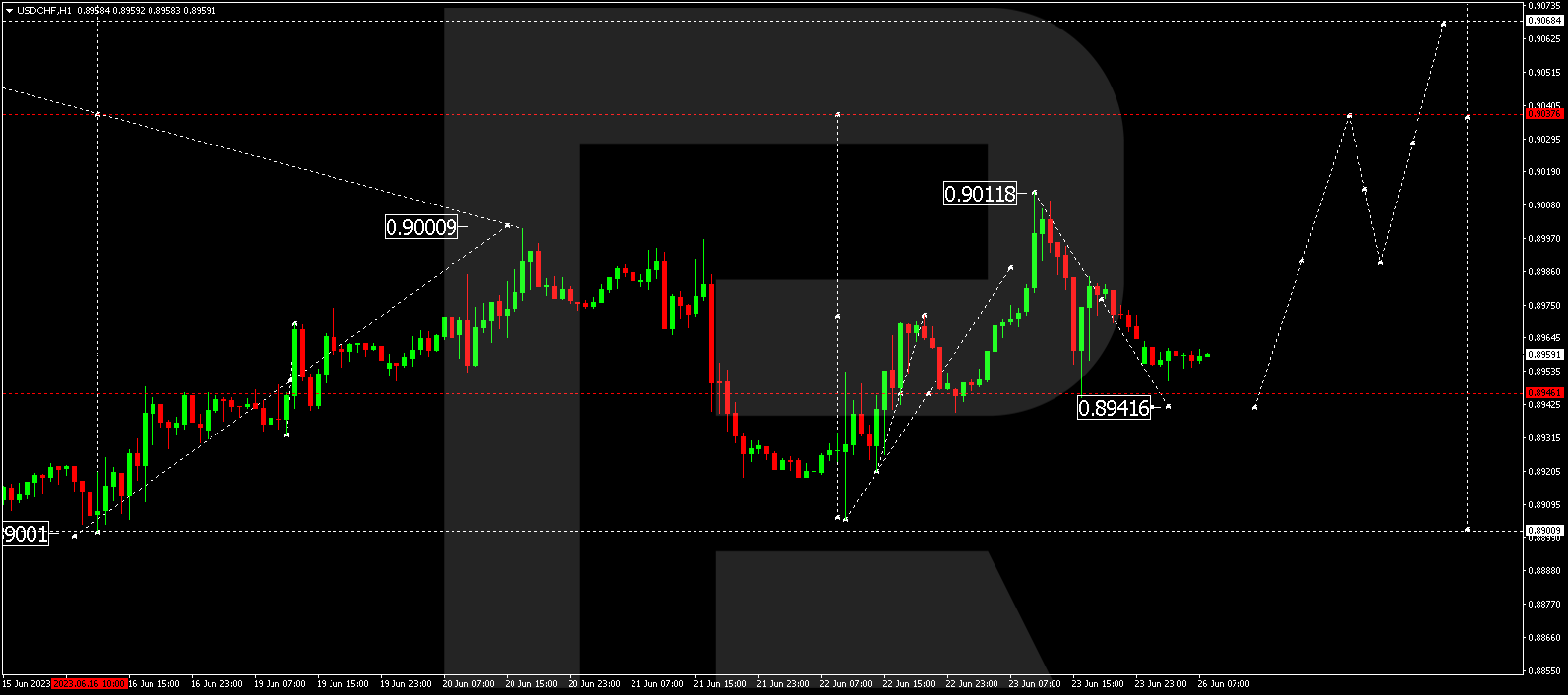

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has completed a structure of a wave of growth to 0.9011. Today the market is correcting to 0.8942. After the correction is over, a new wave of growth to 0.9040 might begin.

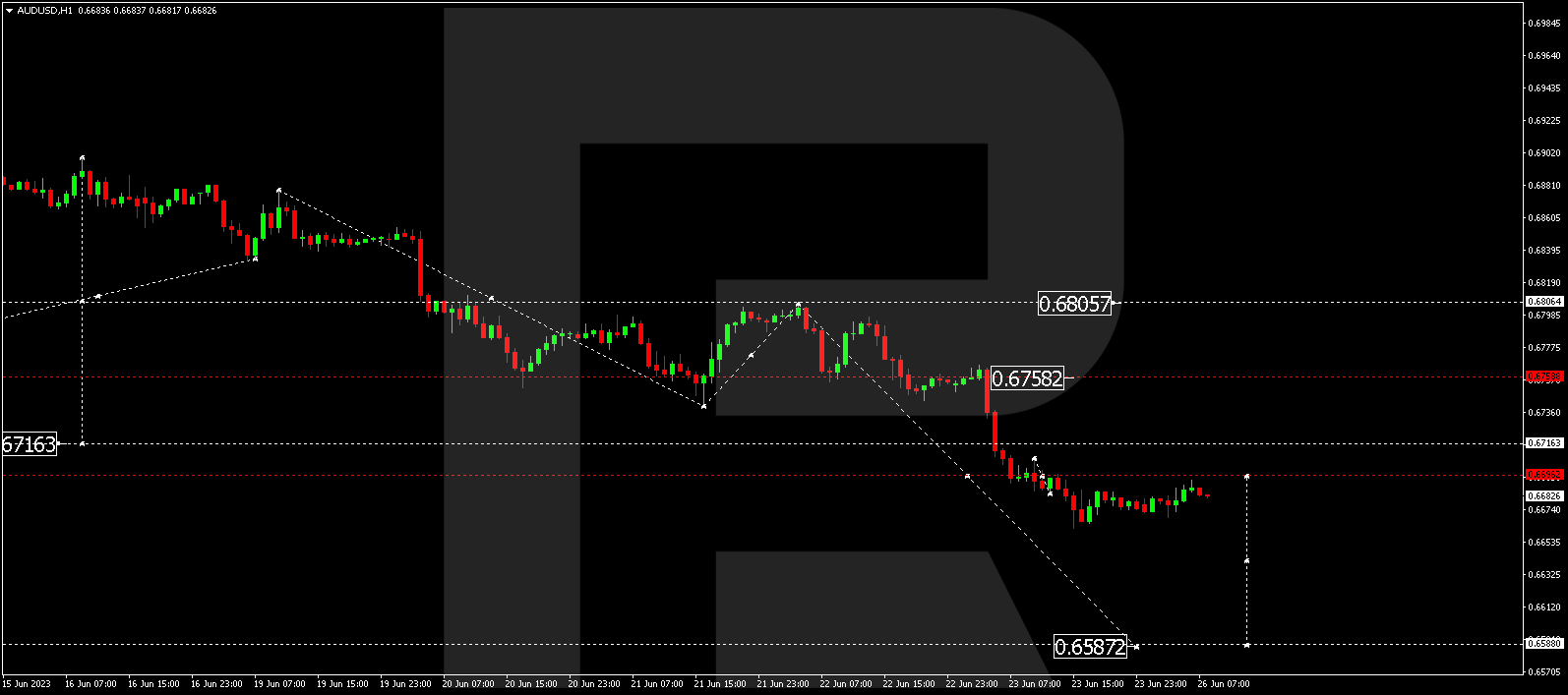

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair continues developing a consolidation range around 0.6696. With an escape from the range upwards, a link of correction to 0.6755 is not excluded. With an escape downwards, the trend could continue to 0.6588.

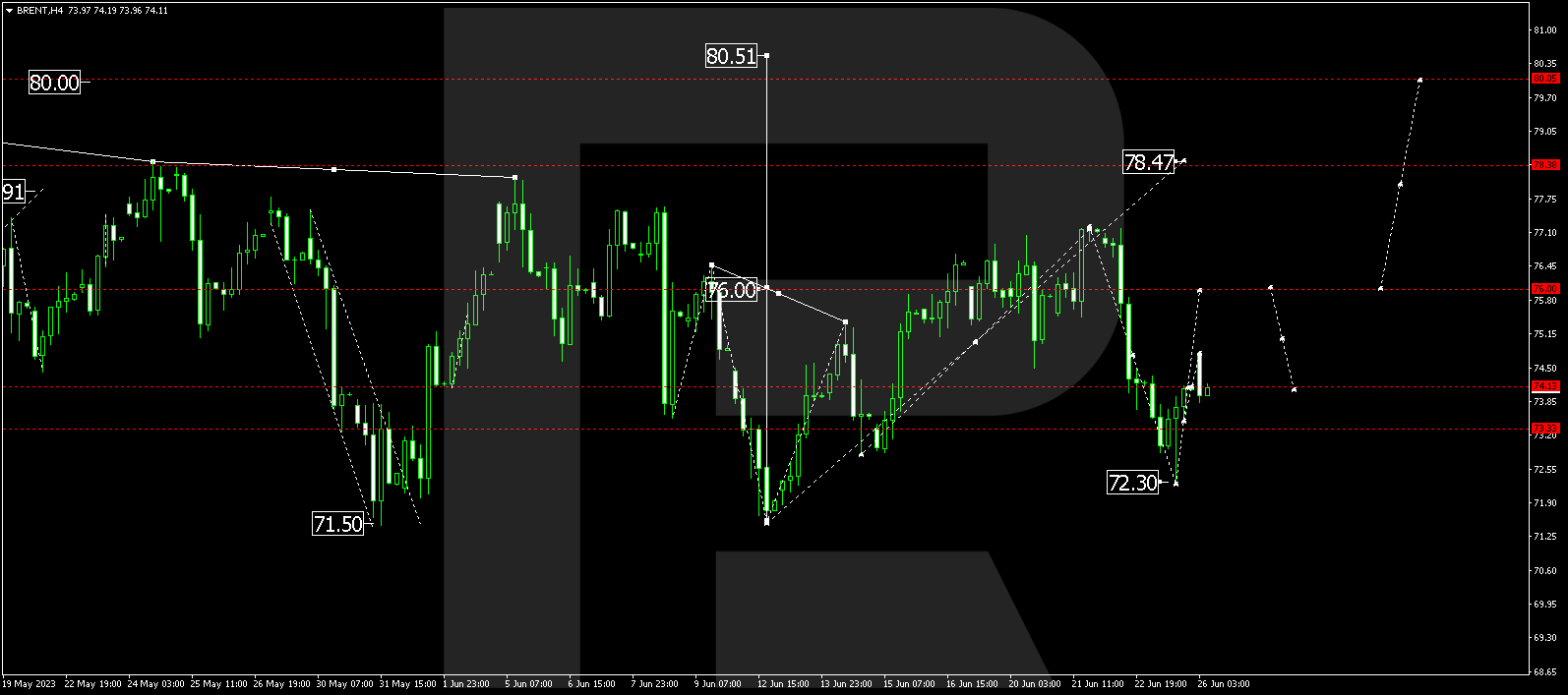

BRENT

Brent has completed a wave of correction to 72.30. Today a link of growth to 76.00 is expected. After the price reaches this level, a link of decline to 74.15 is not excluded. Next, a wave of growth to 78.47 might begin, from where the wave might continue to 80.00.

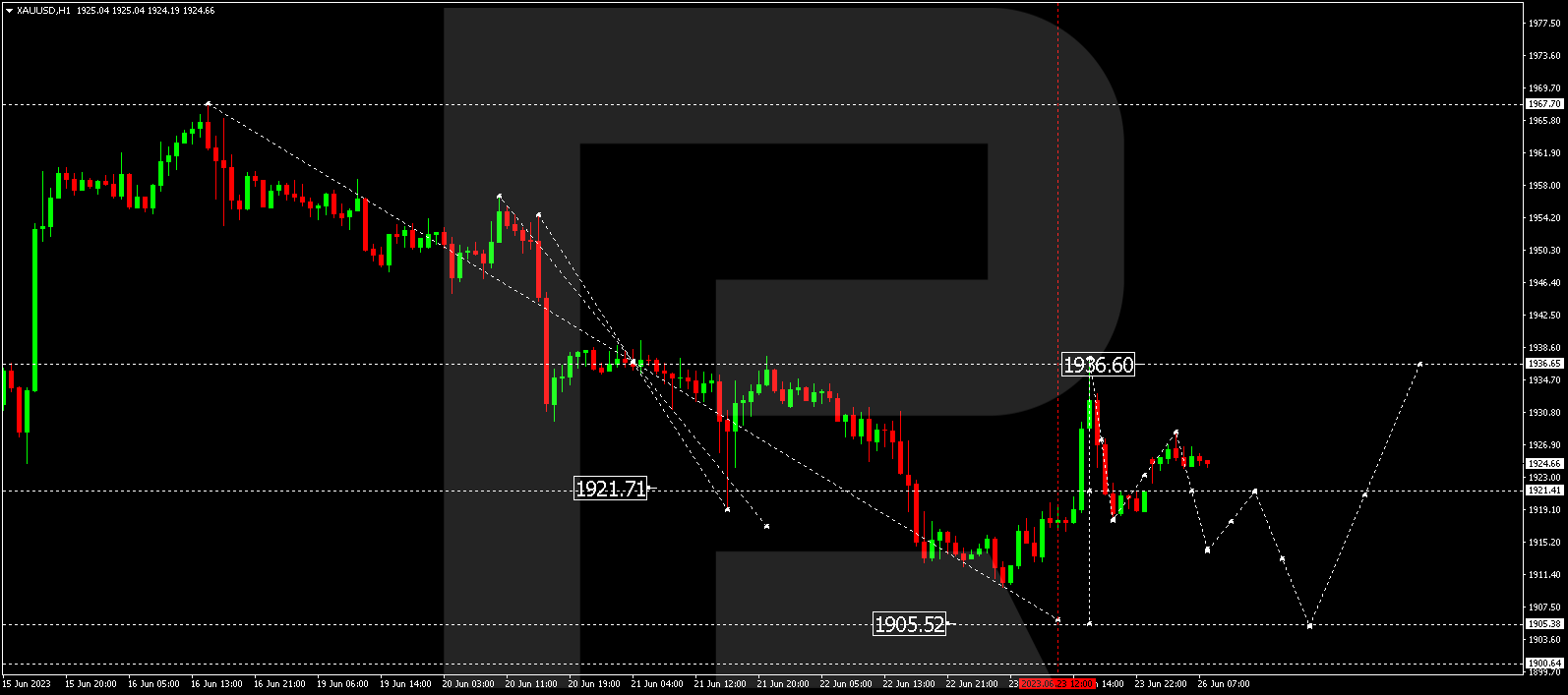

XAUUSD, “Gold vs US Dollar”

Gold has corrected to 1936.80 (a test from below). At the moment, the market has completed an impulse of decline to 1917.90. Today the market is correcting this impulse, aiming at 1928.50. After the correction is over, the wave of decline could continue to 1905.55.

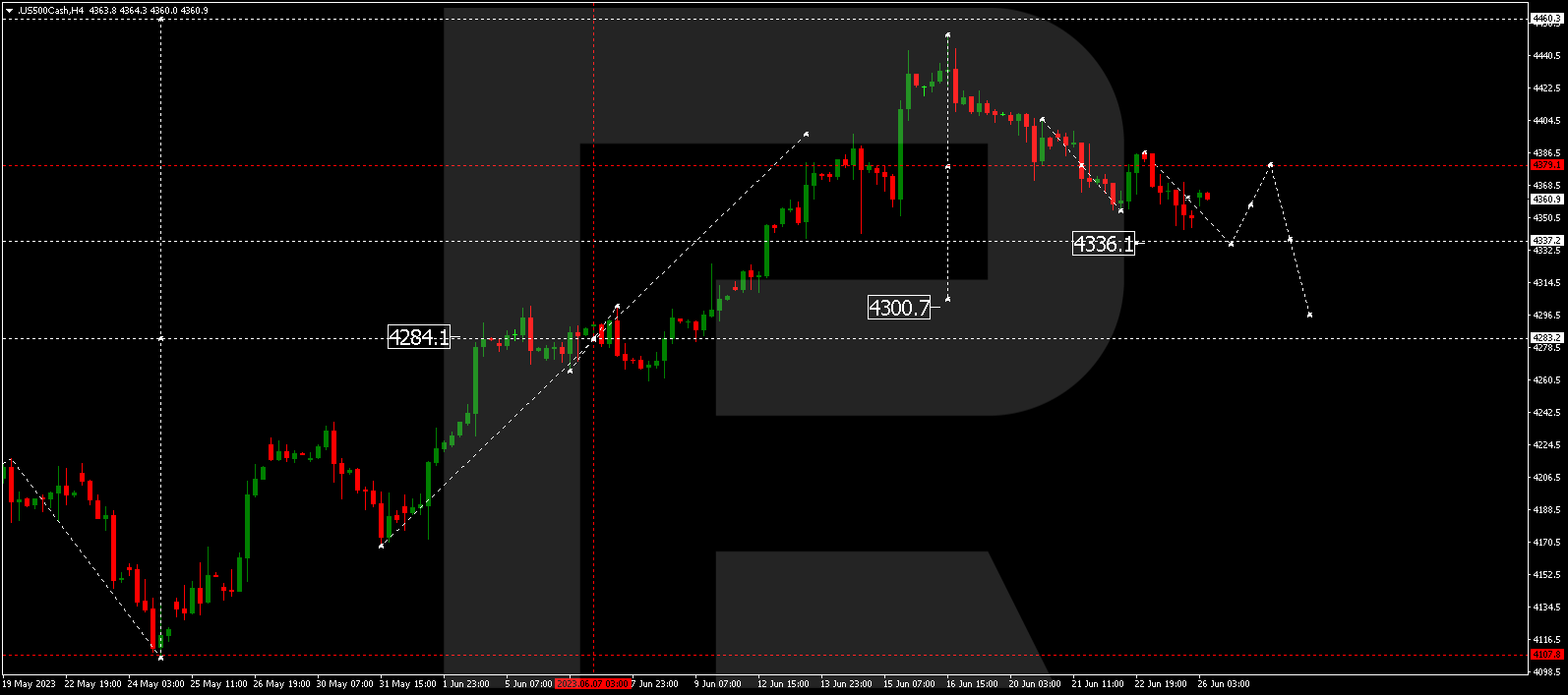

S&P 500

The stock index continues developing a wave of decline to 4336.0. After the price reaches this level, a correction to 4379.0 might follow. Next, a decline to 4296.0 is expected. This is the first target.