Position in Rating | Overall Rating | Trading Terminals |

3rd  | 4.7 Overall Rating |    |

FP Markets Review

In the fast world of forex trading, your broker is super important. They give you the platforms, tools, and everything you need to get into markets and make trades. If you get a broker with small spreads, good support, and cool features, it can really help you win and keep up in this crazy market.

FP Markets is a popular choice for forex trading because it has good prices and a bunch of things you can trade. Whether you're just starting out and want something easy or you're a pro who wants advanced tools, FP Markets has something for you. They've got over 10,000 instruments to trade, including forex, CFDs, and cryptocurrencies, with low spreads, quick trades, and great support.

In this review, we'll figure out why FP Markets is a good pick for traders. We'll look at everything from spreads and trading tools to account types and how commissions work. Based on expert opinions and what users say, we want to give you a good idea of what to expect when you trade with FP Markets.

What is FP Markets?

FP Markets is a well-established forex and CFD broker based in Australia, offering a broad range of financial instruments for trading. Founded in 2005, FP Markets has developed a reputation for its competitive pricing, tight spreads, and strong customer support, making it a solid choice for traders worldwide. The broker provides access to forex, commodities, stocks, and even cryptocurrencies, allowing traders to diversify their portfolios and access multiple markets from a single platform. Whether you are interested in traditional forex pairs or newer digital assets, FP Markets ensures that there is something for everyone, regardless of experience level or trading strategy.

One of the key strengths of FP Markets is its commitment to offering powerful trading tools. Traders have access to popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both known for their advanced charting capabilities, automated trading options, and comprehensive technical analysis tools. These platforms cater to both beginner and professional traders, providing everything from real-time data and customizable interfaces to advanced order execution features. Whether you're looking to trade manually or use algorithmic strategies, FP Markets’ platforms support both approaches seamlessly, helping you to improve trading efficiency.

FP Markets is also fully regulated by top-tier authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring a secure, transparent trading environment. The broker’s regulatory compliance guarantees that clients' funds are handled in accordance with industry standards, offering peace of mind to traders. Additionally, FP Markets provides multiple deposit and withdrawal options, including bank wire transfers, credit/debit cards, and e-wallets like PayPal, Neteller, and Skrill. Withdrawals are generally processed promptly, though some methods, such as bank wire transfers, may take a few days. With over 15 years of experience, FP Markets has built a solid reputation in the industry for providing excellent trading conditions, support, and a wide range of educational resources to help traders improve their skills.

This combination of reliable service, advanced tools, and secure funding options makes FP Markets a trusted choice for both new and experienced traders globally.

Advantages and Disadvantages of Trading with FP Markets

FP Markets Pros and Cons

PROS

- Spreads from 0.0 pips on ECN accounts.

- Available on MT4, MT5, and cTrader.

- Regulated by ASIC and CySEC.

- Fast trade execution.

CONS

- Limited educational resources for beginners.

- Higher commissions on ECN accounts.

- Not available in all regions.

Analysis of the Main Features of FP Markets

4.7 Overall Rating |

4.5 Execution of Orders |

4.6 Investment Instruments |

4.8 Withdrawal Speed |

4.9 Customer Support |

4.5 Variety of Instruments |

4.6 Trading Platform |

FP Markets Customer Reviews

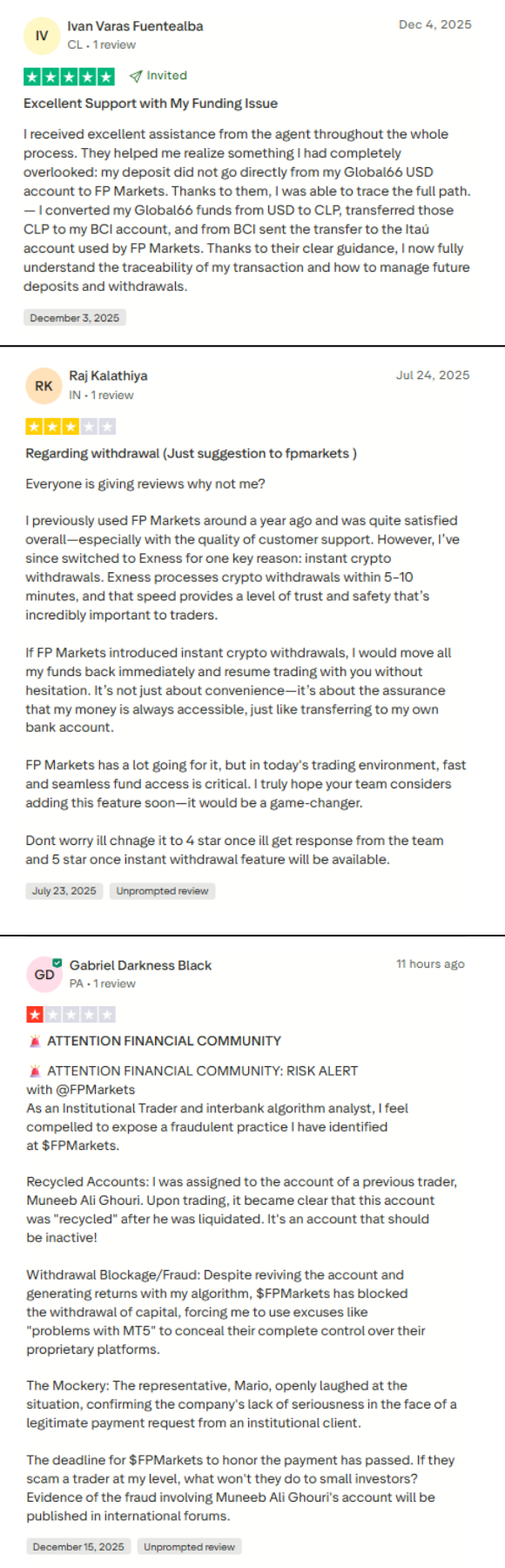

FP Markets is often praised for its quick customer support and user-friendly platform. Traders like the tight spreads, fast trades, and easy deposit and withdrawal methods. It's a good pick if you want strong support and quick trading.

Still, there are red flags when it comes to withdrawals and account issues. Some traders report delays in getting their funds or having to provide excessive documentation to process withdrawals. A few users have also faced problems with recycled accounts and sudden account closures, raising concerns about FP Markets' transparency and customer care. These issues suggest that while the broker offers good features, security and reliability may not always be guaranteed.

FP Markets Spreads, Fees, and Commissions

FP Markets offers a transparent pricing model that changes based on the account you choose. The Standard account on MT4, MT5, or cTrader has spreads starting at 1.0 pips on major forex pairs and no separate commission. This makes it simple for traders who prefer a clear pricing structure without the need to calculate commissions. Spreads on other instruments like metals, indices, and crypto CFDs also follow real market conditions, keeping costs competitive.

For those seeking tighter spreads, the Raw account offers spreads starting from 0.0 pips, but with a commission of about $3 per lot per side. This pricing model works well for active traders or those who trade in larger volumes, as the overall cost (spread plus commission) can be lower than wider spreads alone. The Raw account can be more cost-effective if you trade frequently.

FP Markets does not charge platform access fees for MT4, MT5, or cTrader. However, swap/overnight fees apply if you hold positions overnight. For funding, FP Markets typically does not impose withdrawal fees on trading accounts, but third-party fees may apply for certain payment methods. Leverage can go up to 1:500 depending on your region, offering greater position sizes with smaller capital. However, high leverage also increases risk, so traders should use it cautiously.

How FP Markets Fees Compare to other Brokers

Account Types

FP Markets offers two account types: the Standard account, which provides commission-free trading with competitive spreads, and the Raw account, which offers tighter spreads but charges a commission per lot for more cost-effective trading.

Standard Account

FP Markets offers a Standard account with a minimum deposit of $100, allowing you to trade on MT4, MT5, and cTrader. Spreads start at around 1.0 pips on major forex pairs, and there is no separate commission — all costs are built into the spread. This makes it ideal for traders who prefer a simple, straightforward pricing structure without the complexity of extra fees. It’s a solid option for those who want an easy-to-manage account with predictable costs.

Raw Account

The Raw account also requires a minimum deposit of $100, and you can trade on MT4, MT5, cTrader, and TradingView. With this account, you get spreads from 0.0 pips, but there is a commission of around $3 per lot per side. This setup is beneficial for active traders who want tight spreads and more control over trading costs. The Raw account can lower overall trading expenses if you trade frequently or in higher volumes. Both accounts offer leverage up to 500:1, but it's important to remember that higher leverage increases risk, especially in volatile markets.

How To Open Your Account?

The account opening process on the FP markets is very easy. Anyone who is interested in opening an account on FP markets can go to the official website of the platform. On the very first landing page, there is an option to “open a live account.” However, you can also browse through the website as it provides all the relevant information regarding the FP markets trading services.

After clicking on the “open live account” tab, the website will take you through various account opening processes. The first step is to provide correct personal details, including the email, first name, last name, account type, country, gender, and phone number. After entering this information, clicks on the ” save and next” button.

This step requires more information related to the date of birth, address, zip code, and financial information. After providing this information again, click on “save and next.” The website will now take you to the account configuration process, where you will be asked to choose your preferred trading account, trading currency, leverage options, and choose a password and click ” save and next.”

The next step is the declaration, where questions will be asked about your trading experience, and you will have to accept the terms and conditions which the firm sets. The page also recommends to reads certain procedures from the website before agreeing to open an account. After reading, understanding, and agreeing to the terms and conditions, you can click on “Accept and open account.”

At this point, you will have access to a trading account and can start live trading after depositing the initial amount requirement. However, those who are unsure can also go for a demo account which has all the trading features of the platform, so that you can familiarize yourself with the trading process before actually investing in a live trading account.

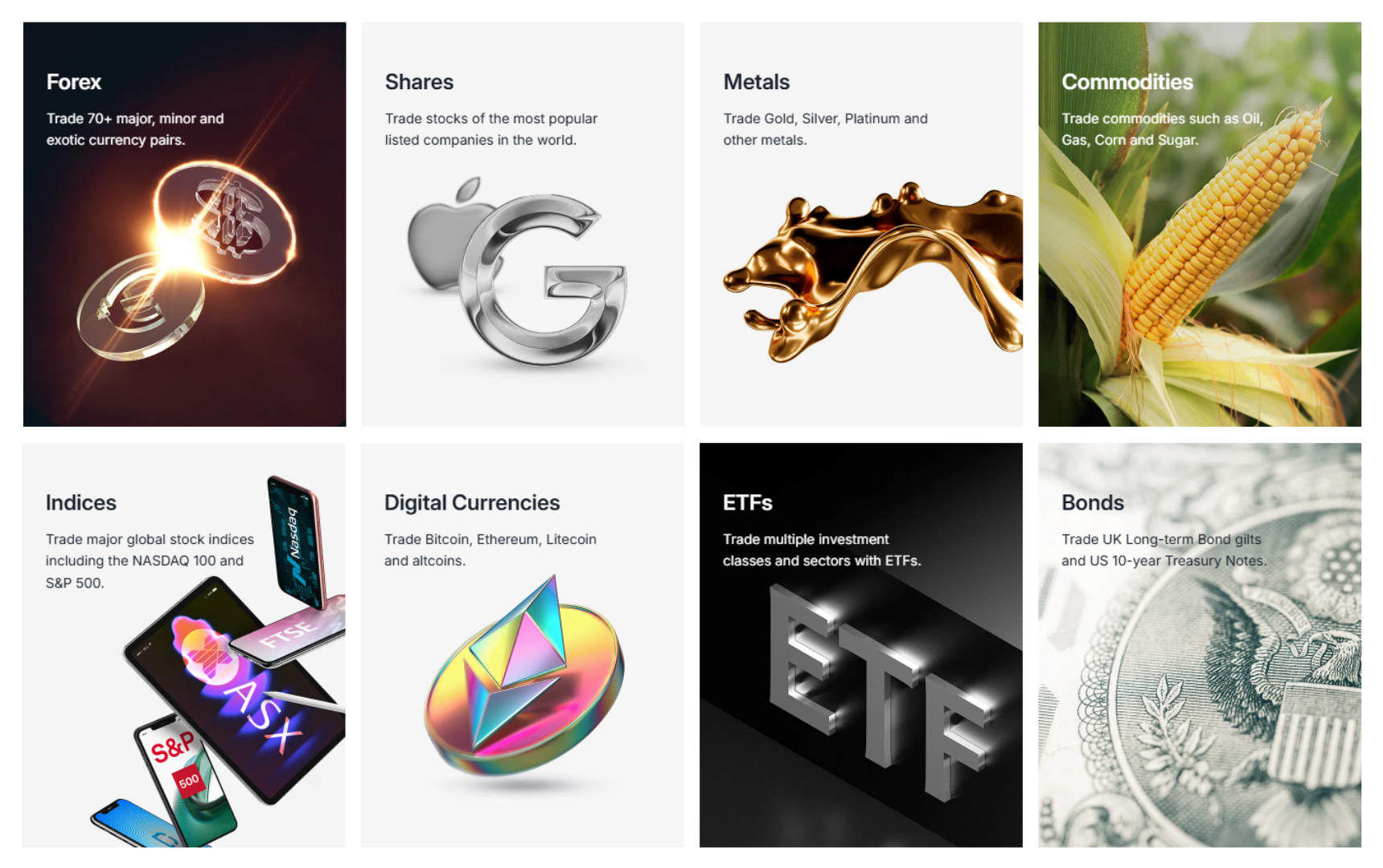

What Can You Trade on FP Markets

FP Markets provides traders access to over 10,000 instruments in global markets, making it a solid option for diversifying your portfolio. They offer 70+ forex pairs, so you can trade common pairings such as EUR/USD or explore others. This variety lets you make the most of different market conditions and strategies.

If you want to trade more than just forex, FP Markets also offers CFDs for stocks, indexes, and commodities. You can trade indexes like the S&P 500 and FTSE 100, and commodities like gold, silver, and oil. These markets let you speculate on price changes without owning the asset, which gives short-term and long-term traders flexibility.

For those interested in crypto, FP Markets allows you to trade crypto CFDs on digital assets such as Bitcoin, Ethereum, Ripple, Litecoin, and others, without needing to hold the coins. With this method, you can use leverage and speculate on crypto prices straight from your trading account.

FP Markets Customer Support

When I needed help with FP Markets, I found their 24/7 customer support pretty responsive. I reached out via live chat for a quick question about account setup, and I was connected to an agent within minutes. The support was clear, and I got the info I needed right away. If I had more complex questions, I tried email, and while responses were a bit slower, they were still helpful and detailed.

There’s also a FAQ section on the website that helped me sort out some basic issues like depositing funds and using the platform without needing to contact support. Overall, FP Markets’ support works well for routine inquiries, but for anything more detailed, response times can vary.

Advantages and Disadvantages of FP Markets Customer Support

Contacts Table

Security for Investors

FP Markets Withdrawal Options and Fees

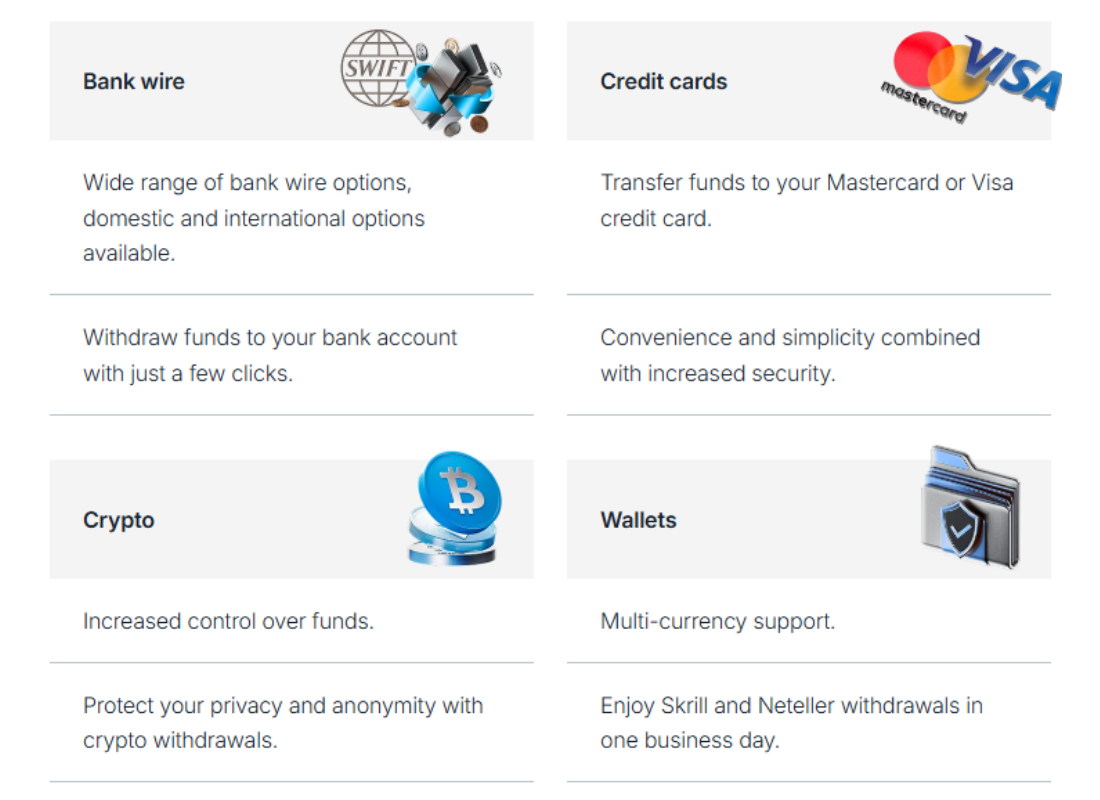

When it comes to withdrawals, traders want a smooth, fast process with as few fees as possible. FP Markets understands this and provides a range of withdrawal methods to ensure flexibility. Traders can withdraw funds through bank wire transfers, credit/debit cards, and popular e-wallets like PayPal, Neteller, and Skrill. These options allow for quick access to funds in a way that suits most traders' needs. E-wallets and credit/debit card withdrawals are typically processed within 24 hours, making them ideal for those needing fast access to their money.

In terms of fees, FP Markets does not charge internal fees for bank transfers or credit/debit card withdrawals. However, third-party charges may apply, especially for international bank transfers. E-wallet withdrawals, while often faster, may incur fees ranging from 1% to 5%, depending on the method used. These fees can vary depending on the payment provider and the location of the trader. While FP Markets keeps their withdrawal fees low, traders should be aware of these potential costs when choosing their preferred withdrawal method.

For those using bank transfers, withdrawals can take 3 to 8 business days, depending on the country and intermediary banks involved. Though FP Markets offers no hidden withdrawal fees, traders should expect additional charges from third-party processors or depending on the payment method. It’s important for traders to plan ahead when withdrawing funds, especially if relying on international transfers.

FP Markets Vs Other Brokers

FP markets review is incomplete without comparing it with other financial market brokers. This comparison would provide a clear picture to the potential traders, investors, and financial institutions who are interested in investing with FP markets or are still searching for the right broker. The differentiation between these brokers will highlight the advantage and disadvantages of each firm for a better understanding.

#1. FP Markets vs Avatrade

Avatrade is a brokerage company founded in 2006 and has been offering services to more than 4000,000 registered users across the globe. The best part about Avatrade is that it is a secured firm that is regulated by not one but more than five regulatory authorities making the funds of the customers safe and protected. With advanced trading tools, a variety of trading instruments, and the availability of different account types, Avatrade can be a good choice.

However, various reviews also reflect the cons of Avatrade, like its complex user interface, slow trading platform, and poor customer service of Avatrade. Comparatively, FP markets have better customer service with an informative FAQ section that guides better, and the prompt response from live chats, along with EAs, helps in resolving issues quickly.

Nonetheless, the biggest advantage of FP markets is that it is cost-friendly, as even when it is not commission-free however, there are no additional charges like overnight premium, inactivity fees, or administration fees like with Avatrade.

#2. FP Markets vs Roboforex

Roboforex is one of the leading brokerage services in the market. It is a licensed company that has been operating since 2009 and has reached millions of customers worldwide. The high leverage of 1:2000 gives Roboforex an edge over other brokers with tight spreads and 24/7 customer service. Moreover, Roboforex also a very low initial eposit requirement of $10 and with accessibility to multiple trading terminals.

With all the rights for Roboforex, it is certainly a better option for traders to invest with as it is also cost-friendly with no withdrawal charges, low minimum deposit requirement, and minimal commissions. However, FP markets could be a choice for big-budget investors or financial institutions as it offers a separate corporate account type for such customers, which is not available at Roboforex.

#3. FP Markets vs Alpari

Alpari is among the most experienced trading platforms in the financial market. Operating since 1998, Alpari has been able to perform better with each passing year and has spread over 2 million customers worldwide. Alpari provides multiple account types, high leverage of up to 1:3000, and an advanced trading platform of MT4 and MT5; Alpari has many advantages. However, the drawback of Alpari remains its limited accessibility of asset classes for its customers.

When FP markets offers a trading selection from forex, indices, commodities, and cryptocurrencies, in contrast, Alpari only deals in forex, metals, and CFDs with slow withdrawal processes and higher commission rates. For this reason, FP markets is a better choice than Alpari, with more trading instruments and comparatively lower trading costs for customers.

How FP Markets Compare against other Brokers

Conclusion: FP Markets Review

FP Markets is a well-known brokerage platform that offers a solid range of trading options, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are perfect for traders who want access to advanced charting tools, automated trading, or a simple interface to suit their trading style. With over 10,000 instruments available, including forex, indices, commodities, stocks, and crypto CFDs, FP Markets caters to both traders looking for broad market exposure and those who prefer to focus on specific niches.

When it comes to pricing, FP Markets provides tight spreads, particularly on their Raw accounts, where spreads can start as low as 0.0 pips, with a commission of $3 per lot per side. For traders who prefer a more straightforward pricing model, the Standard accounts offer spreads from 1.0 pips and no commission, making it easier to track costs. FP Markets is regulated by ASIC and CySEC, ensuring a secure trading environment. It also offers multiple deposit and withdrawal methods like PayPal, credit/debit cards, e-wallets, and bank transfers, although processing times can vary depending on the method used.

While FP Markets stands out for its competitive pricing and regulated environment, some traders have reported issues with withdrawal delays, particularly for international bank transfers, and there are occasional requests for additional documentation during account verification. These issues are not common but may be an inconvenience for traders who need faster withdrawals and smoother account management.

All things considered, FP Markets is a strong choice for traders looking for good pricing, reliable regulation, and a solid range of platforms, but it’s worth considering these potential drawbacks if you rely heavily on quick and hassle-free withdrawals.

FP Markets Review FAQs

Is FP Markets legit?

Yes FP markets is a legitimate firm that is licensed and regulated by two financial commissions. Moreover, FP markets has been in the financial industry since 2005 making it more than 15 years of experience in the field. In addition to this, FP markets has also redeemed many awards incuing the “Best Fx Broker Australia” award in 2020 and “Best Trade Execution” “#1 Most Satisfied Traders” award by Investment Trends Report.

Another credibility of FP markets is that it is providing financial services to more than 10,000 customers which ensures that the firm is working genuinely and is not a scam. Similarly, the reviews and feedback of the customers is also a proof of the legitimacy of the firm.

Is FP Markets regulated?

Yes FP markets is licensed by 1 tier highly trusted regulator that is Australian Securities & Investment Commission (ASIC). Similarly, it is also regulated by an average-risk regulator including the Cyprus Securities and Exchange Commission (CySEC), and the European Securities and Markets Authority (ESMA).

These regulators to only provide a license to any brokerage firm, but also ensures that the firm is performing according to the security threshold and keep all financial transactions under surveillance. This system provides safety of data and funds to the customers and makes sure that they are provided with a segregated account.

Is FP Markets an ECN broker?

Yes FP markets is an ECN broker, as it provides price feeds without any intermediatary from the liquidity providers.This allows the traders and investors to avoid desk dealing or third party brokers where most of the time manipulation of prices conflict of interests are involved.

Therefore, we can say that FP markets provide low-commissioned ECN accounts on advance trading platform of MT4 nad MT5 through price transparency, high liquidity, fast executions and minimal slippage.