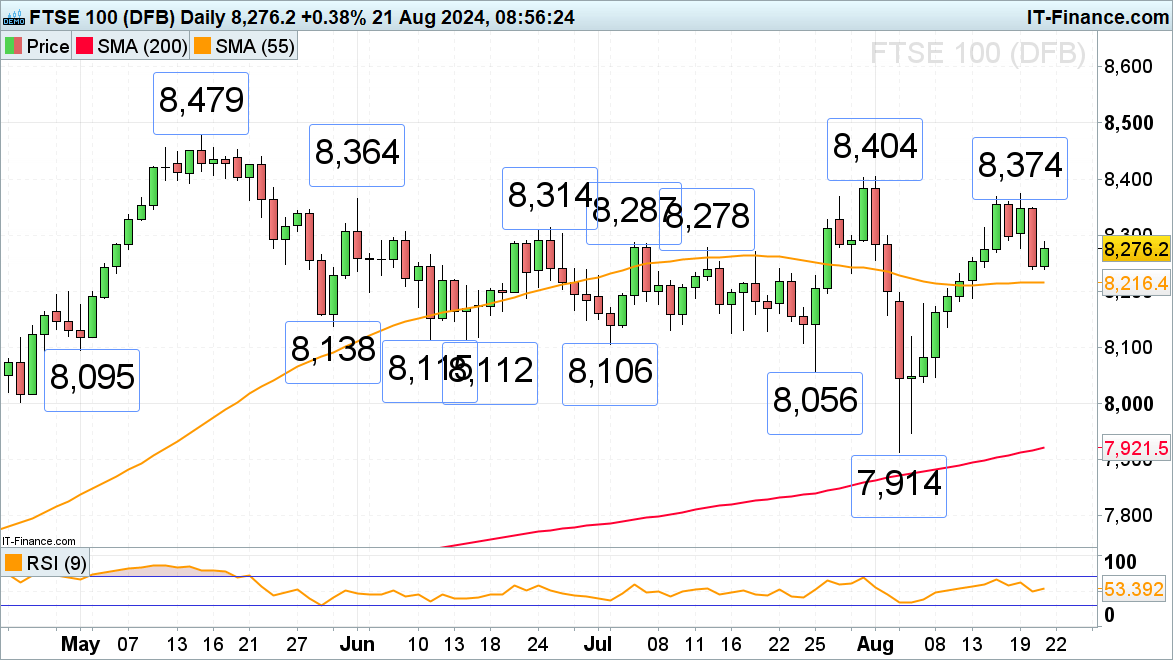

FTSE 100 Pauses After Strong Gains

After nearly two weeks of robust buying, the FTSE 100 is seeing some profit-taking ahead of the release of the US FOMC minutes and the upcoming Jackson Hole symposium, which could provide further insights into US monetary policy. The index may revisit the 55-day simple moving average (SMA) at 8,216 this week, with a significant support zone lying between the late May to early July lows at 8,138 to 8,106. Key resistance remains at the early August high and this week's peak, located between 8,374 and 8,404.

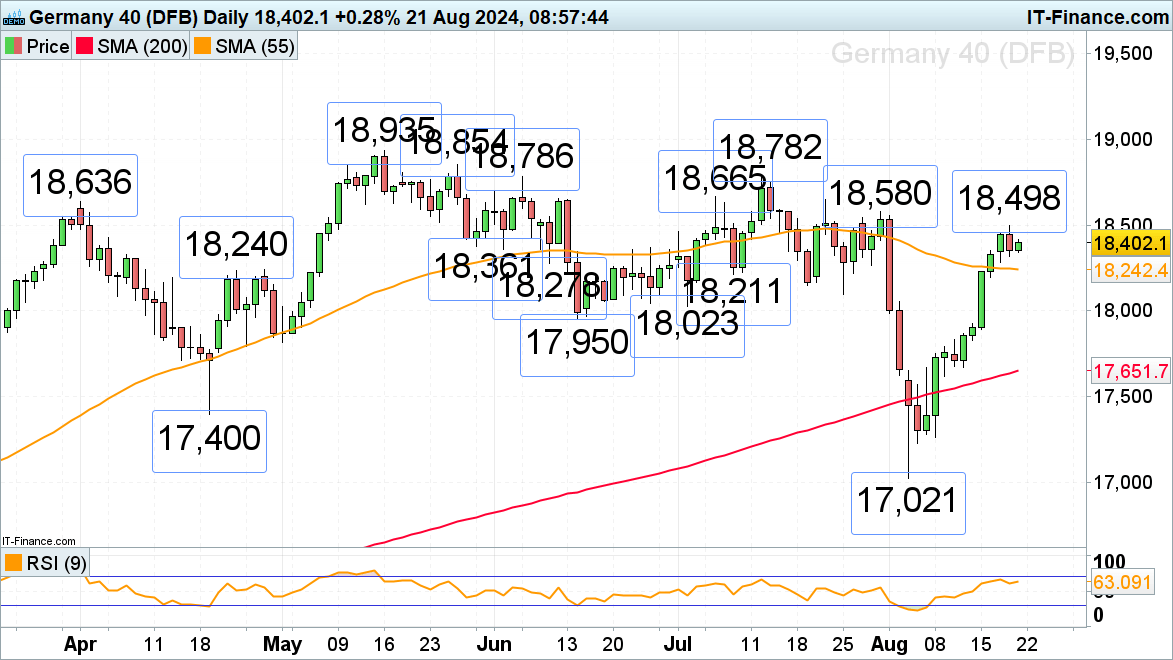

DAX 40 Rally Eases as Momentum Slows

The DAX 40 has seen a quick recovery from its early August low of 17,021, approaching its late July high at 18,580, with a recent rise to 18,498 on Tuesday before profit-taking set in. Minor support is expected around the 55-day simple moving average (SMA) at 18,242, with further support at the 9 July low of 18,211.

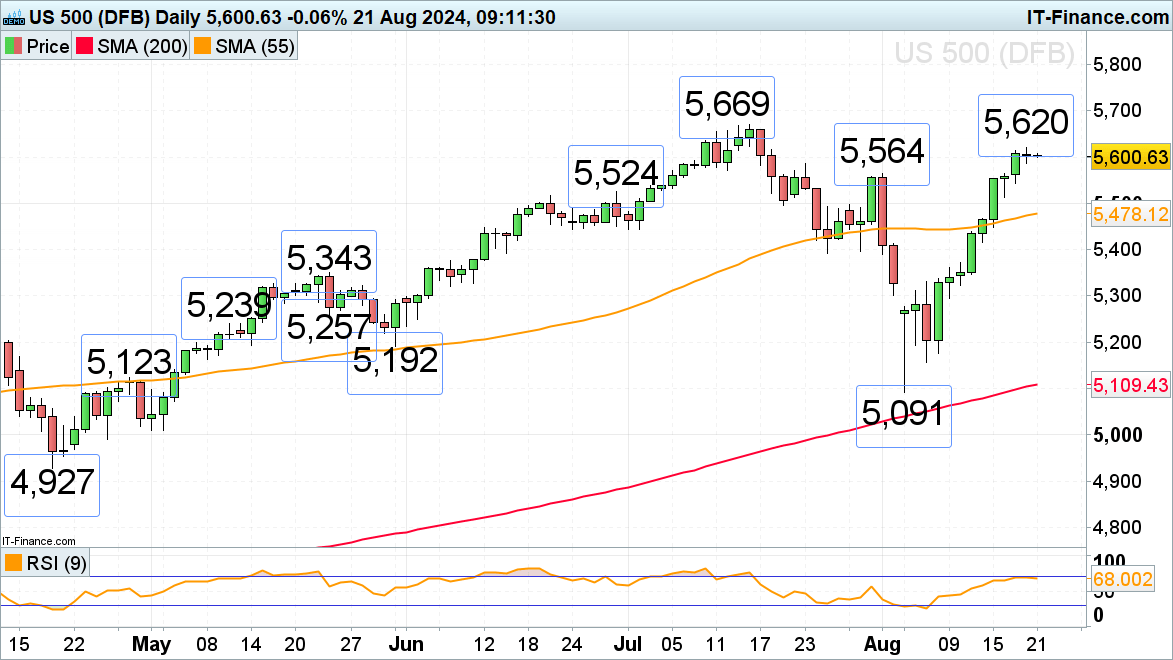

S&P 500 Stalls Ahead of FOMC Minutes Release

The S&P 500‘s strong rally from its 5 August low of 5,091 came just shy of matching a 20-year-old winning streak, reaching a high of 5,620 on Tuesday before slightly retracing. A move above this level could target its July record high of 5,669. Potential declines may find support near the early August high of 5,564.