FTSE 100 Experiences Continued Decline

The FTSE 100 extended its bearish trend on Thursday, experiencing its largest drop this year due to weaker-than-expected flash PMI data for May, particularly in the services sector. On Friday, the index faced further pressure as UK retail sales fell by 2.7% YoY in April, against an anticipated -0.2% decline.

A potential downside target is the late April high at 8,200, with no rise expected above Thursday’s high at 8,385.

DAX 40 Breaks Through Uptrend Line

The DAX 40 is heading for its third consecutive day of losses, having broken through its April-to-May uptrend line.

Minor support is located at the 4 April 18,429 high, followed by the 24 to 29 April highs at 18,240 to 18,238.

Resistance is seen along the breached uptrend line at 18,666.

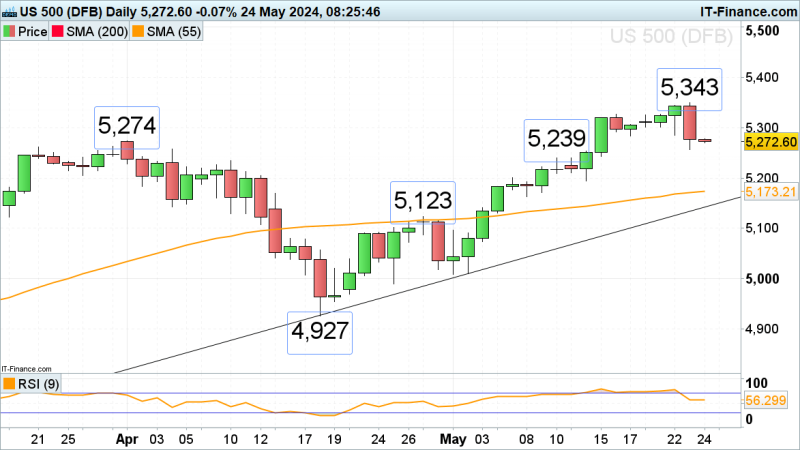

S&P 500 Drops Significantly from Record High

The S&P 500 sharply declined from Thursday’s record high at 5,343, dropping over a percent as strong US flash PMI data heightened expectations that interest rates will remain high for an extended period, causing investors to avoid risky assets.

A fall below Thursday’s low at 5,257 would highlight the 10 May high at 5,239, beneath which lies the mid-May low at 5,194. Breaching this level could indicate the formation of a medium-term top.

Minor resistance above Wednesday’s low at 5,286 is noted at last week’s high of 5,319.