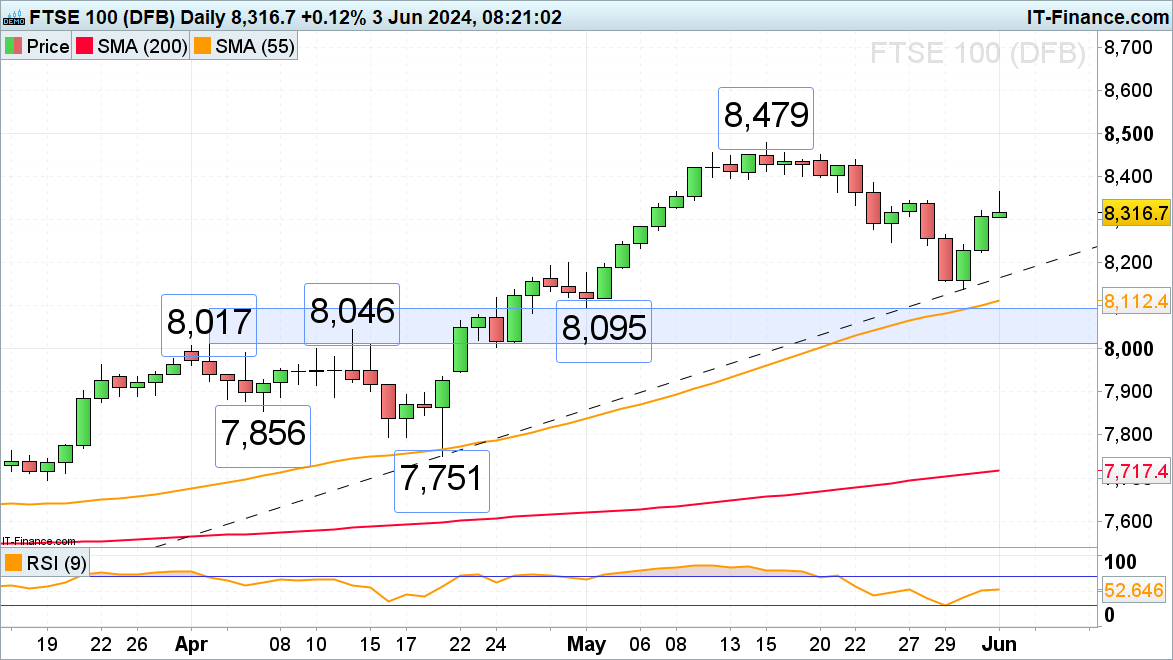

FTSE 100 on Track for Third Day of Gains

On Monday morning, the FTSE 100 briefly rallied above last week’s high at 8,345 before giving back some of its recent gains. Above Monday’s 8,364 intraday high lies the 8,400 region and the May record high at 8,479.

Potential slips may find support around the 24 May low at 8,249.

DAX 40 Remains Short-Term Bid

The DAX 40’s bounce off last week’s low at 18,379 has so far taken it to Monday’s intraday high at 18,700 before stalling ahead of Thursday’s European Central Bank (ECB) meeting, where a 25 basis-point rate cut is expected. If the 18,700 level is overcome, the late May high at 18,854 could be back in the frame.

Minor support can be found around the 24 May low at 18,514.

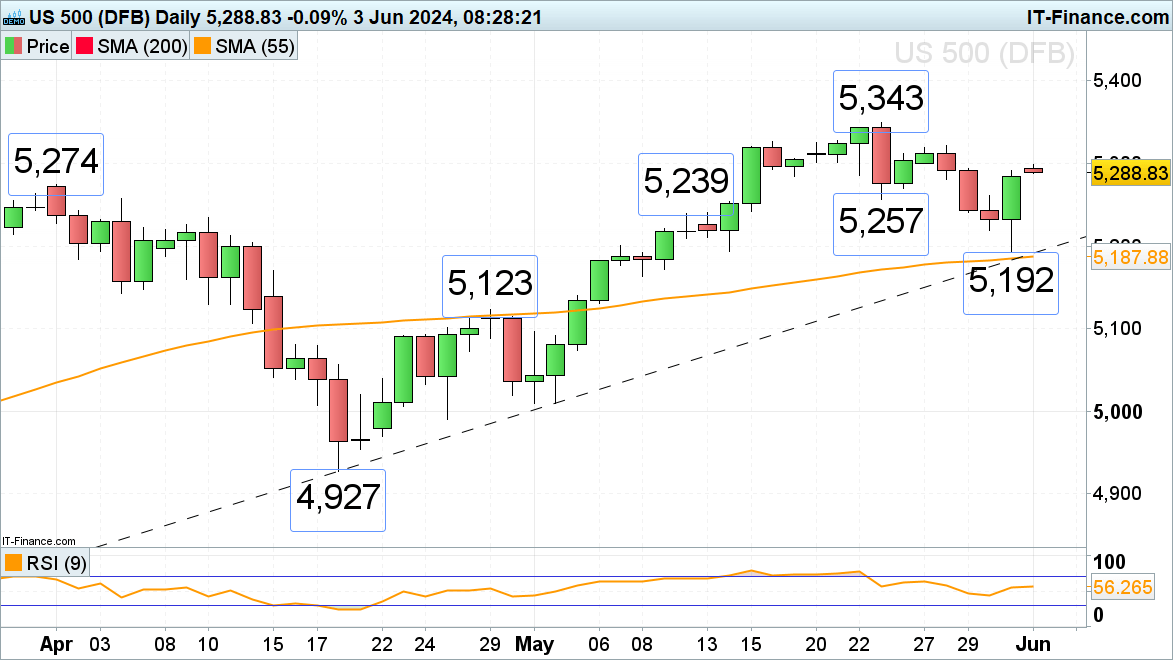

S&P 500 Likely Ended Corrective Move Lower on Friday

The S&P 500’s corrective move lower from its May record high at 5,343 to Friday’s 5,192 low likely ended at last week’s low. It appears to be an Elliott wave abc zig-zag correction, which should be followed by an advance to new all-time highs.

The medium-term uptrend will remain intact while the late May low at 5,192 underpins. Minor support can be spotted at the 30 May high at 5,260 and the 23 May low at 5,257.

Minor resistance sits at the 28 May high at 5,321.