Position in Rating | Overall Rating | Trading Terminals |

2nd  | 4.5 Overall Rating |    |

Funded Trader Markets Review

Funded Trader Markets is a proprietary trading company that offers both evaluation-based and instant funding programs. It started in August 2024 and seeks to give traders quick rewards, clear rules for trading, and low-cost ways to get started with different sorts of accounts.

People also like that the company offers customizable account alternatives, such as one-step, two-step, and instant funding methods. Funded Trader Markets covers a wide range of trading strategies by giving you access to FX, indices, metals, and crypto on 4 platforms (Meta-Trader 5, MatchTrader, C-Trader and Trade-Locker). The company's standards that emphasize on consistency encourage disciplined strategy instead of reckless behavior.

Their customer service team is also quite responsive, which is another plus about them. Traders frequently discuss how quickly support responds to requests, particularly when they are in the evaluation or withdrawal stage. Traders feel more confidence during the funding process when they receive this much assistance.

What is Funded Trader Markets?

Funded Trader Markets is a prop trading firm that lets regular traders get funded accounts through evaluation work or instant funding options. The prop firm formally began in August 2024 and is led by CEO Revin Zabala.

They handle transactions and payouts through a third-party solution called RISE, while also having their own trading platform licenses, with no third-party broker involvement, to assure safe and transparent trading and payment operations. Its tasks are intended to reward people who are consistent and disciplined, rather than those who take risks.

Due to its transparency, clear criteria, and improved reputation among successful funded traders, the company is growing in popularity. Before providing funded accounts, the evaluation procedure evaluates trading skills, risk management, and trading rules. We'll discuss its rules, account kinds, fees, and trading environment next.

Funded Trader Markets Regulation and Safety

Funded Trader Markets is a legally registered proprietary firm based in Saint Lucia, with the registration number 2025-00239. While it is not subject to major financial regulators like the FCA or CFTC, the firm is open about its operations and clearly specifies its terms and trading procedures.

Despite not being regulated by a top-tier organization, as the prop firm industry has no regulatory body and this is considered the norm, Funded Trader Markets has developed risk limits and trading standards that prioritize consistency over aggressive approaches. The corporation openly states its anti-gambling policy and enforces internal consistency criteria to guarantee that traders meet realistic performance objectives.

At the same time, positive feedback on payout consistency and customer service suggests that Funded Trader Markets is gaining trust in the trading community.

Funded Trader Markets Pros and Cons

Pros

- Offers both evaluation and instant funding models

- Fast and consistent payout processing

- Clear, rules-based structure that encourages trader discipline

- Competitive pricing across account types

- Simple, intuitive signup and funding process

Cons

- Instant funding profit split capped at 80%

- Newer firm with limited long-term track record

Benefits of Trading with Funded Trader Markets

Funded Trader Markets stands out on its trading journey for its flexibility and speed, which many organizations lack. Traders can now receive on-demand payouts without having to wait 14 days, and the firm even guarantees a payout within 24 hours, or they will double it. According to reports , the majority of rewards arrive in less than two hours. Traders are paid promptly once profits are realized, and the firm is known for paying traders quickly and reliably.

The company also offers a 100% profit split on certain challenge accounts, swap-free trading, and the chance to trade during high-impact news events. These policies give traders more independence and earning potential without being limited by restrictive conditions.

Traders can also select between MT5, cTrader, Match Trader, and TradeLocker to suit their workflow. Funded Trader Markets provides 24/7 customer support, cryptocurrency trading, small spreads with up to 1:100 leverage, and some of the industry’s lowest entry fees, making it accessible to both beginners and seasoned traders. Traders can expect high service quality and reliable payouts when using the platform.

START TRADING WITH FUNDED TRADER MARKETS

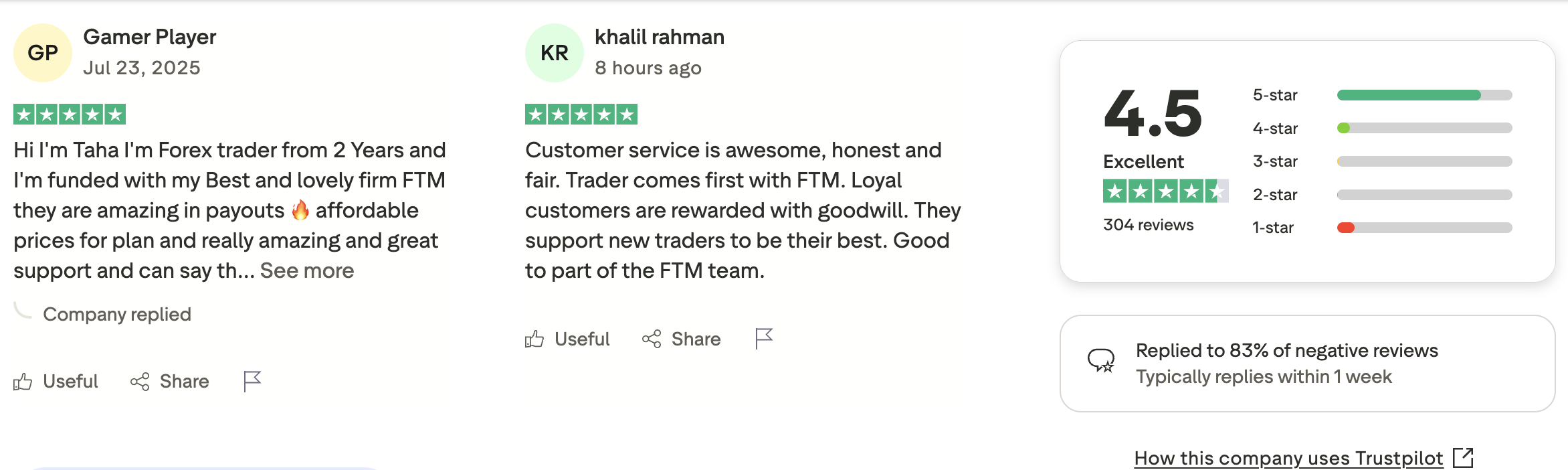

Funded Trader Markets Customer Reviews

Customer feedback for Funded Trader Markets has been overwhelmingly good, with traders applauding the company's quick payouts, prompt assistance, and clear rules. On Trustpilot , consumers commonly highlight payout speeds of roughly 2 hours and claim a simple account creation with no hidden processes or delays.

Reviewers on Myfxbook compliment the company's user-friendly interface and challenge model variety. Many users commend the fairness of the trading regulations, particularly the consistency-focused approach, and claim that the company's support team is quick to assist with everything from login issues to payout tracking.

Reliability is a prevalent theme in both platforms. Compared to older companies with slower processing times or rigid procedures, traders say the experience is clear, quick, and pleasantly professional.

LEARN MORE ABOUT FUNDED TRADER MARKETS

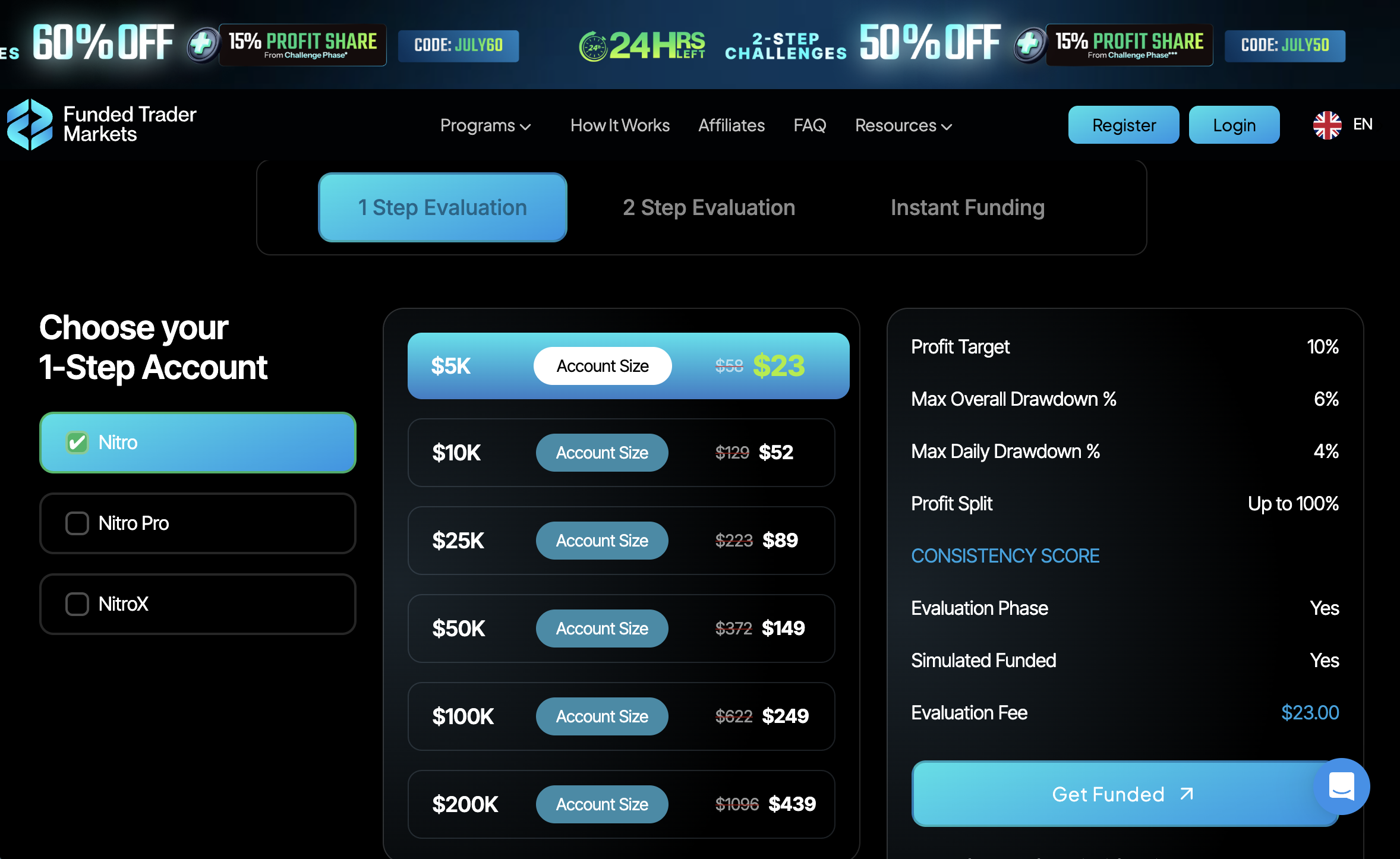

Funded Trader Markets Fees and Commissions

Funded Trader Markets has some of the most reasonable evaluation pricing in the industry. The 1-Step Nitro Pro challenge costs US$15 for a $5k account and scales up to $269 for a $200k account. The Nitro basic plan ranges from $23 to $439 based on account size.

All account kinds (evaluation or instant) provide on-demand rewards without any hidden maintenance or inactivity fees. Traders report that withdrawals are processed swiftly, often within two hours or less, and sometimes in less than an hour.

Account Types

Funded Trader Markets offers three primary financing options: 1-Step Challenges, 2-Step Challenges, and Instant funding accounts. Each is designed for a different kind of trader. Each has its own set of guidelines, objectives, and costs. Before traders can access the firm's capital in the funded stage, they must first complete an evaluation phase, which involves meeting specific trading criteria and demonstrating their skills.

1-Step Challenges (Nitro & Nitro Pro)

Nitro and Nitro Pro One-Step Challenges

These accounts are structured as trading challenges designed to test traders' skills. Each challenge has a single profit goal, with a specific profit target often set around 10% that must be reached to pass. They also have drawdown limits of 4% per day and 6% total. Nitro Pro has slightly stronger limits, but it also includes features such as a 100% profit split for the best traders. Prices for a $5,000 account start at $15.

2-Step Challenges (Speed & Standard)

These are the typical challenges that property firms confront, and they are separated into two categories. Phase 1 typically requires a profit of 8-10%, whereas Phase 2, also known as the second phase of the evaluation, requires a profit of 5%. In this stage, traders must prove their consistency and trading skill to advance to a funded account. These models give traders more time and space to demonstrate that they can be consistent before getting a funded account.

Instant Funding (Standard & Pro)

With instant accounts, traders can start trading immediately. These have an 80% profit split and predetermined drawdown. They are ideal for traders that have a proven method and don’t want to evaluate it. Instant accounts are best suited for experienced traders who have demonstrated consistent results.

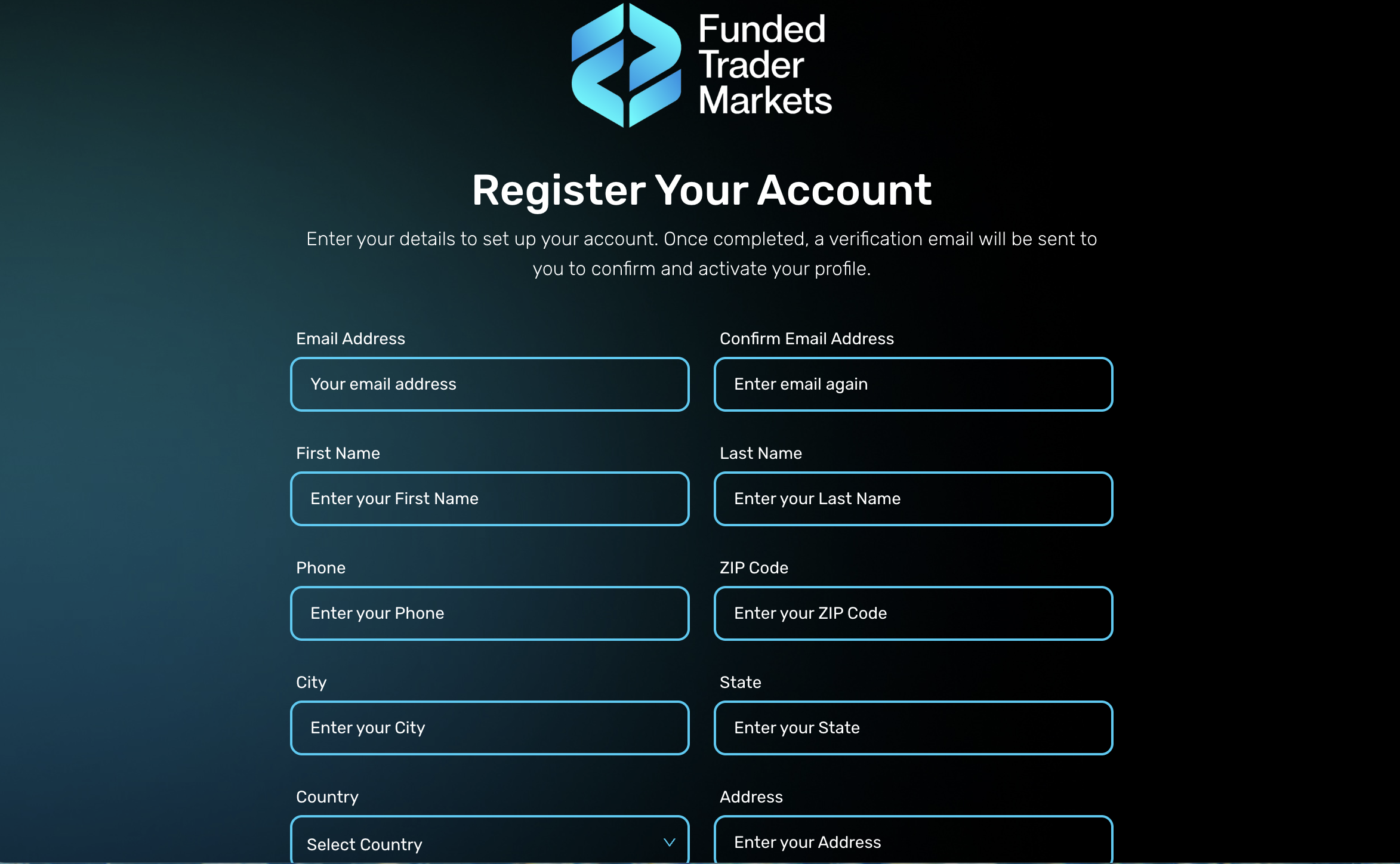

How to Open Your Account

Getting started with Funded Trader Markets is quick and beginner-friendly. Traders can choose from a variety of trading challenges and move through the setup process at their own pace, allowing for flexibility and a personalized experience. Here’s a step-by-step guide:

Step 1: Visit the Website

Visit the official Funded Trader Markets website fundedtradermarkets.com. To begin the registration process, click the “Get Funded” or “Join Now” button.

Step 2: Sign Up with Your Details

Enter your name, email address, and create a password. Make sure your information is correct for a smooth verification procedure.

Step 3: Choose a Funding Model

Choose from their available models: 1-Step, 2-Step, or Instant Funding. You will also select your preferred account size and platform (MT5, cTrader, Match Trader, or TradeLocker).

Step 4: Make Payment

Pay the one-time cost with your preferred payment method. Once payment is received, your trading credentials will be supplied promptly.

Step 5: Agree and Start Trading

Review the terms and conditions before beginning your challenge or live trading. Depending on the account type you choose, Funded Trader Markets allows you to have rapid access.

Funded Trader Markets Customer Support

One standout feature of Funded Trader Markets is its 24/7 customer support, which traders say is “responsive,” “super helpful,” and “always available when needed.”

Whether it’s a payout worry, technical difficulty, or trading rule inquiry, help is simply a live chat or Discord message away, even during weekends. This help that is available 24/7 gives traders in different time zones more confidence.

FTM is also unique in that users may trade cryptocurrency 24/7, giving them greater control over their positions outside of usual market hours. This is a significant advantage for those who prefer to trade at night or on weekends, especially since the support crew is constantly present.

Advantages and Disadvantages of Funded Trader Markets

Withdrawal Options and Fees

Funded Trader Markets allows you to receive your money straight now, without having to wait 14 days. Most withdrawals are completed in less than two hours. If they do not happen within that time frame, they will double the award and provide you with a free account.

Rise Platform

A third-party platform that lets you take out USDC utilizing the Arbitrum network. Rise also makes it easy to send money to banks in certain of the places it works. This gives traders more choices if they don't want to use cryptocurrency.

Cryptocurrency Withdrawals

Withdrawals are made in stable coins (USDT or USDC), generally through the TRC20 or ERC20 networks. This is the most common procedure and is recommended for its quickness and cost.

How Can Asia Forex Mentor Help You Pass Funded Trader Markets’ Evaluation?

Asia Forex Mentor's One Core Program teaches traders great trading discipline, which helps them pass the Funded Trader Markets examination. The program teaches traders how to accurately control risk, which is required to meet FTM's daily and overall drawdown limits of 5% and 10%, respectively. Also concerned with high pall trade pall shoeing and setup validation, which promotes consistency over randomness, essential for attaining the 10% Phase 1 and 5% Phase 2 profit targets without violating limits.

Furthermore, AFM teaches a rule-based strategy that eliminates guesswork and emotion, which is critical for passing FTM's no-lag, live-market conditions. Traders learn to track metrics, refine entries, and prevent overtrading, all of which are important habits to develop while trading under the FTM assessment system.

Asia Forex Mentor's structured training and Funded Trader Markets' flexible funding give prospective professionals the tools they need to succeed. AFM creates strategy and attitude, while FTM provides funds, quick rewards, and growth.

GET EZEKIEL CHEW'S FREE TRAINING NOW

Our Journey at Asia Forex Mentor

Asia Forex Mentor has always worked hard to turn retail traders into professionals who make money. Over the years, thousands of traders have learned from a method that has been tried in war and shown to work. All of the techniques, lessons, and tools are made to work in real markets and meet the needs of institutions.

That's why Funded Trader Markets suits our goals. Our strategy complements their trader-centered funding, which includes flexible evaluations and timely incentives. Trading in a prop firm like FTM allows traders to apply their AFM knowledge and make money.

Many traders reflect on their journey and appreciate Asia Forex Mentor not only for teaching them methods, but also for helping them build the discipline and mindset required to grow their accounts and treat trading as a legitimate business.

OPEN AN ACCOUNT WITH FUNDED TRADER MARKETS

Conclusion: Funded Trader Markets Review

Funded Trader Markets stands out because it offers rapid withdrawals, a true 100% profit share, and no restrictions on news or weekend trading. Traders benefit from quick funding, flexible rules, and 24/7 crypto access, all of which are uncommon in a single prop firm.

For serious traders, FTM's quickness, trust, and trader-first policies outperform most competitors. It's a top alternative for those who want freedom, capital, and quick rewards without the typical barriers.

Also Read: iFunds Review – Latest 2025 Review by Traders

Funded Trader Markets Review FAQs

How fast are withdrawals from Funded Trader Markets?

Withdrawals are normally completed in within two hours. They also have a 24-hour payout guarantee; if your payout is delayed, they will double it (up to $1,000) and issue a free account.

Can I trade crypto or during weekends and news events?

Yes. Funded Trader Markets allows crypto trading 24 hours a day, seven days a week, with no restrictions on weekend or news trading, providing complete freedom across trading styles and schedules.

Does Funded Trader Markets allow internal fund transfers and account management tools?

Yes. FTM's iPass feature permits internal wallet transfers, allowing traders to manage numerous accounts or consolidate earnings without having to wait for external withdrawals.

OPEN AN ACCOUNT NOW WITH FUNDED TRADER MARKETS AND GET YOUR BONUS