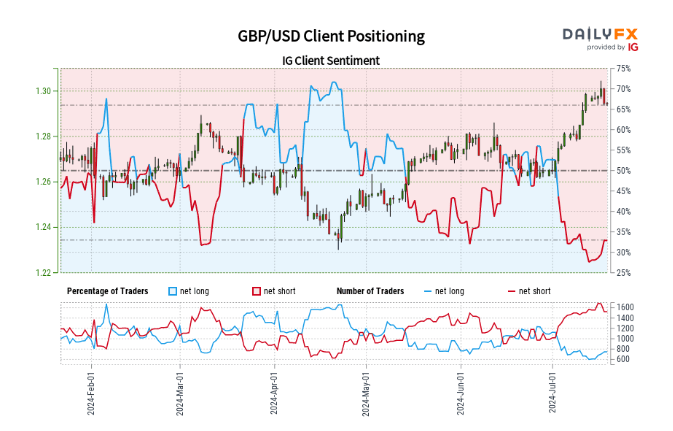

GBP/USD: Potential Downturn?

Recent data shows retail traders are 32.63% net-long with a short-to-long ratio of 2.07:1. There has been a 1.37% rise in net-long positions since yesterday and a 13.89% increase over the past week. Conversely, net-short positions have dropped 4.09% since yesterday but have seen a 1.06% rise from last week.

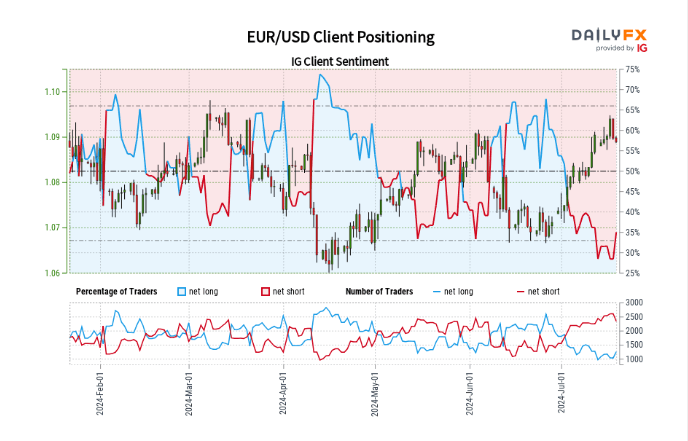

EUR/USD: Ambiguous Sentiment

The data indicates 34.95% of traders are net-long, with a short-to-long ratio of 1.86:1. Net-long positions have surged 20.13% since yesterday but have decreased by 1.65% from last week. Net-short positions have declined 10.96% since yesterday but increased 3.60% week-over-week.

With the current net-short positioning, our contrarian view suggests a potential rise in EUR/USD. However, the mixed changes in net-short positions compared to yesterday and last week imply an uncertain trading outlook for EUR/USD.

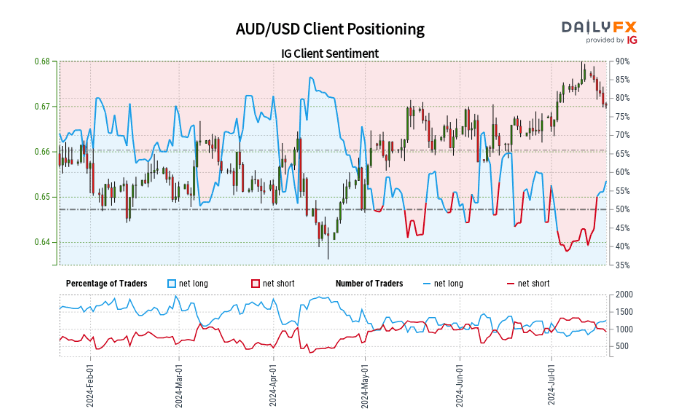

AUD/USD: Bearish Sentiment

The data shows 58.13% of traders are net-long, with a long-to-short ratio of 1.39:1. Net-long positions have grown 6.13% since yesterday and 28.51% from last week. Meanwhile, net-short positions have decreased 8.06% since yesterday and 22.21% over the week.

According to our contrarian trading approach, the net-long positioning indicates a potential decline in AUD/USD prices. The significant rise in net-long positions compared to both yesterday and last week strengthens a bearish outlook for AUD/USD.