Position in Rating | Overall Rating | Trading Terminals |

433rd  | 4.0 Overall Rating |

OPEN AN ACCOUNT

FXCentrum Review

FXCentrum (FXC) is an online broker that offers 2,200 trading instruments, these includes Forex, stocks, indices, commodities, metals, cryptocurrencies, and CFDs. Traders can use the Trader platform of FXCentrum, available for both desktop and mobile devices with over 24 languages, along with features designed for both beginners and advanced users. FXCentrum also offers a low minimum deposit of $10, spreads of 0.2–0.3 pips, leverage up to 1:1000, and copy trading through ZuluTrade, educational materials, free signals, and analytical tools.

In this review, the goal is to provide a clear and practical evaluation of FXCentrum, outlining both its strengths and possible limitations. This review covers topics such as account types, trading conditions, bonuses, fees, and deposit and withdrawal options. By combining objective analysis with trader-focused insights, this review will help you decide whether FXCentrum is the right broker for your trading needs.

What is FXCentrum?

FXCentrum (FXC), is an online Forex and CFD broker that lets you trade more than 2,200 different instruments. These include currency pairs, stocks, indices, commodities, metals, and cryptocurrencies. This lets traders trade in a variety of global markets from one platform.

The broker has three types of live accounts with different trading conditions, as well as a demo account and a demo-real account that lets users move profits to a live account after the trial period. FXCentrum supports trading through its own FXC Trader platform, which is available on desktop and mobile in 24 languages. It has features like low minimum deposits of $10, spreads starting at 0.2 pips, high leverage of up to 1:1000, copy trading through ZuluTrade, educational resources, analysis tools, bonuses, and trading contests.

Is FXCentrum Regulated and Safe?

The Seychelles Financial Services Authority (FSA) has given FXCentrum license number SD055 to do business. This means that the broker is following the law and has to follow certain rules, like KYC (Know Your Customer) and basic oversight by the FSA.

The FSA isn't as strong as the FCA in the UK or the ASIC in Australia. These are higher-level regulators that offer better protections and plans for compensating investors. Because of this, FXCentrum's rules may not protect clients including the brokers who are regulated in major financial areas.

FXCentrum offers negative balance protection to help keep traders safe. This means that you can't lose more than what you put in, and the company says that client funds are kept separate from its operating accounts. Still, the level of safety mostly depends on the FSA's rules and not on other systems for compensating investors.

What Can You Trade with FXCentrum?

FXCentrum allows traders to access a wide range of financial markets through Forex and CFD trading. The broker offers more than 2,200 instruments, including major, minor, and exotic currency pairs, giving traders many options in the global Forex market.

In addition to Forex, FXCentrum provides CFDs on stocks, indices, commodities, metals, and cryptocurrencies. This variety enables traders to diversify their portfolios and trade different asset classes from a single trading platform, using both short-term and long-term strategies.

FXCentrum Spreads, Fees, and Commissions

On major currency pairs, FXCentrum offers competitive trading costs, with spreads ranging from 0.2 to 0.3 pips. For active traders who open and close positions frequently, lower spreads can help cut trading costs. Depending on the account type you select, you will receive a different spread.

With a $10 minimum deposit, the broker is affordable for traders with little money. Spreads are the primary expense for the majority of accounts, though specific commission fees aren't mentioned. Depending on the market and length of the position, additional fees, such as overnight (swap) charges, may be applicable. To be aware of all possible expenses, always review the most recent fee schedule on the FXCentrum platform prior to trading.

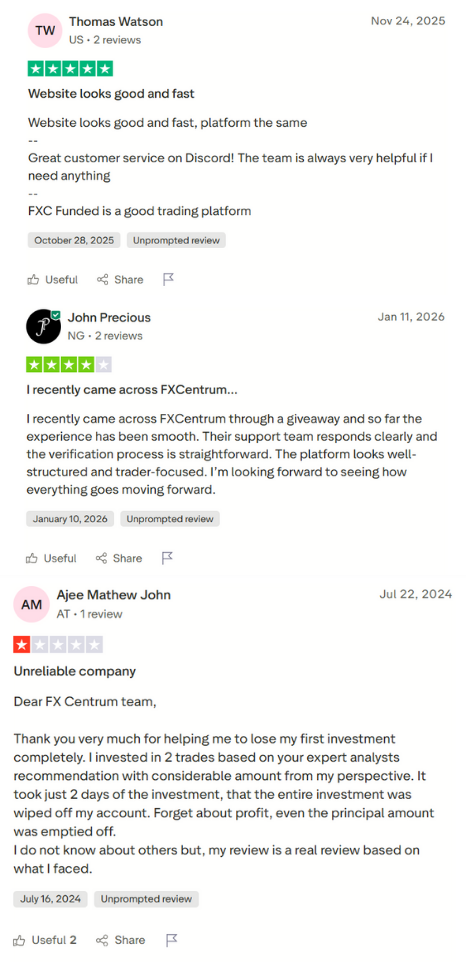

FXCentrum Customer Reviews

Traders' opinions of FXCentrum have been mixed, with many pointing out its large selection of tradable assets and low minimum deposit as advantages. In order to help both novice and seasoned traders gain confidence in their trading, traders frequently value the demo-real account option as well as the availability of educational tools and signals.

Some reviews also point out areas where FXCentrum could improve, such as clarifying fee structures and expanding its regulatory footprint for greater trust and transparency. Overall, customer sentiment tends to reflect the broker’s growing service offerings and usability, but prospective traders should read detailed reviews and user experiences to decide if FXCentrum fits their trading needs.

Advantages and Disadvantages of FXCentrum Customer Support

Trading Platforms and Tools Offered by FXCentrum

FXCentrum provides their own Trader platform for all clients, available to use on both desktop and mobile devices. Their platform supports up to 24 languages and is designed to be user-friendly, this makes it simple for traders of all levels to monitor markets, place trades, and manage positions in real time.

In addition to the main trading platform, FXCentrum offers useful trading tools to support decision-making. These tools include technical and fundamental analysis tools, economic calendar, free market signals, and regular newsfeeds with basic analytics. For those Users who are interested in automated strategies, FXCentrum also supports copy trading through ZuluTrade, allowing you to follow and replicate the trades of experienced traders.

FXCentrum Account Types & Leverages

FXCentrum offers up to several types of live accounts, each with its own set of trading rules that can be tailored to different needs and levels of experience. These account options let you pick the features and prices that work best for your trading style, whether you're just starting out or are already a pro. There is also a demo account for practice and a demo-real account that lets you move your profits to a real account after you have tested your skills.

FXCentrum also offers leverage of up to 1:1000, which lets traders control bigger positions with less money. High leverage can raise both the chances of making money and the risks, so it's important to know how it affects your trading. There are many different types of accounts and leverage options, which gives traders the freedom to set up their accounts in a way that works best for them.

Customer Support at FXCentrum: Is It Reliable?

Users of FXCentrum say that the customer service is good. Traders say that the support staff are helpful, respond quickly, and are clear with the answer to the users questions. Users also say that it's easy to talk to people on social media sites like Discord, where moderators and support teams usually answer questions quickly.

Most customers say that the verification and initial setup went well. Some customers also say that the support team was helpful when they had problems or needed help using the platform. Many good reviews say that they had good experiences with support through email and community channels.

While some reviews, on the other hand, are are mixed. Traders have said they had trouble refunding or that support didn't meet their needs in tough situations. Customers generally think that support is quick to respond and helpful for many users, but experiences can vary. It's a good idea to contact support early on to see how quickly they can help you.

Account Types Offered by FXCentrum

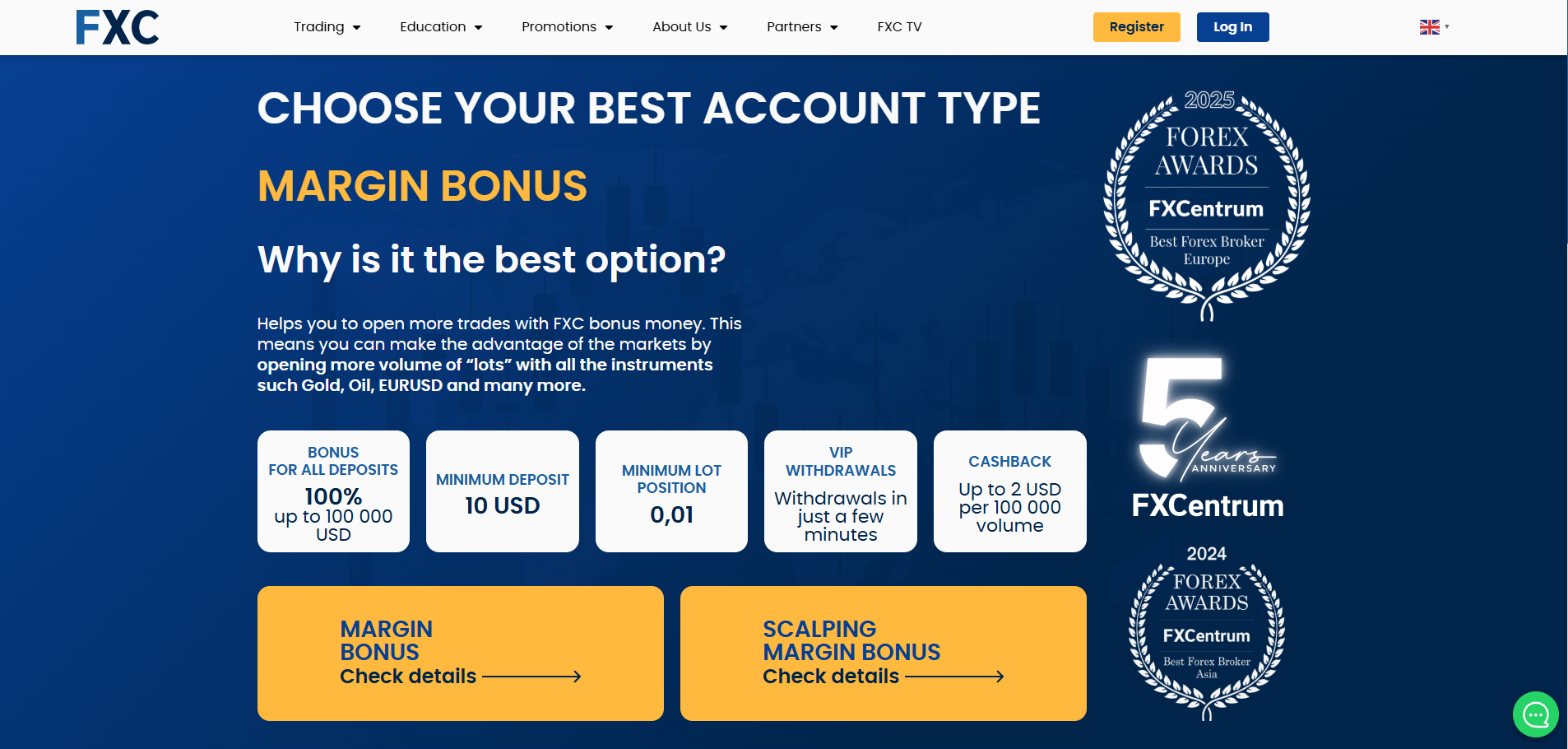

- Floating Bonus Account: A live account type with a low minimum deposit of $10, variable spreads, and bonus features to help boost trading capital. This account is a common choice for beginners or casual traders.

- Margin Bonus Account (100%): This live account also starts at $10 and offers a 100% deposit bonus, giving traders extra equity to trade with. It’s useful for those who want more buying power, though scalping is not allowed.

- Scalping Margin Bonus Account: Designed for more active traders, this live account typically requires a higher minimum deposit (e.g., $10,000) and allows scalping strategies. It includes tighter spreads and other enhanced features.

- Zulu Copytrading Account: An option focused on copy trading via ZuluTrade, letting traders follow strategies from experienced traders. This account type may have separate conditions like fixed spreads and different instrument access.

- Demo Account: A practice account with $10,000 in virtual funds that mirrors real trading conditions so you can learn the FXC Trader platform without risking money.

- Demo-Real Account: A hybrid practice option that lets you trade with virtual funds and, after the trial period, transfer profits to a live account under specific conditions.

FXCentrum Pros and Cons

Pros

- Low minimum deposit starting at $10

- Access to over 2,200 trading instruments

- High leverage up to 1:1000

- Three live account types plus demo and demo-real accounts

- Proprietary FXC Trader platform (desktop and mobile, 24 languages)

- Copy trading available via ZuluTrade

- Educational materials, free signals, and analysis tools

- Welcome bonuses and regular trading contests

Cons

- Regulated offshore with limited investor protection

- No support for MT4 or MT5 platforms

- Bonus terms may come with trading conditions

- Withdrawal fees may apply after free limits

- Platform choice limited to FXC Trader only

FXCentrum Withdrawal Fees and Options

FXCentrum lets traders withdraw money in a number of ways, such as bank transfer, card payments, USDT/Tether, and other digital payment methods. This gives traders a lot of options for getting their money. Once you've sent in the necessary paperwork and been verified, you can withdraw money directly from the client portal. Depending on the method you choose, the processing time usually takes anywhere from a few minutes to 24 hours.

FXCentrum doesn't charge you for your first withdrawal each month, which can help you save money on trading costs. But there is a $10 fee for the second withdrawal in the same month, and for the third or more withdrawals, the fee is 2.5% of the amount withdrawn. These fees are pretty common for brokers that let you take money out often.

Before you ask for a payout, you should read the terms carefully. Some user reviews say that there are delays or conditions that come with bonuses and profit transfers. You can avoid surprises when you take out money by checking the latest fees and requirements in your FXCentrum dashboard.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Our Final Verdict on FXCentrum

Many traders like FXCentrum because it has a lot of tradable assets, low minimum deposits, high leverage, and a platform that is easy to use. A lot of people who leave reviews say they had a good experience overall, mentioning good customer service and easy verification processes.

Some traders, on the other hand, have had bad experiences with withdrawals, bonus conditions, and transparency, according to what they have said online. Some independent reviews point out that FXCentrum may not be as safe as brokers that are regulated by major authorities because there isn't much regulation and oversight is unclear.

In short, FXCentrum might be a good choice for traders who want to trade in a lot of different markets and don't want to pay a lot to get started. However, it's important to read the terms carefully, especially those about withdrawals and regulation, before putting money into the account. You can figure out if it meets your trading needs and risk tolerance by comparing it to other brokers that are well-regulated.

FXCentrum Review: FAQ’s

What is FXCentrum?

FXCentrum is an online Forex and CFD broker that offers access to more than 2,200 trading instruments, including forex pairs, stocks, indices, commodities, metals, and cryptocurrencies. Traders use the proprietary FXC Trader platform, which is available on desktop and mobile devices.

What is the minimum deposit and leverage at FXCentrum?

The minimum deposit at FXCentrum starts from $10, making it accessible for new traders. The broker offers leverage of up to 1:1000, allowing traders to open larger positions with smaller amounts of capital.

Does FXCentrum offer demo accounts?

Yes, FXCentrum provides both a standard demo account and a demo-real account. These options allow traders to practice strategies without risk, with the demo-real account offering the ability to transfer profits to a live account after the trial period.

OPEN AN ACCOUNT NOW WITH FXCENTRUM AND GET YOUR BONUS