BoE's Catherine Mann Signals Inflation Concerns

Catherine Mann, a member of the Bank of England’s Monetary Policy Committee (MPC) and one of the four policymakers who recently voted to keep interest rates steady, cautioned over the weekend that inflation might see an uptick in the coming months. In an interview with the Financial Times, Ms. Mann highlighted recent surveys indicating an “upwards ratchet” in both wage-setting and pricing processes. She suggested that this could be a structural issue, developed during the past couple of years of high inflation, and warned that it may take considerable time to unwind.

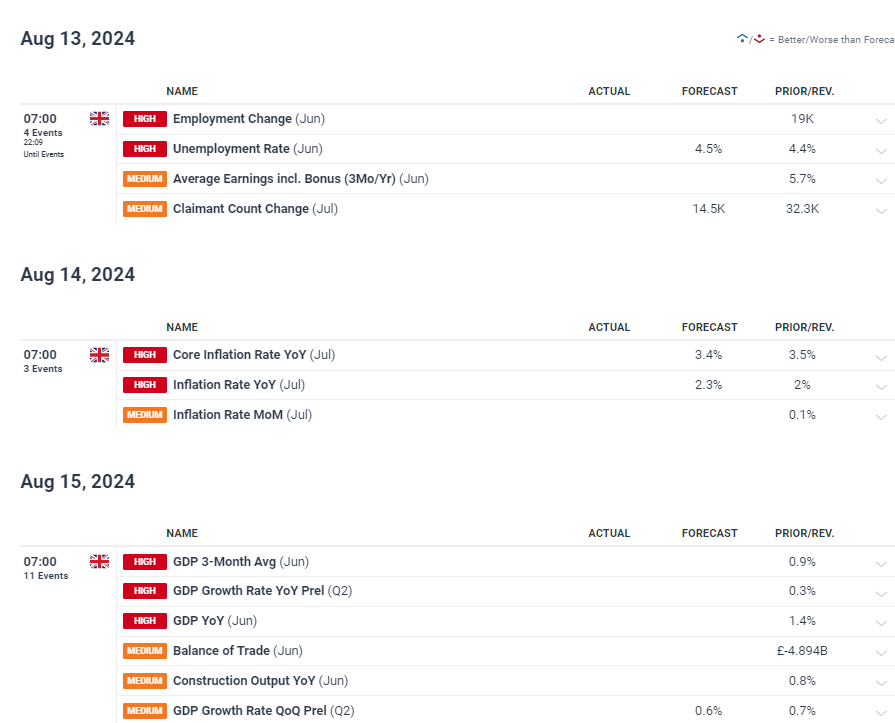

Ms. Mann's comments come just before a packed week of economic data releases, including the latest figures on UK employment, wages, inflation, and GDP.

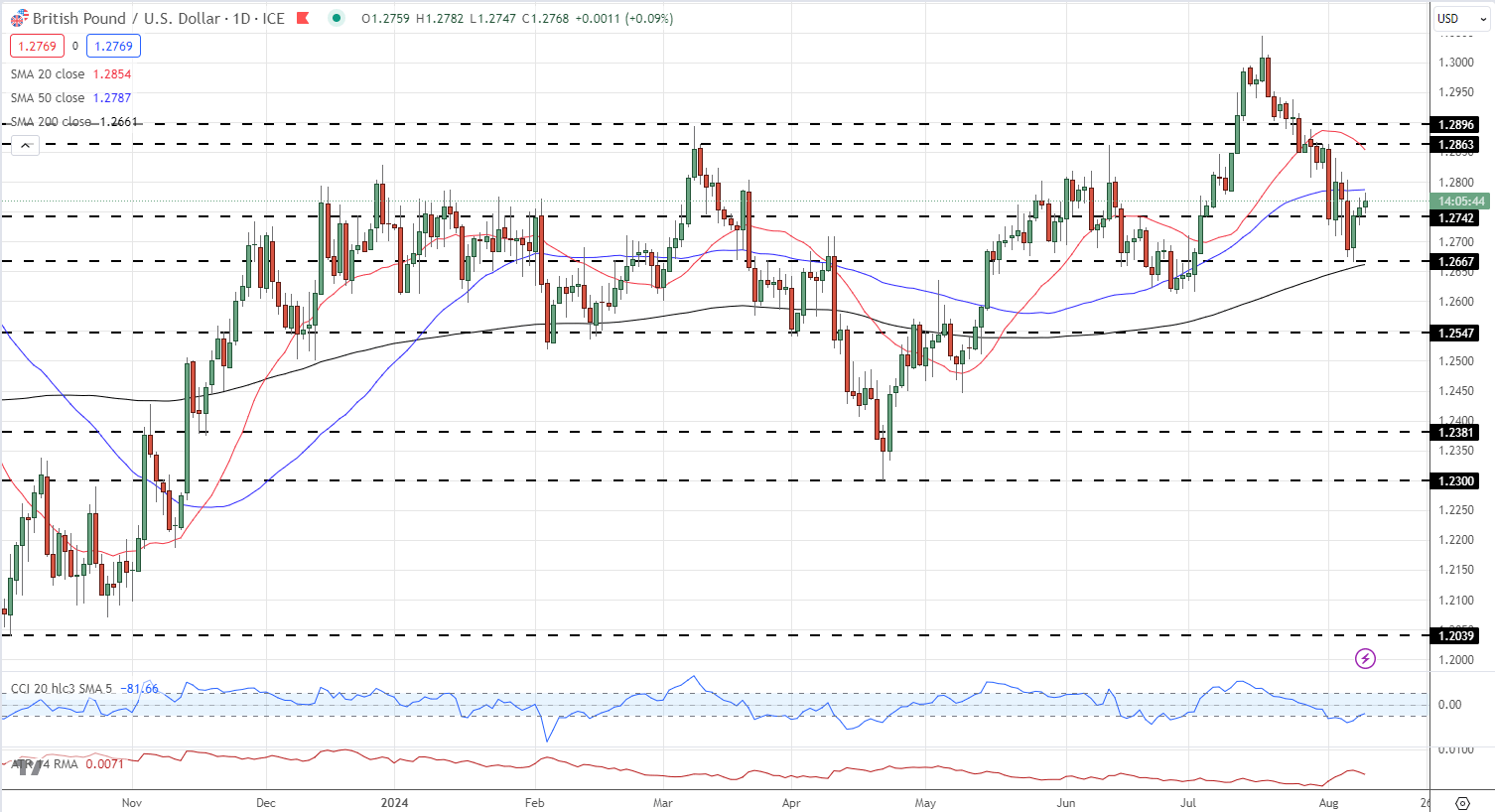

GBP/USD Rebounds from Multi-Week Low

The GBP/USD currency pair hit a multi-week low of 1.2665 last week due to a weaker British Pound and a stronger US Dollar. However, the pair has since rebounded, supported by the 200-day Simple Moving Average (SMA), and is currently trading around 1.2770. After hitting a 13-month high of 1.3045 on July 17, the pair is attempting to break out of a sharp one-month downtrend. This week’s economic data will be crucial in determining the pair’s direction. Key support is located around 1.2665, underpinned by the 200-dsma at 1.2661, while immediate resistance lies near 1.2863.

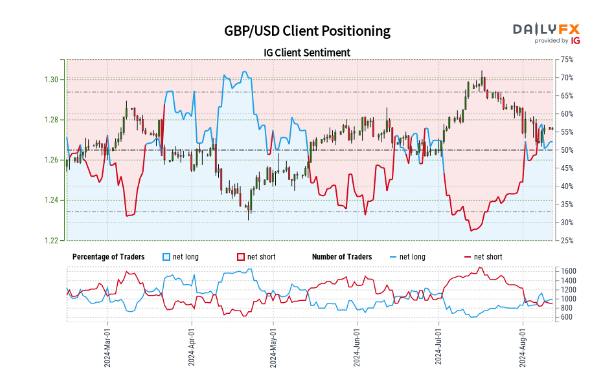

Retail Sentiment Hints at Further GBP/USD Weakness

Retail trader data reveals that 51.94% of traders are currently net-long, with the long-to-short ratio standing at 1.08 to 1. The number of traders net-long has increased by 0.92% since yesterday and by 13.53% compared to last week. Meanwhile, the number of traders net-short is 0.44% higher than yesterday and 4.78% lower than last week.

Analysts often take a contrarian stance to crowd sentiment, and the fact that traders are net-long suggests that GBP/USD prices may continue to decline. The growing net-long positions, combined with recent sentiment shifts, reinforce a bearish contrarian outlook for the pair.