UK Manufacturing Sees Robust Expansion in May

In May, the UK manufacturing sector saw significant growth, marking the fastest expansion in over two years. This surge was fueled by a strong influx of new orders. Optimism among manufacturers reached its peak since early 2022, with 63% of companies expecting increased output in the coming year. The S&P Global UK Manufacturing PMI rose to 51.2 in May from April's 49.1, achieving its highest level since July 2022, albeit slightly below the preliminary estimate of 51.3.

Rob Dobson, director at S&P Intelligence, noted, “May featured a robust revival in UK manufacturing with the fastest rise in production levels and new business since early 2022. The recovery spanned across all main sub-industries—consumer, intermediate, and investment goods—and across all company sizes, a first in more than two years.”

Sterling Strengthens on Positive Economic Indicators

The Sterling's effective exchange rate has returned to its pre-Brexit vote levels of June 2016. This measure, which represents the weighted average of the British Pound relative to a basket of major trading partners' currencies, has been bolstered by favorable UK economic data and a positive risk sentiment. This support has contributed significantly to the pound's performance this year.

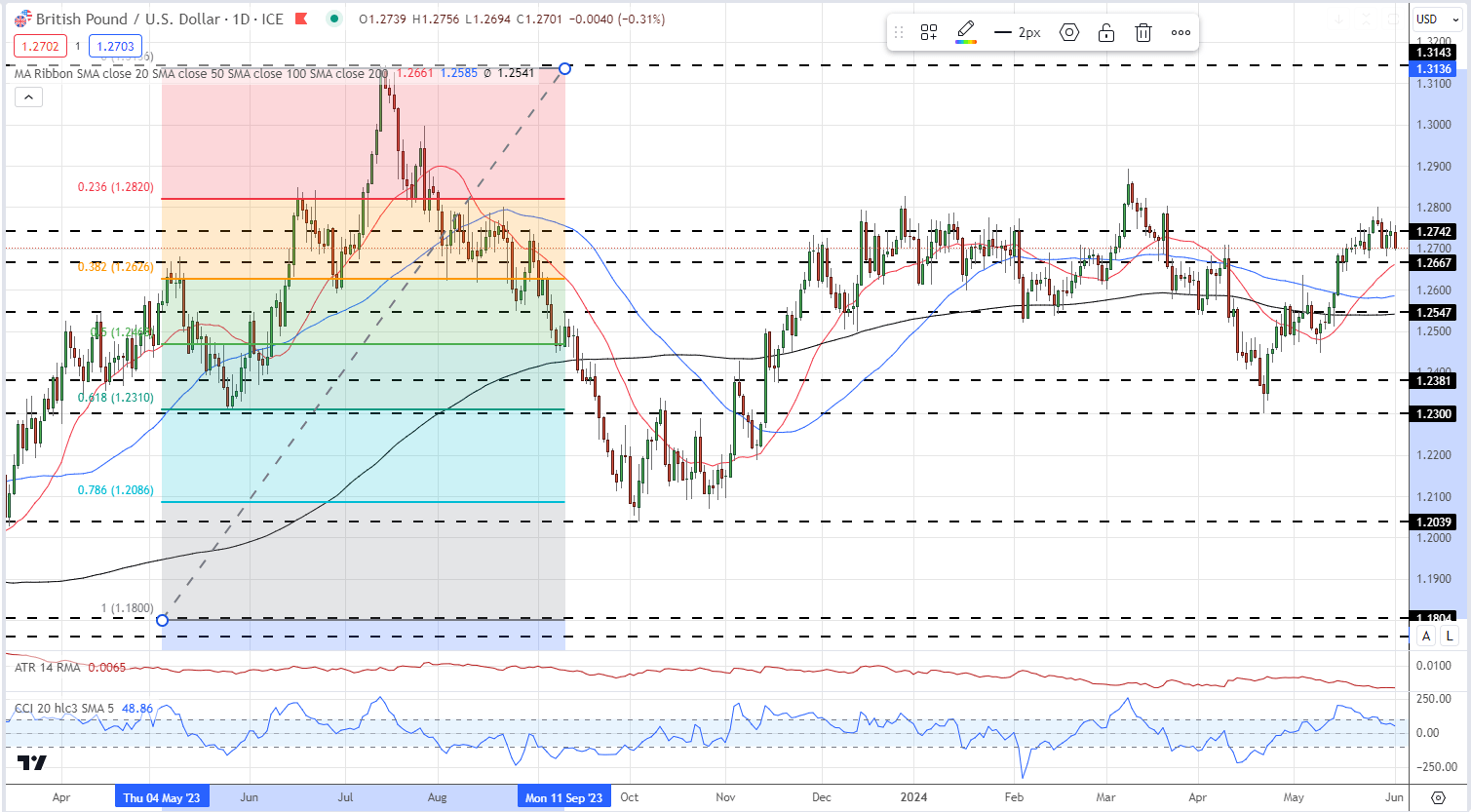

GBP/USD Challenges the 1.2700 Level

The GBP/USD pair is testing the 1.2700 level after recently reaching a multi-month high of 1.2800. The downward pressure is largely due to the strengthening USD, driven by expectations that the Fed will maintain current interest rates longer than anticipated. The next rate cut is projected for November 7, with September 18 still being considered a possibility. Key support levels are found at 1.2667 and the 38.2% Fibonacci retracement at 1.2628.

Market Sentiment and GBP/USD Outlook

IG Retail data indicates that 37.42% of GBP/USD traders are net-long, with the short-to-long trader ratio at 1.67 to 1. The count of net-long traders is up 4.10% from yesterday and 3.01% from last week, while net-short traders have increased by 2.49% from yesterday but decreased by 8.47% from last week.

Despite the prevalence of short positions, this contrarian indicator suggests that GBP/USD prices might continue to climb. However, with the reduction in net-short positions from yesterday and last week, the current upward price trend could soon reverse.