The reported death of Hamas leader Ismail Haniyeh in Iran, allegedly due to an Israeli missile strike, has significantly heightened tensions in the Middle East. This incident is likely to provoke imminent retaliatory attacks.

Iran's leadership has issued strong responses:

- President Masoud Pezeshkian warns that Iran will “make the occupiers (Israel) regret this cowardly act.“

- Supreme Leader Ayatollah Ali Khamenei declares, “We consider it our duty to avenge his blood.“

These aggressive statements raise concerns about the potential for a broader conflict in the region. The possibility of an all-out war in the Middle East creates uncertainty in the oil market, as regional instability often affects oil production and distribution. The situation remains volatile, with potential implications for global energy markets and international relations. Markets are closely monitoring developments for signs of further escalation or diplomatic efforts to defuse tensions.

US Economic Events Impact Markets

Despite the uneasy political landscape, upcoming US events and data may influence the rising oil and gold prices. Later today, the latest FOMC meeting is expected to keep US borrowing costs unchanged, but Fed chair Jerome Powell is anticipated to outline a potential rate cut path at the September FOMC meeting. On Friday, the monthly US Jobs report (NFP) is forecasted to show a slowdown in the US labor market with 175K new jobs created in July, compared to 206K in June. Average hourly earnings year-over-year are also projected to decrease to 3.7% from last month’s 3.9%.

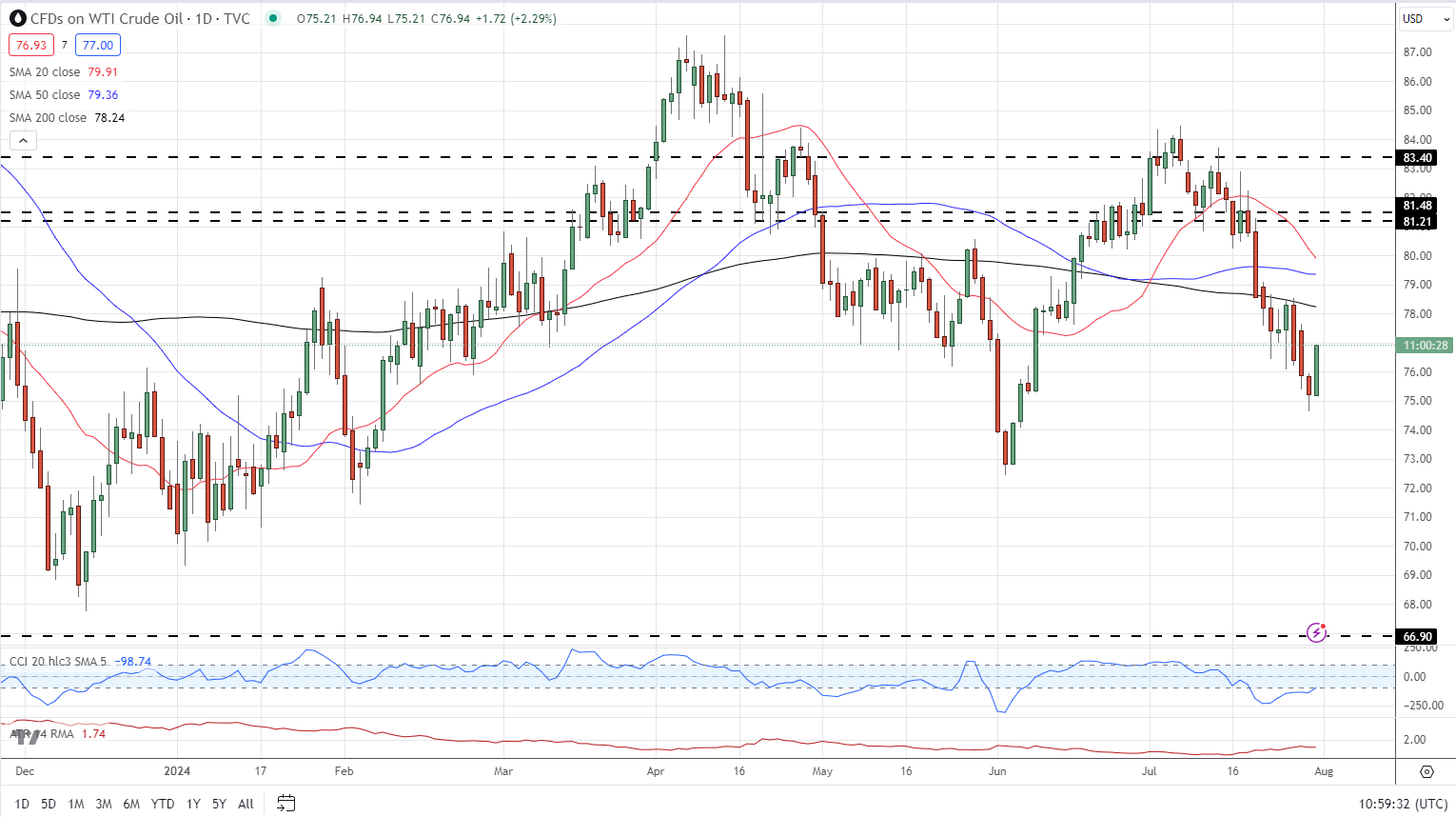

Oil Market Reaction

US oil rose over 2% on the news but remains within a multi-week downtrend. Weak Chinese economic data and fears of a further slowdown in the world’s second-largest economy have pressured oil prices recently. Chinese GDP slowed to 4.7% in Q2, down from 5.3% in Q1, according to recent data.

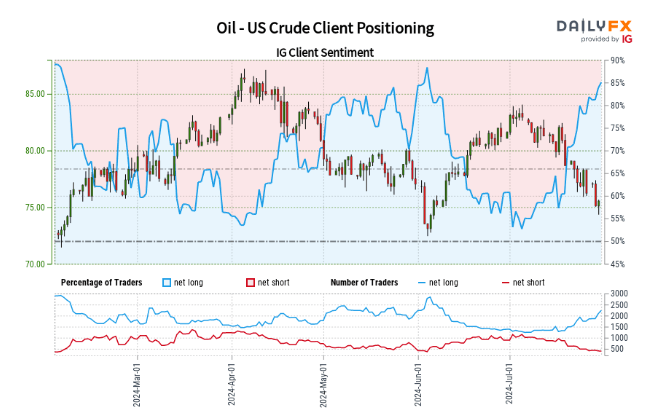

Retail trader data indicates that 86.15% of traders are net-long US Crude, with the ratio of traders long to short at 6.22 to 1. The number of traders net-long is 5.20% higher than yesterday and 15.22% higher than last week, while the number of traders net-short is 10.72% lower than yesterday and 31.94% lower than last week.

Analysts typically adopt a contrarian view to crowd sentiment, and the fact that traders are net-long suggests US Crude prices may continue to fall. The combination of current sentiment and recent changes reinforces a bearish contrarian trading bias for US Crude.

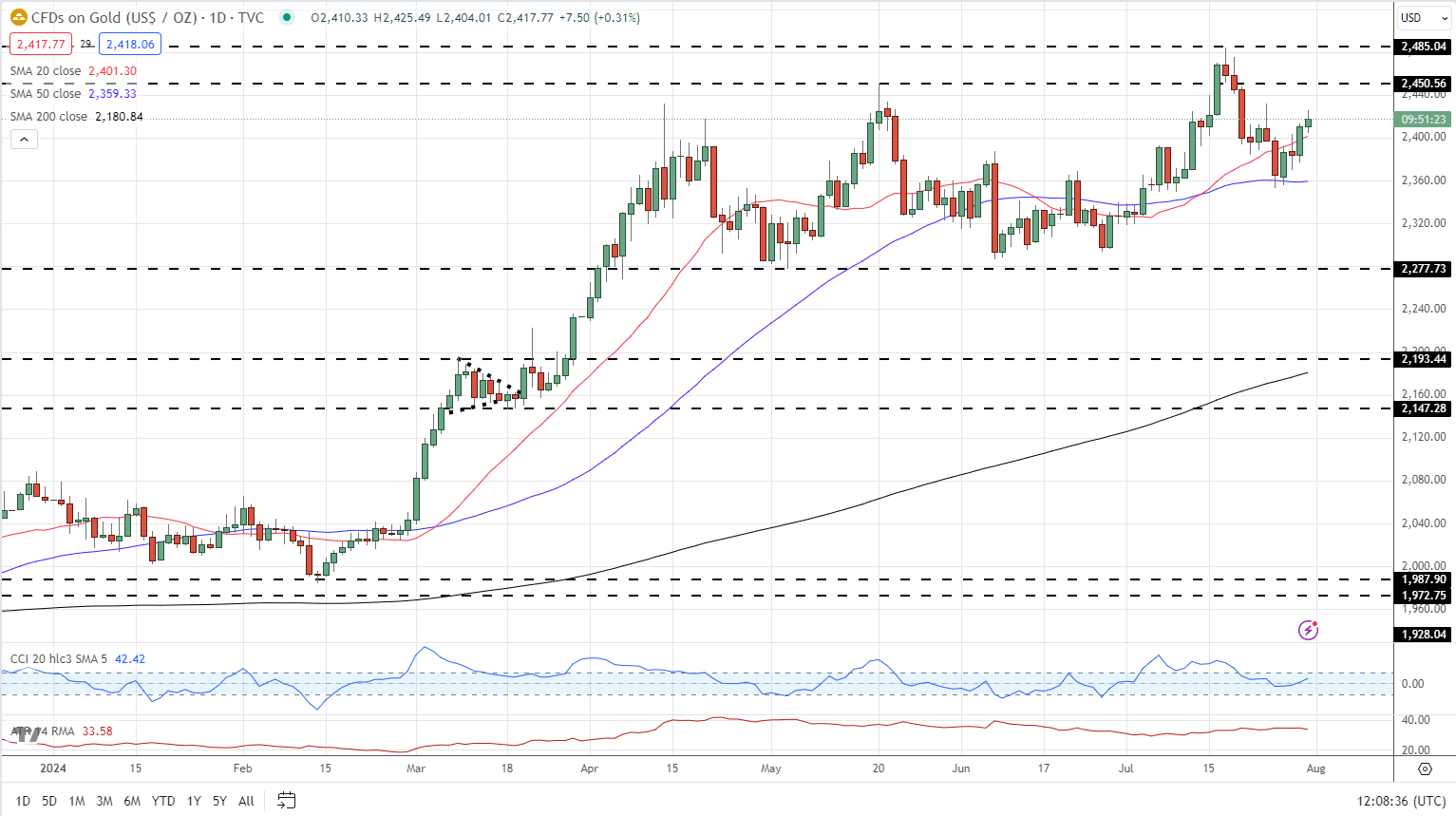

Gold Prices Surge

Gold has retraced around half of its recent sell-off and is heading towards an old level of horizontal resistance at $2,450/oz. This level was broken in mid-July before the precious metal fell sharply back into a multi-month trading range. Any increase in Middle East tensions or a dovish Jerome Powell tonight could see gold not just test prior resistance but also approach the recent multi-decade high at $2,485/oz.