Investing in trend analysis is an essential aspect of any trader's lifecycle. The trending system gives investors confidence that future prices will fluctuate. There are currently two types of Trends in the market: the Uptrend and the Downtrend. All kinds of trends tell different stories and affect traders' success.

While uptrends exhibit higher high levels and lower low levels, downtrends exhibit lower levels and higher levels. Peaking or troughs appear in a chart, and upward trends emerge from the chart. During the movement, the price may have higher highs and lows.

Also Read: Forex Trading Strategy:Catch the Highs and Lows (REALLY?)

Contents

- Understand the open high low trading strategy

- Is higher high and higher low a trending pattern?

- What to Anticipate when Lower Prices Change Negatively

- Using Technical Indicator while Trading Volatile Stocks

- The formula for the High-Low Method

- Determining a bearish or Bullish (Down trend or Up trend) Market Using H/L methods

- Bottomline

Understand the open high low trading strategy

July 7, 2020. The trading strategy world is packed with terminology. The trading system uses a wide range of indicators to identify trends and understand the fundamentals of cryptocurrency trading. An asset's highest and lowest prices are the prices at which the stocks and securities are traded. These generally have a time-based format, showing the extent of movement of the price within a given time.

A 200-day high would show the highest and lowest price security has achieved within two days; a 200-hour low would show prices' highest and lowest during that same period, and so on.

In trading, highs and lows refer to the highest and lowest prices at which a security or asset has been traded. This is typically expressed in a time-based format to show how far the price has moved in a given period. Significantly, these highs and lows are based on the security's value at the end of each trading day, known as the closing price.

This means an asset's value can exceed the high or low mark during a trading day, but it won't be recorded unless it ends the day (or closes) at that price.

Is higher high and higher low a trending pattern?

The setup is pretty basic and consistent with patterns seen at least once daily. But seeing a low-high level is insufficient for formulating an appropriate plan of action. You want trigger signals: These signals tell you when you have a chance to start your trade.

If your low is above, you will be short unless the price begins to fall back. If your price has gone down a bit more than a year, it should be longer, but not before the price recovers. Here the triggered event happens. Figure 3 presents trades in figure 1, but I added additional details and named two typical types of triggers — Range and Channel.

Understanding Lower Highs and Higher Lows Patterns

Detecting lower and higher lows as the basis for trading strategy is again somewhat unusual but certainly not uncommon. The experienced trader has learned a range of techniques to exploit lower highs patterns in downtrends, enabling them to control market change.

An inverted spread trade signal strategy could be used for an inherently more inferior higher-low model. However, the fact remains that many professional traders have their strategy because of the differences that exist in how they approach this market.

High-Low Patterns in the Countertrend Trading Strategy

Investors who use a countertrend trading strategy will seek a small profit by trading against a current, more significant trend. Often called contrarian investing or simply countertrend trading. Typically a trader may use countertrend strategies only to determine whether the movement is undergoing a slight downward decline. In this case, they'll be trying to benefit through the smallest reversals. Counter trend trading is also a short-time-based

During the past few days, the entry strategy was primarily used for short-term trading because signals could easily be found. Depending upon the period you trade, use an hourly graph of 1-3 minutes and 10-15 minutes. Use strategies for maximum efficiency during the opening and closing periods in the marketplace.

In this case, the trade in EURUSD will only happen if Europe and US markets are open. Once open, prices start to drop or reach the highest level. Watch for higher prices before settling for higher prices. If the price has made it's first high, look out for an inferior high, as there's the possibility of short selling.

What to Anticipate when Lower Prices Change Negatively

Daily low pricing investment strategy is a cost management method that allows companies or retailers to offer low-priced products to their customers consistently. Companies focus on providing low-cost products to customers rather than offering discounts, coupons, and promotions.

Bear in mind that this pricing technique is highly profitalbe for a business if the cost of production remains constant, enabling them to profit from selling goods at a lower price. If the product costs match the low-price method, the business can reach long-term goals for a prolonged period.

Companies and brands consider a wide range of factors when they decide to implement such pricing strategies. Price tracking, or repricing are essential factors in price management that enables business and retailer to develop a strategy that meets their business goals.

In today's article, we'll look at the distinction between daily low and high/low pricing. Also, we’ll discuss the advantages and limitations of high-low methods, explaining how to apply this price-action technique to improve your return on investments (ROI), Read on!

Using Technical Indicator while Trading Volatile Stocks

The average difference between a security's daily high and low, divided by the stock price, is one way short-term traders measure it. Because the percentage change is more influential than the first, a stock that moves $5 per day with a $50 share price begins more volatile than a stock that moves $5 per day with a $150 share price.

Trading in highly volatile markets is profitable since they theoretically have the highest profit potential. Many traders seek out these stocks without their dangers but confront two key questions: How to locate the most volatile stocks and trade them using the technical analysis indicator.

Also Read: Best Technical Indicators for Day Trading

The formula for the High-Low Method

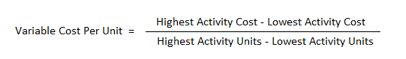

Under the high-low method, the variable cost for each unit is calculated by differentiating between the highest and lowest activity costs. Next, devide the result by the difference between highest and lowest activity unit numbers. Mathematically it is represented as,

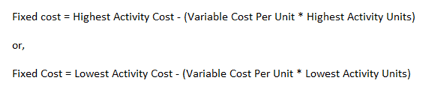

Once you determine the variable cost for each unit, you can calculate fixed costs as follows:

Mathematically, it is represented as,

Determining a bearish or Bullish (Down trend or Up trend) Market Using H/L methods

The vocabulary of trading methods is extensive. For instance, traders employ highs, lows, higher, lower, and higher highs to comprehend the trends that characterize the stock market or cryptocurrency movement.

What Is the Difference Between Higher Highs and Lower Lows?

A trader's confidence in the future performance of an asset or security can be seen when they use the terms higher highs and lower lows or lower highs and higher lows. These metrics, when combined, can aid in identifying market trends and enable traders to create trading plans based on these trends. They employ this straightforward technique involving lower highs and higher lows to identify increasing trends in overall asset value

-

Higher highs

Higher highs occur when the security price closes higher than it did at the closing of the previous period, which was also increased. A trader can be confident that the asset's value will likely continue to rise in the near term because of this plausible indicator of an upward trend (particularly when accompanied by higher lows).

-

Higher lows

Higher lows occur when the security price closes at a low level but exceeds the low level at the end of the previous day. This is a plausible sign of an upward trend (particularly when combined with higher highs), which gives a trader hope that the asset's value will rise in the near future.

They use a similar technique to identify downward asset overall value trends:

-

Lower lows:

Lower lows are when the security price closes lower than it did at the previous day's close, which was also low. This offers a trader confidence that the asset's value will likely continue to decline in the near term and is a reasonable indication that a trend is falling (particularly when coupled with lower highs).

-

Lower high:

A lower high occurs when the security price closes at a high level but is lower than the high reached at the end of the past period day. A trader can be confident that the asset's value will likely continue falling in the near term because this is a reasonable indication that a trend is plunging (particularly when coupled with a lower bottom).

As a result, a higher high plus a higher low indicates that the value of a security or asset is predicted to continue to climb, while a lower low plus a higher high indicates the exact opposite. This enables traders or investors to lower their expectations for how the security or asset will perform. Traders can then use this information to create specific strategies.

Bottomline

The high-low technique makes separating fixed and variable expenses simple. Cost accountants can rapidly and simply determine information about cost behavior using only two data values and basic algebra. The high-low approach does not utilize or call for any sophisticated instruments or software.