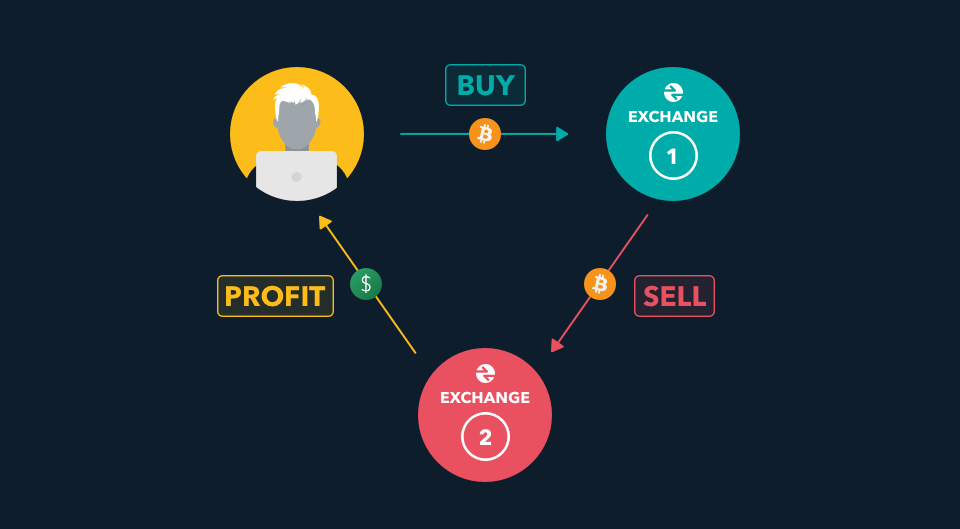

The appeal of crypto arbitrage is compelling: making money just by buying and selling cryptocurrency for what might seem, at times, like no effort at all, and simply for some small price difference across exchanges. It feels almost like a cheat code in the world of digital assets that can be volatile. But, as we move through 2025, we have seen many variations of cryptocurrency trading that conditions in the market generally change rapidly. Are arriving price “anomalies” a remnant way to continue making money, or is it just a notion that some people believe is still a “goldmine”? Can somebody who wants to try this make a “solid” income of $100 a day by utilizing this strategy or any variance of it, and furthermore, how does one even start a specific crypto arbitrage trading strategy? Let's disrobe some of the myths that circulate the cryptocurrency arbitrage trading community and get to the bottom of what questions so many traders have on their minds.

Is Crypto Arbitrage Still Profitable? (The Honest Truth)

Yes, there is still money to be made in crypto arbitrage, but it isn’t the quick and simple opportunity it used to be for anyone who wasn’t a professional trader. Because the cryptocurrency market has advanced, it is now more efficient. As a result, those sizeable price differences are now grabbed by experts using impressive algorithms and lots of money.

Arbitrage profits are typically very small for individual arbitrage traders, and these opportunities don’t last long. Besides other retail traders, you’re also facing professional market players backed by advanced systems, colocation, and huge capital. Nonetheless, some inefficiencies in smaller or emerging market crypto assets can still make arbitrage possible. The key to making a profit with arbitrage is to consider the volatility of the market, the trade fees that take away a large part of your gain, and how rapidly trades can be completed. Crypto arbitrage today requires traders to be precise and have the right tools.

Can You Really Make $100 a Day with Crypto Arbitrage?

To me, making a consistent $100 a day in crypto arbitrage is an ambitious target, and in many cases, you will accomplish this with a substantial amount of capital, automated tools, and setup for you to understand the crypto market and crypto opportunities. It is achievable, but you will have to act and think like a professional.

As an example, if you were looking to make $100 profit a day, and the average profitable arbitrage opportunity takes you approximately 0.1% to 0.5% profit after exchange fees, you will need to trade the equivalent of a lot of crypto asset volume during the day. For example, if you only wanted to make $100 at a 0.2% margin, you will need to be trading around $50,000 worth of assets during the day, not in 1 single $50,000 trade, but in a combination of several trades that complete that trade volume. This will require:

- Substantial Starting Capital: You need enough funds spread across multiple platforms or multiple exchanges to seize arbitrage opportunities instantly, without waiting for transfers.

- Automation: Manual arbitrage trading at this scale is virtually impossible. You'd need an arbitrage bot (or several crypto arbitrage bots) to monitor prices across dozens of crypto exchanges 24/7 and execute trades in milliseconds through automated trading.

- Low Trading Fees: Transaction fees are your biggest enemy in arbitrage. You'd need to be on crypto exchanges with very competitive fee structures or trade at trading volumes that qualify you for tiered discounts to maximize arbitrage profits.

While some platforms and arbitrage trading strategies claim to offer ways to earn significant daily returns even with smaller capital (e.g., $100), these often involve higher market risk, less transparent mechanisms, or are not pure arbitrage in the traditional sense (e.g., P2P arbitrage, which involves more market risk and manual effort). For a genuine, relatively low-risk trading strategy in crypto arbitrage, $100 a day usually necessitates a more robust setup than a casual investor might have.

How Do I Start Crypto Arbitrage? (A Step-by-Step Guide)

If you're serious about exploring cryptocurrency arbitrage, here's a practical roadmap to get you started:

- Educate Yourself Thoroughly: Understand the various types of arbitrage (e.g., spatial arbitrage across different markets, triangular arbitrage within one exchange, statistical, DeFi), the risks involved (slippage, transaction fees, execution delays, regulatory changes, liquidity risk, general market risk), and the nuances of different crypto exchanges.

- Acquire Sufficient Capital: As discussed, you'll need more than pocket change. Assess how much capital you can comfortably risk and consider the implications of spreading it across multiple platforms.

- Open Accounts on Multiple Exchanges: To take advantage of price differences across different platforms, you will need accounts on several reputable crypto exchanges. Look for exchanges with high liquidity, low trading fees, and fast deposit/withdrawal processing. Examples normally include global exchanges like Binance, OKX, Kraken, Bybit, etc. However, don't forget to check out regional crypto exchanges, as there might be local price differences due to regional demand.

- Master Fund Management: Learn how to quickly move funds across exchanges (or pre-position funds) to take advantage of fleeting arbitrage opportunities. This often involves using stablecoins like USDT or USDC to minimize market volatility during transfers and reduce transaction costs.

- Choose Your Tools (Crucial for Speed):

- Price Tracking Tools: Use services that provide real-time price comparisons across multiple exchanges.

- Arbitrage Bots: For serious attempts, automated trading is key. Research reputable crypto arbitrage bots (e.g., 3Commas, Bitsgap, Cryptohopper, Pionex) that can monitor prices across dozens of crypto exchanges 24/7 and execute trades at high speed. Be extremely cautious and understand how these automated tools work.

- Start Small and Test: Begin with small amounts of capital and observe how your arbitrage trading strategies perform in real-time. Backtesting with historical data can also be valuable.

- Implement Robust Risk Management: Always factor in transaction fees, potential for price shifts, and liquidity risk. Never invest more than you can afford to lose. The crypto market is 24/7, highly volatile, and susceptible to rapid market moves; effective risk management is key for successful crypto arbitrage.

Which Crypto Exchange is Best for Arbitrage?

There isn't a single “best” crypto exchange for arbitrage, as the ideal choice depends on your specific arbitrage strategy, geographic location, and the type of cryptocurrency arbitrage you're pursuing. However, here are key factors to consider when choosing cross-exchange arbitrage:

- High Liquidity: You need crypto exchanges where you can buy and sell large trading volumes of crypto assets without significantly impacting the cryptocurrency prices. Major crypto exchanges often have high liquidity.

- Low Trading Fees: Even tiny price differences can be erased by exchange fees and withdrawal fees in arbitrage. Look for crypto exchanges with tiered fee structures that reward higher trading volumes.

- Fast Deposit and Withdrawal Speeds: Time is critical in arbitrage. Slow transfers across exchanges can cause you to miss an arbitrage opportunity entirely.

- Wide Range of Assets and Pairs: More crypto assets and trading pairs mean more potential arbitrage opportunities, especially for triangular arbitrage.

- Reliability and Uptime: A crypto exchange that goes down during a critical arbitrage window can lead to losses and increased market risk.

- Regulatory Compliance: Ensure the crypto exchanges comply with regulations in your jurisdiction to avoid future complications, which is a key part of risk mitigation.

- API Accessibility: If you plan to use automated trading or arbitrage bots, robust and reliable API access is essential for successful crypto arbitrage.

While crypto exchanges like Binance, OKX, KuCoin, Bybit, and Kraken are frequently mentioned for their liquidity and diverse offerings, the “best” for you might also include smaller, regional exchanges where unique, localized price discrepancies occur due to capital controls or specific regional demand. Diversifying your accounts across several reputable multiple platforms is often a key arbitrage strategy for many traders.

In Conclusion

This area of crypto trading is still a popular one, giving chances to the skilled and devoted. It’s best not to think about finding something valuable for free but rather to use your skill and timing to react quickly to changes in the market. While it’s tempting to concentrate on daily arbitrage profits, there is strong competition from clever systems and the need to have a lot of money and knowledge of technology. Go into it knowing the risks, and make sure you do your own research in cryptocurrency trading since things move fast here.

Methods such as crypto arbitrage should not be used by everyone, as they involve considerable market risk. Because cryptocurrency prices change a lot, you might end up losing most or all of your money. The information in this article is not intended as financial or investment advice. It is important to talk to a financial expert before you invest your money.