Yen’s Rise Spurs Reversal of Currency Hedges

The recent strengthening of the yen has led global investors to scale back exchange-rate hedges on Japanese stocks, as they no longer expect a sharp decline in the Japanese currency. Strategists at JPMorgan Chase & Co., UBS Group AG, and BNP Paribas Asset Management have advised unwinding these currency hedges, particularly on Japanese equities that have outperformed other regional markets, to potentially enhance returns in dollar terms.

Wei Li, a multi-asset quant solutions portfolio manager at BNP Paribas Asset Management, noted, “Investing in Japanese stocks without hedging the currency exposure allows for higher returns in dollar terms if the yen continues to appreciate.”

Hedging Adjustments Reflect New Yen Outlook

This shift reflects a broader change in sentiment towards the yen following the Bank of Japan’s decision to raise interest rates in July. The stronger currency suggests a healthier Japanese economy but poses a challenge for foreign investors, making equities more expensive and potentially impacting exporters' earnings.

UBS strategist Nozomi Moriya now favors investing in Japan without hedging against a weaker yen, after the firm revised its year-end forecast for the yen to 145 against the dollar, up from 160. Despite this, UBS has downgraded Japanese stocks to underweight in local-currency terms due to the risks the stronger yen presents to earnings forecasts.

Japanese Stocks Outperform, But Caution Remains

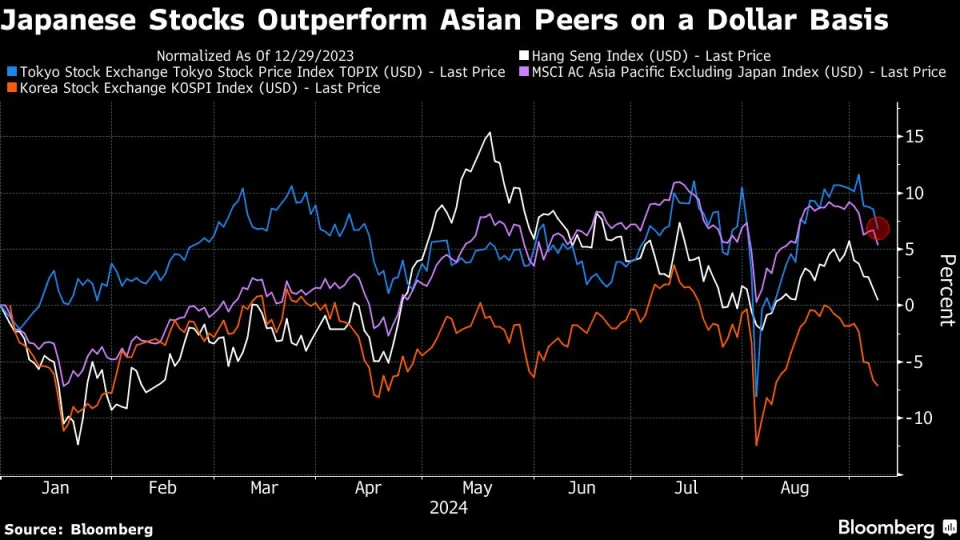

In dollar terms, the Topix has rebounded from its August 5 decline and hit a three-year high last week, although it has since retraced some gains amid concerns over global economic slowdown. The Topix’s year-to-date growth of 7.1% outperforms the MSCI AC Asia Pacific Excluding Japan Index's 5.4% rise, as well as the Hang Seng Index and South Korean Kospi.

Traditionally, many long-term investors avoid hedging their foreign stock investments against currency movements. However, the yen's consistent weakness in recent years led to the popularity of such hedging strategies, exemplified by the WisdomTree Japan Hedged Equity ETF’s size tripling over 2023. Yet, as the yen gained strength, this ETF experienced an outflow of $897 million since August, while the unhedged JPMorgan BetaBuilders Japan ETF saw an inflow of $687 million in the same period.

Focus Shifts from Yen to Other Earnings Drivers

Not all analysts view the yen’s movement as the primary factor influencing earnings. Masashi Akutsu, chief Japan equity strategist at Bank of America Securities, believes that Japanese earnings growth is now more influenced by a company's ability to raise prices in an inflationary environment than by the yen's weakness.

Still, the risk of a rapidly strengthening yen impacting corporate earnings remains a concern, leading some analysts to adopt a more cautious stance when selecting stocks. Charu Chanana, a strategist at Saxo Markets, emphasized the need to be selective in Japanese equities, focusing on long-term themes like corporate governance reforms and geopolitical plays. She added, “The short-term risk-reward is tilted towards a stronger yen and weaker Japanese equities in the current market environment.”