Kimura Trading Review

Forex trading is a complex and dynamic environment where currency pairs, ETFs, and various other financial instruments are traded. Given the high stakes involved, selecting the right Forex broker is crucial for both novice and professional traders alike. The right broker not only offers access to a wide range of trading assets but also ensures reliability, transparency, and support that traders can depend on.

Kimura Trading stands out in the crowded Forex brokerage market by offering a comprehensive trading platform. Traders gain access to a variety of assets, including currency pairs, ETFs, CFDs on stocks, indices, commodities, energy sources, and cryptocurrencies. With features like a free demo account and a reasonable minimum deposit of €100, Kimura Trading positions itself as an accessible option for both newcomers and seasoned traders.

In our forthcoming review, we delve deep into what makes Kimura Trading a potential leader in Forex trading. We will cover the full spectrum of their offerings, from account options and deposit methods to withdrawal processes and commission structures. By combining expert analysis with real trader feedback, our goal is to provide you with a balanced and detailed perspective, empowering you to make a well-informed decision about whether Kimura Trading could be your broker of choice. Stay tuned for a detailed exploration of Kimura Trading, where we uncover both its strengths and areas of concern.

What is Kimura Trading?

Kimura Trading is a Forex broker that facilitates access to a diverse range of financial instruments. It allows traders to engage in markets involving currency pairs, ETFs, and CFDs on stocks, indices, commodities, energy sources, and cryptocurrencies. This broad selection makes it a versatile choice for traders interested in exploring different asset classes.

The broker offers several types of accounts to cater to different levels of traders. The standard account is accessible with a minimum deposit of €100 and includes a free demo account for beginners to practice without risk. For more experienced traders, there's a professional account which requires proof of the trader’s qualifications, and a corporate account that can be set up upon request, providing tailored solutions for larger trading operations.

Kimura Trading is notable for its cost-effective pricing structure. It only charges floating spreads, starting from 0.7 pips on currency pairs, and there are no additional trading fees or withdrawal fees. This straightforward approach to pricing, combined with a maximum leverage of 1:30, makes it an attractive option for traders looking to minimize costs while having reasonable access to leverage.

Benefits of Trading with Kimura Trading

Based on my personal experience with Kimura Trading, the benefits of trading with this broker are quite notable. One major advantage is the competitive spreads that start from as low as 0.7 pips on major currency pairs. This makes trading cost-effective, particularly for frequent traders who are concerned with minimizing trading costs over each transaction.

Another significant benefit is the accessibility of the platform. Kimura Trading uses the cTrader platform, which is known for its user-friendly interface and robust functionality. This platform suits both new and experienced traders, providing advanced charting tools, level II pricing, and one-click trading options which enhance the trading experience.

Moreover, Kimura Trading offers a variety of financial instruments, including forex, CFDs on stocks, commodities, indices, and cryptocurrencies. This diversity allows me to diversify my trading portfolio and take advantage of different market conditions without needing multiple brokers. The absence of additional fees on transactions and withdrawals is another aspect that adds to the straightforward and transparent pricing structure, making it easier to manage my investments effectively.

Kimura Trading Regulation and Safety

Kimura Trading is overseen by ELP Finance Ltd, which is registered and regulated in Malta by the Malta Financial Services Authority (MFSA). This regulatory body is comprehensive in its scope, covering sectors from banking to investment services, which reinforces the credibility of the brokers it oversees.

ELP Finance Ltd is also listed in the European Union Intellectual Property Office (EUIPO) registry, which provides an additional layer of legitimacy and regulatory compliance, especially concerning intellectual property and trademark rights. This is particularly important for ensuring that the broker's operations meet European standards for financial and operational conduct.

Understanding the regulation and safety measures of a Forex broker like Kimura Trading is vital because it offers reassurance about the security of your investments and the broker's commitment to fair trading practices. The Investor Compensation Scheme affiliation of ALB Limited, which operates under Kimura Trading, further protects investors by providing a rescue fund for customers of failed investment firms licensed by the MFSA.

In summary, Kimura Trading's compliance with regulatory requirements in Malta and its registration with the EUIPO underscores its dedication to providing a secure and transparent trading environment. This knowledge is crucial for traders in assessing the reliability and integrity of their chosen Forex broker.

Kimura Trading Pros and Cons

Pros

- Regulatory credibility through affiliate licensing.

- cTrader platform offers low spreads and versatility.

- Access to diverse financial instruments including cryptocurrencies and ETFs.

Cons

- Lacks a direct license, using an affiliate's credentials.

- Unclear trading conditions online, creating potential uncertainty.

- Limited payment methods, lacks popular e-payment options.

- No copy trading or support for major trading platforms.

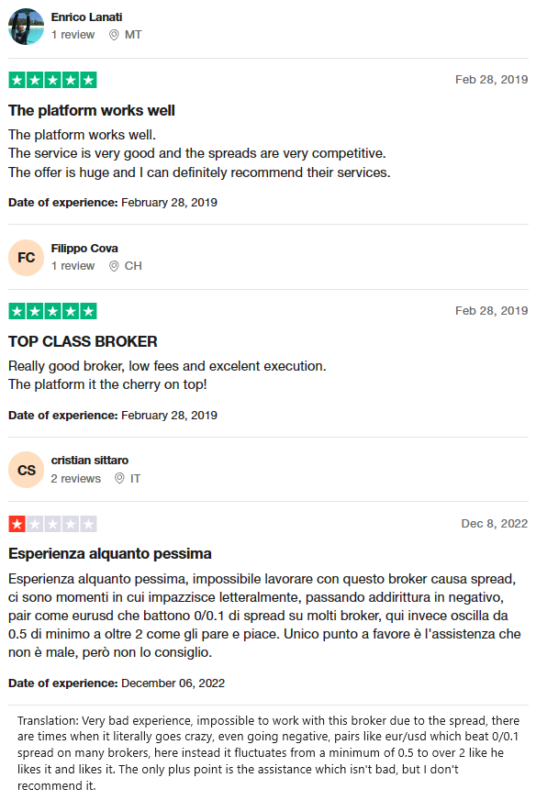

Kimura Trading Customer Reviews

Customer reviews of Kimura Trading are mixed, highlighting both strengths and weaknesses of the broker. Users generally praise the platform's functionality and customer service, noting the competitive spreads and efficient execution that enhance their trading experience. The platform is frequently mentioned as a highlight, underscoring its user-friendliness and the broad range of financial instruments available. However, some customers report dissatisfaction, particularly with the variability of spreads on major currency pairs like EUR/USD, which can significantly fluctuate and even reach higher levels compared to other brokers. This inconsistency in spread levels has led to negative experiences for some traders, despite the decent support offered by the broker.

Kimura Trading Spreads, Fees, and Commissions

At Kimura Trading, we maintain a straightforward approach to spreads, fees, and commissions, which is central to our competitive edge in the forex trading market. Unlike many brokers that incorporate a combination of spreads, transaction fees, and withdrawal fees, we focus solely on spreads. These are primarily floating spreads, meaning they adjust based on market conditions, ensuring that traders always get the most current rates.

Our average spreads for most currency pairs typically range from 0.7 to 1 pip, aligning well with industry standards. This competitive range is particularly beneficial for our traders because we do not charge any transaction fees. This policy not only simplifies the trading experience but also makes it more cost-effective, as traders do not have to worry about additional costs eating into their profits. This approach underscores our commitment to providing transparent and economical trading conditions.

Account Types

At Kimura Trading, we offer a range of account types to suit the varied needs of our traders, from beginners to seasoned professionals and corporate entities. Here’s a detailed look at each type:

Demo Account

- No deposit required: Ideal for beginners, this account can be opened without any financial commitment and does not require verification.

- Virtual trading: Operates just like our standard account but uses virtual funds, allowing you to practice strategies without risk.

Standard Account

- Minimum deposit of €100: Accessible for all individual clients starting out with Kimura Trading.

- Competitive spreads: Floating from 0.7 pips for currency pairs and as low as 0.17 pips for other assets, with no transaction fees.

Professional Account

- Experience requirement: Available to traders who have demonstrated significant experience and financial depth, with prior accounts totaling at least €500,000.

- Enhanced conditions: Offers reduced spreads starting from 0.1 pips, among other trading advantages.

Corporate Account

- By request only: Tailored for legal entities wanting to trade under individual conditions.

- Customizable features: Provides the flexibility to operate with unique terms suited to corporate needs.

How to Open Your Account

- Visit the Kimura Trading website and select your preferred language in the top right corner.

- Fill out the registration form with your first and last names, country's telephone code, and contact number.

- Set and confirm your password, select cTrader as your platform, and set the account currency to euros, then click ‘Next'.

- Enter your address and email, choose how you prefer to be contacted, and proceed by clicking ‘Next'.

- Provide detailed personal information such as your date and place of birth and tax identification number, then click ‘Next'.

- Answer the broker's questions about your trading experience and agree to the terms of cooperation to proceed.

- Verify your identity by uploading the necessary documents under ‘Account Settings' and then wait for the verification to be completed.

- Fund your account by navigating to ‘Trading Accounts', clicking the ‘Deposit' button, and following the on-screen instructions, then download and install the trading platform to start trading.

Kimura Trading Trading Platforms

In my experience using Kimura Trading, the platform exclusively utilizes cTrader. This means traders are limited to this single platform and cannot use other popular platforms like MetaTrader or NinjaTrader. The cTrader platform is known for its robust features and user-friendly interface, making it a suitable option for both beginners and experienced traders.

However, the absence of alternative platforms like MetaTrader could be a limitation for some traders who prefer specific functionalities or are accustomed to those environments. The exclusive use of cTrader ensures a streamlined and focused trading experience, but it might not satisfy all trading strategies or preferences.

What Can You Trade on Kimura Trading

Based on my experience with Kimura Trading, the variety of trading instruments available is quite comprehensive. Traders have access to a wide range of currency pairs, which is ideal for those interested in forex markets. This includes major pairs, minors, and exotics, providing ample opportunities for currency trading.

In addition to forex, Kimura Trading offers ETFs and CFDs on a variety of assets. These include stocks, which cater to traders looking to tap into the equity markets without the need for direct stock purchases. Indices, commodities, and energy sources are also available, allowing for a diversified trading portfolio. This broad selection is particularly beneficial for traders looking to spread their risks across different sectors and asset classes.

Lastly, for those interested in the digital economy, Kimura Trading provides the ability to trade CFDs on cryptocurrencies. This offers a gateway to one of the most dynamic and rapidly evolving markets, with options to trade on popular cryptocurrencies. This range of instruments ensures that traders at Kimura Trading can find suitable markets no matter their trading style or investment goals.

Kimura Trading Customer Support

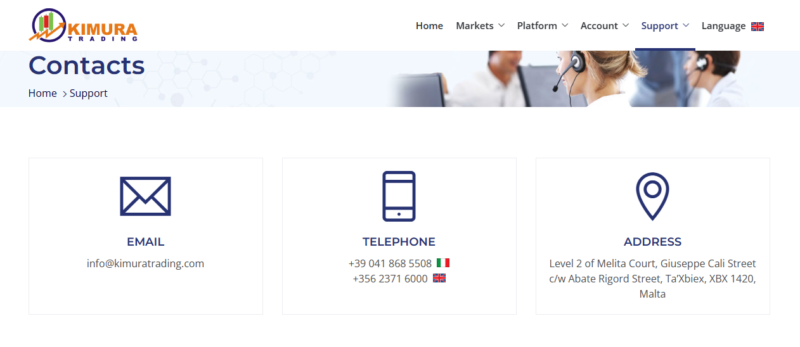

Based on my experience, Kimura Trading's customer support is both accessible and efficient, catering well to trader needs. The broker provides multiple communication channels, ensuring that traders can easily reach support when required. You can contact technical support via phone, email, live chat, or through submitting tickets on their website.

The support team is available 24/5 on weekdays, offering assistance during all major trading hours. This is particularly useful as it aligns with global forex market hours, ensuring that traders can get help whenever the markets are open. From my interactions, the live chat feature is the quickest way to get responses. It is available both on the website and directly in the Trader's Room, providing real-time assistance.

Feedback from other users confirms that Kimura Trading is known for providing quality and prompt support. The availability of multiple contact methods and the responsiveness of the live chat make it easy for traders to resolve issues and obtain needed information swiftly. This robust support system enhances the trading experience by minimizing downtime and uncertainty.

Advantages and Disadvantages of Kimura Trading Customer Support

Withdrawal Options and Fees

In my experience trading with Kimura Trading, the withdrawal process is straightforward and user-friendly. Once you transition from a demo to a trading account, any profits earned are available for withdrawal. These funds are visible in your account balance and can be withdrawn either partially or in full at any time, providing flexibility in managing your earnings.

To initiate a withdrawal, you simply generate a request through the options available on your user account dashboard. Kimura Trading also allows for withdrawals through its mobile platform, adding convenience for traders who prefer managing their transactions on the go. Currently, withdrawals can be made to either a bank account or a bank card.

One of the notable advantages is that Kimura Trading does not charge any fees for withdrawals. However, it's important to note that additional fees may be incurred on the side of the bank or card provider, as they act as the third party in the transaction. Typically, the transferred funds should reflect in your bank account or on your card within 1-2 days, making the process both quick and efficient.

Kimura Trading Vs Other Brokers

#1. Kimura Trading vs AvaTrade

Kimura Trading specializes in a focused range of instruments and utilizes the cTrader platform exclusively, catering to those who prefer this technology. It's regulated in Malta and offers competitive spreads and no transaction fees. AvaTrade has been operational since 2006 and offers a broader range of financial instruments across multiple platforms including MetaTrader and AvaTradeGo. It's highly regulated globally, with multiple offices worldwide and serves a vast clientele.

Verdict: AvaTrade might be better for traders looking for a more diversified trading experience and global regulatory assurance. Its wide selection of platforms and instruments make it a robust choice for traders who engage in multi-asset trading and prefer a platform choice.

#2. Kimura Trading vs RoboForex

Kimura Trading provides a straightforward trading environment with a single platform choice and is known for its clear fee structure. RoboForex offers a wider array of trading platforms, including MetaTrader, cTrader, and RTrader, appealing to a broader range of trading preferences. It also boasts a vast range of trading options and asset classes, making it versatile for various trading styles.

Verdict: RoboForex may be preferable for traders who require diverse technological options and a wider range of financial instruments. Its flexibility in trading platforms and the extensive variety of assets cater to both new and experienced traders with different trading strategies.

#3. Kimura Trading vs Exness

Kimura Trading focuses on providing a simple, efficient trading platform with competitive spreads and no additional fees for transactions. Exness is known for its high trading volume and offers a remarkable feature of unlimited leverage on some accounts, which is attractive for high-volume traders. It also provides a wide array of trading instruments and several account types to cater to different trader needs.

Verdict: Exness stands out for traders who are looking for high leverage options and a large selection of trading instruments. Its capability to handle high trading volumes and its flexible account options make it particularly appealing to both high-risk and experienced traders.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH KIMURA TRADING

Conclusion: Kimura Trading Review

Based on the comprehensive analysis and user feedback, Kimura Trading stands out for its straightforward trading environment and commitment to transparency. The brokerage offers competitive spreads without additional transaction fees, making it cost-effective for traders. The exclusive use of the cTrader platform, while limiting for those accustomed to other platforms like MetaTrader, is praised for its efficiency and user-friendly interface.

However, potential traders should be aware of some limitations. The lack of platform diversity and the absence of advanced trading features such as copy trading may not suit all trading styles or preferences. Additionally, the support services, while reliable during the week, are not available on weekends, which could be a drawback for traders who operate on a different schedule or need assistance during those times.

Kimura Trading Review: FAQs

What types of trading accounts does Kimura Trading offer?

Kimura Trading provides several types of accounts tailored to different traders: a Demo Account for beginners wanting to practice without risk, a Standard Account with a minimum deposit requirement of €100, a Professional Account for experienced traders, and a Corporate Account which is customized for legal entities.

Are there any fees for withdrawals at Kimura Trading?

No, Kimura Trading does not charge any fees for withdrawals. However, traders should be aware that while the broker does not impose fees, there might be charges from banks or card providers involved in the transaction process.

Can I trade cryptocurrencies with Kimura Trading?

Yes, Kimura Trading offers traders the ability to trade CFDs on major cryptocurrencies, providing access to one of the most volatile and potentially profitable markets in the trading landscape.

OPEN AN ACCOUNT NOW WITH KIMURA TRADING AND GET YOUR BONUS