Position in Rating | Overall Rating | Trading Terminals |

100th  | 2.6 Overall Rating |

OPEN AN ACCOUNT

LeoPrime Review

LeoPrime is an online forex and CFD broker regulated by the Financial Services Authority (FSA) of Seychelles. They offer several different account types, these include STP, ECN, and cent accounts, along with market execution, a leverage up to 1:1000, and access to more than 100 trading instruments such as forex pairs, stocks, indices, and commodities. LeoPrime also received industry recognition, these include the “Best Multi-Asset Broker” award in 2021 and acknowledgment for transparency by FX Daily Info.

This LeoPrime review provides a clear overview of its main features and trading conditions. This article explains how different account types work, outlines available markets, and highlights its main strengths and limitations. The goal of this article is to help traders see whether LeoPrime is a suitable broker for their trading needs.

What is LeoPrime?

LeoPrime is an online broker for forex and CFDs that lets traders buy and sell financial assets like currency pairs, commodities, indices, and cryptocurrencies. LeoPrime works with well-known trading platforms like MetaTrader 4 and MetaTrader 5. They also have different types of accounts, such as ECN, STP, and cent accounts, with market execution and leverage up to 1:1000. According to LeoPrime, their goal is to provide both new and experienced traders with competitive trading conditions and an easy-to-use interface.

The Seychelles-registered company says it is regulated by the Financial Services Authority (FSA) under license SD032. However, this oversight is considered offshore and not as strict as that of major regulators like the FCA or ASIC. Traders should know that reviews are mixed: some people praise the service and execution, while others say they have problems with withdrawals and support.

Is LeoPrime Regulated and Safe?

LeoPrime is a broker company that is based in Vanuatu and says it is controlled by the Seychelles Financial Services Authority (FSA) under license number SD032. They're not regulated by the UK’s FCA, Australia’s ASIC, or Cyprus’s CySEC. But instead, they're regulated from outside the country, which means less strict oversight and fewer protections for their traders.

Due to Seychelles being a tier-3 jurisdiction, LeoPrime doesn't have the same investor protection programs or strict enforcement criteria that other top-tier authorities do. Because of this, traders may be at risk if something goes wrong, and customer fund protection and dispute resolution are limited.

Other users say they had good experiences with LeoPrime, while others are not so sure about LeoPrime's security. Many reviews on sites like Trustpilot and Forex Peace Army talk about LeoPrime’s problems with withdrawals or accounts. LeoPrime is regulated, but it may not offer the same level of security and safety as other brokers licensed by major financial agencies, due its offshore regulation and conflicting assessments.

What Can You Trade with LeoPrime?

LeoPrime allows their users to trade a variety of financial products through its online forex and CFD platform. They provide access to more than 100 instruments, these include both major and minor forex currency pairs, even precious metals like gold and silver, and energy commodities such as crude oil and natural gas.

LeoPrime also offers trading on popular stock indices like US30 and NAS100, along with cryptocurrencies including Bitcoin, Ethereum, Litecoin, and XRP. These assets are available on MetaTrader 4 and MetaTrader 5 platforms, giving users flexibility in how they decide to trade.

Although LeoPirme range covers many key markets, LeoPrime does not include individual stocks or ETFs in its standard instrument list, which can limit choices for their traders seeking broader equity exposure.

LeoPrime Spreads, Fees, and Commissions

The type of account you choose with LeoPrime will affect the spreads and any commissions you have to pay. Standard and Cent accounts usually have wider spreads, starting at about 1.6 pips on major pairs like EUR/USD. They don't charge extra commissions, so the cost is included in the difference between buying and selling. Spreads can be much tighter on ECN and Pro accounts, like 0.1 to 0.3 pips for EUR/USD, but these accounts usually charge a commission for each lot traded (about $3 to $6 depending on the plan).

LeoPrime may charge you extra fees that aren't related to trading, which can raise your overall costs. There may be fees for deposits and withdrawals, usually between 0% and 1%, depending on the method used. Different ways to fund your account may also have their own fees from banks or payment processors. LeoPrime doesn't usually charge an inactivity fee, which means that accounts that aren't used for a while won't automatically have to pay monthly fees.

In general, ECN accounts have lower spread costs that are good for active traders, but they still have commission and non-trading fees that add to the total cost. Standard accounts, on the other hand, trade at higher spreads without any upfront commissions. Traders should compare these fee structures to their own trading patterns to see how much they might have to pay over time.

LeoPrime Customer Reviews

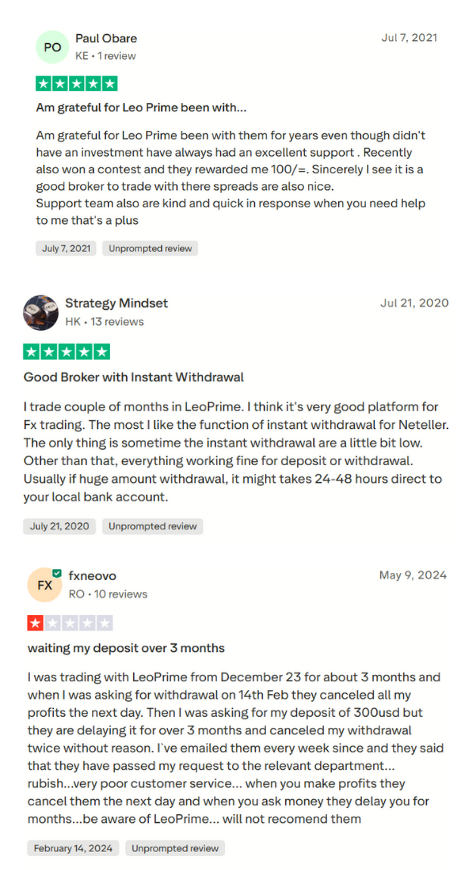

Reviews of LeoPrime on major review sites are mixed, with many users saying they had problems with withdrawals and support. The broker has a low rating of 2 to 2.6 out of 5 stars on Trustpilot. Many traders say that they had to wait weeks or months to get their money back or that their withdrawals were canceled without any clear reason.

Some users say they had good experiences with customer support and the platform, saying that support helped them fix problems quickly and that trading went smoothly. But there are fewer positive comments than there are complaints.

WikiFX and other independent review sites show that many people have complained about canceled profits, long withdrawal waits, and support that doesn't respond, which makes some traders worry about how reliable these sites are.

Trading Platforms and Tools Offered by LeoPrime

Traders can use the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms with LeoPrime. These are two of the most popular trading systems in the forex and CFD markets. You can trade from a Windows, Mac, iOS, or Android device on either platform, so you can choose which one you want to use.

Many forex traders like MT4 because it has a simple interface, advanced charting tools, automated trading with Expert Advisors (EAs), and technical indicators. MT5 adds more timeframes, technical tools, order types, and market access, which can be helpful for traders who want more analytical tools.

LeoPrime also has a number of trading tools to help users analyze the markets, such as an economic calendar, a forex calculator, and market news. They also offer high-speed VPS hosting for automated trading strategies. These tools can help traders make better decisions and carry them out more smoothly, especially if they use expert advisors or run strategies that need to be up all the time.

LeoPrime Account Types & Leverages

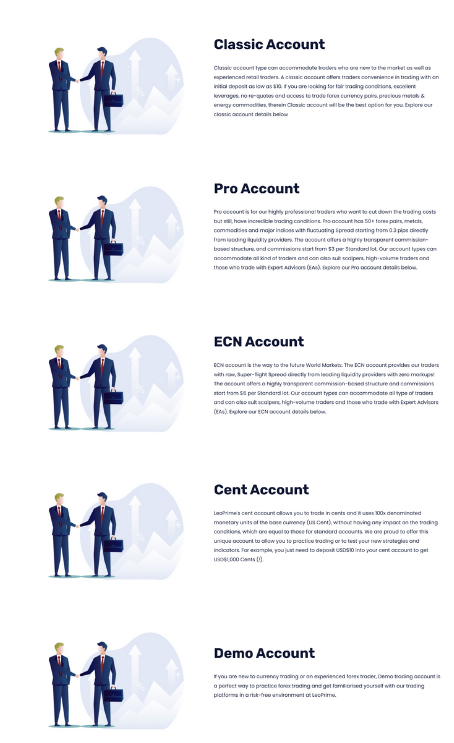

LeoPrime has different types of accounts to meet the needs of different traders, such as Cent, Classic, Pro, and ECN accounts. The Cent and Classic accounts are for beginners and traders who want to save money. They have low minimum deposits (around $10) and high leverage (up to 1:1000). The Pro and ECN accounts, on the other hand, need higher deposits (usually around $1,000) and have tighter spreads with commission fees.

Different types of accounts have different trading conditions. The Cent and Classic accounts have wider spreads, no commission, and maximum leverage of 1:1000. The Pro account has lower spreads and leverage of 1:500 with a small commission. The ECN account has the tightest spreads and access to deeper pricing, but it also has commission fees and lower maximum leverage (around 1:200).

Traders should know how leverage works before using it because it can increase potential gains but also the risk of losses. Users can also use demo accounts and Islamic swap-free options, which let you practice or follow certain trading rules.

Customer Support at LeoPrime: Is It Reliable?

Many traders are worried about LeoPrime's reliability due their customer reviews of its support are mixed. They have a below average rating (ranging from 2–2.6 out of 5) based on different review sites like Trustpilot. Many users say that the company takes a long time to respond or that they have to wait multiple times to get help from support with problems like withdrawals or account questions. Users say they get automatic replies or very little follow-up, which can make it hard to solve problems.

Even though there are complaints, some users say they had good experiences with customer service, saying that support was helpful and answered questions quickly, especially through live chat or email. But there are fewer positive comments, and they are often older, which suggests that the quality of service may change over time or depending on the situation.

LeoPrime does offer several ways to get help, such as live chat, email, and phone. They say they can help you 24 hours a day, five days a week, and in multiple languages. But due to its mixed reviews and reports of delays, traders should be careful and be ready for support that may be slow or unavailable when needed.

LeoPrime Customer Support Advantages and Disadvantages

Also Read: AvaTrade Review 2024- Expert Trader Insights

Account Types Offered by LeoPrime

- Cent Account

• Minimum deposit: $10.

• Leverage up to 1:1000 and spreads from about 1.6 pips.

• No commission and suitable for beginners or small traders. - Classic Account

• Minimum deposit: $10.

• Leverage up to 1:1000 with spreads around 1.6 pips.

• No commission; often includes Swap-free (Islamic) option. - Pro Account

• Minimum deposit: $1,000.

• Leverage up to 1:500 with tighter spreads (~0.3 pips).

• Includes a small commission per lot. - ECN Account

• Minimum deposit: $1,000 (varies by source).

• Leverage up to 1:200 with very low spreads (~0.1 pips).

• Commission applies per lot, often preferred by experienced traders. - Demo Account

• Practice account with virtual funds.

• Lets you test platforms and trading strategies without real money.

LeoPrime Pros and Cons

Pros

- Multiple account types, including Cent, Classic, Pro, and ECN

- High leverage up to 1:1000

- Supports MetaTrader 4 and MetaTrader 5

- Access to 100+ trading instruments

Cons

- Offshore regulation with limited investor protection

- Mixed customer reviews, especially about withdrawals

- No individual stocks or ETFs

- High leverage can increase trading risk

LeoPrime Withdrawal Fees and Options

There are many ways to withdraw money from LeoPrime. For example, you can use local bank transfers in Malaysia, Indonesia, Thailand, and Vietnam, as well as bank wire transfers and e-wallets like Neteller, Skrill, Perfect Money, and WebMoney. Most of these options have a minimum withdrawal amount, which is usually around $10. This gives traders the freedom to choose how they get their money back.

Bank wire withdrawals may come with fees that the bank charges, not the broker. However, LeoPrime often doesn't charge direct withdrawal fees for e-wallets and local bank transfers. It can take anywhere from 1 to 5 business days for the money to arrive, depending on the provider. This is usually done within 24 hours of the withdrawal request being processed.

Traders should also look into any additional fees that payment systems may charge, since LeoPrime may not always pay those processing fees. Knowing which method works best for your schedule and budget can help you avoid delays and extra fees when withdrawing your profits.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Our Final Verdict on LeoPrime

LeoPrime offers many useful trading features that traders like. These include support for MetaTrader 4 and MetaTrader 5, multiple account types, and high leverage up to 1:1000. Trading forex, commodities, indices, and cryptocurrencies is easy with its platform and wide range of instruments.

The Seychelles FSA, which regulates the broker from outside the US, is seen as weak compared to top-tier regulators. It also doesn't have investor protection or compensation plans that many serious traders depend on. User feedback is mixed, with some traders saying they had problems with withdrawals, customer service, and their accounts. This makes people wonder how reliable and safe the service is overall.

Overall, LeoPrime might be a good choice for traders who are okay with offshore brokers and higher risk. However, traders who value strong regulation and good trader protection might want to use brokers licensed by well-known organizations like the FCA, ASIC, or CySEC. Before putting real money into something, you should do your homework.

LeoPrime Review: FAQ’s

Is LeoPrime regulated?

LeoPrime says it is regulated by the Financial Services Authority (FSA) of Seychelles under license SD032, but this regulation is considered offshore and weaker than oversight from major authorities like the FCA, ASIC, or CySEC. Because of this, trader protection and legal recourse may be limited compared with brokers under stricter regulators.

Can I trust LeoPrime with my money?

Some traders report positive experiences with trading execution and support, but many user reviews cite withdrawal delays, canceled profits, and support issues. These mixed reviews, along with offshore regulation, suggest traders should be cautious and do their own research before depositing funds.

What markets and platforms does LeoPrime offer?

LeoPrime provides access to 100+ instruments, including forex, commodities, indices, and cryptocurrencies, through widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms support desktop, web, and mobile trading for flexibility.

OPEN AN ACCOUNT NOW WITH LEOPRIME AND GET YOUR BONUS