Contents

- What Are Market Conditions?

- Types Of Market Conditions

- Market Forces

- The Participant Effect On Market Prices

- Conclusion

- FAQs

What Are Market Conditions?

Market conditions are the situation of an economy, industry, or nation. This term is often used in the stock market or the real estate market. Market conditions could either be favorable or unfavorable, and this explains volatility and stability.

Market conditions can also be referred to as the economic situation of an industry, business, or investment market. A favorable condition would give room for economic growth, potential investors, and lots more. An unfavorable condition makes the market difficult to navigate.

Also Read: Everything About Credit Spread

Types Of Market Conditions

Market conditions can be categorized into various types. These types explain the situation of prices in various markets.

Trending market

In a trending market, the prices change and move in a particular trend direction for a period of time. This direction is determined by the factors affecting market conditions. There are two types of trending markets.

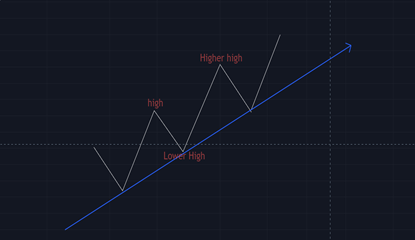

Uptrend

This is a market situation where prices keep increasing or going up. These price movements could be strong or weak. Strong uptrends are rapid increases in prices. While weak uptrends are slow and gradual increases in price.

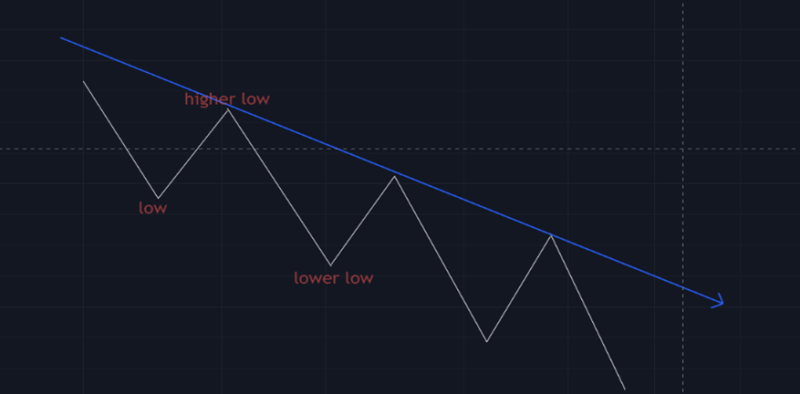

Downtrend

This is the direct opposite of an uptrend. A downtrend is when there is a consistent fall in price. It could be caused by many factors. A downtrend can be denoted by lower lows and higher lows.

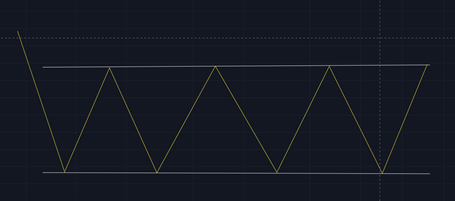

Ranging market

This is a market condition where prices just move sideways. In a ranging market, price just bounces off support and resistance. There is no clear direction in a ranging market.

Market Forces

There are some major factors influencing the condition of a market. Activities carried out by these factors affect the trends of the market. These factors include:

Supply and Demand (Invisible Hands)

The available supply and quantity demand are the main factors affecting the general prices of goods and services. A change in supply or demand can directly affect the prices of products, services, currencies, and other investments.

If demand for a commodity remains constant or decreases, and the supply increases for that same commodity. The price of the commodity would fall.

In a case where supply is reduced and demand increases, the price of that commodity would increase. Individuals, businesses, and the money system as a whole are all affected by supply and demand. Supply is determined by a tangible product in some markets such as real estate markets.

Government Policies

Government policies are the main factors that companies, investors, realtors, or any other market participant (buyers and sellers) monitor.

The fiscal and monetary policies adopted by the government or central bank always play a major role in market conditions.

By using monetary policies to change interest rates, the government can control the speed of economic growth.

The government can use fiscal policies to change government spending. This can be used to improve employment, create new jobs, change a trend, and control prices.

International Transactions

The exchange of funds between countries affects the value of a nation's currency and its economy. An economy weakens as money leaves that economy. Balancing international transactions keeps the currency of a country stable.

Speculation and Expectation

Consumers, investors, and officials all have various expectations about where the economy will head in the future, which influences how they act today. Speculation and expectation are essential components of the financial sector.

Future action expectations are influenced by present actions, which impact both present and future trends. Sentiment indicators are often used to assess how specific types of people feel about the present state of the economy. These indications, together with other types of fundamental and technical research, can establish a bias.

The Participant Effect On Market Prices

The research and positions established by traders and investors based on knowledge about government policies like interest rates and foreign transactions generate conjecture about where prices will move.

When a large number of individuals agree on a single course of action, the market enters a long-term trend. Market players who are incorrect in their assessments can perpetuate trends. When they are compelled to leave losing positions, this forces trading prices to move further in the current direction.

Conclusion

The situation of the market is a very important factor to consider for traders and investors. It can dictate as much as your investment period in a certain industry, taxes, mortgage rate, and lots more. Investors should always apply market fundamentals to their trading activities. Knowing the situation of things before including money, would make your business more profitable. There are a lot of buyers and sellers, an analysis of their activity would further improve your trading decision.

Also Read: How To Use 3 Bar Play

FAQs

How do you identify market conditions?

The market is divided into two types. They are trends and ranges. A trend might signal greater highs or lower lows. Lower lows and lower highs are frequently used to characterize downtrends. When prices trade between their upper and lower values, this is referred to as a range.

What are market conditions economics?

The word “market circumstances” refers to the situation of an organization. It is commonly used in real estate markets that look unpredictable or unstable. They give several clues about how many individuals act.

What are normal market conditions?

This is when prices remain stable for a long period of time. There is low volatility, quotations remain constant. This condition must have past acceptance and potential general acceptance.

What are interest rates?

An interest rate is the percentage of a sum lent or borrowed, to be paid periodically. An interest rate is a percentage that indicates how quickly a sum of money will increase over time. Governments and the Central Bank use interest rates to control the growth of an economy.

What is Market Presence?

Marketing presence is the signal your company sends to its prospects and customers. The message should be clear and straightforward, and it should include the essential traits and additional resources you want linked with your company.