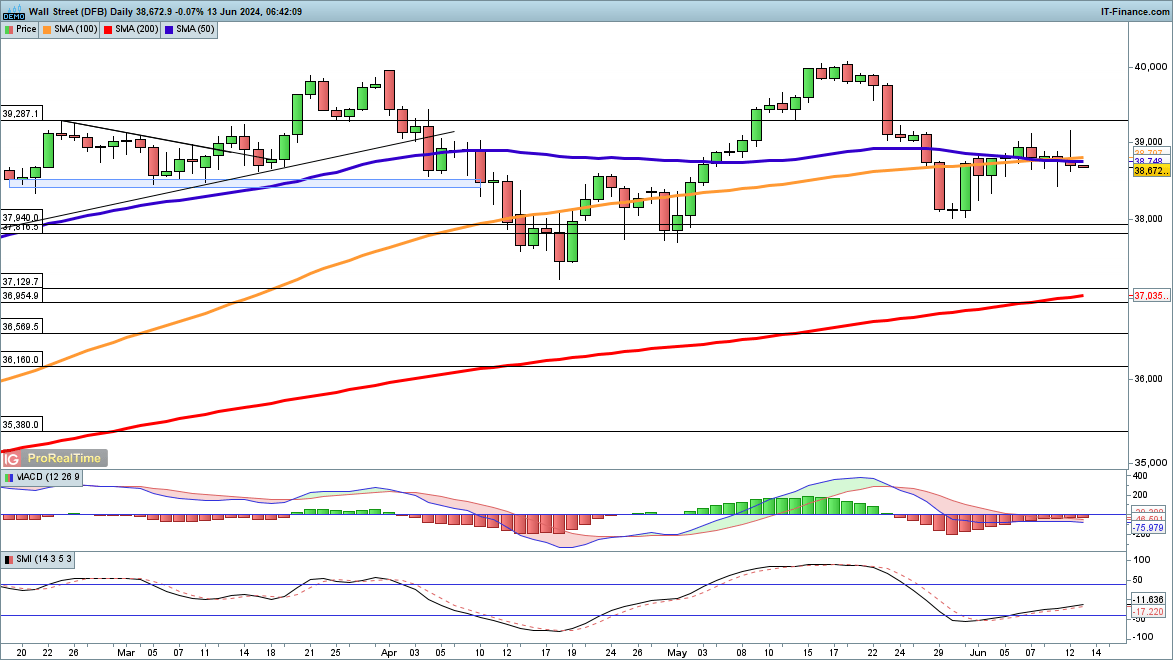

Dow Falters Post-CPI

The Dow Jones Industrial Average has retreated following the Federal Reserve meeting, unable to sustain the initial gains post-U.S. CPI announcement. With expectations of fewer rate cuts in 2024—now anticipated to be just one, down from two—the sentiment has dampened, leading to a decline.

The index risks falling to 38,000, possibly reaching lows seen in April around 37,500. For optimism to return, the Dow needs to secure a close above 39,000, signaling the potential start of an upward movement.

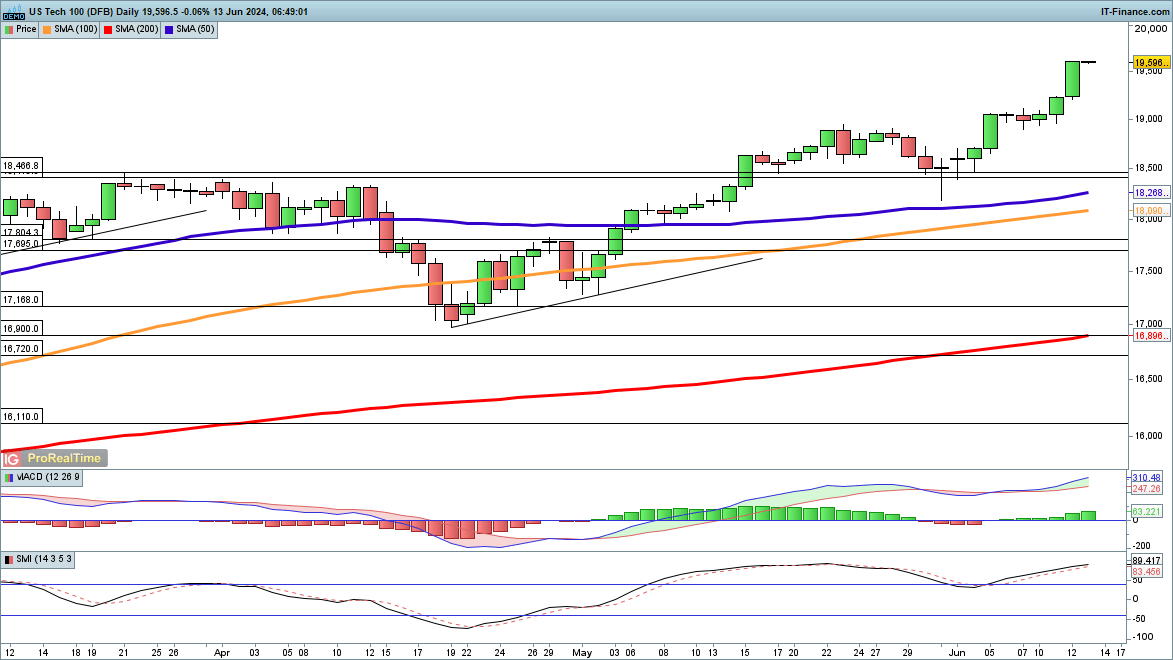

Nasdaq Hits Record Highs

In contrast, the Nasdaq 100 has surged, crossing 19,500 for the first time, driven by a robust performance in technology stocks. This bullish momentum, which started in late May, has repeatedly pushed the index to new records.

Looking ahead, the 20,000 mark emerges as a significant psychological barrier. However, a dip below 19,000 could suggest the current rally might be losing steam in the near term.

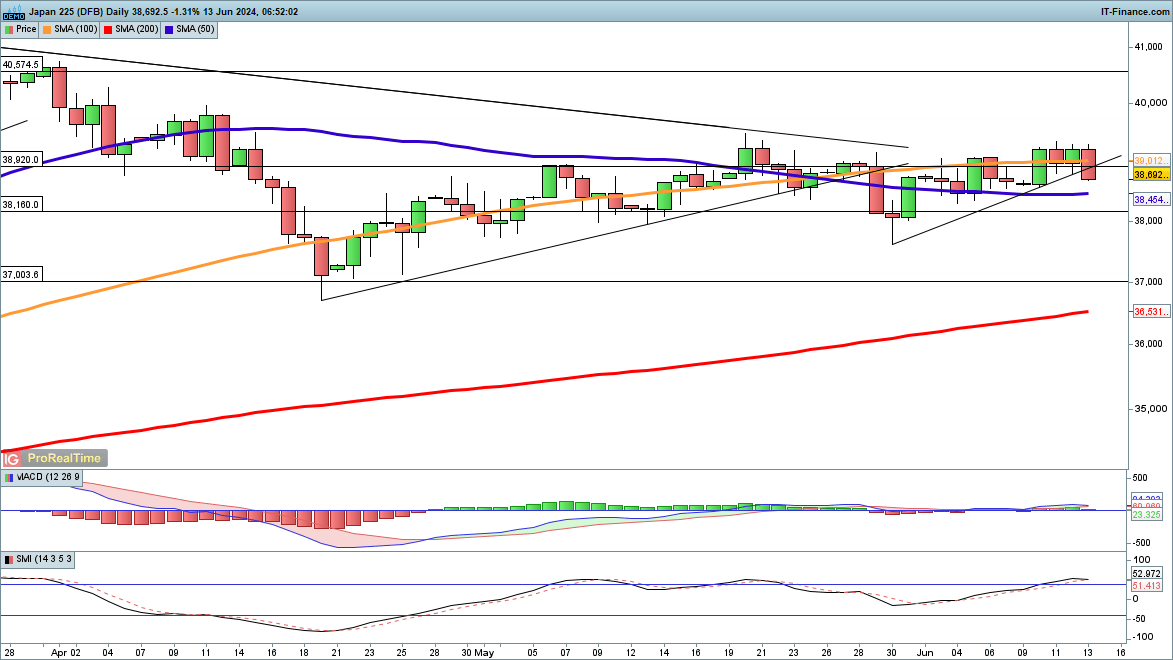

Nikkei 225 Faces Resistance

The Nikkei 225's advance earlier in the week has paused amid concerns over the Bank of Japan’s future policy directions. The index faltered around 39,340, echoing the resistance faced in mid-May.

A break below the trendline from late May's low points to potential declines, possibly down to May’s low of 37,500. A rebound above 39,000 is necessary to indicate a resurgence in bullish momentum.