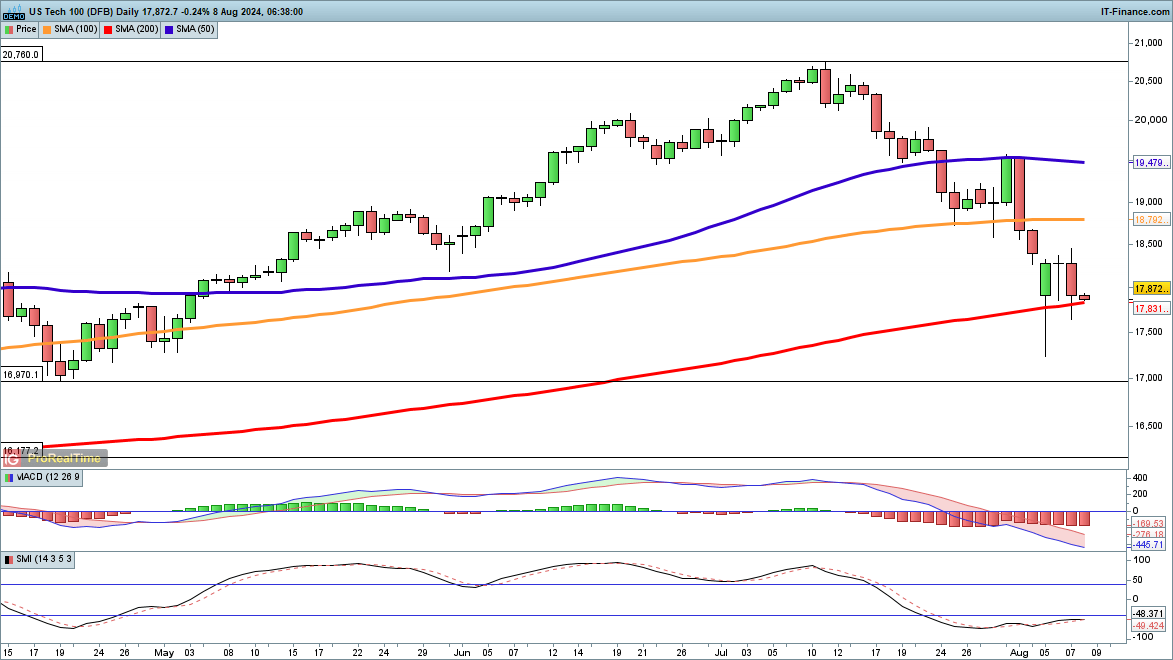

Nasdaq 100 Struggles to Maintain Support at 200-Day MA

After a brief rebound on Tuesday, the Nasdaq 100 index fell back on Wednesday, hovering around the 200-day simple moving average (SMA), currently at 17,831, but managed to close above this critical level.

In early trading on Thursday, the index faced additional pressure, though it remains above the 200-day SMA for now. A close below this level could indicate a new move towards the week’s lows. Conversely, closing back above 18,300 would suggest that a potential bottom has been established.

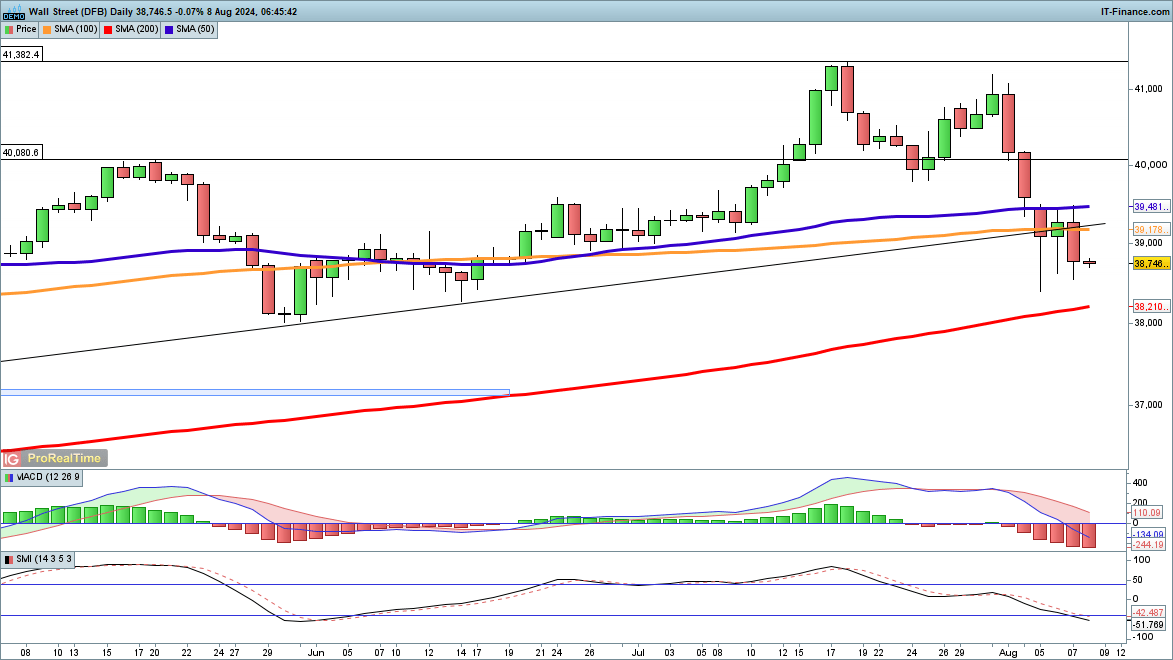

Dow Faces Continued Pressure Following Reversal

Wednesday brought renewed losses for the Dow, though the index has managed to stay above Monday’s lows so far. Tuesday’s bounce failed to extend into Wednesday, putting the price at risk of further declines. If losses continue, the focus will shift to Monday’s low and the 200-day SMA, currently at 38,210.

A close above 39,200 could indicate that the index has found a low point.

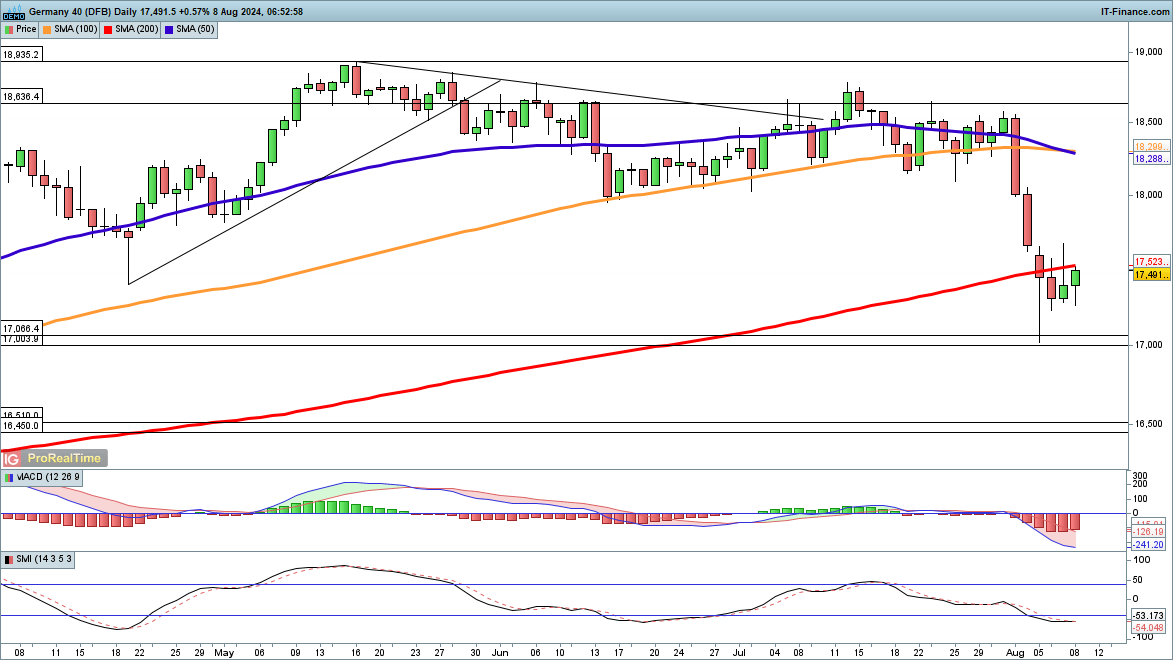

DAX Recovers, Eyes Key Resistance

Thursday began with gains for the DAX, which may now challenge its 200-day SMA from below, after reversing direction on Wednesday and closing beneath this level.

A close above the 200-day SMA could suggest that a low has been formed, potentially setting the index on an upward trajectory. However, failing to hold above this key level would likely lead to a fresh decline, targeting 17,250 and lower.