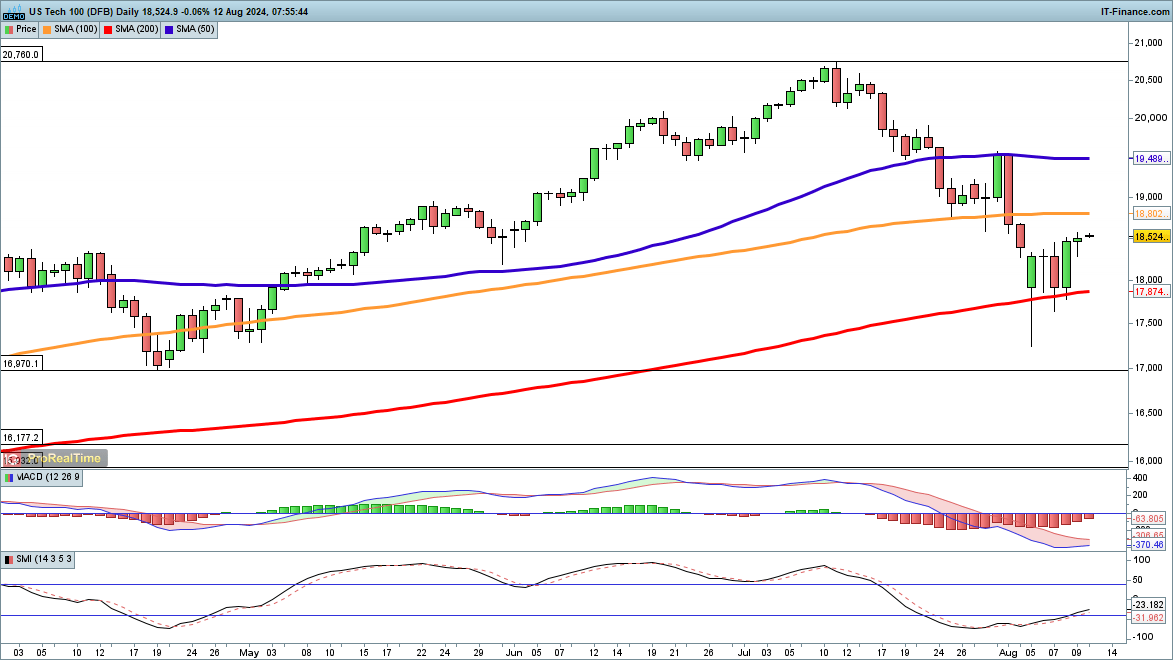

Nasdaq 100 Eyes Further Growth

The Nasdaq 100 ended the week on a strong note, rallying above 18,000 and remaining above the critical 200-day SMA. Currently, buyers hold the upper hand, pushing the index off its recent lows. The next targets are 19,000 and the late July peak at 19,500. However, a close below 18,000 could indicate the beginning of a new downward trend.

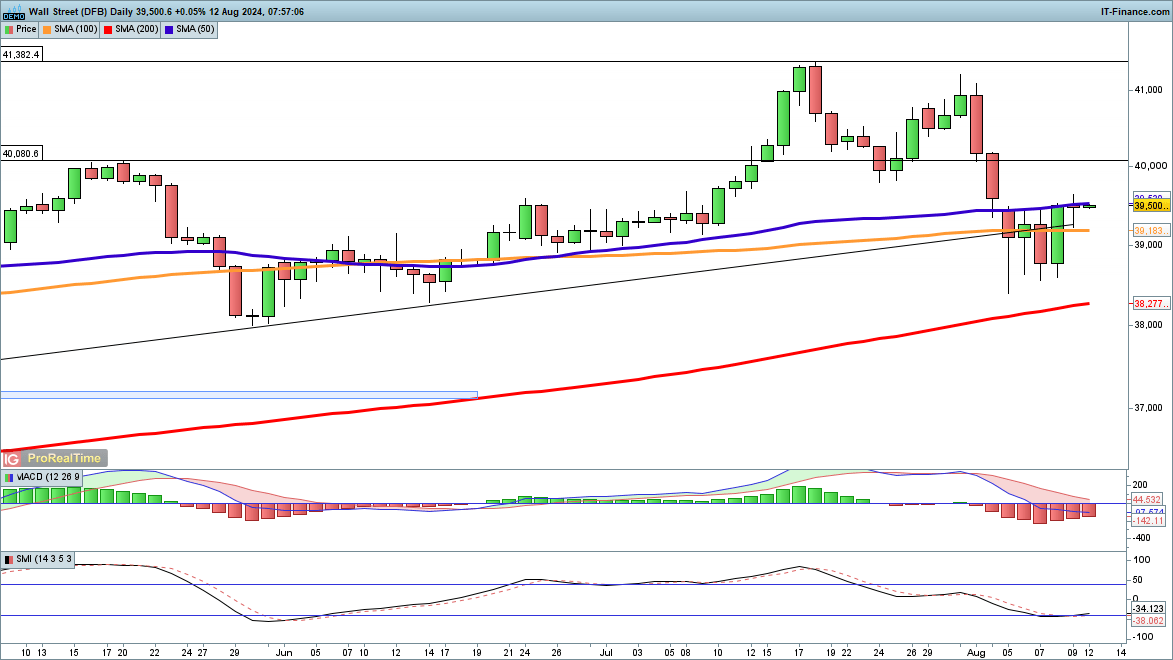

Dow Recoups Recent Declines

The Dow Jones Industrial Average also shows a bullish trend after rebounding from last week's lows near 38,500. If the index closes above the 50-day SMA, it would strengthen the bullish outlook and pave the way toward 40,000 and beyond. Conversely, a close below 39,000 could signal a retest of the recent lows.

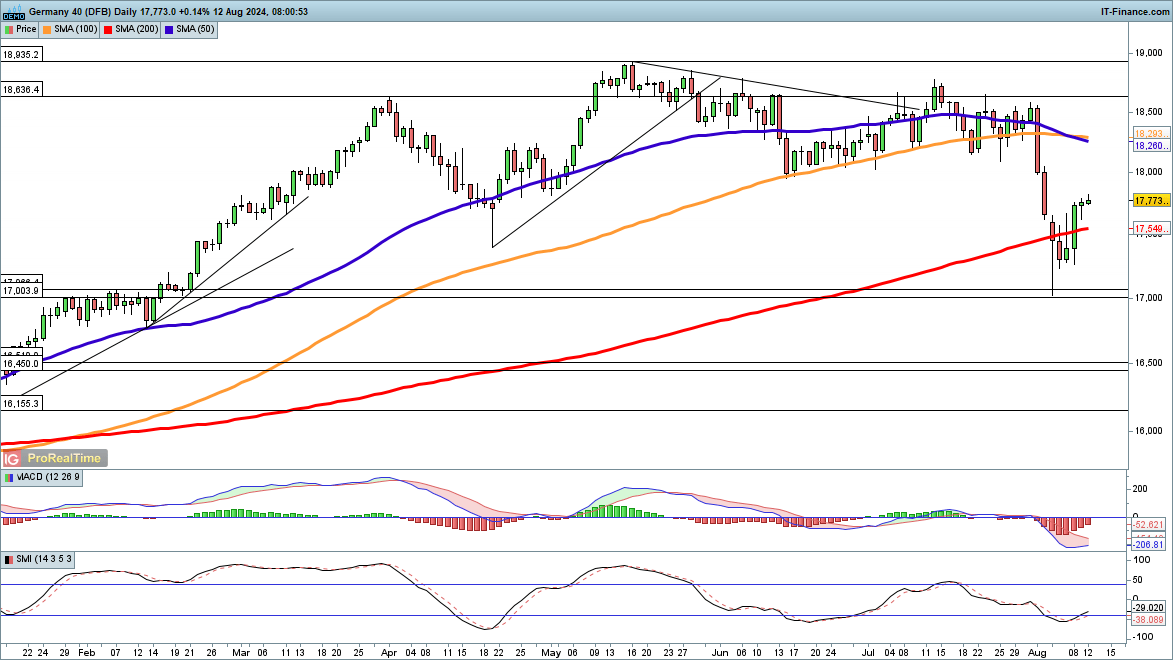

DAX Continues Its Upward Drive

The DAX nearly touched 17,000 last week but has since recovered strongly, moving above the 200-day SMA. With the index reclaiming the April low, it now appears set to test 18,000. A close above this level would support the expectation of a retest of the July highs. On the other hand, sellers will aim for a close below 17,500 to bring the index back under the 200-day SMA.