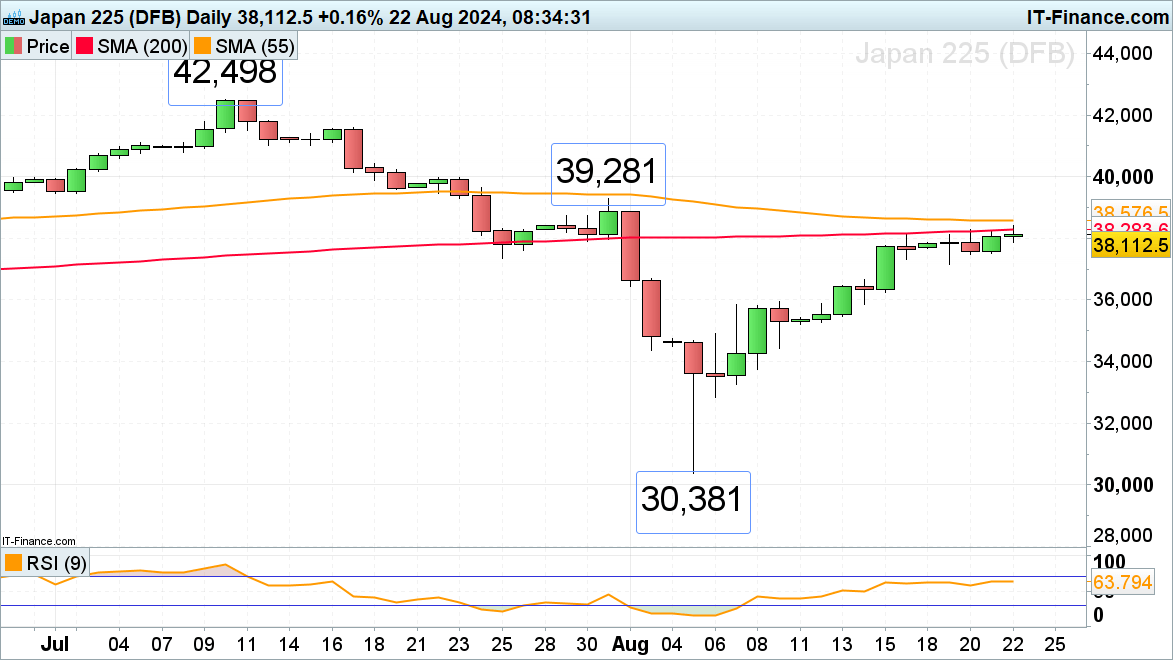

Nikkei 225 Stalls Near Key Moving Averages

The Nikkei 225 has been trading sideways around the 200-day simple moving average (SMA) at 38,284, remaining below the 55-day SMA at 38,577 for the past week. A move above these averages could target the late July high of 39,281.

However, a drop below Monday’s low of 37,163 could pave the way for a revisit to the 36,000 region.

As long as Monday's low of 37,163 holds, the short-term bullish outlook remains intact.

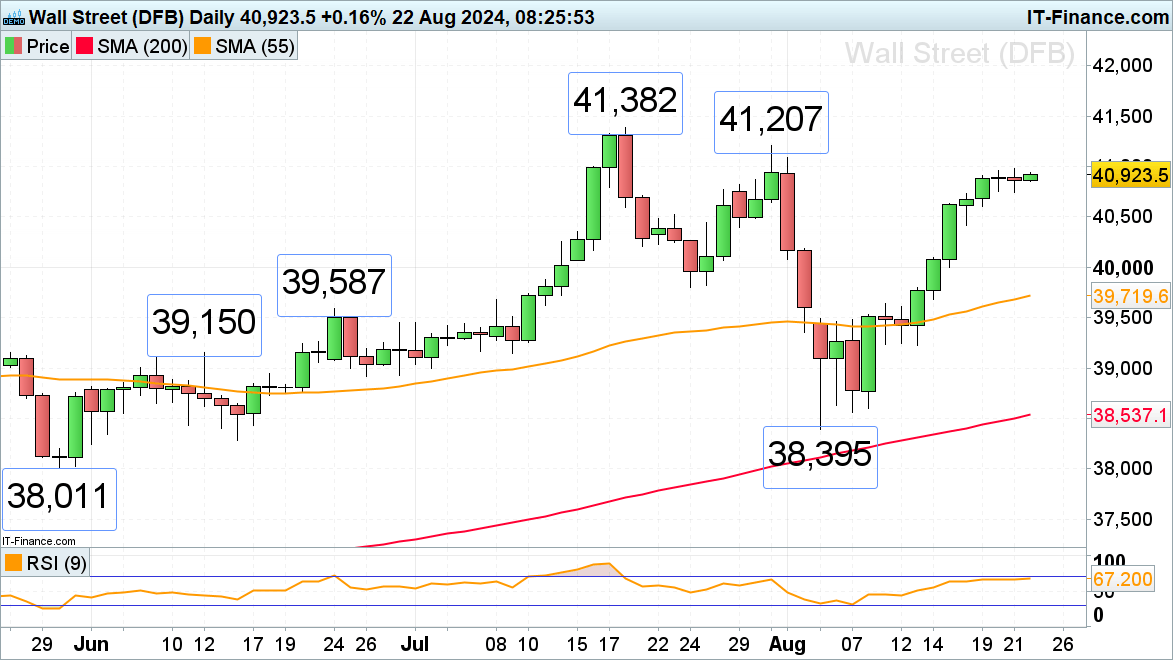

Dow Jones Rally Loses Momentum

The Dow Jones Industrial Average rally is showing signs of fatigue, with trading characterized by low volatility and volume as investors await Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium on Friday for insights on the pace of potential rate cuts later this year.

Despite the slowdown, the late July peak at 41,207 is still within reach, with the all-time high of 41,382 just above it. The uptrend is expected to remain solid as long as Monday's low of 40,606 holds.

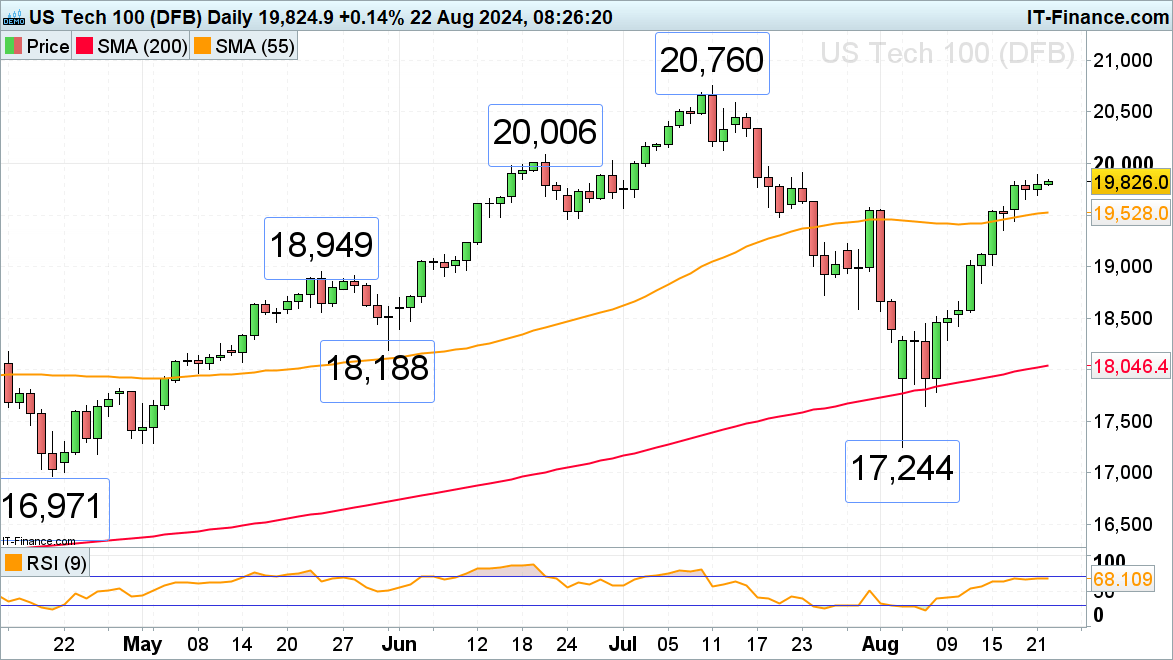

Nasdaq 100 Rally Slows

The Nasdaq 100 has seen its upward momentum slow after rising above the 55-day moving average at 19,528 and the late July high of 19,577. This move positions the index to challenge the June high of 20,006.

The previous resistance zone between 19,577 and 19,501 is now expected to act as support, following the inverse polarity principle.